Someone always has to pay for the feast, but I didn't expect to be the waiter.

Written by: Leek, Foresight News

Under the great benefit of the easing of tariffs between China and the United States, BTC surged to $106,000, and ETH skyrocketed by 40% in three days, briefly topping the trending searches on Douyin. Established altcoins and MEME tokens bloomed in multiple areas under the market's push, with daily appearances of large bullish candles exceeding 30%. It can be said that those who got in on the rise were overjoyed, while those who were short were dizzy. Holders were once again winning big.

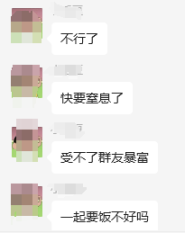

Even my friend told me: when going out for dinner at night, walking on the street, I suddenly felt like I owned the world. Spending 300 on dinner, I checked the exchange after the meal and found an extra 3000u, which means I spent nothing. This is the confidence that the crypto world has given me!

I opened my wallet homepage, refreshed my asset balance a few times, and never replied to my friend again.

Degen Taught Me How to Live

On May 13, I spent the entire morning trading DEGEN, which was on the top of the gainers list with 20x leverage. DEGEN is the English translation for "gambler." As a reward token for the Web3 social application Farcaster, which was once promoted by Vitalik Buterin, and the native token of the Degen L3 chain, it is expected to perform well in 2024 (I had previously bought at a high point). However, after more than a year of decline, in my view, its original technical background and investment team have lost their significance, and it has transformed into a member of the "quality" altcoins that have not yet been pumped.

Last night before bed, I actually saw signs of DEGEN trying to break through at the bottom of the gainers list, but I was too sleepy to stay awake and missed it. This morning at 7:30, I checked and saw a massive bullish candle breaking through the sky, topping the gainers list, so I panicked and chased it with 20x leverage, bravely enjoying the wind at the mountain top.

After cutting losses, I noticed that BTC and other mainstream coins were showing a trend of correction, so I reluctantly shorted, oscillating between profit and loss while watching the market. Finally, within half a minute of the official drop, I quickly closed my position, instantly panicking, and continued to short, but every time it rebounded, I would panic and close my position. So even though DEGEN had a 20% correction and I was basically shorting, I still didn't make much profit.

In the end, BTC rebounded, while I continued to short DEGEN out of habit. After DEGEN violently surged in a minute, I could only cut losses on the spot. After counting, I realized that after a busy morning, I had lost 50% of my contract position.

Similar losses have cycled through N times in the past few days.

When the whole network is shouting "the bull is back," there is always a group of contract players like me staring blankly at liquidation emails. They are not ordinary retail investors but evolved "losing warriors" with a "reverse operation gene," using real money to enact the philosophy of loss: "When others are greedy, I am greedier; when others have small losses, I go bankrupt."

They have the words "not admitting mistakes" welded onto their trading accounts, and "liquidation equals stop-loss" is no joke. When BTC was at $86,000, they opened short positions, firmly believing they were "the reincarnation of Soros," and when BTC broke through $90,000, they shouted that a technical correction was imminent. When BTC broke through $100,000, their voices were quieter, but seeing their nearly zero positions still struggling to survive.

Looking at the position records, the frequency of these manual traders opening positions is somewhat alarming, with "BS" (Buy & Sell) filling the 15-minute chart for individual assets. However, upon analyzing the contracts, the losses far exceed the profits. When they analyze Powell, U.S. stocks, U.S. bonds, and gold trends with great insight but end up wiping tears in front of liquidation notices, they say, "See, I told you the main force would dump, I just opened too early!"

The most vivid example is the "old hand" in the contract group I joined, who transferred all his USDT to a shady exchange and immediately opened a 500x short position when BTC broke through $100,000, live-streaming his anti-position diary in the group:

"Day 1: Margin left 70%, Bollinger Bands top divergence, RSI overbought, Air Force One assembled";

"Day 2: Used my wedding anniversary red envelope as margin, my wife scolded me for being obsessed with trading, she knows nothing";

"Day 3: The last message before liquidation was 'It's all the exchange's fault, I want to defend my rights.'"

After liquidation, the old hand felt relieved: "Now it's good, I don't have to explain to my wife why my phone is still on at three in the morning every day."

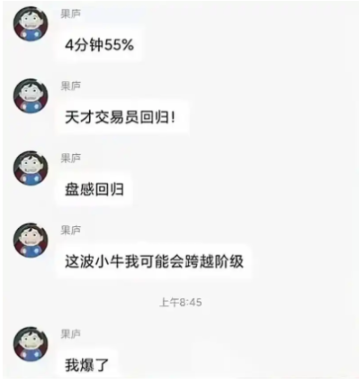

Another post-00s crypto friend boasted to me: "I never look at K-lines when trading contracts, I only look at sentiment indicators—when others shout to buy, I short; when others shout to short, I buy, it's as thrilling as bungee jumping without a safety harness!"

As a result, on the night of ETH's surge, he turned a $300 principal into $5,000 in half an hour, posted a screenshot in the group, and before it even cooled down, 15 minutes later he sent a message—"Brothers, goodbye, I'm liquidated."

Every bull market feels like a grand Ponzi dance party, with everyone dancing on K-lines. Those crying over liquidation texts and those feeling lost in the revelry are not lacking in intelligence, but rather blinded by greed—stop-loss, leverage, risk. Before the real profit/loss numbers start jumping wildly, we must admit that we are all basically dizzy.

So, when you want to show off your profit screenshot, it is often the best time to cash out.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。