At the beginning of the New Year 2026, two of the most mysterious and influential capital forces in the crypto world made directional choices simultaneously.

On one side, there are the "sleepers" from ancient times. On January 10, a Bitcoin genesis miner transferred 2,000 Bitcoins, which had been dormant for over 15 years, to an exchange. Calculated at the time's price, this transfer, valued at approximately $180 million, marked the first significant action from this group since November 2024. Historical charts coldly show that spikes in the movement of such "fossil-level" Bitcoins often coincide with key turning points in the market.

On the other side, there are the "ocean overlords" active in the contemporary derivatives market. Almost simultaneously, whales in the margin market of Bitfinex were conducting a "tactical retreat" on a record scale: they actively reduced their Bitcoin leveraged long positions from a peak of about 73,000 Bitcoins. However, the remaining long-to-short position ratio still stood at a staggering 252:1.

One side signals a suspected exit from epic holders, while the other side shows the seemingly contradictory "bullish reduction" from leveraged giants. This synchronized movement involving at least $280 million in positions is not coincidental. It reveals the core contradiction in the current market: a cognitive showdown over the cycle turning point has silently begun in on-chain data and exchange ledgers.

1. Event Focus: Synchronized Movements of Two Camps

Market sentiment is fermenting amid divergence, and the most authentic traces of the game are forever etched in on-chain data and the deep ledgers of exchanges.

1. Ancient Miners: Timing Signals Across Cycles

● The transfer on January 10, 2026, triggered an earthquake due to its irreplaceable "pedigree." This batch of Bitcoins originated from block rewards in 2010, when each block produced 50 Bitcoins, obtained through primitive CPU mining. The holder has not moved them through multiple halvings and countless bull and bear markets, making them one of the most steadfast "diamond hands" in the market.

○ Data charts shared by Julio Moreno, head of research at CryptoQuant, reveal a concerning pattern:

○ The "net outflow" activity of these Satoshi-era miners shows a clear "spike pattern," and these spikes often coincide with periods of significant price increases.

○ For instance, similar large transfers occurred during Bitcoin's surge to historical highs in 2021 and when prices were around $91,000 at the end of 2024. This historical pattern of cashing out during strong rallies casts a shadow of a "potential top signal" over the current transfer.

2. Leveraged Whales: Optimistic Narrative of "Healthy Correction"

● In stark contrast to the miners' "exit narrative" is the extreme positioning of margin whales on Bitfinex. Although the total long positions have decreased from their peak, the ratio of long to short positions remains as high as 252:1, reflecting an extremely optimistic market sentiment.

● The key lies not in the absolute value of positions but in the direction of their change and the market's interpretation. Analysts generally view this proactive reduction of leveraged long positions as a positive signal for a healthy market direction.

● The cryptocurrency education platform Coin Bureau points out that historically similar large holders' reduction behaviors often occur before significant bullish breakthroughs. This "clearing the deck" operation is seen as a way to mitigate the risk of a sharp decline due to potential chain liquidations from high leverage, paving the way for a more robust upward movement.

2. Data Tracing: The Deep Game of Long and Short Forces

The seemingly contradictory behaviors point to deeper structural changes in the market. Broadening the perspective to the entire market reveals that this is not a simple long-short opposition but a complex handover between old and new capital at critical price levels.

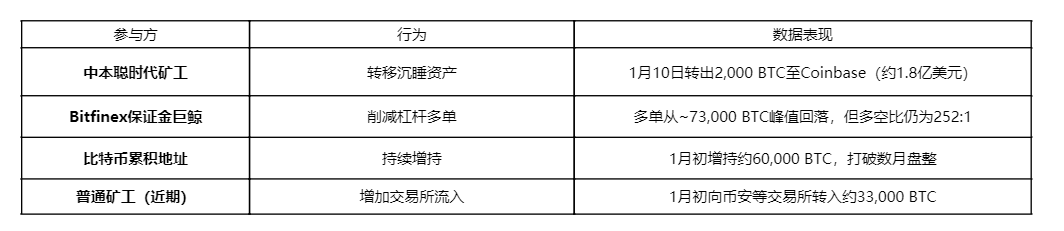

The above table reveals the core tug-of-war in the current market: on one side is the selling pressure from early holders (ancient miners) and short-term profit-takers (recent miners); on the other side is the buying power from long-term accumulators (accumulation addresses) and leveraged giants (who, despite reducing positions, remain bullish).

● Glassnode's on-chain report provides a more nuanced annotation of this game. The report indicates that after experiencing large-scale deleveraging at the end of 2025, the market is entering a new phase with clearer structures. On one hand, the profit-taking pressure from long-term holders has significantly eased, providing stability for prices;

● On the other hand, the market is entering a cost-intensive zone (between $92,100 and $117,400) dominated by "recent top buyers" during the rebound, creating natural upward resistance. Whether it can sustain a breakthrough and stabilize above the cost basis of short-term holders (currently around $99,100) is seen as the first key confirmation signal for the market to completely reverse its downward trend.

3. Multidimensional Interpretation: The Market Logic Behind the Game

Why do the behaviors of the two "whale groups" generate such significant interpretative divergence? This stems from their entirely different investment logic, cost bases, and action goals.

1. Temporal Displacement: Strategic Exit vs. Tactical Adjustment

● The behavior of ancient miners is a strategic decision measured in years or even decades. Their costs are close to zero, and moving assets may signify wealth planning, asset rebalancing, or judgments on ultra-long-term trends. Their "selling" is a true release of supply.

● The behavior of leveraged whales is a tactical layout measured in weeks or months. They are active in the derivatives market, using leverage to amplify returns. Their reduction of long positions is more about adjusting risk exposure and position structure rather than a complete bearish stance. Their "operations" are risk management without changing fundamental positions.

2. Evolution of Market Structure: Emergence of New Buffer Layers

Unlike previous cycles, today's market has a strong new demand side capable of buffering the selling pressure from early holders. This primarily refers to the institutional buying power constituted by the U.S. spot Bitcoin ETF.

Although recent ETF fund flows have experienced severe volatility, even showing net outflows exceeding $1 billion in a single day, it has overall become a normalized source of demand. Meanwhile, the Bitcoin accumulation addresses focused on "buying and holding" have shown strong accumulation capabilities at the beginning of 2026, adding tens of thousands of Bitcoins in a single week. This explains why the market has shown resilience despite ongoing outflows from miners (reaching 33,000 BTC at the beginning of January) and the awakening of ancient whales.

3. "Reset" of the Derivatives Market

At the end of 2025, the Bitcoin options market underwent the largest scale of open interest reset in history, with over 45% of positions being concentratedly cleared. This allowed the market to break free from the constraints of old hedging positions, making price behavior more reflective of genuine buying and selling intentions. In this context, the behavior of whales reducing leveraged long positions resembles a re-layout on a "clean slate," with clearer signal significance than under complex hedging structures.

4. Institutional Perspectives: Consensus and Expectations Amid Contradictory Signals

Faced with contradictory data, professional institutions' analytical frameworks tend to incorporate short-term fluctuations into a more long-term positive narrative.

● About the Cycle: An increasing number of analysts believe that the classic Bitcoin "four-year halving cycle" logic is becoming ineffective. The spot ETF represented by BlackRock's IBIT has brought sustained structural buying, and corporate treasury allocations are gradually becoming routine; these "new normal" demands are smoothing out the severe volatility driven by halving events.

● About Price: Although there are divergences in short-term direction, mainstream institutions remain generally optimistic about long-term price expectations for 2026. Standard Chartered, Bernstein, and others maintain a $150,000 year-end target price; CoinShares' head of research has provided a range expectation of $120,000 to $170,000. More optimistic views suggest that, in comparison to the global monetary environment and gold market capitalization, Bitcoin has the potential to challenge $250,000 in this cycle.

● About Behavioral Interpretation: Regarding the whales' reduction of leverage, the macro strategy head at Wells Fargo pointed out that the downward trend in market volatility supports investors' preferences for risk assets like cryptocurrencies. An orderly deleveraging process itself is a manifestation of reduced volatility and increased market maturity, laying a healthier foundation for subsequent upward movements.

5. Outlook

The awakening of sleeping whales and the retraction of leveraged giants point to the same fact: the market is at a critical window where liquidity structures are subtly changing, and long-short consensus needs to be reestablished.

In the short term, the market's balance leans towards cautious optimism. The clearing of leverage has alleviated the burden for upward movements, while the buying power from ETFs and accumulation addresses provides foundational support. However, the heavy historical trapped positions above (in the range of $92,000 to $117,000) and the potential continued profit-taking from early holders will pose strong resistance. In the coming weeks, whether Bitcoin can effectively break through and stabilize above the $100,000 mark will be the primary technical observation point to validate the quality of this rebound.

In the long term, a new demand structure composed of spot ETFs, corporate treasuries, and long-term accumulators is forming. It may not generate the kind of frenzied "animal spirit" bull market seen in the past, but it is more likely to create a "institutional bull" market that lasts longer and has relatively milder volatility. In this process, the gradual transfer of chips from ancient holders to new institutional investors will be an inevitable path toward market maturity and stability.

The rhythm of history always oscillates between cycles and evolution. This time, the market's signal is not sounded by a single force but arises from the collision of whale songs from two eras. Their harmony may be composing the prelude to the next mature chapter of crypto assets.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。