Author: Jae, PANews

When the governance benchmark of the DeFi market collides with real commercial interests, a brutal game to determine "who is the master" is unfolding within the leading lending protocol Aave.

As a leader in the DeFi market, Aave not only manages approximately $34 billion in assets but is also regarded as a model for on-chain governance. However, in December 2025, Aave found itself in the most severe trust crisis in its eight-year history.

This controversy was not accidental. The initial trigger was a seemingly inconspicuous change in front-end fee distribution, which unexpectedly triggered a domino effect. Under the catalysis of a series of key events, Aave, the lending giant, was ultimately pushed to the forefront of the storm.

This is not merely a dispute over profit distribution; it has opened a rift, exposing the most fundamental and sensitive conflict in the DeFi field: under the narrative of decentralization, who holds the power—the founding team that controls the code and brand, or the DAO community that holds governance tokens?

This is not just Aave's crisis; this event poses an urgent question to the entire DeFi market: how to balance the commercial incentives of the development team with the governance rights of token holders as the protocol matures?

$10 Million "Vanished," Aave Labs Accused of Stripping Community Rights

The source of the internal war in Aave governance began with a technical optimization update.

On December 4, 2025, Aave Labs announced that it would change its official front-end asset exchange service provider from ParaSwap to CoWSwap, citing better prices and MEV protection.

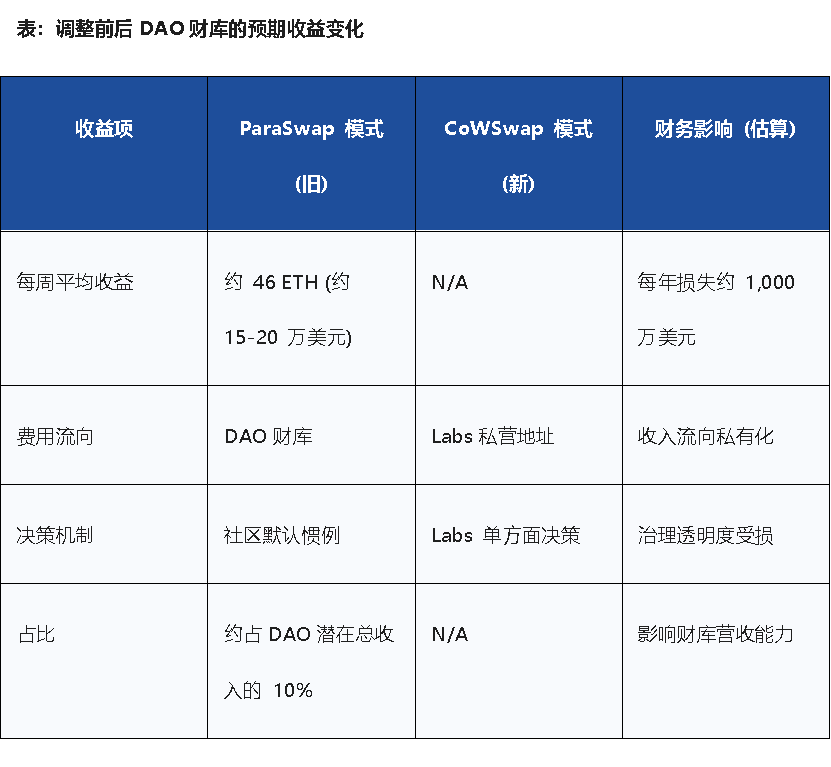

However, the subsequent financial changes were not adequately disclosed in the announcement. Community representative EzR3aL discovered through on-chain data tracking that fees generated from user transactions would no longer flow into the DAO's public treasury after the change, but instead would be redirected to an address controlled by Labs. Based on historical data estimates, this missing annualized revenue could reach as high as $10 million.

Aave community leader Marc Zeller pointed out that this is a form of invisible privatization of brand assets. Labs profited from the technology and brand value funded by the DAO, breaking a long-standing trust agreement.

Aave founder Stani Kulechov, however, believes that this is a distinction between the protocol and the product. He explained that the Aave protocol built on smart contracts belongs to the DAO, while the front-end product app.aave.com, which requires high operational and maintenance costs, should have its commercial rights belong to the builders, Labs. The fees that previously flowed to the DAO were merely "voluntary donations." This viewpoint challenges the traditional understanding in the DeFi community that tokens should capture all economic value generated by the protocol ecosystem.

To the community, Stani's logic is akin to a sovereign deprivation. If the front-end, as the most important user entry and traffic gate, can have its revenue unilaterally intercepted by Labs, will future projects like Aave V4, GHO stablecoin, and Horizon RWA also face similar revenue interception? In this case, the value capture promise carried by the governance token AAVE may become an empty check.

Related reading: Annual loss of tens of millions in revenue triggers governance controversy, Aave Labs accused of "backstabbing" the DAO

Internal Conflicts Escalate, DAO Proposal Seeks to Reclaim Brand Ownership

When moderate negotiations failed to reach a consensus, the radicals in the community began to adopt extreme gaming strategies. On December 15, a governance proposal called the "poison pill plan" was put forward by user tulipking, proposing three highly aggressive demands:

- Mandatory Asset Transfer: Require Labs to unconditionally transfer all code repositories, intellectual property (IP), and trademarks to the DAO, or legal action will be initiated.

- Equity Seizure and Subsidiarization: Advocate that the DAO should obtain 100% equity of Labs, transforming the originally independent company into a wholly-owned subsidiary of the DAO, with founders and employees becoming DAO employees.

- Recourse for Past Earnings: Seek to reclaim all historical front-end earnings generated from the use of the Aave brand from Labs and return them to the treasury.

Although this bombshell was temporarily shelved due to procedural issues, its deterrent intent was achieved, indicating that the community has the capability and willingness to reverse-acquire a non-cooperative development team through governance voting.

In the shadow of the extreme proposal, former Aave CTO Ernesto Boado proposed a more constructive proposal "Phase One - Ownership," sounding the horn for the sovereignty recovery action: reclaiming domain names like aave.com; reclaiming official social media accounts on X, Discord, etc.; reclaiming control of the GitHub code repository.

Boado stated bluntly that true decentralization must include the decentralization of "soft assets." He proposed establishing a legal entity controlled by the DAO to hold these brand assets, thereby obtaining recourse rights within traditional legal jurisdictions, marking the DAO's attempt to evolve from a loose on-chain voting organization into a "digital sovereign entity" with actual legal definitions and assets.

Token Prices Drop, Whales Cut Losses, Labs' Unilateral Push for Voting Causes Discontent

As governance fell into internal strife, the secondary market began to vote with their feet. Although the $34 billion in assets locked in the protocol did not show significant fluctuations, the price of the AAVE token, directly related to the interests of holders, continued to drop over 25% within two weeks.

On December 22, the second-largest holder of AAVE tokens cut losses, having accumulated 230,000 AAVE tokens at an average price of around $223, but liquidated at about $165 during the governance turmoil, with an estimated paper loss of up to $13.45 million. The whale's exit is a negative statement on Aave's current governance chaos and a deep skepticism about its future value capture ability: if profits can be easily stripped away, the past valuation models of the token will also become invalid.

To make matters worse, Labs unilaterally advanced the proposal to the Snapshot voting stage without the original author Boado's consent, provoking strong protests from the community, with several representatives criticizing this move as a violation of normal governance procedures.

Crypto KOL 0xTodd pointed out two issues: 1) The voting date was set for December 23-26, during which many users would be on holiday for Christmas, potentially leading to reduced voting participation; 2) Currently, Boado's proposal is still in the discussion phase, and typically a discussion post requires 3-6 months of repeated communication and optimization before entering the voting stage.

However, Stani responded that the new ARFC proposal voting fully complies with the governance framework, and voting is the best way to resolve issues and the ultimate path of governance. This highlights the divergence between the DAO's emphasis on procedural correctness and Labs' focus on efficiency.

On the other hand, absolute procedural correctness could also stifle efficiency. If the commercial returns of the development team are completely stripped away, Labs' motivation to push for the protocol V4 upgrade will significantly decrease. If the brand is managed through the DAO, in the event of legal disputes, the absence of direct responsible parties may hinder quick responses, potentially leading to the brand being directly seized by regulatory authorities.

As of now, votes in favor account for only 3%, showing a one-sided situation. The community may once again enter the "proposal-voting" process, potentially worsening into a deadlock. In fact, Aave, in a state of governance deadlock, has already wasted a significant amount of time.

However, this trust crisis is likely just a phase issue and a rite of passage for Aave as a DeFi leader.

Many seasoned DAO participants have stated that even the on-chain governance benchmark Aave is on the verge of splitting, perhaps indicating that the DAO governance model may not be feasible. However, the fact that such transparent, intense, and evenly matched debates can occur within Aave itself proves its high level of decentralized governance. This collective corrective ability is the value of decentralized governance.

A more critical turning point comes from external regulation. On December 20, the U.S. SEC concluded a four-year investigation without taking any enforcement action against Aave. This is widely interpreted as the regulatory agency's tacit approval of highly decentralized governance models like Aave.

Amid the storm, Aave's fundamentals remain highly resilient. Founder Stani continues to respond to questions, personally increasing his holdings by a total of $15 million in AAVE, enduring over $2 million in paper losses, and has announced a "three-pillar" strategy to rebuild community consensus and trust. However, Stani's actions have also faced community skepticism, with accusations of intentionally increasing his voting power. Even so, merely increasing Labs' influence in governance remains a superficial solution.

Governance Evolution, Hybrid Organizations May Become the Path for Interest Reconstruction

As the turmoil evolves, a governance evolution route may emerge: Aave may transform from a single on-chain protocol into a "hybrid organization."

Returning to the content of the latest proposal itself, Boado's model essentially redefines the relationship between the two parties from three aspects.

- DAO Holds Sovereignty: Not only owning the smart contracts but also the brand, domain names, trademarks, and user distribution channels;

- Labs as a Professional Service Provider: Labs will no longer profit as "owners" but will act as a top service provider authorized by the DAO. Fees collected by Labs on the front end should be based on DAO authorization and may need to determine a sharing ratio with the DAO to cover development costs and feed back into token value;

- Contractual Governance: All profit distributions will no longer be based on "voluntary donations" but on on-chain service agreements.

In fact, this dispute bears a high similarity to the 2023 incident where Uniswap Labs faced community dissatisfaction over front-end fees. Ultimately, Uniswap reached an agreement with the community by defining Labs' commercialization rights and the decentralization of the protocol layer.

Aave may go further, attempting to resolve the question of "who is the true owner of the brand" from a legal root through the "Phase One - Ownership" proposal. If the proposal passes in the future, any commercialization actions by Labs will have to obtain DAO authorization at the procedural level, fundamentally ending the possibility of "invisible privatization."

Aave's predicament is a common contradiction faced by all decentralized protocols. Does the market want an efficient but potentially centralized "product," or a decentralized but possibly inefficient "protocol"? This not only concerns the boundary of governance token rights but also determines the evolution direction of DeFi.

Currently, this $30 billion DeFi experiment is at a crossroads, and its future direction will gradually be revealed through each on-chain vote.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。