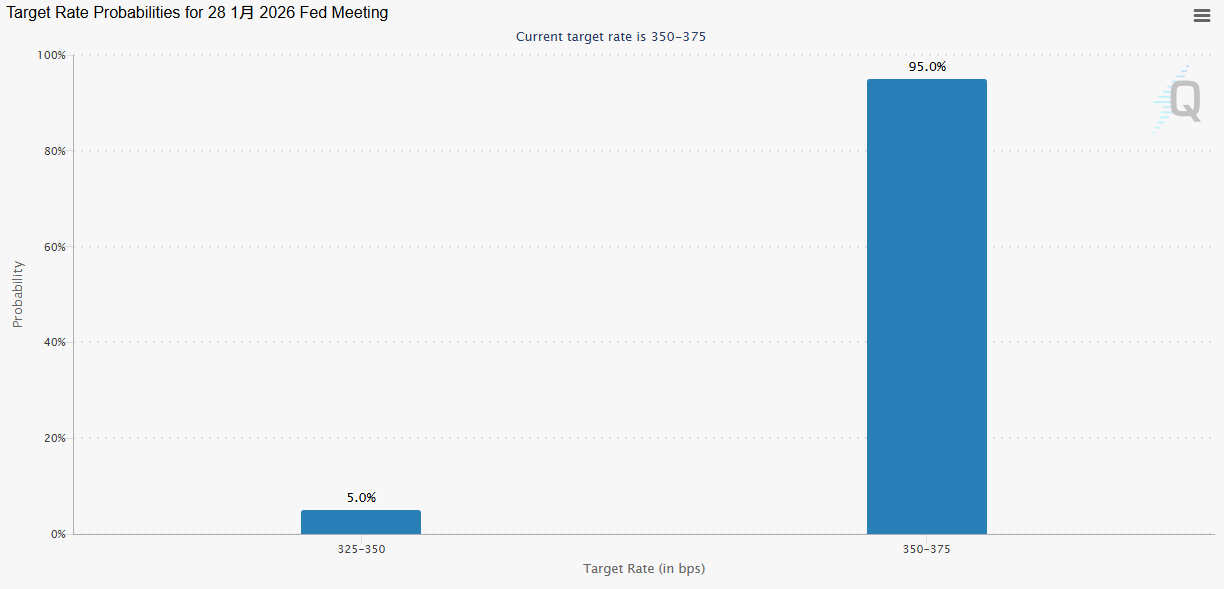

After the unemployment rate data for December was released, market expectations for a Federal Reserve interest rate cut plummeted sharply. Traders quickly adjusted their betting direction, with the probability of a rate cut in January crashing from the previous 11% to just 5%.

The December non-farm payroll data showed weak job growth, but the unemployment rate unexpectedly fell to 4.4%, below expectations.

The U.S. economy is exhibiting a "low hiring, low firing" delicate balance, a contradictory state that puts the Federal Reserve in a dilemma regarding interest rate cuts. At the same time, risk assets like Bitcoin reacted immediately, with prices retreating to around $90,000, and market sentiment once again fell into "extreme fear."

1. Key Data

● On the evening of January 9, Eastern Time, the U.S. Department of Labor released the employment data for December. This report is regarded as the first complete non-farm payroll report for 2026 and has attracted significant market attention. The number of new non-farm jobs was only 50,000, below the market expectation of 60,000. The previous value (November data) was also revised down to 56,000, indicating that the momentum for job growth has weakened.

● However, the unemployment rate unexpectedly dropped from 4.6% to 4.4%, not only lower than the previous value but also below the market's general expectation of 4.5%. This data interrupted the trend of rising unemployment rates and became the most surprising part of this report.

In terms of hourly wages, the average hourly wage increased by 0.3% month-on-month, maintaining stable wage levels.

2. Market Reaction

● After the non-farm data was released, the market reacted swiftly. CME Federal Funds futures indicated that the market's expectation of a 25 basis point rate cut in January plummeted from 11% to just 5%, while the probability of maintaining the current rate surged to 95%.

● The magnitude and speed of the market's expectation adjustment show that traders have almost ruled out the possibility of a rate cut in January, and hopes for a rate cut at the beginning of the year have basically evaporated. For the year as a whole, the market still expects the Federal Reserve to cut rates by about 50 basis points in 2026, but the timing of the cuts has been delayed. The expected timing for the first rate cut has been pushed back from early in the year to June.

This market pricing of "unchanged expectations for rate cuts throughout the year, but with delayed timing" indicates that traders believe a shift in Federal Reserve policy will still occur, but it requires more time to confirm the direction of the economy.

3. Institutional Interpretations

In response to this complex data, major financial institutions quickly adjusted their forecasts for Federal Reserve policy.

● Morgan Stanley adjusted its rate cut expectations from January and April to June and September, each by 25 basis points.

● Citigroup expects to cut rates by 25 basis points in March, July, and September, a change from the previous forecast of January, March, and September.

● The differences in predictions among institutions reflect varying views on data interpretation and policy paths. Guotai Junan's research report pointed out that the "low hiring, low firing" state of the U.S. job market in December is still ongoing. Many employment indicators show that the risk of a slowdown in the U.S. job market remains low, and the Federal Reserve still has room to pause rate cuts after having already cut rates three times in a row.

4. Policy Logic

The contradictory nature of this data—weak job growth but a declining unemployment rate—reveals the unique state of the current U.S. labor market: "low hiring, low firing" delicate balance.

● Analysts point out that companies are hesitant to hire on a large scale but also reluctant to lay off employees en masse, with wage levels remaining strong. This stalemate is the most challenging situation for the Federal Reserve to navigate. They are concerned about inflation rebounding if they cut rates, yet fear an economic slowdown if they do not.

● The U.S. economy still maintains a certain level of resilience, and the labor market remains strong. The U.S. labor market is still robust, and with the number of job vacancies still higher than pre-pandemic levels, it is difficult to determine whether the U.S. job market has begun to deteriorate.

5. Asset Performance

● In the stock market, interestingly, despite the data showing weak job growth and cooling rate cut expectations, the U.S. stock market did not experience panic. By the close last Friday, both the Dow Jones Industrial Average and the S&P 500 Index reached new highs.

○ The market has already priced in related expectations, and the current concern is not about interest rates but whether the economy will experience a hard landing. In the current economic situation, the Federal Reserve "has every reason to wait to further understand the possible direction of the economy."

● The gold market reacted noticeably. After the data was released, the dollar remained stable, and the upward momentum of gold prices was hindered. The previous rise in gold prices driven by rate cut expectations has temporarily paused, indicating a cooling of market enthusiasm for non-yielding assets.

● In the bond market, the yield on 10-year U.S. Treasuries stabilized around 4.2%, with limited fluctuations.

● The cryptocurrency market reacted particularly quickly, with Bitcoin prices retreating to around $90,000. Meanwhile, the cryptocurrency fear and greed index fell to 25, entering the "extreme fear" zone, down from 27 the previous day, with a weekly average of 29.

6. Future Focus

● The future direction of the Federal Reserve's monetary policy will depend on tariff policies and economic development trends. The short-term focus shifts to the appointment and statements of the new Federal Reserve Chair. Future events that could catalyze rising rate cut expectations need to pay close attention to the appointment and statements of the new Federal Reserve Chair.

● JPMorgan analysts believe there is still room for further rate cuts in 2026, especially if the job market performs worse than the Federal Reserve's predictions.

● If a strong economic period occurs during the tax rebate period for households in the first half of 2026, it may persuade the Federal Reserve to slow down the pace of monetary easing. As U.S. immigration policies tighten, they are having a profound impact on the labor market.

As the cryptocurrency fear and greed index falls to 25, returning to the "extreme fear" zone, the correlation between digital assets and traditional financial markets is strengthening.

When risk aversion sentiment in traditional markets heats up, cryptocurrencies, as emerging risk assets, are the first to be affected. Bitpush News reports that investors may now view Bitcoin more as a non-sovereign store of value and a tool to hedge against geopolitical uncertainties.

The U.S. economy's "low hiring, low firing" stalemate continues, and the Federal Reserve's dilemma in policy positioning is unlikely to change in the short term. The repeated adjustments in market expectations for rate cuts reflect the difficult process of finding a balance between inflation and growth.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。