Author: Frank, PANews

The points game of Binance Alpha is pushing "involution" to an unprecedented extreme. As the points threshold once broke the 200-point barrier and airdrop earnings plummeted to around $25, the decline in the user input-output ratio sparked widespread community discussion.

Beneath this seemingly winner-takes-all feast, one viewpoint suggests that its massive traffic is "overflowing" to other ecosystems like Sui and Solana, injecting vitality into them. However, what is the true situation of this overflow effect? What profound impact will this "money-making" frenzy ignited by Binance Alpha ultimately bring to the industry?

The Illusion and Reality of Traffic "Overflow": Observing the Alpha Effect of Sui

The point game mechanism of Binance Alpha has been detailed in previous articles, so it will not be repeated here. But generally speaking, as more users participate, the ultimate result is that each airdrop's earnings have a clear upper limit, while the points threshold continues to rise. In this case, users must further cut costs to retain profit margins.

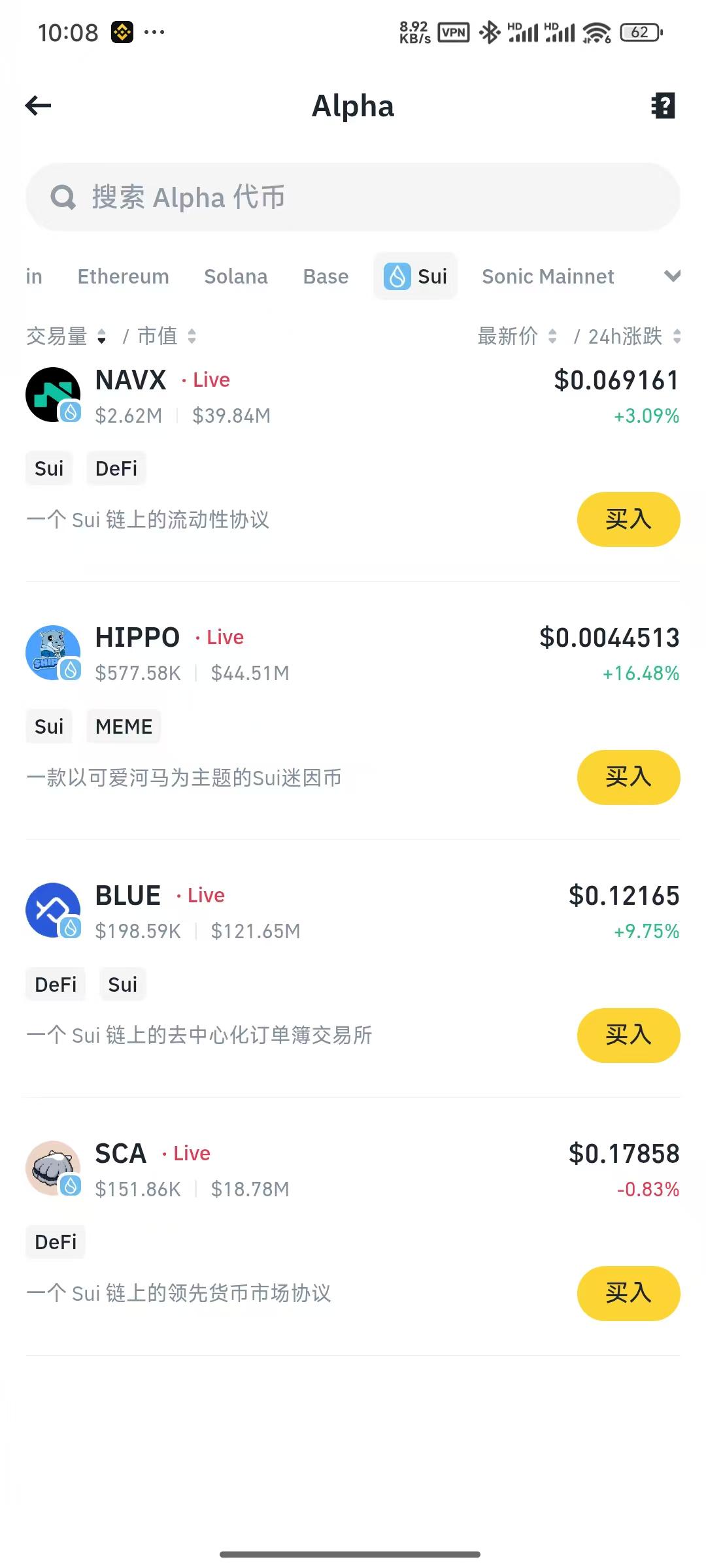

Recently, Binance Alpha began to launch Sui ecosystem tokens and subsequently announced several Alpha projects within the Sui ecosystem. The addition of the Sui ecosystem provides a new cost advantage for users looking to boost trading volume. On May 14, several KOLs, including @lianyanshe, pointed out that projects like NAVX in the Sui ecosystem have lower gas fees when boosting trading volume and are not susceptible to sandwich bots, resulting in overall lower wear and tear. Therefore, several projects in the Sui ecosystem are set to become the "new volume kings" for Binance Alpha.

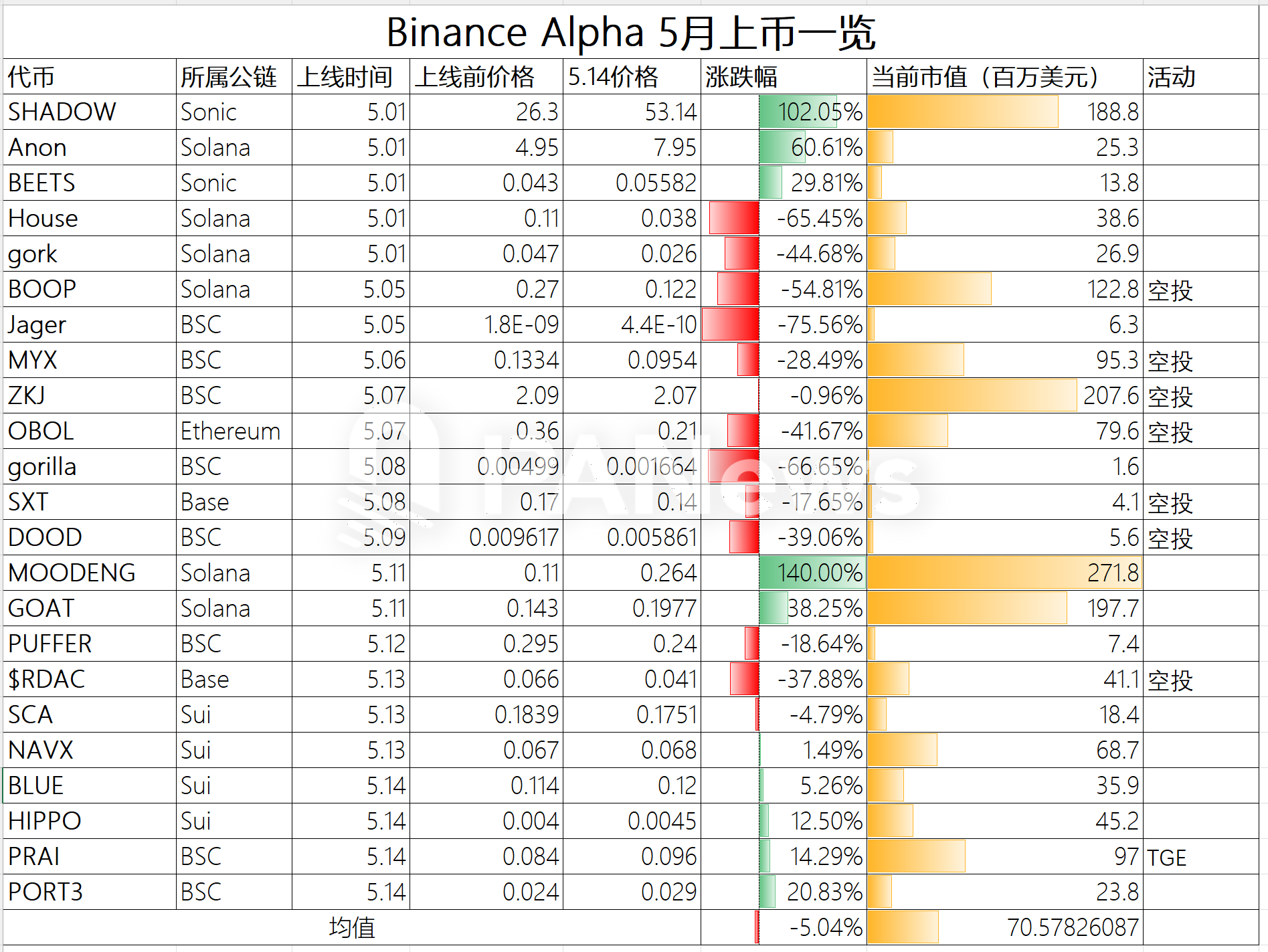

If most users choose this form, it could indeed bring considerable trading volume and token popularity to the Sui ecosystem. However, the reality seems to show a different effect. According to a PANews investigation, the trading volume of Sui ecosystem tokens on Alpha is not significant, with the highest NAVX only reaching $3.34 million in 24-hour trading volume, while others like HIPPO, BLUE, and SCA had trading volumes ranging from tens of thousands to hundreds of thousands of dollars. In contrast, several projects on the Solana chain have trading volumes consistently above $10 million, with some leading projects on BSC exceeding $200 million. However, for NAVX, launching on Binance Alpha did indeed boost its trading volume, reaching $1.6 million on May 13, compared to just a few thousand dollars the day before.

In the actual trading process, it can be observed that the official cross-chain bridge of the Binance wallet currently does not facilitate the exchange of assets between the Sui ecosystem and the BSC chain. Users cannot directly exchange assets like BNB for USDC on Sui; to save on this wear and tear, they must endure the costs of using other cross-chain bridges.

Solana's Leading MEME Unexpectedly Gains Capital Inflow

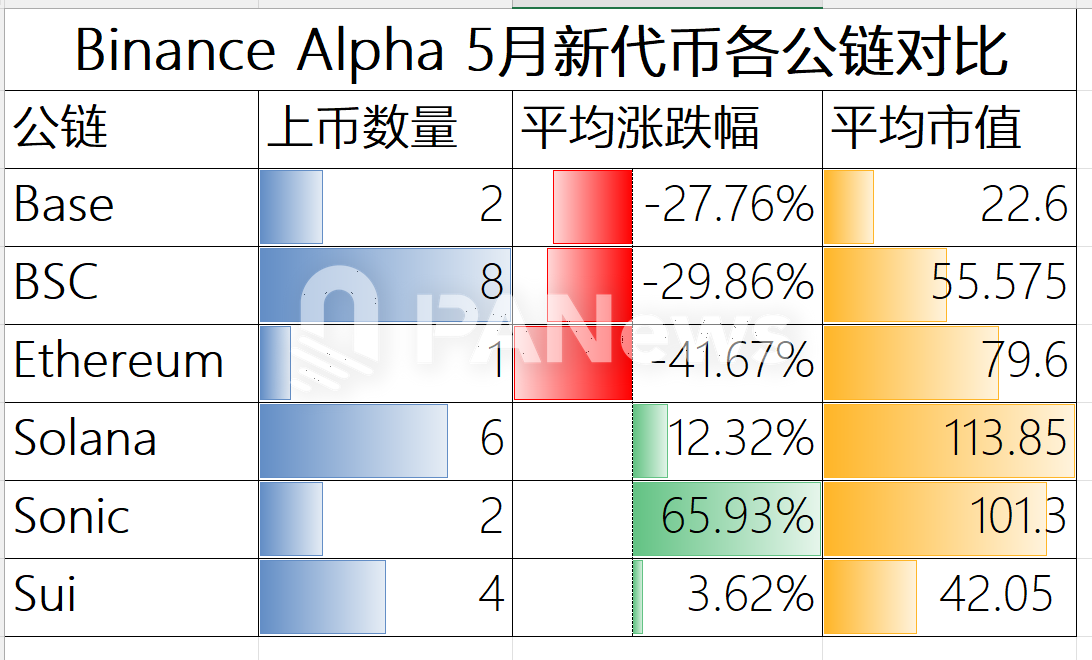

Solana is one of the ecosystems with the most projects launched on Binance Alpha, aside from BSC. Since May, Solana's overall DEX trading volume has indeed seen a significant increase. On May 4, Solana's DEX trading volume was $2.2 billion, and by May 15, this figure had risen to $4.59 billion, more than doubling. Several leading tokens like MOODENG and jellyjelly that launched on Binance Alpha have indeed seen a huge increase in trading volume recently, with notable price surges. MOODENG's price rose by 140% from its launch to May 14, and the average price increase of the six tokens launched on Binance Alpha in May from the Solana ecosystem reached 12.32%, making it one of the few ecosystems with positive performance among various public chains.

Aside from the Sui and Solana ecosystems, the Sonic ecosystem has recently benefited most from this overflow effect. As a new brand of Fantom, Sonic currently needs exposure and capital inflow to break into the mainstream. Although only three Sonic ecosystem projects have launched on Binance Alpha, the average price increase of the two tokens launched in May reached 65.93% (data as of May 14), ranking the highest among all ecosystems. However, due to the small number of tokens launched, this does not necessarily indicate that Sonic ecosystem tokens have higher potential.

However, on May 1, when Binance Alpha announced the launch of two Sonic ecosystem projects, the DEX trading volume of the Sonic ecosystem indeed saw a significant increase, soaring from over $73.4 million the previous day to $194 million.

Project Dilemma: Is Launching the Peak or Value Discovery?

From the perspective of the ecosystem, Binance Alpha represents exposure and a traffic hub. For users, the current involution is eliminating ordinary users, turning it into a battleground for professional studios and large players. As the points threshold reaches 205 points, users need to earn at least 15 points daily to keep up with the threshold. With a principal of $1,000 (earning 2 points), they also need to achieve a trading volume of $8,000 daily to accumulate points. The daily slippage and gas fees for this trading volume may exceed $10. If they fail to meet the next threshold or receive fewer airdrops, they face a losing outcome that is both costly and labor-intensive. The latest RDAC token airdrop result essentially yielded only $25, hardly covering the cost of 205 points.

It is foreseeable that the points threshold will continue to rise, and according to the current rules, the required points and trading volume will increase exponentially. Either Binance Alpha will raise the airdrop amount for single addresses, or a large number of users will exit the involution, allowing the points threshold to fall back to a reasonable range. However, regardless, this game of involution seems to be nearing its end. The DEX trading volume on the BSC chain has also begun to decline in recent days, dropping to $2.64 billion on May 15, down 16.4% from $3.16 billion on May 12.

Overall, the "traffic overflow" effect of Binance Alpha shows significant differences across different ecosystems. The Sui ecosystem has not absorbed a large amount of trading volume as expected, while the Solana ecosystem has demonstrated stronger positive interaction and growth. For project parties, the short-term highlights brought by Alpha often fail to translate into sustained value support, with price declines after the peak becoming the norm, and airdrop activities have not become the savior of prices. Each project providing airdrops has become the "payer" for Binance's promotional wallet products.

The more core issue is that this points-driven frenzy is ruthlessly pushing ordinary users out of the table. The continuously rising points threshold and exponentially increasing trading volume requirements, combined with shrinking airdrop returns, are causing Binance Alpha to gradually evolve into a "zero-sum game" for professional studios and large players. The recent decline in DEX trading volume on the BSC chain also seems to indicate that this reliance on high-intensity "involution" is approaching its sustainability threshold.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。