The Trump family has leveraged their fame and connections to profit from cryptocurrency at a pace far exceeding traditional businesses.

Written by: Tom Maloney, Annie Massa, and Demetrios Pogkas, Bloomberg

Translated by: Luffy, Foresight News

In December 2024, a photo of Donald Trump holding Bitcoin was displayed at a Coinhero store in Hong Kong, marking Bitcoin's price surpassing $100,000 for the first time. Image source: Bloomberg

On the surface, Donald Trump's personal net worth appears to have changed little since his return to the White House: it was $6.5 billion on election day and is now $6.4 billion.

However, a deeper look at the data reveals an unprecedented and significant shift in how he and his family are consolidating their wealth empire, and they are benefiting from their fame, influence, and power at a pace far beyond what was previously possible.

Whether applying their brand to real estate projects or associating it with perfumes and mattresses, the Trump family has long utilized licensing agreements to make quick profits, whereas real estate development typically requires years of planning and execution. Now, with cryptocurrency, the Trump family has further accelerated the monetization of their brand.

Coupled with the Trump administration's relaxation of restrictions on overseas transactions, this has created a wealth bonanza. According to the Bloomberg Billionaires Index, cryptocurrency investments have brought Donald Trump at least $620 million in wealth appreciation within months. This index has for the first time estimated the earnings the Trump family has gained from projects like World Liberty Financial and the Trump Meme Coin (TRUMP).

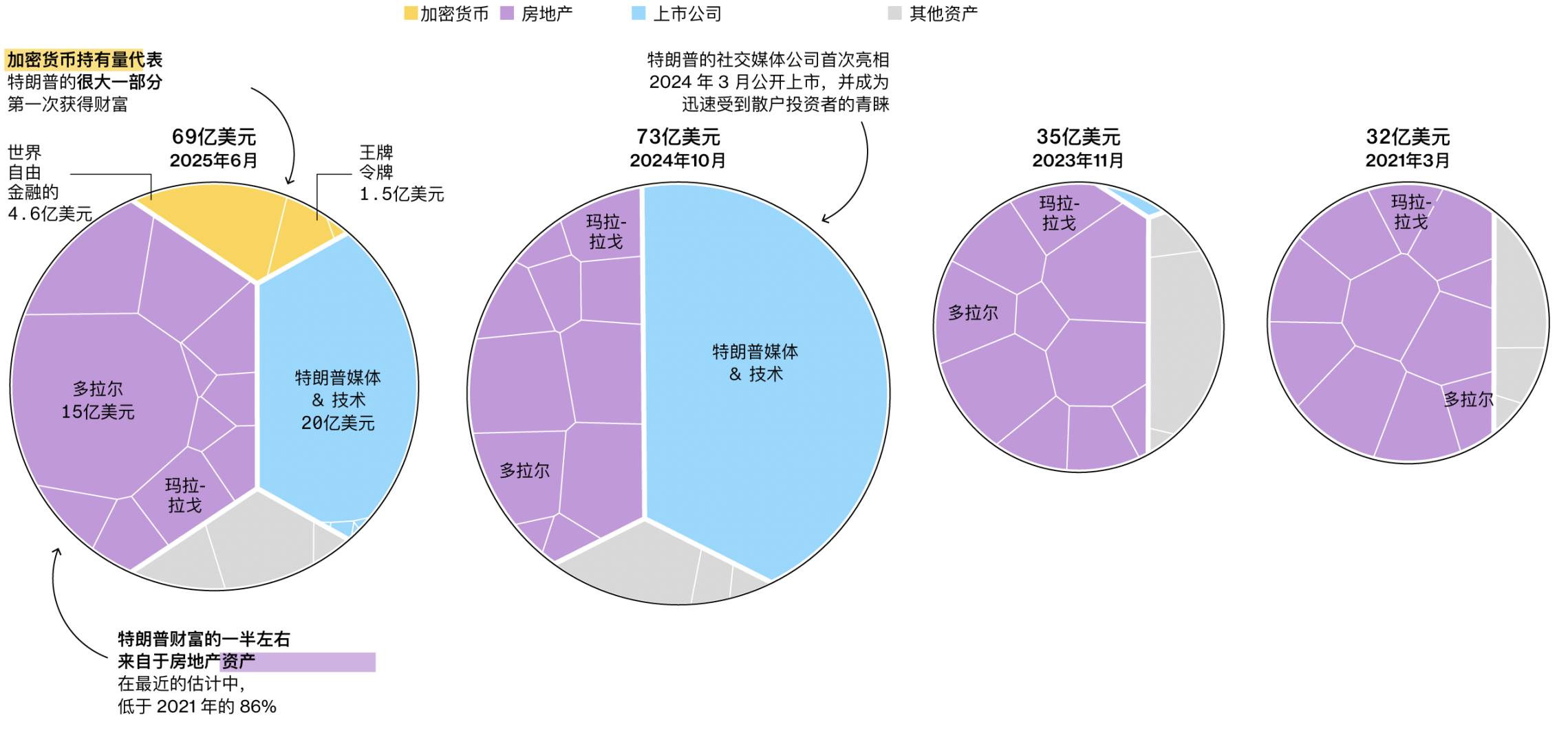

Trump's wealth is increasingly linked to cryptocurrency and Memecoins. Source: Bloomberg Billionaires Index (Note: Liabilities are not included. The latest valuation of publicly traded assets is as of the end of June.)

An increasing number of cryptocurrencies and lesser-known companies have gained value through their association with Trump and his "Make America Great Again (MAGA)" movement, and the money earned by these cryptocurrencies and companies far exceeds the more than $34 million that the Trump Organization earned last year through real estate licensing deals.

Eric Trump, executive vice president of the Trump Organization and Donald Trump's second son, stated, "I am incredibly proud of our outstanding company; we have never been stronger."

While President Trump's assets are held in a trust managed by Donald Trump Jr., he still directly benefits from the success of the Trump Organization, and the Bloomberg Wealth Index attributes the family's various interests to this "patriarch." Many private investments involving Trump's children have not yet been included, as the details of their financial interests remain unclear, including the private club Executive Branch in Washington, the Bitcoin hoarder Metaplanet transformed from a Japanese hotel company, the broadcasting and podcast company Salem Media Group Inc., the prediction market startup Kalshi, and the online pharmaceutical retailer BlinkRX.

Despite Trump and his children venturing into the cryptocurrency space, since December, Eric Trump and Donald Trump Jr. have spoken at events in Abu Dhabi, Washington, Dubai, and Las Vegas, sometimes separately and sometimes together. However, one of the biggest drivers of Trump's personal wealth is a long-gestating domestic project.

Eric Trump (left) and Donald Trump Jr. at the Bitcoin 2025 conference. Image source: Bloomberg

In January of this year, the Trump National Doral resort was approved to build approximately 1,500 luxury apartments on the site, a long-term goal of the Trump family that required extensive outreach to the community. According to Bloomberg's calculations, this project has increased the value of the 600-acre site in suburban Miami, which includes four golf courses and a resort with over 600 rooms, from $350 million to $1.5 billion.

Meanwhile, the publicly traded social media company Trump Media & Technology Group Corp., the parent company of Truth Social, has experienced extreme volatility. The company reported a net loss of $401 million last year but added over $4 billion to Trump's wealth in October. Even as the company attempts to enter the financial and Bitcoin sectors, Trump's stake is still valued at $2 billion.

However, the surge in cryptocurrency projects associated with Trump has provided the family with new avenues for profit.

The most notable is World Liberty Financial, a platform that sells its own tokens and issues a stablecoin called USD1. USD1 is a cryptocurrency designed to peg its value to the dollar. The Trump family profits from token sales, holding a portion of the parent company's shares, and holding its World Liberty Financial tokens.

As of March, World Liberty had sold tokens worth $550 million. According to Bloomberg's calculations, approximately $390 million of that flowed to the Trump family. The Trump family also owns 22.5 billion tokens, which, based on the trading price of the tokens in June, is valued at over $2 billion. Since these tokens are non-transferable, they are excluded from Trump's net worth calculations, although the company has recently indicated that this may change soon.

According to details on the company's website, the Trump family reduced its stake in World Liberty from 60% to 40% last month. It is unclear who the buyer is or what the Trump family gained from this divestment.

World Liberty also launched the stablecoin USD1. The Abu Dhabi-based tech investment company MGX announced plans to invest $2 billion in the cryptocurrency exchange Binance using this token, significantly boosting USD1's circulation. According to The Wall Street Journal, Binance founder Changpeng Zhao has been seeking a presidential pardon after admitting to violating U.S. anti-money laundering laws. He is currently serving as an advisor to World Liberty alongside cryptocurrency industry leaders Justin Sun and Bilal Ben Saqib, chairman of the Pakistan Cryptocurrency Committee.

Donald Trump attended the Bitcoin 2024 conference in Nashville. Image source: Bloomberg

According to Bloomberg's calculations, if we estimate World Liberty's valuation at around $1.4 billion based on the market capitalization of stablecoin issuer Circle Internet Group Inc. and the circulation of USDC, the limited adoption of USD1 means it has not been included in Trump's net worth. However, its $2.2 billion circulation suggests that World Liberty could earn about $100 million from reserves this year.

Another Memecoin named after the president (TRUMP) was launched two days after his inauguration. When the price of TRUMP rises, the Trump family benefits: Fight Fight Fight and the Trump Organization's subsidiary CIC Digital hold 80% of the TRUMP supply, with some tokens set to be gradually unlocked and sold over three years. Memecoins have no intrinsic value, and trading is entirely based on market sentiment.

Trump's Memecoin (TRUMP) has been highly sought after due to its connection to the current president's family, and demand surged after a competition held in May of this year. This competition invited 220 of the largest TRUMP token holders to a private dinner with Trump at his golf club in Virginia, where he spoke. Justin Sun was also a guest, and he posted a selfie wearing a black tie on his way to the event at the Virginia Trump Golf Club. Guests enjoyed filet mignon and pan-seared halibut, while protesters outside held signs calling it a "fraud fest."

Valuing Memecoins is very difficult, often because the token creators hold the vast majority of the supply, and once sold, the market collapses. Cryptocurrency risk modeling firm Gauntlet found that digital wallets associated with the creation of Memecoin TRUMP hold nearly 17 million TRUMP tokens.

These wallets have also transferred approximately 17 million TRUMP tokens to cryptocurrency exchanges.

On May 22, outside the Trump National Golf Club in Sterling, activists from the "Our Revolution" organization held a protest. The private dinner hosted by Trump that day invited 220 of the largest TRUMP token holders. Image source: AP

The Trump Organization holds 40% of the total supply of TRUMP tokens, which is the same as its disclosed stake in World Liberty Financial. According to Bloomberg, after applying a large liquidity discount and accounting for nearly $300 million in trading and selling profits, Trump's Memecoin investment is valued at about $150 million, not including the 800 million tokens that will begin unlocking later this month over the next three years. At current prices, these 800 million tokens are worth over $7 billion.

Although World Liberty Financial and TRUMP were initially two separate projects, they have now intersected at least in one aspect: Eric Trump revealed that World Liberty Financial plans to accumulate a large amount of TRUMP tokens as part of the company's cryptocurrency asset reserves.

In addition, the Trump family has a trump card in the cryptocurrency space.

American Bitcoin, an entity spun off from a small investment bank under Trump, is planning to become a publicly traded company, which will add another source of wealth from cryptocurrency for the Trump family. When American Bitcoin was established in February of this year, a press release stated that it would focus on AI infrastructure and data centers. By March, the company had developed a new strategy, shifting its focus to the cryptocurrency sector and rebranding.

Bitcoin miner Hut 8 Corp. agreed to acquire a majority stake in American Bitcoin and transfer nearly all of its cryptocurrency mining equipment. Hut 8 Corp. plans to merge with the low-market-cap company Gryphon Digital Mining Inc., which is listed on Nasdaq, to take the entire company public. The Trump family and its partners hold a 20% stake in American Bitcoin.

According to Bloomberg's calculations, Gryphon's stock price values the new joint venture at over $3 billion. Considering that the new company's main asset will be the Bitcoin mining equipment provided by Hut 8 (with a book value of about $120 million), the $3 billion figure seems excessively high by any traditional valuation standard.

However, like many of the assets and businesses that constitute Trump's new wealth, fundamentals are often not the focus.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。