Author: Charlie Little Sun, the Loop Lion on Dune Road

First, the conclusion: In the G10 gold corridor like USD-EUR, Airwallex's "instant + 0.01% fee" indeed scores almost full marks; however, the financial world is far more than this expressway. Stripe's reckless acquisition of Bridge, Visa integrating stablecoin settlements into its network, and Circle's explosive IPO on the NYSE—these actions collectively outline a larger landscape: whoever can clear the "last mile" of money has the opportunity to rewrite the next round of payment infrastructure.

1. The halo of "0.01% + instant" only covers 15% of the territory

Jack Zhang has been posting long articles on X, and his core viewpoint is very straightforward:

- Price—Airwallex has pushed the USD→EUR rate down to 0.01%;

- Speed—Funds settle in real-time; on-chain may not be faster;

- Grounding—Stablecoin inflows and outflows are expensive and regulatory hurdles exist; there have been no hardcore use cases for 15 years.

If we limit the stage to London ↔ New York ↔ Frankfurt, he is not exaggerating. The problem is—85% of global cross-border traffic does not travel on this broad avenue. For freelancers in Argentina, banks still take three days to start and charge a 3% fee; Kenyan merchants supplying Nigeria have to navigate two correspondent banking "winding roads"; Turkish importers wanting to pay a deposit on Friday night face banks closed for the weekend and can only wait. In these corners ignored by the "mainstream," the volume of stablecoins has tripled in six months, growing wildly like weeds.

2. Three curves explain "why stablecoins"

Latin America Curve: Dollar scarcity spurs on-chain dollars. In 2021, stablecoins in Latin America had a scale of only $20 billion; by 2024, it surged to $68 billion, and in the first half of this year, it rose to $75 billion. High inflation, dollar scarcity, and weekend downtime have all pushed funds onto the chain—not to save 0.01%, but to ensure "it arrives right now."

Big Tech Betting Curve: Keep customers in the network, don’t let money escape. Bridge was just acquired by Stripe for $1.1 billion, and Visa immediately laid down this route in Ecuador, Peru, and Colombia. What they value is not the FX spread, but the expansion dividends of "keeping money within their ecosystem"—once money doesn't have to land in banks, payment companies can simultaneously transform into custodians, wealth management supermarkets, and credit gateways.

Wall Street Valuation Curve: Circle can print money just from interest spreads. Last year, Circle earned $780 million just from USDC position interest; its stock price more than doubled within three days of its IPO. What Wall Street is paying for is the cash machine of "on-chain dollars + treasury bond interest spread," as well as the early signs of a network effect already realized: the more companies that accept USDC, the less demand for withdrawals, and the less controversy over fees.

3. Beyond "cheap" and "fast," there are more tricky costs

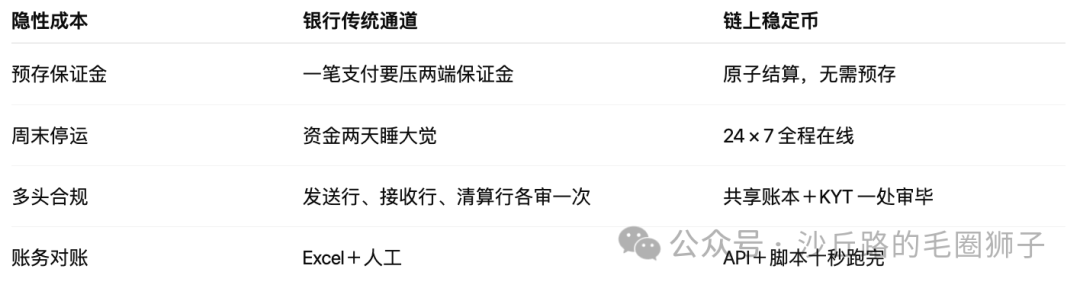

Many people focus on the fee schedule but overlook the hidden T+2 liquidity, Nostro pre-funding, and KYC multi-layer reviews behind the reports. These are the black holes that consume cross-border profits.

When these frictions are compressed into "code logic," the 0.01% fee advantage quickly becomes insufficient.

4. Three scenarios that can outperform banks right now

USD→ARS Salaries

With bank foreign exchange controls and weekend downtime, transfers must wait until business days. USDC wallets arrive in 5 minutes, with an actual comprehensive fee rate of approximately 1%—employers are stable, and employees are willing to receive.

KES↔NGN Small and Medium Payments

There is no direct clearing between Kenya and Nigeria; on-chain P2P operates 24 hours, with a fee rate of 1-2%. Weekend Global Liquidity Dispatch

Banks enter sleep mode after Friday, causing funds to be stuck; finance departments can sweep funds to BUIDL on-chain in seconds, safely earning 4% annualized, and immediately transfer out on business days. These may not be "sexy," but they represent the thickest profit margins and the long tail where bank services are lacking.

5. How the flywheel accelerates before 2026

Bank Issuers: After MiCA takes effect, at least ten regional banks in continental Europe will replicate Société Générale's EUR stablecoin. Super App Entry: Grab, MercadoPago, and others are already in gray testing for USDC wallets; once defaulted, tens of millions of users will immediately step into the on-chain world. On-chain closed loops take shape: merchants receive, supply chains pay, employees earn, and wealth management earns interest, all completed within the same network, naturally driving off-ramp fees to zero. Corporate Financial Migration: Deloitte predicts that by 2027, 10% of the idle cash of the Fortune 500 will be parked in interest-bearing stablecoin accounts, with banks' demand deposits being drained significantly. By then, discussing the 0.01% of the G10 corridor will be like telecom giants in 2010 still cutting long-distance fees by a penny, unable to stop WhatsApp from gaining a million new users in free calls each day.

6. The last words left by Circle's IPO

Circle tells the market with a beautiful interest margin ledger and a rapidly expanding network effect: "Cheap remittances" are just the prologue; rewriting the financial infrastructure is the main act.

Airwallex has nearly perfected the G10, which is the champion posture in a 15% world; but the remaining 85% of the market is changing tracks and scoreboards. Next stop, money will fly everywhere like emails. At that time, who will still care whether the email stamp is 1 cent or 0.1 cent? Watch the landscape shuffle, and don’t tie your hands and feet at the starting line.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。