This week, global financial markets experienced a comprehensive sell-off, with a noticeable cooling of risk asset preferences.

Bitcoin fell below the important psychological level of $100,000 on Tuesday, hitting a low of $98,962.06, down 21% from its October peak. The total market capitalization of the entire cryptocurrency market also dropped to a four-month low of $3.44 trillion.

Technical Breakdown Continues

From a technical analysis perspective, Bitcoin's trend does not look optimistic.

Analyst Micah Zimmerman stated that the support level at $106,900 – aligned with the 0.146 Fibonacci retracement level – was repeatedly tested last week but ultimately failed to trigger effective buying intervention. The market is currently focusing on the $104,000 defense line, but this level has already been tested twice, and the support strength is weakening.

If $104,000 is confirmed to be lost, traders generally expect $96,000 to become the next important support area.

In contrast, for an upward path, bulls need to first reclaim the 21-day exponential moving average and the price control point near $111,000 to regain upward momentum. After that, they will need to break through the resistance levels of $114,600 and $122,000 consecutively.

Liquidity Tightening Increases Market Pressure

"Bonds have become the only standout asset class this week, while risk assets like Bitcoin, gold, and stocks are generally under pressure," said Tim Sun, a senior researcher at HashKey Group. Despite the ongoing downward pressure, he still believes that $85,000 will be an important support level for Bitcoin.

This judgment is supported by several analysts. Jiehan Chen, an operational analyst at Schroders, pointed out directly: "The strengthening dollar may be the main driver behind this round of market declines." A strong dollar significantly suppresses risk assets priced in dollars.

Derek Lim, head of research at Caladan, added in an interview with Bloomberg: "The cryptocurrency market is facing multiple resistances. After the large-scale liquidation event in October and the series of protocol vulnerability attacks, the market's foundation has been damaged." Against this backdrop, traders are choosing to deleverage, avoiding the establishment of aggressive long positions.

Panic Sentiment and Fundamentals Diverge

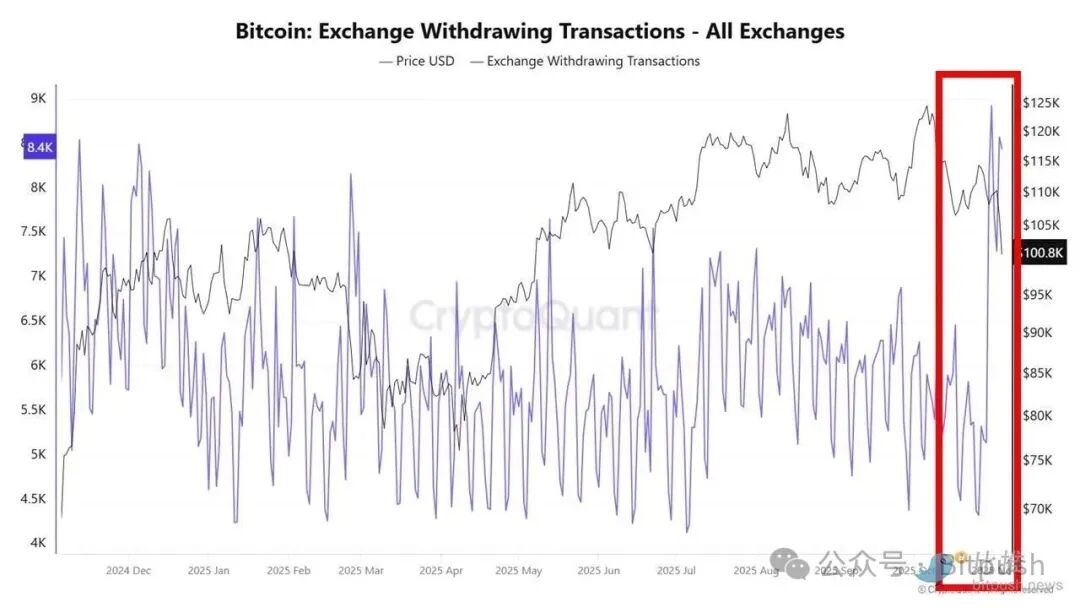

It is worth exploring that despite the sharp deterioration in market sentiment, on-chain data shows a completely different picture.

CryptoQuant certified analyst XWIN Research analyzed: "Bitcoin's drop below $100,000 is more driven by sentiment." Data shows that the Fear and Greed Index has plummeted to an extreme fear level of 21, reflecting that market sentiment has entered an irrational zone.

However, the fundamentals of the Bitcoin network remain robust: the total network hash rate is maintained near historical highs, and there has been an inflow of $10.7 billion in stablecoins into Binance, which may provide support for a subsequent rebound.

On-chain analysis platform Santiment also observed that during the market decline, a large number of investors are still firmly buying the dips.

Matt Hougan, Chief Investment Officer of Bitwise, described the current market as "two parallel worlds": "Crypto-native investors are in a state of extreme pessimism, with leverage being significantly cleared… but when I talk to institutional investors, they are still enthusiastic about allocating to these assets."

This divergence is confirmed by the flow of ETF funds. Although the pace of inflows has slowed compared to the second quarter, Bitcoin ETFs still maintain stable net inflows.

Hougan specifically mentioned that Bitwise's Solana staking ETF attracted $400 million in its first week, showing that institutional demand remains solid. However, this ETF has significantly declined in the recent crypto downturn, dropping nearly 20% since its launch on October 28.

Bottom Prediction?

There are significant differences among analysts regarding the bottom position for Bitcoin.

Ryan Yoon, a senior analyst at Tiger Research, insists on a support level of $98,000 while maintaining a long-term target of $200,000;

Tim Sun from HashKey believes that $85,000 is a stronger support;

Michael Saylor, CEO of Strategy, stated last week on CNBC that he believes Bitcoin could reach $150,000 by the end of the year, which is one of many recent bullish predictions, although it seems poorly timed at the moment.

However, Bitwise's Hougan believes this prediction is not unreasonable. He stated on CNBC: "I think Bitcoin could easily set a new all-time high before the end of the year. This means reaching around $125,000 to $130,000. Whether it can reach Saylor's predicted $150,000 remains to be seen."

Macroeconomic Environment Adds More Variables

However, these predictions face severe tests from the macroeconomic environment. Signals from the short-term funding market are alarming: widening spreads, increased usage of the Federal Reserve's standing repo facility, and the U.S. Treasury account size surpassing $1 trillion are all continuously draining liquidity from the market.

The month-long U.S. government shutdown has further exacerbated the situation, leading the market to pin high hopes on the consumer price index report set to be released on November 13, expecting this data to act as a catalyst for a shift in market sentiment.

In this uncertain time, experienced traders understand one principle: the market bottom is never a precise point but rather a range. Within this range, the panic-stricken see risk, while the rational see a rare opportunity.

As the market gradually digests short-term bearish factors, those who can remain calm amid the panic may be accumulating chips for the next wave of market movements. As we have observed, institutional investors have a more rational understanding of the fundamentals of crypto assets, and they are likely to become the main driving force behind the next market cycle.

However, before the market completes this necessary "emotional cleansing," investors still need to be patient, as the road to the bottom is often more winding than expected.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。