原文作者:CoinGecko

原文编译:AididiaoJP,Foresight News

自 2020 年以来,数字资产财库公司的崛起已成为加密货币领域最具标志性的发展之一。尽管媒体焦点大多集中在 ETF、迷因币和下一代 DeFi 协议上,但 DATCo 已悄然成为市场中一股强大的新兴力量。

那么 DATCo 是如何从边缘的企业实验,成长为如今横跨比特币、以太坊和各种山寨币,规模达 1300 亿美元的强大力量的呢?

本文带你了解数字资产财库公司如何成为本轮周期的明星公司。

摘要

- 上市公司 2017 年开始将加密货币纳入储备资产,Strategy 的崛起让纯业务型 DATCo 成为焦点。

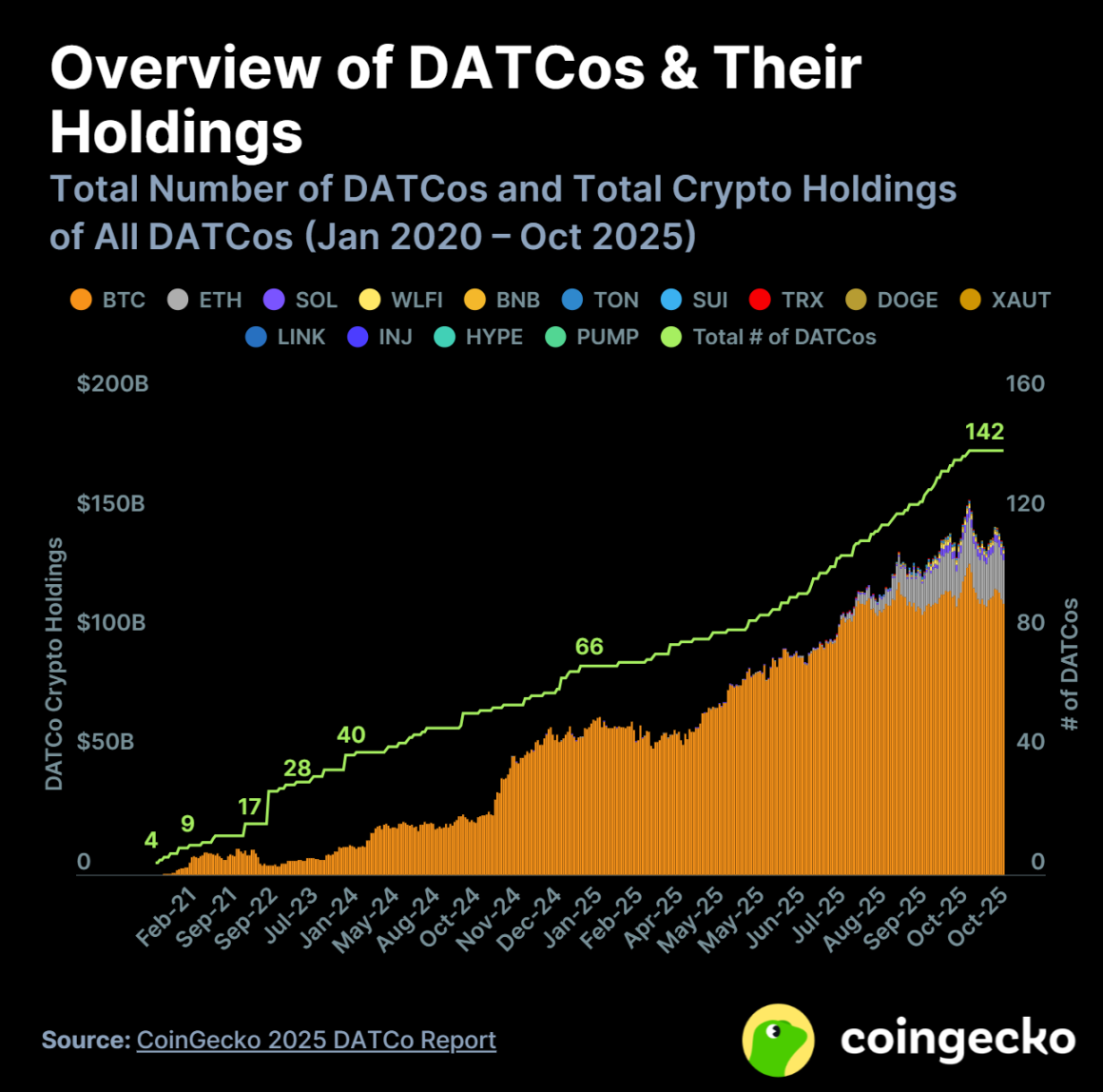

- DATCo 数量从 2020 年的 4 家激增至 142 家,其中 76 家成立于 2025 年。

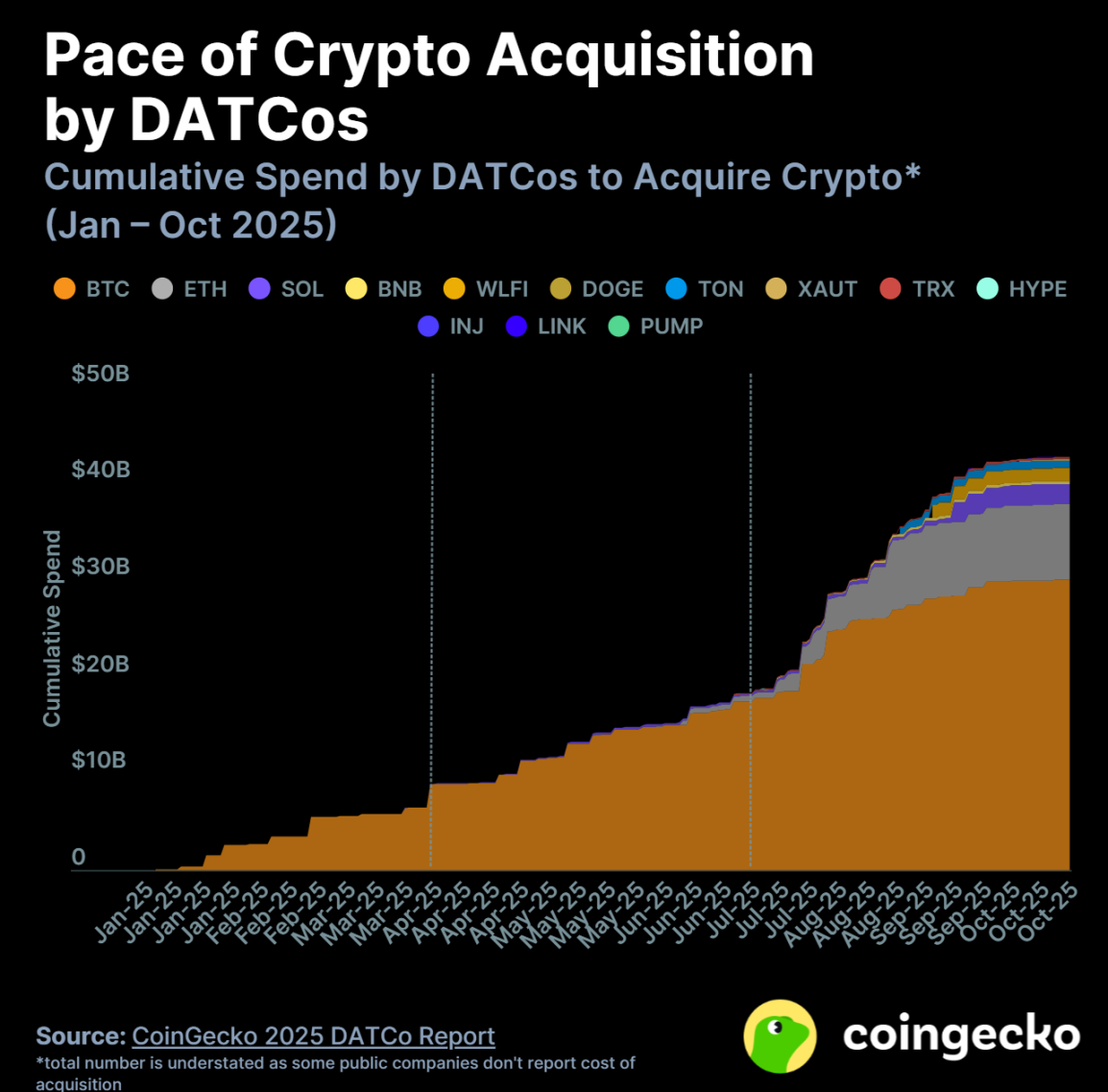

- DATCo 在 2025 年共投入 427 亿美元,半数以上发生在第三季度之后。

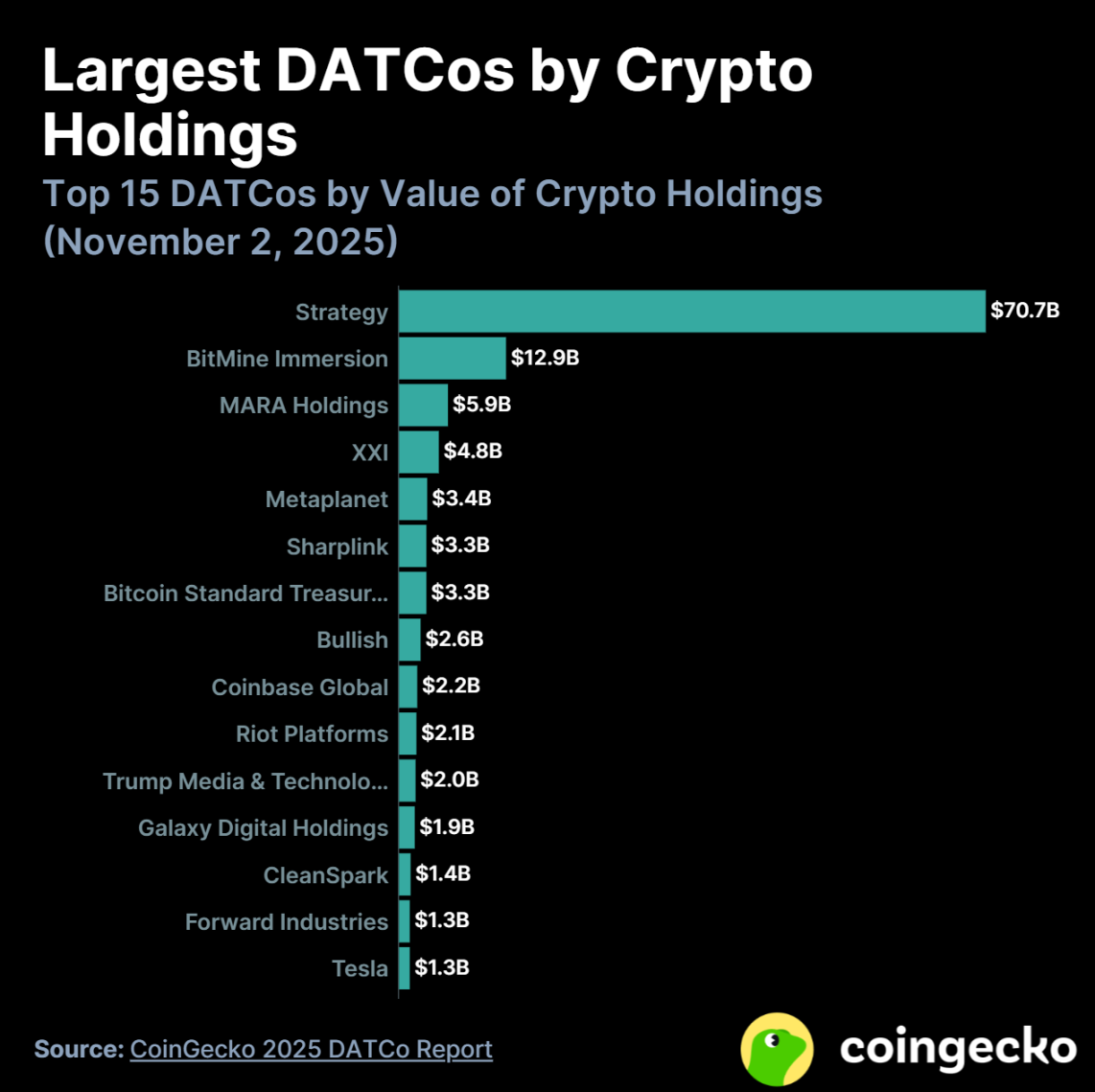

- Strategy 在该领域占据主导地位,持有 707 亿美元资产,约占所有 DATCo 加密资产总值的 50%。

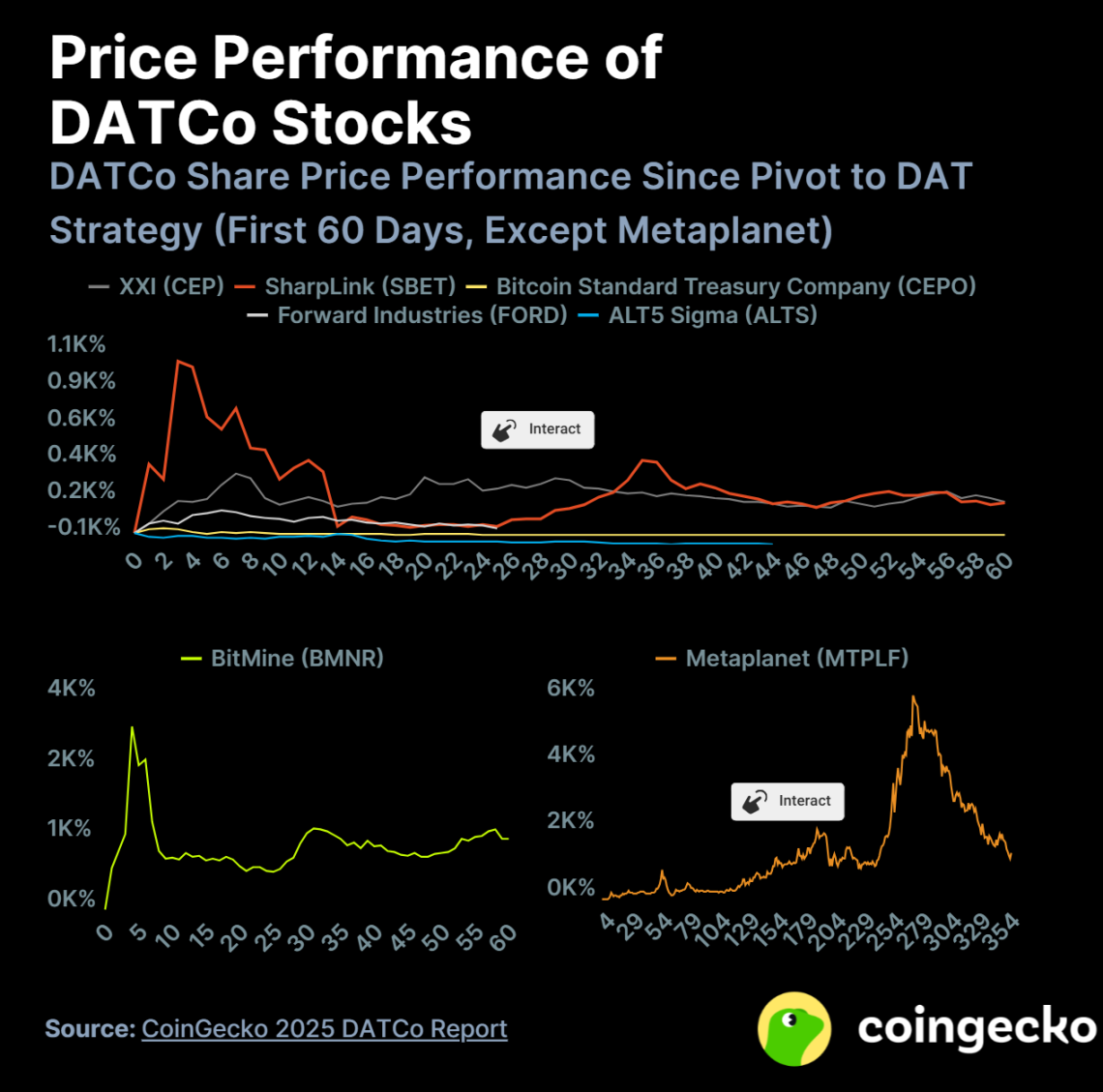

- DATCo 股票在最初 10 天内暴涨(例如 BitMine 涨幅达 3,069%),随后普遍出现回调。

Strategy 的崛起让纯业务型 DATCo 成为焦点

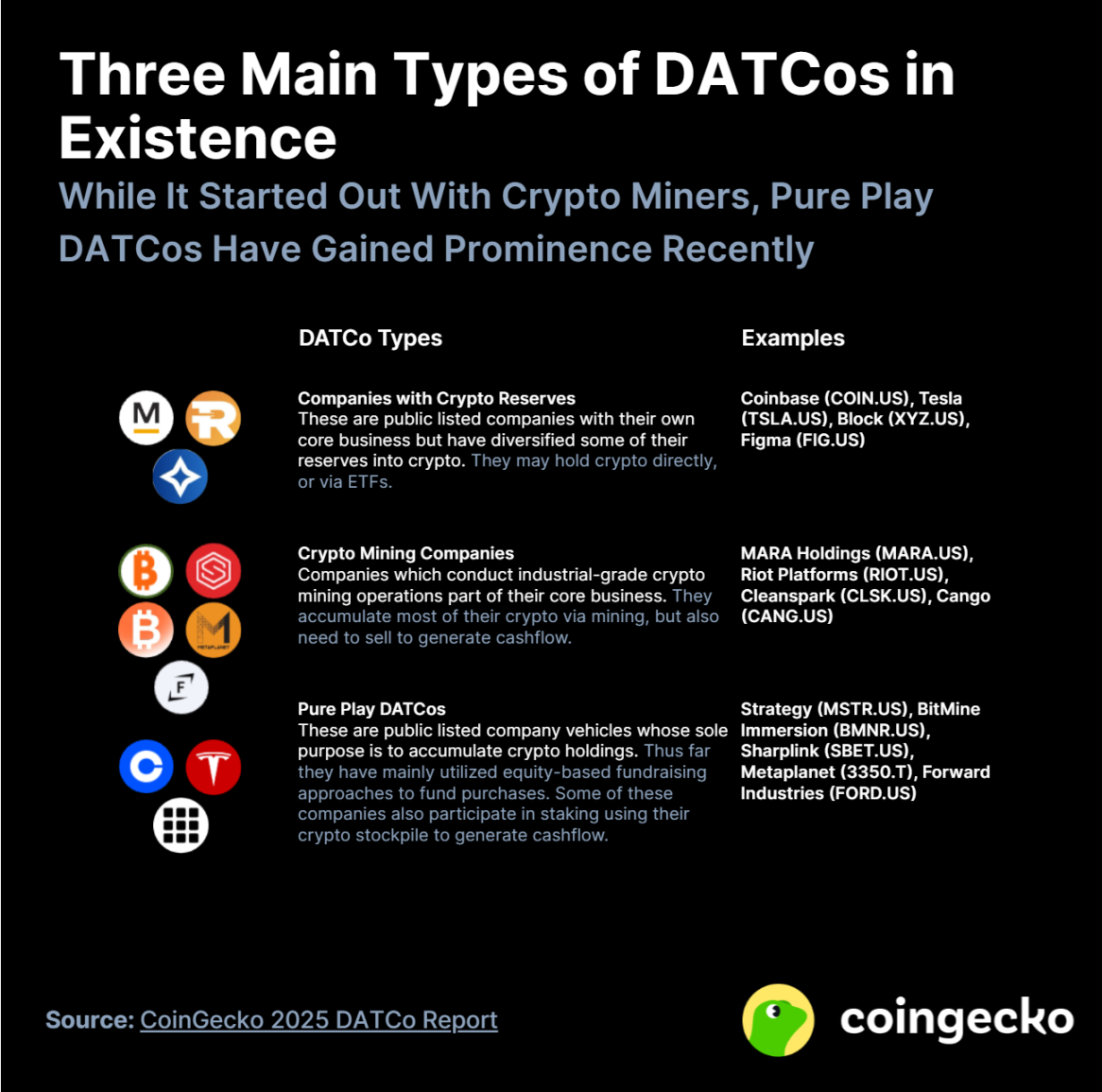

数字资产财库公司最早出现于 2017 年,初期主要是公开上市的加密货币挖矿公司。Strategy 作为首家纯业务型 DATCo 于 2020 年 8 月问世,并随之带动了一波同类公司的兴起。

2023 年底,美国财务会计准则委员会引入了加密货币会计准则,允许 DATCo 按公允价值计量其加密资产,并将增值部分计入收益。这一政策显著增强了 DATCo 资产负债表的表现。

此外,美国总统特朗普对加密货币的友好态度,以及比特币等加密资产价格的飙升,共同推动了华尔街资金大量涌入该领域,其中就包括 DATCo。

在法币表现疲软的背景下,许多非加密货币主营业务的上市公司也开始将加密资产纳入储备策略,以对冲货币贬值的风险。

DATCo 截止 2025 年 10 月共计 142 家,其中 76 家成立于 2025 年

首家 DATCo 是 Hut 8 Mining Corp,一家于 2017 年 11 月在多伦多证券交易所上市的比特币矿企。在 2017 至 2020 年间,加密货币矿企是 DATCo 的主要形态。直到 2020 年 8 月,Strategy 作为第一家纯业务型 DATCo 出现。

截至 2025 年 10 月底,所有 DATCo 持有的加密资产总价值已达 1373 亿美元,较年初增长超过一倍(+139.6%)。

在 142 家 DATCo 中,有 113 家(79.6%)将比特币作为储备资产,而持有以太坊和 Solana 的则分别为 15 家和 10 家。以美元价值计算,比特币占所有 DATCo 加密资产总量的 82.6%,其次是以太坊(13.2%)和 Solana(2.1%)。

从地域分布来看,美国拥有最多的 DATCo,共 60 家,占比 43.5%;加拿大和中国分别以 19 家和 10 家位列其后。日本虽只有 8 家,但值得注意的是,它拥有第五大 DATCo,Metaplanet,这也是美国以外规模最大的 DATCo。

DATCo 在 2025 年共投入 427 亿美元,半数以上发生在第三季度

2025 年第三季度,加密货币 DATCo 在新资产收购上至少投入了 226 亿美元,成为迄今支出规模最大的季度。其中,山寨币 DATCo 贡献了 108 亿美元,占比 47.8%。而自 2025 年初以来,DATCo 在收购加密资产上的总支出已至少达到 427 亿美元。

比特币 DATCo 是最大的买家,自 2025 年初以来累计购买了至少 300 亿美元的 BTC,占所有 DATCo 加密资产购买总额的 70.3%。

以太坊 DATCo 是第二大买家,2025 年报告的购买金额至少为 79 亿美元。其中大部分采购发生在 8 月,单月购入的 ETH 价值至少 71 亿美元,这也正值以太坊价格冲上 5000 美元历史高点之际。

Solana、BNB、WLFI 等其它资产在 2025 年的采购中占比 11.2%。随着更多山寨币被纳入储备,这一比例预计还将上升。不过,比特币和以太坊目前仍是 DATCo 的首选资产。

Strategy 约占所有 DATCo 加密资产总值的 50%

Strategy 以 707 亿美元的比特币持仓,遥遥领先于其他 DATCo。在前 15 大 DATCo 中,仅有三家为山寨币 DATCo,分别是 BitMine Immersion(第 2 位)、Sharplink(第 5 位)和 Forward Industries(第 14 位)。值得注意的是,这三家均是在 2025 年 6 月之后才转型为 DATCo,可见其资产积累速度之快。

在前 15 大公司中,有七家为纯业务型 DATCo,而加密货币挖矿公司仅占三席。

在五家持有加密储备的上市公司中,除特斯拉外,其余四家均从事与加密货币相关的业务。

目前,Strategy 持有比特币总供应量的 3.05%;BitMine Immersion 持有以太坊总供应量的 2.75%;Forward Industries 则持有 Solana 总供应量的 1.25%。

DATCo 股票在最初 10 天内暴涨,随后普遍出现回调

大多数 DATCo 在宣布转型后的前 10 天内,股价都会经历一波急速上涨,通常在冲高后出现回落。

部分公司的股价在 10 天内甚至实现数十倍增长,其中 BitMine Immersion 的回报率高达 3,069%。

目前唯一的例外是 Metaplanet,其股价在前 10 天内上涨约 100%,但之后用了 269 天才达到约 6,200% 的峰值回报。

多数 DATCo 股票在正式转型前就已出现大幅波动,这通常只有早期买家或内部人士能够获益。此类情况已引发争议,美国证券交易委员会和金融业监管局正就此展开内幕交易调查。

然而,这些涨势往往难以持续,大多数 DATCo 股票在转型后数日内即大幅下跌。例如,ALT5 Sigma 在转型 44 天后股价下跌 71%。其持有的 WLFI 资产同样表现不佳,自上市以来已下跌 56%。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。