Circle completed the construction of a full-stack platform in 2025, integrating trusted digital assets, real-world applications, and the Arc blockchain, serving as the economic operating system of the internet.

Written by: Circle

Translated by: Chopper, Foresight News

By the end of 2025, stablecoins are the absolute protagonists of the crypto world. As the year comes to a close, one of the key drivers of the stablecoin wave, Circle, released its annual review report. Circle elaborated on the achievements of the full-stack platform construction over the past year, detailing regulatory breakthroughs, growth in stablecoin market share, application implementations, and exploration of Arc infrastructure, showcasing the evolution of programmable finance into the mainstream world. Below are the key points extracted from the report.

TL;DR

Global regulatory frameworks such as the U.S. GENIUS Act and the EU MiCA have been implemented, clarifying the mainstream financial positioning of fully reserved stablecoins and laying the foundation for industry scaling.

Circle completed the construction of a full-stack platform in 2025, integrating trusted digital assets (USDC, EURC, USYC), real-world applications, and the Arc blockchain, serving as the economic operating system of the internet.

Breakthroughs in institutional commercialization partnerships, covering giants like Intercontinental Exchange, Deutsche Börse, Finastra, and FIS, with applications spanning core areas of payment, clearing, and treasury management.

The practical value of digital assets has been realized, extending from cross-border remittances and global payroll to AI intelligent payments, with the public testnet of the Arc blockchain supporting the next generation of finance.

Circle firmly believes that global economic infrastructure should possess the speed and scale of the internet, allowing value to flow seamlessly like information. Since our inception, our mission has been to enhance global economic prosperity through frictionless value exchange, committed to building open, programmable, vertically integrated financial service technology solutions that enable trusted digital currencies and financial applications to operate natively on the internet.

In 2025, this vision became increasingly clear. New regulatory frameworks have been issued or fully implemented in various regions, including the U.S., Europe, Canada, Hong Kong, and the UAE, clearly defining on-chain settlement digital currencies with full reserves and stable value as components of the global financial system. Against this backdrop, Circle's IPO became a milestone in development, reinforcing our long-term commitment to transparency, sound governance, and strict risk management.

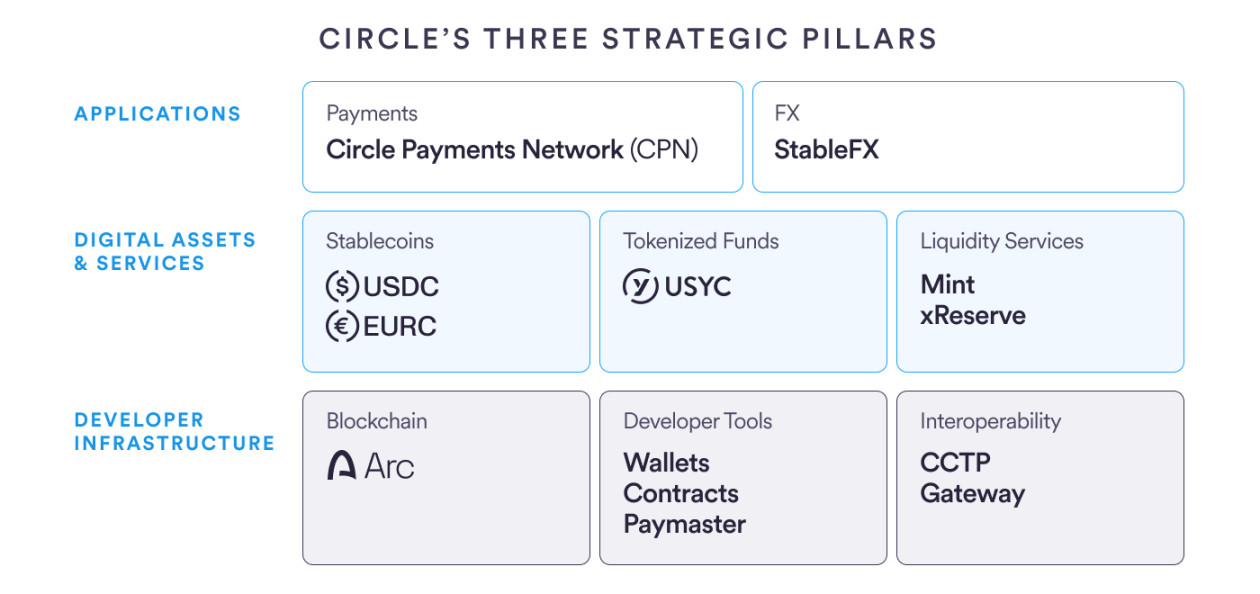

Our strategy relies on three synergistic pillars, continuously advancing in 2025: first, fully reserved digital stablecoins (USDC, EURC, and USYC); second, an application service matrix (including Circle Payments Network and StableFX); third, the launch of the Arc blockchain, integrating programmable currencies with real economic activities to create neutral institutional-level infrastructure. Together, these form a full-stack technology platform that propels programmable currencies and on-chain transactions into the global financial mainstream.

Our efforts aim to create tangible value: low-cost, fast remittances help families retain more income; efficient cross-border payments benefit small and micro enterprises; programmable funds empower financial institutions to manage liquidity in real-time and explore new markets, driving the financial system towards an open and inclusive internet-native form. This annual report focuses on the key pillars of transformation in 2025, covering four core areas: regulatory milestones, digital asset growth, application service expansion, and exploration of Arc infrastructure.

Regulatory Clarity: Unlocking Industry Scaling Potential

In 2025, regulatory breakthroughs across multiple jurisdictions globally became a turning point for the industry. Key markets such as the U.S., EU, Hong Kong, and UAE introduced frameworks that clearly define "fully reserved, stable value, transparent and traceable" on-chain settlement digital currencies as long-term components of the financial system, reversing policy uncertainty.

Progress in the U.S. market is crucial. In July, the GENIUS Act took effect, clearly defining fully reserved payment stablecoins as core components of modern financial infrastructure, with terms highly aligned with Circle's standards. At the same time, Circle received conditional approval from the OCC to establish the "First National Digital Currency Bank," which will enhance the security of USDC reserves and regulatory transparency, filling the gap between traditional finance and digital asset services.

The global regulatory collaboration landscape is expanding. In the EU market, Circle is the only mainstream issuing institution with both MiCA-compliant USDC and EURC, covering all 27 EU countries; in the Middle East, the DFSA listed USDC/EURC as the first batch of compliant stablecoins, and Circle obtained a full license from Abu Dhabi FSP, expanding application scenarios in the UAE.

Compliance capability has become a core advantage, as Circle joined the global travel rules network, deepening collaboration with the TRUST network, embedding compliance functions into products like CPN and Gateway, and reducing customer access costs.

Meanwhile, industry insiders have been assessing how to integrate USDC more deeply into their products and services, while the overall positive regulatory environment for digital assets has also driven demand growth for EURC and USYC. These developments signify a structural shift in the financial system, viewing digital assets as scalable, mainstream, and resilient cash equivalents.

Commercial Expansion: Institutional Collaboration Penetrating Core Financial Scenarios

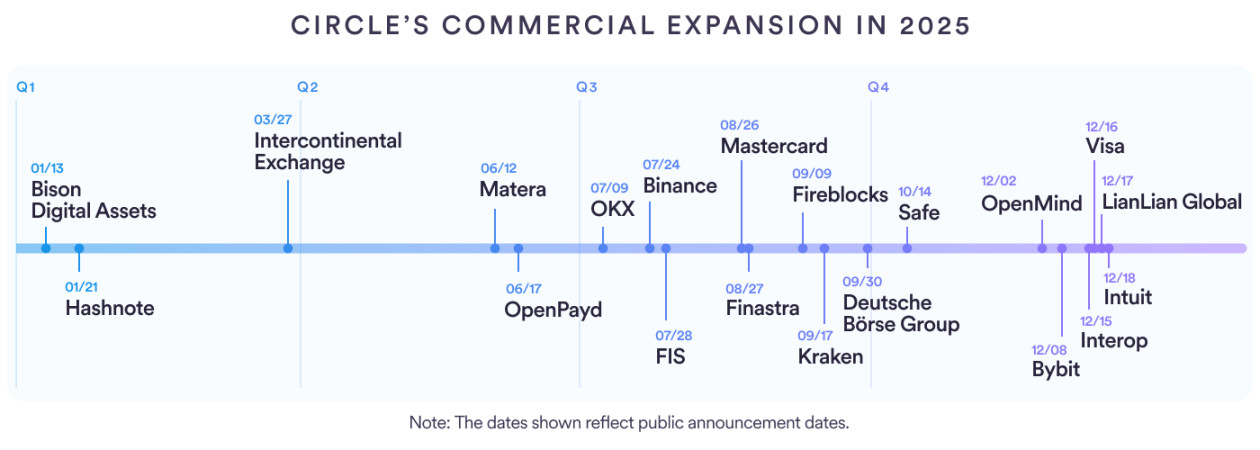

Regulatory clarity catalyzed explosive growth in institutional business in 2025, with global market infrastructure providers, fintech companies, and exchanges collaborating with Circle to validate the value of digital assets in enhancing efficiency and reducing risk.

The entry of top market infrastructure providers has become a trend indicator. The Intercontinental Exchange (ICE) in the U.S. announced the introduction of USDC/USYC, exploring integration into capital market trading and clearing processes; the Deutsche Börse in the EU committed to integrating USDC/EURC throughout the entire process to reduce settlement risk.

Fintech giants are accelerating their integration. Finastra plans to integrate USDC settlement into its Global PAYplus platform, which processes trillions of dollars in cross-border funds daily; FIS will include USDC in its "fund circulation hub," benefiting a vast number of banking clients; Intuit signed a multi-year strategic partnership to deploy stablecoin infrastructure covering small and micro enterprise treasury management.

Breakthroughs have been achieved in cross-border payments and regional markets. In Brazil, Circle partnered with Matera to empower enterprises with low-cost global payments; in the Asia-Pacific region, collaboration with LianLian Global is optimizing cross-border collection for small and micro enterprises; in Europe, a subsidiary of Bison Bank launched USDC/EURC deposit and exchange services. In terms of payment card organizations, Visa U.S. launched real-time settlement with USDC, and Mastercard expanded its services to the EMEA region.

Collaboration within the exchange ecosystem has deepened. Binance supports USYC as collateral for derivatives, expanding USDC's application to 240 million users; Bybit, Kraken, and OKX have respectively strengthened liquidity, accelerated integration, and launched two-way exchange services. In terms of infrastructure layout, Circle acquired Interop to accelerate the advancement of Arc and CCTP; acquired Hashnote to integrate USYC into Circle's full-stack platform; collaborated with Safe to create multi-signature smart accounts; and laid out AI intelligent payment standards.

Digital Assets: Building the Core Value Carrier of Global Finance

In 2025, the three core digital assets USDC, EURC, and USYC achieved dual enhancements in scale and quality, covering diverse scenarios such as payments, foreign exchange, and treasury management.

USDC: The Global Stablecoin Benchmark

As of December 23, 2025, the market capitalization of USDC rose from $44 billion to $77 billion, a growth of 75%. On-chain coverage expanded to 30 blockchains, with 14 new public chains including XRP Ledger. After the upgrade of the CCTP protocol, it supports cross-chain transfers across 17 chains, with a cumulative transaction volume exceeding $126 billion and over 6 million transfers.

Market liquidity significantly improved over the past year, with Binance's BTC/USDC spot liquidity increasing by 227%, and perpetual contract depth improving by over 200%. Trading metrics optimized, with 99% of time points having spreads below 1 basis point, and slippage for $100,000 trades reduced from 42 basis points to less than 5 basis points, gradually narrowing the gap with USDT, becoming a highly credible liquidity carrier.

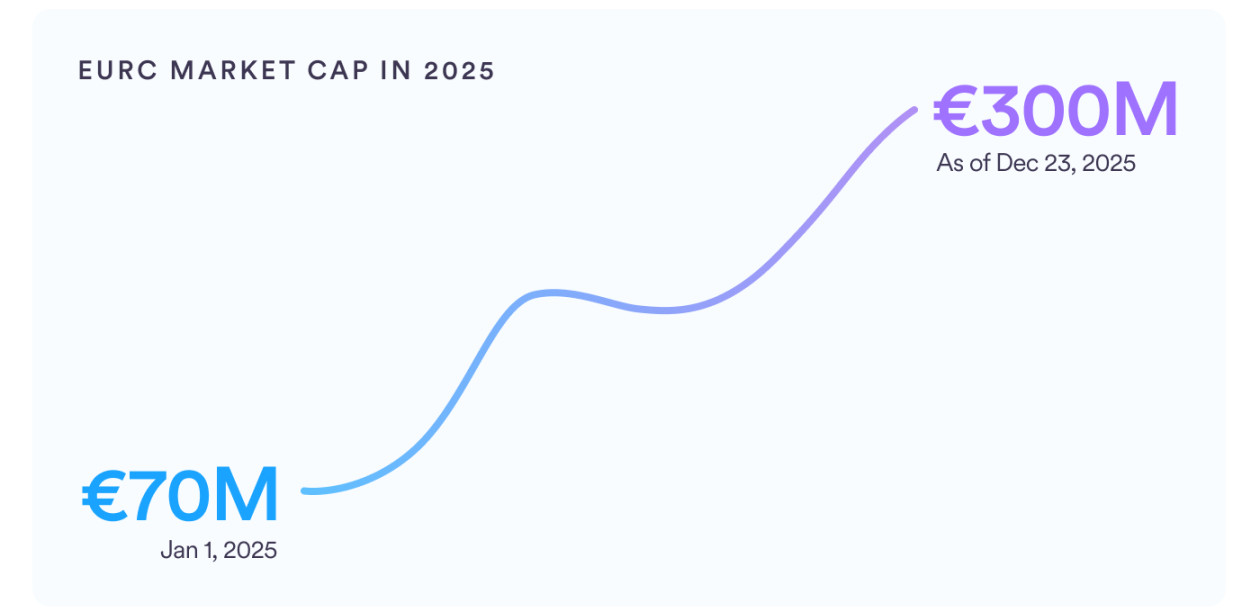

EURC: Leading the EU Compliance Market

2025 was also a crucial year for EURC. The implementation of MiCA drove explosive growth for EURC, with its market capitalization rising from €7 million to over €300 million as of December 23, a growth of 328%, firmly establishing it as the leading euro stablecoin.

The growth of EURC is attributed to its expansion on the World Chain. The World Chain brought EURC to over 37 million World App users, enabling daily euro transaction buying, selling, and transfer functions.

The "regulatory compliance + institutional inflow and outflow + consumer-level distribution" model formed a complementary regional liquidity network with USDC, validating the feasibility of the regional strategy.

USYC: The Core Choice for Institutional Yield Assets

Like USDC and EURC, Circle's TMMF (Token Management Fund) USYC also continued to grow. From November 1 to December 23, 2025, the assets under management of USYC increased by approximately $592 million, from $948 million to $1.54 billion, making it the second-largest TMMF globally.

USYC successfully launched on BNB Chain and Solana, reaching more institutional clients due to its high throughput and low latency characteristics. Its core value lies in "traditional asset returns + on-chain flexible settlement," supporting 24/7 redemption and conversion to USDC, meeting institutional liquidity needs.

Applications and Services: Bridging the Last Mile

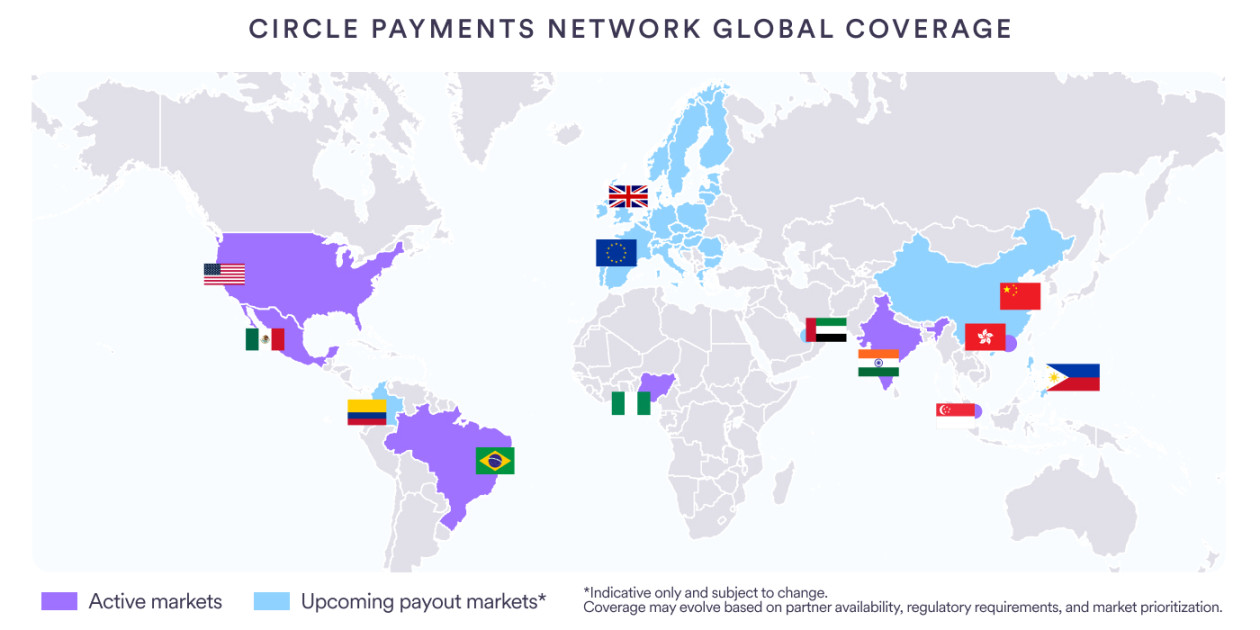

As the regulated digital asset landscape continues to grow, the focus in 2025 is on making these assets more applicable to real-world financial workflows. Circle's CPN (Circle Payments Network), CCTP (Cross-Chain Transfer Protocol), Gateway, Circle xReserve, Mint, StableFX, Circle Wallets, and other supporting applications and services have become the link connecting digital assets with everyday financial infrastructure.

CPN: Accelerating Global Capital Flow

To address the pain points of traditional cross-border payments, which have T+2 to T+5 delays and high fees of 3%-5%, Circle launched the CPN stablecoin payment network at the beginning of 2025. It provides a real-time payment coordination platform for licensed financial institutions. The core advantages of CPN include: a "one-to-many" integration model that reduces setup costs; a programmable risk control framework that supports real-time policy effectiveness; and native compliance capabilities that realize "compliance as a service."

The CPN Console self-service interface shortens the onboarding cycle, with over 25 design partners by the end of the year. For example, Brazil's Alfred achieved second-level cross-border payments, reducing exchange rate costs by 20%; Asia-Pacific's Tazapay addressed the pain points of small and micro enterprise collections.

Liquidity and Interoperability Tools

As the use of digital assets in the real world continues to grow in 2025, Circle will continue to expand the liquidity and interoperability infrastructure needed to support this growth.

Through Mint, Gateway, and xReserve, a multi-chain liquidity system is being collaboratively built. Mint optimizes rates and account management, adding 24/7 USDC/EURC exchange; Gateway supports 11 core chains, enabling real-time allocation of USDC and integrating decentralized liquidity; xReserve empowers non-native chain issuance of reserve-backed stablecoins, reducing cross-chain trust risks.

StableFX: Restructuring Institutional Forex Trading

While Mint, CPN, CCTP, Gateway, and xReserve focus on payments, liquidity, and interoperability, StableFX and Circle Partner Stablecoins target another important aspect of cross-border finance: foreign exchange.

To address the pain points of traditional T+1 forex settlement and margin prepayment, Circle launched the StableFX engine in November, combining the RFQ model with on-chain settlement to achieve real-time delivery without margin requirements. StableFX is now live on the Arc public testnet.

Wallets and Autonomous Payments: Expanding AI Scenarios

Wallets are the way users interact with the on-chain world; this critical infrastructure brings together end-user experiences, developer workflows, and emerging intelligent agent use cases.

Circle's wallet-as-a-service platform, Circle Wallets, launched a modular solution, with Gas Station and Paymaster features lowering user barriers. Circle also expanded wallet infrastructure into a new domain: autonomous machine-to-machine payments. Through collaborations with Coinbase's x402 protocol and partners like OpenMind, Circle will integrate developer-controlled wallets with x402, enabling AI agents to autonomously access USDC payment APIs for data, computation, and content fees.

Real-World Applications: From Pilot to Scalable Implementation

The true measure of progress in 2025 is not the breadth of Circle's product portfolio or the clearer regulatory frameworks being promoted globally, but the achievements made by developers and customers as a result. In 2025, Circle's digital asset applications transitioned from pilot projects to scalable implementations, covering consumer banking, cross-border remittances, global payroll, and addressing traditional financial pain points.

CAP Program: Alliance Ecosystem Driving Innovation

As of December, the CAP (Circle Alliance Program) had 1,065 members, covering banks, tech companies, and more. The core value lies in ecosystem collaboration, with Circle providing technical support while members innovate based on local needs: Southeast Asian members reduced cross-border remittance times to minutes and cut fees by 50%; Latin American members integrated agricultural supply chain finance to serve small farmers.

Penetration of Mainstream Financial Channels: Reaching Hundreds of Millions of Users

Circle partnered with the Latin American digital bank Nubank to provide low-barrier USDC savings services for 127 million users in Brazil, Mexico, and Colombia, allowing users to exchange for value preservation without needing foreign accounts through existing apps. By integrating USDC into its platform, Nubank began offering millions of Brazilians a convenient way to access and hold digital dollars within the Nubank app.

Cross-Border Payments and Remittances: From T+2 to 24/7

The global payment network Thunes replaced the multi-currency pre-deposit model with USDC, reducing working capital occupancy by 30% and increasing reconciliation efficiency by 60%, covering more emerging markets. On the other hand, the new stablecoin-based bank Lipaworld combined USDC with digital vouchers to provide low-cost remittance services for immigrants, reducing fees by 40%-60% and cutting delivery times to minutes, addressing the issue of insufficient outlets in underdeveloped areas.

Payroll Distribution: Adapting to Remote Work

Circle launched USDC payroll solutions in collaboration with Rise, allowing companies to pay globally through a single platform, avoiding multi-currency exchange costs, and reducing delivery times from 3-5 days to real-time. Over a thousand companies benefited, covering industries such as technology and creative sectors, enhancing income predictability for freelancers and lowering operational costs for businesses.

Social Responsibility: Institutionalizing Financial Inclusion

As Circle expanded its commercial and institutional business landscape in 2025, it also took measures to formally implement our long-standing commitment to inclusive finance and enhancing financial resilience.

Through the "1% Donation" program, the Circle Foundation was established to fund projects promoting mobile payments in Africa, payment access for small and micro enterprises in Southeast Asia, and financial training for immigrants in Latin America. Inclusivity is incorporated into infrastructure design, expanding coverage in emerging markets through CPN and lowering costs for small and micro enterprises with low-barrier APIs.

Arc Blockchain: Launching the Internet Economic Operating System

In 2025, Circle launched the EVM-compatible Layer 1 public chain Arc, positioned as the "Internet Economic Operating System," specifically designed to support real financial activities. The acquisition of the Informal Systems team integrated the Malachite consensus engine, featuring sub-second confirmations, high throughput, and low energy consumption.

In October, the Arc public testnet went live, attracting over 100 institutions, including global core players like BlackRock, Goldman Sachs, Amazon Web Services, and Coinbase. Arc's core features include sub-second final confirmations, predictable fees denominated in USDC, and configurable privacy tools.

The exploration of AI scenarios has shown significant results, with hackathons promoting developer innovation. The "AI Disaster Relief Platform" became a typical example, achieving automatic fund distribution through Arc and USDC, with zero-knowledge proofs ensuring compliance and transparency. As of December, Arc's Discord community exceeded 20,000 members, launching a developer fund to support compliance components, liquidity tools, and other projects, accelerating ecosystem implementation.

Future Outlook: Co-Building an Open Internet Financial System

The progress we made in 2025 is just the beginning. The world is still in the early stages of transitioning from decades-old financial infrastructure to an internet financial system. In this system, value exists natively online and flows at unprecedented speeds. The clarification of key market regulatory policies, the growth and diversification of trusted digital assets, the expansion of applications with practical value, and the early development momentum of blockchain infrastructure built for real-world economic activities all indicate that programmable on-chain finance will play a foundational role in the global economy.

In the future, as a neutral and trusted digital currency issuer, an institutional-level infrastructure builder, and a partner for next-generation financial application developers, we are committed to continuing to play a constructive role.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。