After acquiring Bridge for $1.1 billion, Stripe makes another bold move, targeting emerging markets with its stablecoin financial accounts.

Written by: KarenZ, Foresight News

Following its $1.1 billion acquisition of the stablecoin payment platform Bridge in October 2024, Stripe officially announced the launch of stablecoin financial accounts on May 8, aimed at providing global businesses with more efficient and convenient cross-border payment and fund management solutions, further solidifying its position as a leader in global fintech.

So, which stablecoins are supported by Stripe's stablecoin financial accounts? What is the composition of its underlying assets? Which countries or regions does it cover? From its early exploration of Bitcoin payments to its current stablecoin strategy, what is Stripe's layout in the cryptocurrency field? This article will explore these questions.

Stripe Stablecoin Financial Accounts: Defining Borderless Finance

According to Stripe's official documentation, stablecoin financial accounts allow users to hold USDC and USDB stablecoin balances and send and receive funds through stablecoins and traditional financial channels (such as ACH, SEPA, and wire transfers). This means that funds from the stablecoin balance can be transferred to external bank accounts or crypto wallets. If the recipient is an external bank account, the received amount will be automatically converted based on the current exchange rate, greatly enhancing the convenience and flexibility of fund transfers.

Stripe also revealed that it will gradually support more types of stablecoins in this account in the future. The technical support for this service comes from the Bridge platform acquired by Stripe last year. Bridge focuses on building stablecoin infrastructure, enabling businesses to seamlessly integrate cryptocurrency technology and ensuring the operation of Stripe's stablecoin financial accounts.

In terms of stablecoin custody, Bridge plays a key role. Currently, Stripe's stablecoin accounts support USDC (issued by Circle) and the closed-loop stablecoin USDB issued by Bridge. Notably, USDB is not publicly sold and is pegged to the US dollar at a 1:1 ratio. Its underlying assets consist of US dollars and BlackRock's short-term money market funds.

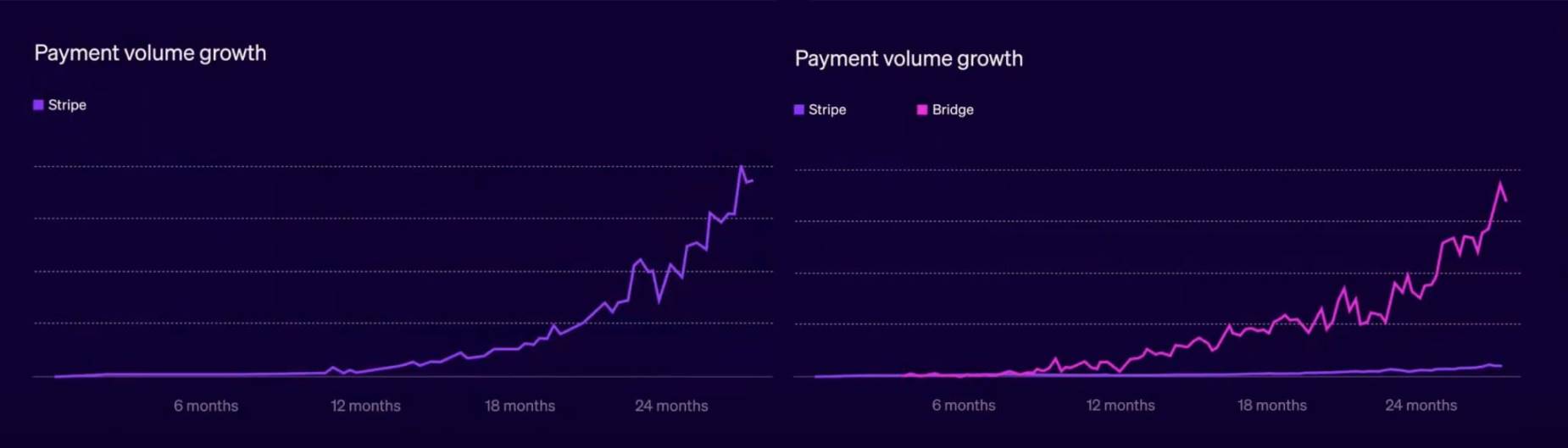

As Stripe executives mentioned at Stripe Sessions 2025, stablecoins can truly achieve borderless finance. By comparing the payment transaction growth of Stripe in its first two years with that of Bridge in its first two years, we can see that Bridge exhibits a more significant exponential growth trend, which indirectly confirms the enormous potential of stablecoins.

I observed in the API call information from the Bridge USDB documentation that USDB is located on the Solana blockchain, with Bridge responsible for minting, burning, and holding the stablecoin reserves.

It is worth mentioning that Bridge also supports the creation of custom stablecoins, including chain selection, token names, and reserve strategies. At the end of each month, Bridge distributes a portion of the earnings to USDB and Bridge custom stablecoin holders. Rewards will be minted in the form of new tokens.

However, in an update a month ago, Bridge stated that Bridge stablecoins (USDB and custom stablecoins) currently support the Solana and Base networks, with plans to launch on Polygon, Ethereum, Optimism, and Arbitrum soon. Meanwhile, Bridge stablecoins are always backed by a 1:1 equivalent value in US dollars. The underlying assets include short-term U.S. Treasury bonds, overnight U.S. Treasury repurchase agreements, money market funds, and cash. This investment portfolio is held in a separate account to protect the rights of token holders and is custodied by BlackRock, Fidelity, and Apex Partners.

In terms of service coverage, Stripe's stablecoin financial accounts are currently open to business users in 101 countries or regions, primarily concentrated in Latin America, Africa, Asian countries mainly in Central/South Asia and Southeast Asia, the Middle East (such as Saudi Arabia and Qatar), Oceania, and European countries that are small economies or offshore financial centers outside the EU. These regions are mainly developing countries, emerging markets, and small economies, typically characterized by high dollarization demand, strong cross-border payment needs, a relatively relaxed regulatory environment, insufficient traditional financial infrastructure, or high inflation. Stripe's stablecoin accounts can provide low-cost and high-efficiency payment and fund management solutions for these areas.

Countries or regions such as China, Hong Kong, the United States, core EU countries, the United Kingdom, India, Russia, Japan, Canada, and Australia have not yet been included in the support list, possibly due to strict regulatory requirements, mature financial markets, or geopolitical factors.

Stripe's Cryptocurrency Layout: From Payments to Ecosystem Building

Stripe's layout in the cryptocurrency field has not been built overnight but has undergone long-term exploration and deep cultivation.

2014-2018: Brief Attempts at Bitcoin Payments

In 2014, Stripe became the first major payment company to support Bitcoin payments, hoping that Bitcoin would become a global decentralized medium of exchange to address the low credit card penetration rate or high transaction fees.

In 2018, due to long transaction confirmation times, high fees, excessive volatility, and a decline in customer willingness to accept Bitcoin, along with Stripe's belief that Bitcoin had evolved to be more suitable as an asset rather than a means of exchange, it announced the termination of Bitcoin payment support.

Despite ending Bitcoin support, Stripe remained optimistic about cryptocurrency, stating that it would focus on the development of emerging technologies and faster payment methods such as the Lightning Network, Stellar (in which Stripe had previously seed invested), and Ethereum.

2019-2021: Cautious Exploration

In 2019, Stripe briefly participated in Facebook's Libra (later renamed Diem) project but withdrew due to regulatory pressure, demonstrating its cautious attitude towards the crypto field.

In 2021, Stripe formed a new crypto team aimed at developing Stripe's crypto strategy and promoting the integration of payments and Web3.

In November 2021, Matt Huang, co-founder and executive partner of Paradigm, joined the Stripe board. Stripe co-founder and CEO Patrick Collison stated at the time, "Few people understand cryptocurrency better than Matt, especially its potential for global internet companies."

2022: Full Return to the Crypto Market

In March 2022, Stripe launched a series of products aimed at providing customers with tools and APIs to make it easier to buy and store crypto tokens, convert them to cash, trade NFTs, and handle KYC and other compliance workflows. Stripe's support page indicated that the company's products would allow users to purchase over 135 cryptocurrencies using fiat currency in 180 countries/regions.

In April 2022, Stripe added support for cryptocurrencies in its programmatic (API-based) payment platform Connect, with Twitter becoming the first platform to allow users to make payments in cryptocurrency using this platform.

2024-2025: Accelerating Stablecoin Strategy

Stripe's crypto ambitions significantly accelerated in 2024, focusing on stablecoins and consolidating its position in the Web3 payment space through acquisitions and product innovation.

In April 2024, Stripe allowed customers to accept cryptocurrency payments, initially supporting only USDC stablecoin, covering Solana, Ethereum, and Polygon.

In October 2024, Paxos launched its new stablecoin payment platform, with Stripe being the first customer to use the new solution. Stripe's Pay with Crypto product is supported by Paxos's stablecoin payment infrastructure, enabling merchants to more easily accept stablecoin payments.

In October 2024, Stripe acquired the stablecoin payment platform Bridge for $1.1 billion. Bridge is referred to as the Web3 version of Stripe.

On April 30, 2025, Bridge partnered with Visa to launch a stablecoin card issuance product, allowing developers using Bridge to programmatically issue Visa cards related to stablecoins in multiple countries/regions through a single API integration. Businesses and individuals can use their stablecoin balances for everyday shopping anywhere Visa is accepted. When cardholders shop, Bridge deducts funds from their stablecoin balance and converts them to fiat currency, allowing merchants to receive payments in local currency like other transactions.

On May 7, 2025, at Stripe Sessions 2025, Stripe launched stablecoin financial accounts. Stripe also announced an expanded partnership with integrated financial operations platform Ramp to launch a corporate card based on stablecoins and integrated expense management software, providing businesses with faster settlement speeds, lower costs, built-in currency fluctuation protection, and seamless card issuance. Specifically, businesses can fund Ramp wallets with local currency and then convert it to stablecoins or deposit directly in stablecoins. Cardholders only need to pay with local fiat currency, and merchants will receive fiat currency. Funds are held at an equivalent value in USD to avoid local currency depreciation.

Future Outlook

From early attempts with Bitcoin to a comprehensive layout centered around stablecoin financial accounts, Stripe's development in the crypto field has accelerated the integration of traditional finance and the crypto economy, promoting the mainstreaming of stablecoins.

With the $1.1 billion acquisition of Bridge and the launch of stablecoin financial accounts covering 101 countries, Stripe has not only effectively addressed many pain points in cross-border payments but also provided an important dollarization tool for emerging markets. Its strategy focuses on the low-cost and high-efficiency characteristics of stablecoins, combined with Bridge's technological advantages and Stripe's own global payment network, laying a solid leadership foundation in the crypto payment field.

As global financial regulators gradually improve their regulatory frameworks for stablecoins, and traditional financial giants like Visa become increasingly open to stablecoins, stablecoins are moving from the margins to the mainstream. The stablecoin financial accounts launched by Stripe provide businesses with low-friction, high-efficiency global payment solutions, driving the global financial system towards a more efficient, convenient, and inclusive direction.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。