Institutional capital entering the market, the Bitcoin halving, and the rise of real applications have created opportunities for long-term investors.

Written by: Luke, Mars Finance

For cryptocurrency investors who experienced the spectacular bull market of 2020-2021, the current market is undoubtedly confusing and agonizing. It was an era ignited by global central banks' "massive liquidity," where liquidity was abundant, everything rose, and it seemed that buying any project with closed eyes could yield astonishing returns. However, those days are long gone. Now, the global financial market hangs in a delicate balance: on one side, unexpectedly strong U.S. economic data, and on the other, the Federal Reserve's unwavering hawkish stance, with a historically high interest rate environment weighing down on all risk assets.

This paradigm shift, driven by the macro environment, has made this round of the crypto cycle the "most difficult era" for retail investors. The previous model of "liquidity-driven, purely emotional speculation" has failed, replaced by a "value bull" market that emphasizes intrinsic value, driven by clear narratives and fundamentals.

However, the difficulty also brings opportunities. When the tide recedes, true value investors will welcome their "golden age." Because it is in such an environment that institutional compliance entry, technological programmatic deflation, and real applications integrated with the real economy can highlight their true, cyclical value. This article aims to deeply deconstruct this profound transformation and explain why this era, which is challenging for speculators, is precisely the golden road paved for prepared investors.

I. The Most Difficult Era: When the Tide of "Massive Liquidity" Recedes

The difficulty of this cycle stems from a fundamental reversal in macro monetary policy. Compared to the extremely friendly environment of the previous bull market characterized by "zero interest rates + unlimited quantitative easing," the current market faces the most severe macro headwinds in decades. The Federal Reserve has initiated an unprecedented tightening cycle to curb the most severe inflation in forty years, bringing dual pressure to the crypto market and completely ending the old model of easy profits.

1. The Macro Data Dilemma: Why Rate Cuts Are Still Far Off

The key to unlocking the current market predicament lies in understanding why the Federal Reserve is reluctant to ease at the end of its rate hike cycle. The answer is hidden in recent macroeconomic data—these seemingly "good" data have become "bad news" for investors hoping for easing.

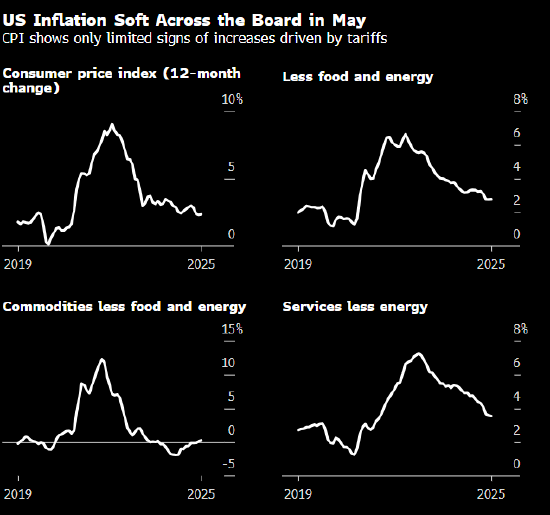

Stubborn Inflation and Hawkish Dot Plot: Although inflation has retreated from its peak, its stickiness is far beyond expectations. The latest data shows that while the U.S. May CPI annual rate was slightly below expectations, the core inflation rate stubbornly remains at a high of 2.8%.

This still shows a significant gap from the Federal Reserve's 2% target. This stubbornness is directly reflected in the Federal Reserve's latest economic projections (SEP) and the closely watched "dot plot." After the June meeting, Federal Reserve officials significantly lowered their rate cut expectations, reducing the median number of cuts for the year from three to just one. This hawkish shift heavily dampened market optimism. As Powell stated in the post-meeting press conference: "We need to see more good data to bolster our confidence that inflation is moving steadily toward 2%." In other words, the threshold for the Federal Reserve to cut rates has become very high.

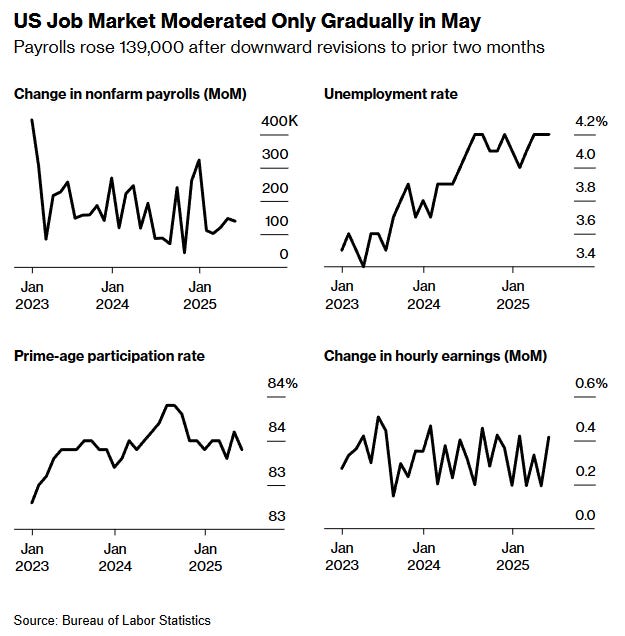

Strong Labor Market: Meanwhile, the U.S. labor market continues to show remarkable resilience. The May non-farm payroll report indicated that 139,000 new jobs were added, better than market expectations, while the unemployment rate remained low at 4.2%. A strong labor market means consumer spending is supported, which in turn puts upward pressure on inflation, making the Federal Reserve even more hesitant about rate cuts.

Powell's "Historical Script": As noted by Nicholas Colas, co-founder of DataTrek Research, current Chair Powell is following the script of his predecessors, adopting a hawkish tone in the final stages of his term to solidify his historical legacy of successfully curbing inflation. This consideration of personal and institutional reputation means that unless there is a dramatic decline in economic data, the policy shift will be extremely cautious and slow.

2. The "Gravity" of High Rates: The "Blood Loss" Effect on Crypto Assets

This macro backdrop has directly led to the difficult situation in the crypto market:

Liquidity Drought: High interest rates mean a reduction in "hot money" in the market. For the crypto market, which heavily relies on new funds to drive price increases, especially altcoins, the tightening of liquidity is its most fatal blow. The once "everything rises" phenomenon has been replaced in this cycle by a "sector rotation" or even a "few hotspots" structural market.

Increased Opportunity Cost: When investors can easily obtain over 5% risk-free returns from U.S. Treasury bonds, the opportunity cost of holding assets like Bitcoin, which do not generate cash flow and have volatile prices, sharply increases. This has led to a significant outflow of funds seeking stable returns from the crypto market, further exacerbating the market's "blood loss" effect.

For retail investors accustomed to chasing hotspots in a liquidity-rich environment, this change in circumstances is brutal. Strategies lacking in-depth research and relying solely on following trends are likely to suffer heavy losses in this cycle, which is the core of the "difficulty" in this round.

II. The Most Golden Era: From Speculation to Value, New Opportunities Emerge

However, the other side of crisis is opportunity. The macro headwinds act as a stress test, squeezing out market bubbles and filtering out truly valuable core assets and narratives, thus opening an unprecedented golden age for prepared investors. The resilience of this cycle is precisely driven by several strong endogenous forces independent of macro monetary policy.

- The Golden Bridge: Spot ETF Opens the Year of Institutionalization

In early 2024, the U.S. Securities and Exchange Commission (SEC) historically approved the listing of spot Bitcoin ETFs. This is not just a product launch but a revolution in the crypto world. It opens a "golden door" for trillions of dollars in traditional finance to invest in Bitcoin in a compliant and convenient manner.

Endless Fresh Capital: As of the second quarter of 2025, the total assets managed by just BlackRock's IBIT and Fidelity's FBTC ETFs have surpassed several billion dollars, with continuous daily net inflows providing strong purchasing power to the market. This "new fresh capital" from Wall Street has largely offset the liquidity tightening caused by high interest rates.

Confidence Anchor: BlackRock CEO Larry Fink called the success of the Bitcoin ETF a "revolution in capital markets" and stated that this is just the "first step in asset tokenization." This endorsement from the world's largest asset management company greatly boosts market confidence and provides retail investors with a clear signal to follow institutional footsteps and engage in long-term value investing.

- The Faith in Code: Hard Core Support Under the Halving Narrative

The fourth Bitcoin "halving" in April 2024 reduced its daily new supply from 900 to 450 coins. This predictable supply deflation, dictated by code, is the unique charm that distinguishes Bitcoin from all traditional financial assets. With demand (especially from ETFs) remaining stable or even growing, the halving provides a solid mathematical underpinning for Bitcoin's price. Historical data shows that Bitcoin's price reached new all-time highs within 12-18 months after the first three halvings. For value investors, this is not a short-term speculative gimmick but a reliable, cyclical long-term logic.

- The Narrative Revolution: When Web3 Begins to Solve Real Problems

Macro headwinds force market participants to shift from pure speculation to exploring the intrinsic value of projects. The core hotspots of this cycle are no longer baseless "Dogecoins," but innovative narratives that attempt to solve real-world problems:

AI + Crypto: Combining AI's computing power with blockchain's incentive mechanisms and data ownership to create entirely new decentralized intelligent applications.

Tokenization of Real World Assets (RWA): Bringing real-world assets like real estate, bonds, and artworks on-chain to release their liquidity and bridge the gap between traditional finance and digital finance.

Decentralized Physical Infrastructure Networks (DePIN): Using token incentives to enable global users to collaboratively build and operate physical world infrastructure networks, such as 5G base stations and sensor networks.

The rise of these narratives marks a fundamental shift in the crypto industry from "speculating on air" to "investing in value." Crypto venture capital giant a16z Crypto emphasized the potential of "AI + Crypto" as the core engine of the next round of innovation in its annual report. For retail investors, this means that the opportunities to discover value through in-depth research have greatly increased, making knowledge and understanding more important than mere courage and luck in this market.

III. New Cycle Survival Rules: Patiently Positioning Between the Final Chapter and the Prelude

We are at a crossroads of eras. The Federal Reserve's "hawkish final chapter" is unfolding, while the prelude to easing has yet to begin. For retail investors, understanding and adapting to the new game rules is key to navigating the cycle and seizing golden opportunities.

- Fundamental Shift in Investment Paradigms

From chasing hotspots to value investing: Abandon the fantasy of finding the "next hundredfold coin" and shift to researching project fundamentals, understanding their technology, team, economic model, and competitive landscape.

From short-term speculation to long-term holding: In a "value bull" market, true returns belong to those who can identify core assets and hold them long-term through volatility, rather than frequent traders.

Building a differentiated investment portfolio: In the new cycle, the roles of different assets will become clearer. Bitcoin (BTC), recognized as "digital gold" by institutions, serves as the "ballast" of the portfolio; Ethereum (ETH), with its strong ecosystem and ETF expectations, is a core asset with both value storage and productive attributes; while high-growth altcoins should be the "rocket boosters" based on in-depth research and small position allocations, focusing on frontier sectors with real potential like AI and DePIN.

- Stay Patient and Position Early

DataTrek's research reveals an interesting phenomenon: in the last 12 months of the terms of the past three Federal Reserve chairs, even with high interest rates, the S&P 500 index averaged a 16% increase. This indicates that once the market is convinced that the tightening cycle has ended, even if rate cuts have not yet occurred, risk appetite may warm up in advance.

This "running ahead" trend may also appear in the crypto market. When the market's focus is generally on the short-term speculation of "when will rates be cut," the true wise investors have already begun to think about which assets and sectors will occupy the most advantageous positions in the future feast driven by macro tailwinds and industrial cycles when the prelude to easing finally begins.

Conclusion

This round of the crypto cycle is undoubtedly a severe test of retail investors' cognition and mindset. The era where one could easily profit through courage and luck has ended, and a "value bull" era that requires in-depth research, independent thinking, and long-term patience has arrived. This is precisely where its "difficulty" lies.

However, it is also in this era that institutional capital is flooding in at an unprecedented scale, providing a solid bottom for the market; the value logic of core assets is becoming increasingly clear; and real applications that can create value are beginning to take root. For those retail investors willing to learn, embrace change, and view investing as a journey of cognitive realization, this is undoubtedly a "golden age" where they can compete with the top minds and share in the long-term growth dividends of the industry. History does not repeat itself simply, but it is always remarkably similar. Between the final chapter and the prelude, patience and foresight will be the only path to success.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。