Author: Yuki is short, so is life

Compiled by: Jiahua, ChainCatcher

Liquidity is the source of confidence in assets. Only with sufficient depth can the market accommodate large transactions, allowing whales to freely build positions, and assets to function as collateral, as lenders need to ensure they can liquidate smoothly when necessary. Tokenized assets with insufficient depth struggle to attract users, which not only suppresses market participation but also creates a vicious cycle of liquidity depletion.

The original intention of tokenization was to maximize capital liquidity, unleash the utility of DeFi, and open channels to access off-chain assets. Its promise is highly attractive: to bring trillions of dollars from traditional financial markets on-chain, allowing anyone to access, lend, and combine in ways that traditional finance has never permitted.

However, beneath the surface, the trading market liquidity of most tokenized assets is scarce and fragile, unable to support sufficient trading volumes. As a prerequisite for composability and financial utility, true liquidity has yet to materialize. The costs and risks arising from this may be hard to detect in small transactions, but once large funds attempt to enter or exit, these hidden dangers will quickly become apparent.

Current Liquidity Landscape

The first hidden cost of tokenized assets is reflected in slippage.

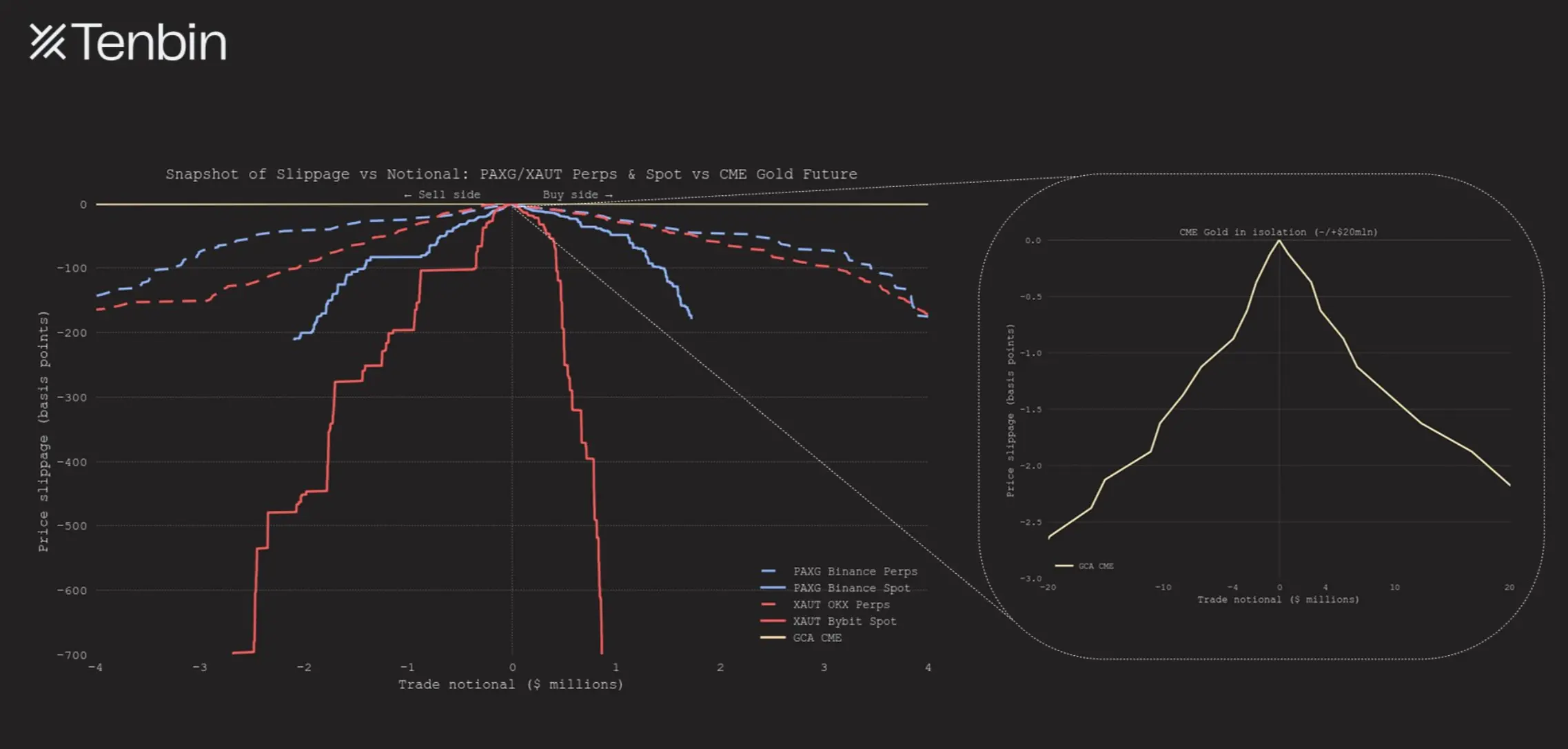

Taking tokenized gold as an example, the chart below compares the expected slippage at different trading volumes between major centralized exchanges and the traditional gold market. The differences are shocking.

(Chart description: Comparison of slippage and trading volume between PAXG/XAUT perpetual and spot vs CME gold futures (physical delivery contracts))

(Chart description: Comparison of slippage and trading volume between PAXG/XAUT perpetual and spot vs CME gold futures (physical delivery contracts))

As trading volume increases, the slippage of PAXG and XAUT perpetual contracts grows exponentially, reaching about 150 basis points (bps) at approximately $4 million nominal value. In contrast, the slippage curve of CME (Chicago Mercantile Exchange) is almost flat along the zero axis, making it difficult to distinguish from the X-axis.

The spot market for PAXG and XAUT is even more constrained. Although the chart shows the best liquidity for each token's spot market, the depth on either side of the order book does not exceed $3 million. This limitation is evident from the early interruption of its curve.

Another chart on the right separately displays the CME curve, highlighting its nearly flat liquidity characteristics. Even when the nominal value far exceeds $4 million, its slippage remains extremely stable. A $20 million gold futures trade has a price impact of less than 3 basis points. CME's liquidity is several orders of magnitude deeper than any cryptocurrency trading venue.

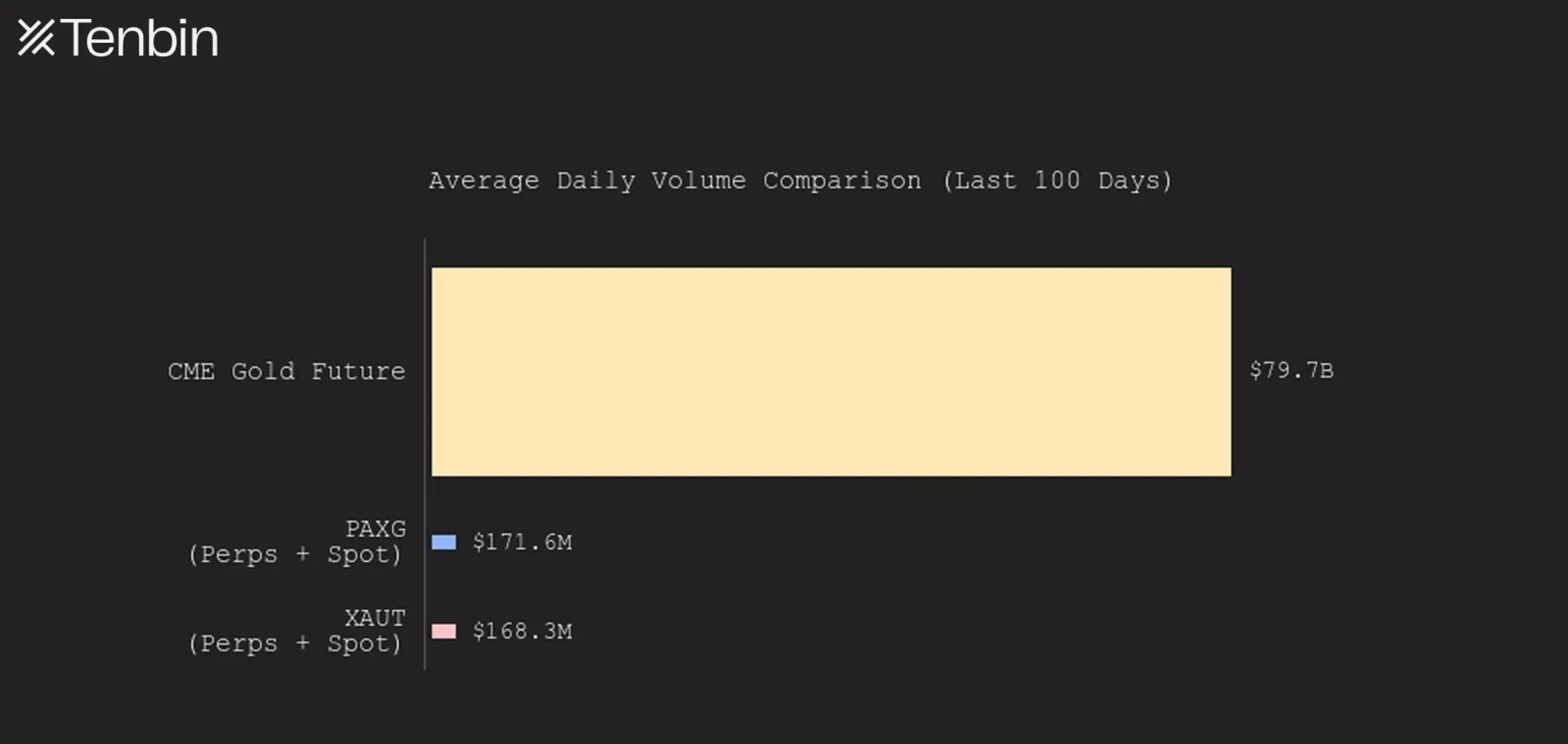

This difference has direct consequences. In deep traditional markets, even large trades can have negligible price impacts. In contrast, the same trade in shallow tokenized asset markets incurs immediate costs and becomes increasingly difficult to close. The daily trading volume comparison below clearly illustrates the magnitude of this gap, which exists not only in the gold market but also in many other assets.

(Chart description: Daily average trading volume comparison between CME gold futures and PAXG/XAUT perpetual and spot)

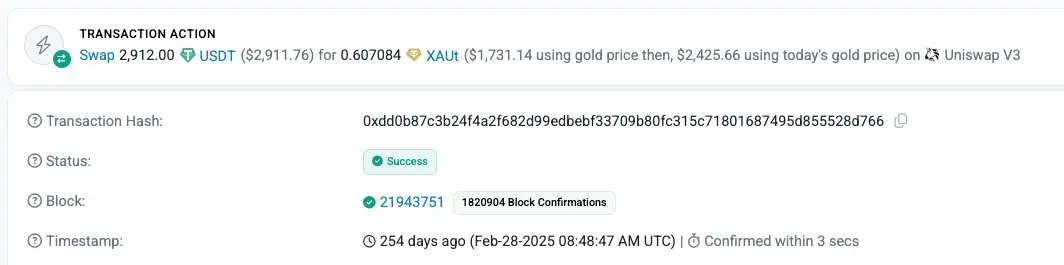

So far, these examples have mainly focused on centralized exchanges. What about AMMs (automated market makers)? The short answer is: it's worse.

Consider this XAUT trade that occurred in February 2025. A user spent 2,912 USDT to obtain only $1,731 worth of XAUT (based on the real gold price at the time), paying a premium of 68%.

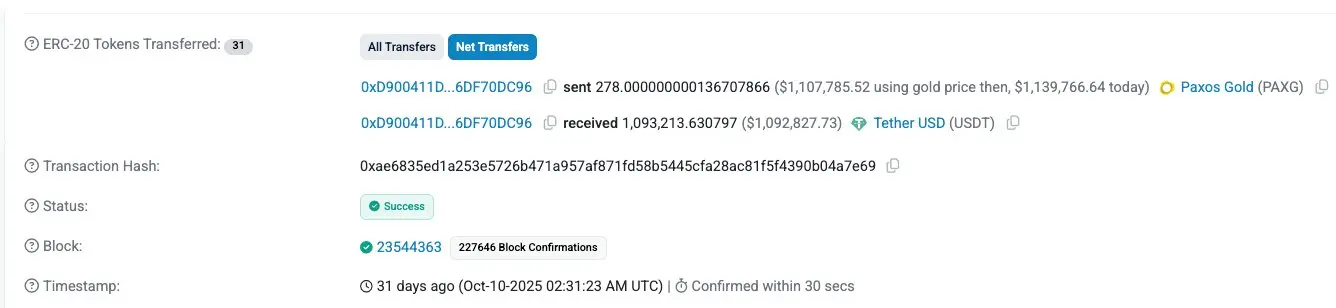

Another trade shows a user selling $1.107 million worth of PAXG (based on the gold price at the time) and receiving only 1.093 million USDT, with slippage of about 1.3%. While not as extreme, this level of slippage is still unacceptable in the context of traditional markets, where price impacts are typically measured in single-digit basis points rather than percentages.

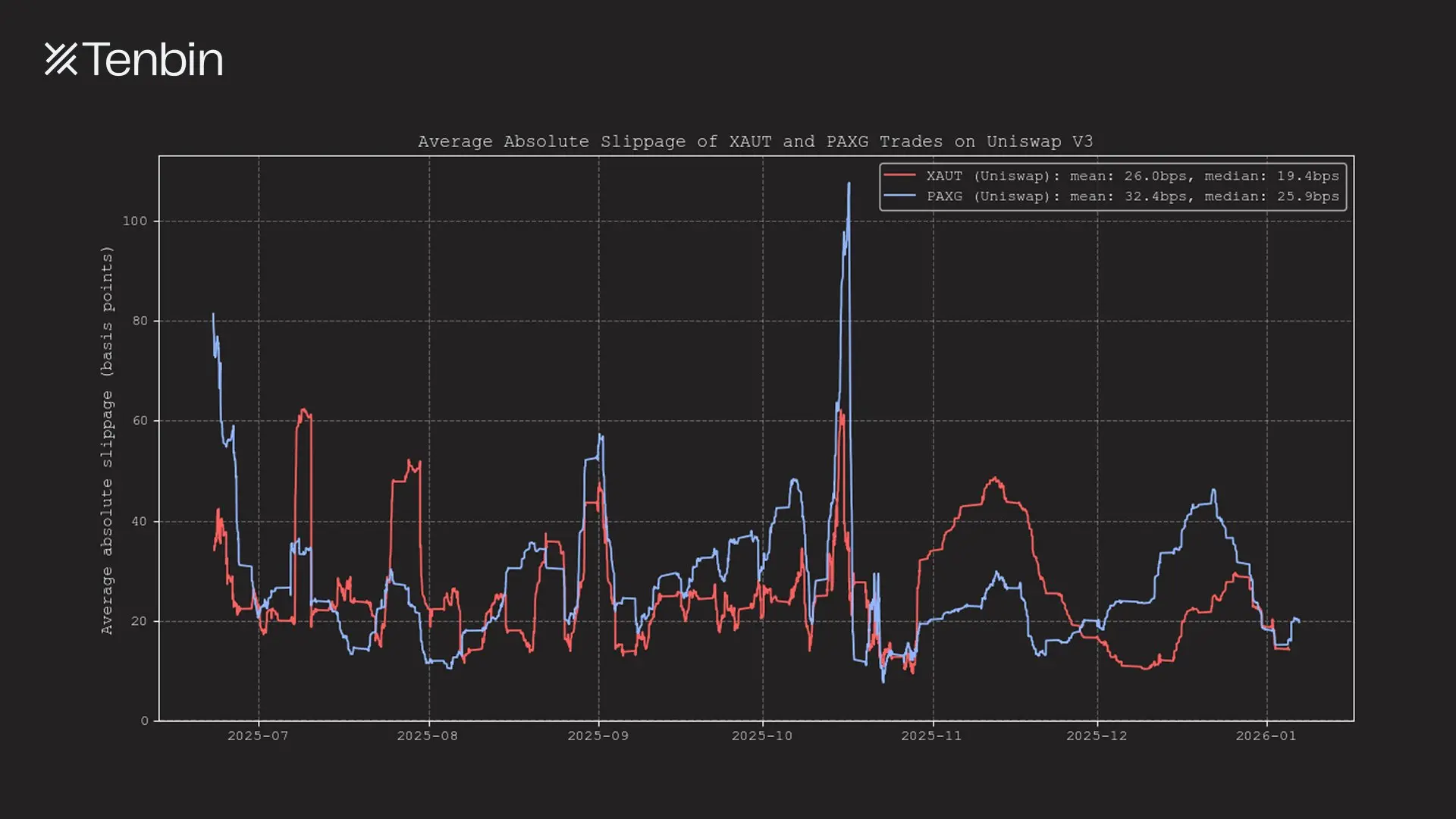

Additionally, over the past six months, the average slippage for XAUT and PAXG trades on Uniswap has ranged between 25 to 35 basis points, occasionally exceeding 0.5%.

(Chart description: Average absolute slippage for XAUT and PAXG trades on Uniswap V3)

We use gold for analysis because it is currently the largest non-USD, non-credit tokenized asset on-chain. However, the same pattern applies to tokenized stocks.

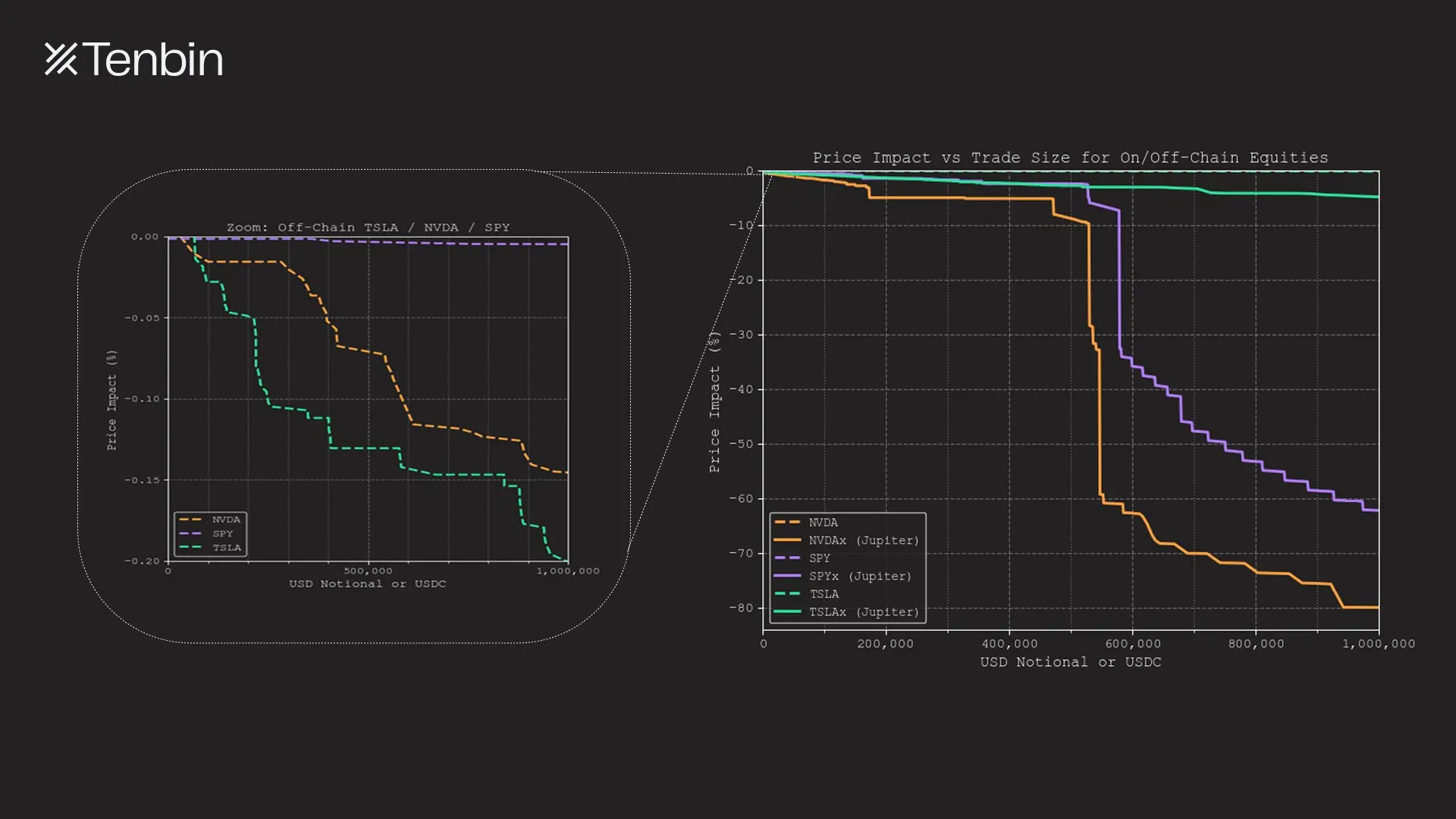

(Chart description: Slippage and trading volume comparison between NVDA/TSLA/SPY on Nasdaq vs NVDAx/TSLAx/SPYx)

TSLAx and NVDAx are two of the top ten single-name tokenized stocks. On Jupiter, a $1 million trade for TSLAx incurs about 5% slippage. NVDAx faces an insurmountable 80% slippage. In contrast, a $1 million trade for Tesla or Nvidia in traditional markets would only result in price impacts of 18 basis points and 14 basis points, respectively (not accounting for liquidity from dark pools and other off-exchange venues).

These costs are easily overlooked in small transactions, but they become unavoidable once users attempt to scale their trades. Insufficient liquidity directly translates into actual losses.

Is the On-Chain Tokenized Market Dangerous?

Insufficient liquidity not only increases trading costs but also undermines market structure.

When liquidity is thin, pricing mechanisms can easily distort, order books become noisy, and oracle price feeds inherit this noise. Small trades can trigger chain reactions in interconnected systems.

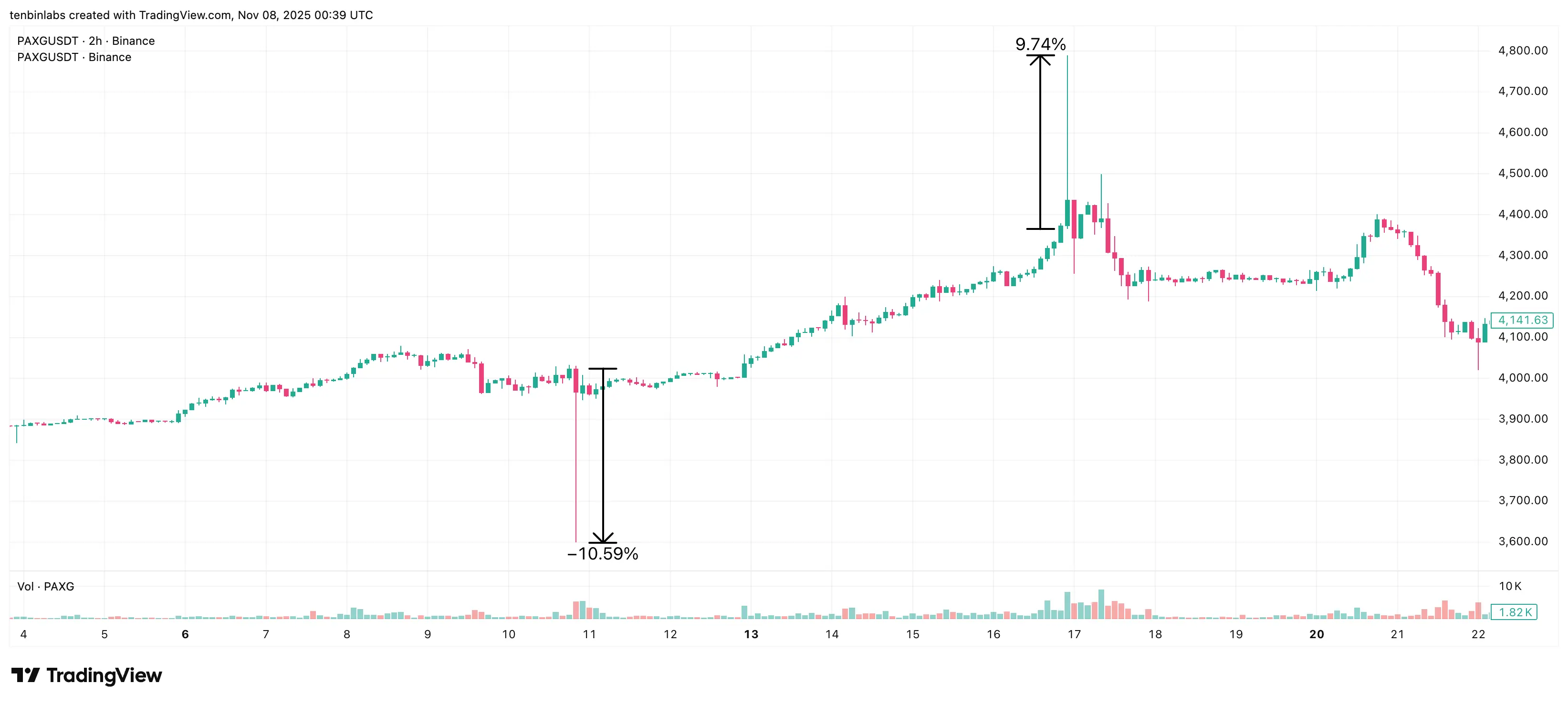

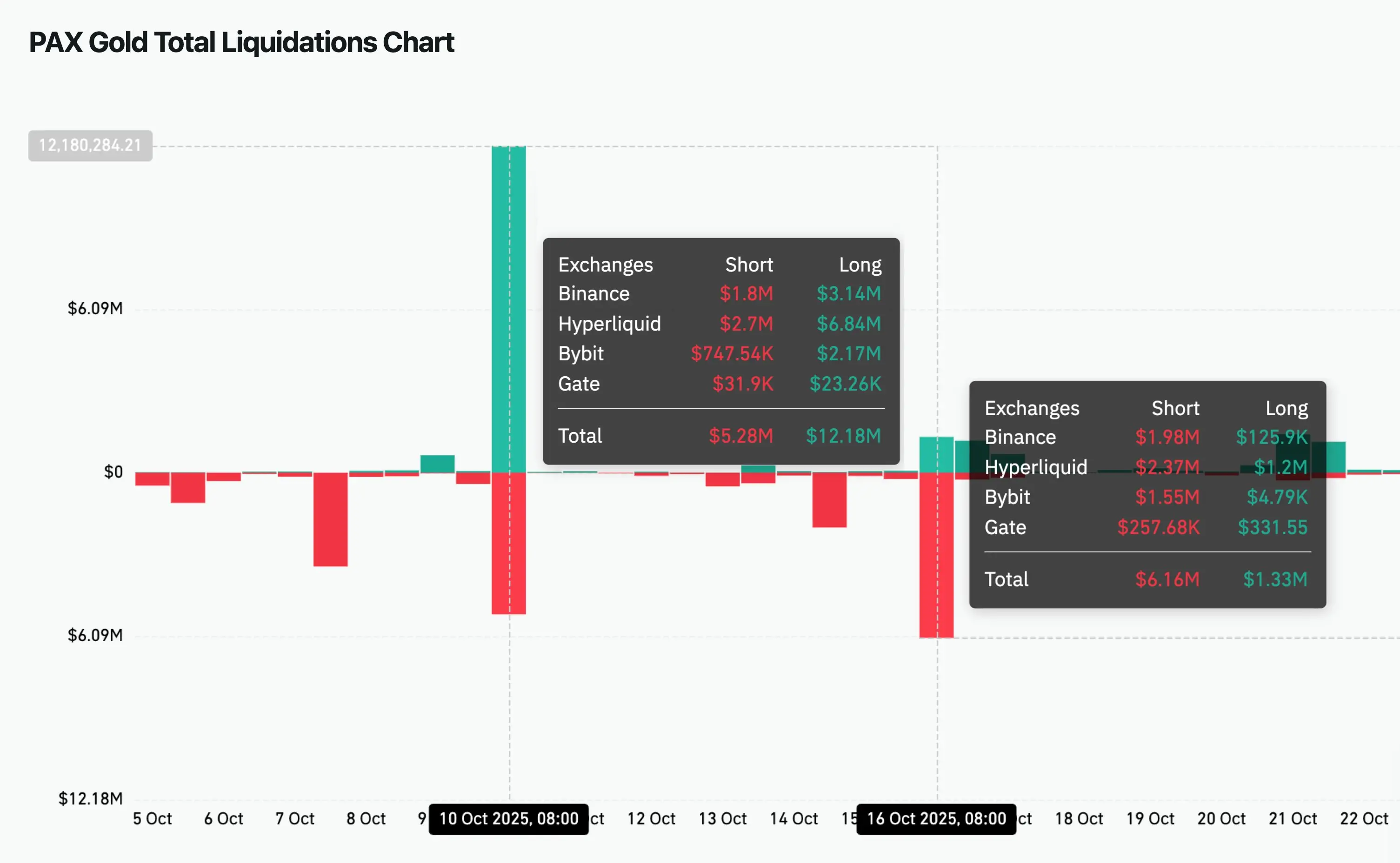

In mid-October 2025, Binance's PAXG spot market experienced two "flash crash" events within a week. On October 10, the price dropped by 10.6%; on October 16, the price surged by 9.7%. Both fluctuations quickly retraced, indicating they were driven by the fragility of the order book rather than fundamental changes.

Due to the highly interconnected nature of the tokenized asset ecosystem, instability in major trading venues does not remain localized. The spot price on Binance holds the highest weight in the oracle construction of Hyperliquid. As a result, during these two events, $6.84 million in long positions and $2.37 million in short positions were forcibly liquidated on Hyperliquid, exceeding the liquidation volume on Binance itself.

This outcome is concerning. It demonstrates how a single low-liquidity venue can propagate and amplify volatility across multiple markets. In extreme cases, it also increases the risk of oracle manipulation. Participants who have never traded in the original spot market may still suffer losses due to liquidations, price distortions, and widening spreads.

All of this traces back to the same root: the primary market lacks true liquidity.

(Chart description: CoinGlass PAXG liquidation chart)

Structural Issues of Insufficient Liquidity

The lack of liquidity in tokenized assets is a structural problem.

Once an asset is tokenized, liquidity does not automatically appear. It is provided by market makers, who are inherently capital constrained. They allocate capital to places where inventory can be efficiently deployed, risks can be continuously managed, and exits can be made with minimal time and cost friction.

Most tokenized assets fail on these dimensions.

To provide liquidity, market makers must first mint the asset. In practice, minting incurs not only explicit costs (issuers typically charge 10 to 50 basis points for minting and redemption fees) but also requires operational coordination, KYC, and settlement through custodians or brokers rather than atomic on-chain execution. Market makers must pre-fund and wait hours or days to receive the tokenized assets.

Once inventory is established, it cannot be redeemed immediately. Redemption windows are typically measured in hours or days, not seconds. Many tokenized assets only allow redemption on a T+1 to T+5 basis, with daily or weekly limits. For larger positions, fully closing out may take days or even longer.

From the market maker's perspective, this inventory is effectively illiquid and cannot be quickly recycled.

Market makers providing depth must hold inventory throughout market cycles, absorbing and hedging price risks while waiting for redemptions. During this time, the same capital could have been deployed in other cryptocurrency markets, where inventory requirements are minimal, hedging is continuous, and positions can be closed instantly; thus, the opportunity cost for market makers on tokenized assets is extremely high.

Faced with this trade-off, rational liquidity providers will allocate capital elsewhere.

The current market structure is not suited to address this issue. AMMs transfer inventory risk to liquidity providers while inheriting the same redemption constraints. Order book-based venues merely obtain fragmented market maker liquidity from various exchanges.

The result is that the market remains in a shallow equilibrium state for an extended period. Limited liquidity suppresses participation, and low participation further reduces liquidity. The entire tokenized asset ecosystem is trapped in this deadlock.

A New Market Structure

Insufficient liquidity is a structural barrier to the growth of tokenized assets.

Insufficient depth hinders sizable positions, and fragile markets propagate instability across various protocols and trading venues. Assets that cannot be reliably exited cannot serve as trustworthy collateral. Under the current tokenization model, liquidity remains constrained, and capital efficiency remains low.

To enable tokenized assets to achieve true scalability, the market structure must change.

What if prices and liquidity could be directly mapped from off-chain markets, rather than being rediscovered and cold-started on-chain? What if users could acquire tokenized assets at any scale without forcing market makers to hold illiquid inventory? What if redemptions were fast, predictable, and unrestricted?

The failure of tokenization does not stem from assets being brought on-chain, but rather because the markets supporting them have never truly gone on-chain.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。