The Federal Reserve's interest rate cuts continue to inject liquidity into the market, which should boost the prices of risk assets. However, why has the cryptocurrency market continued to decline? Especially, why did BTC experience a significant drop yesterday? This article will explore the underlying reasons and provide key observation indicators.

Author: Yuuki, Deep Tide TechFlow

TL;DR

Recent market downturns are caused by phase-specific macro headwinds, the industry black swan on October 11, and capital competition among the stock markets of the U.S., South Korea, and China. In the long term, the Fed's preventive interest rate cuts and the mild liquidity injection have not outweighed the selling pressure from newly issued crypto assets and token unlocks. This is reflected in the growth of the total market capitalization of cryptocurrencies, while most coin prices have declined, leading to a bear market experience for secondary market investors. In the short term, attention should be paid to the U.S. government reopening timeline and the effective date of the Fed's balance sheet reduction (December 1); in the long term, focus on the pace of interest rate cuts and the capital competition between the crypto market and other risk markets.

1. The total market capitalization of the cryptocurrency market grows in tandem with liquidity easing, but the massive supply on the asset side leads to poor price performance

1. From a long-term perspective, the growth of the total market capitalization of the cryptocurrency market is highly correlated with the growth of global risk market capitalization.

The release of macro liquidity affects mainstream global risk assets. A core comparison of the changes in the total market capitalization of the cryptocurrency market and the U.S. stock market reveals a high correlation in their rise and fall rhythms over the long term.

The chart below shows the past year:

Red line: Total market capitalization of the cryptocurrency market;

Green line: Total market capitalization of altcoins excluding BTC and ETH;

Blue line: Performance of the S&P 500 index;

2024.11-2025.11 Total, Total3 & SPX

Data source: TradingView

Several phenomena can be clearly observed:

The market capitalization of the cryptocurrency market has grown more than that of the U.S. stock market.

The three markets generally oscillate in sync, hitting bottoms and restarting upward trends (recently, due to the October 11 black swan event in the crypto space, the rise and fall have not been synchronized, which will not be discussed further in this article).

2. The massive supply on the asset side has led to an increase in the total market capitalization of altcoins, but token prices are declining.

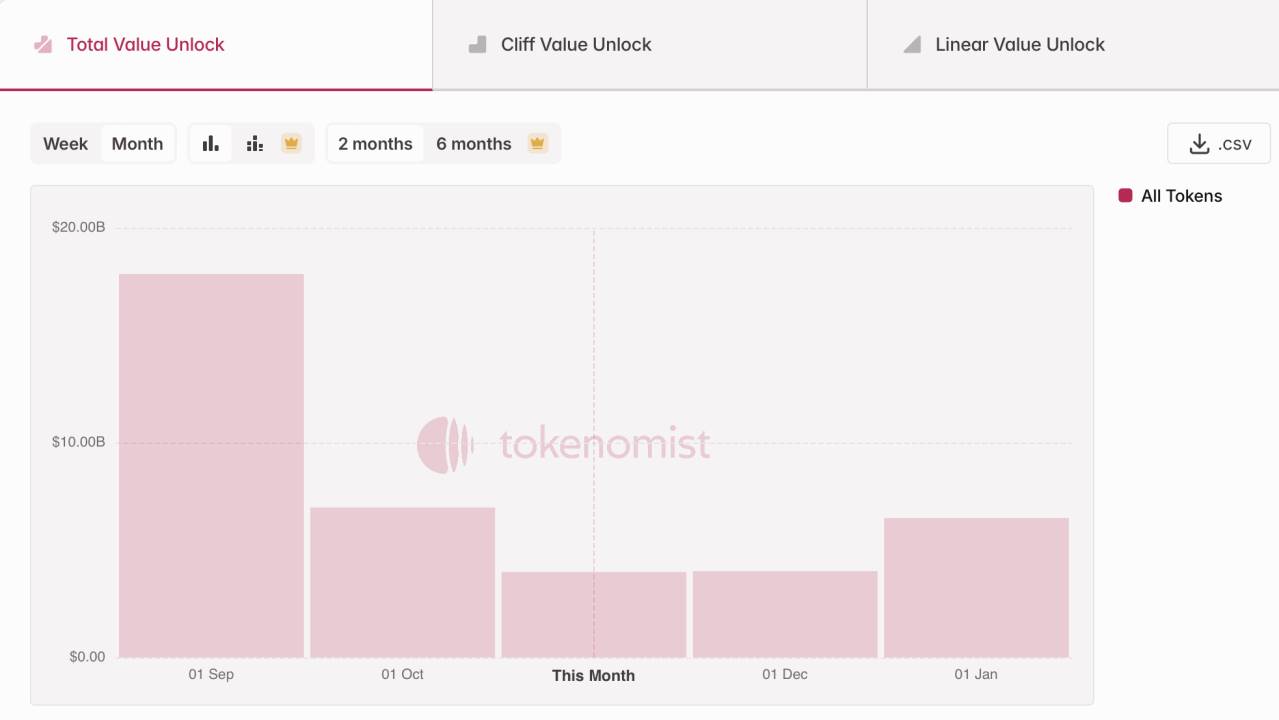

The growth in total market capitalization does not equate to profits for investors. Over the past year, the issuance of a large number of new assets in the cryptocurrency market and the unlocking peak of many projects (especially public chains, DeFi, and AI track tokens launched during the 2021-2023 cycle) have created continuous supply pressure on the market. According to Tokenmist data, the market capitalization of newly unlocked tokens in the past three months is approximately $30 billion.

Approximately $30 billion in token unlocks in the past three months

Data source: Tokenmist

In summary, the current preventive and mild interest rate cuts by the Federal Reserve, along with the buying pressure from mild liquidity injections, have not exceeded the selling pressure from newly issued crypto assets and token unlocks. This is reflected in the growth of the total market capitalization and the decline in most coin prices, resulting in a bear market experience for secondary market investors.

2. In the short term, the current macro liquidity is facing phase-specific headwinds

From a long-term perspective, we are still in a historical process of dual easing in monetary and fiscal policy. However, in the short term, the U.S. government shutdown, the TGA account only receiving funds without outflows, and the slower-than-expected pace of Fed interest rate cuts present significant monetary liquidity headwinds. Additionally, the global risk appetite has been continuously affected by U.S.-China tensions.

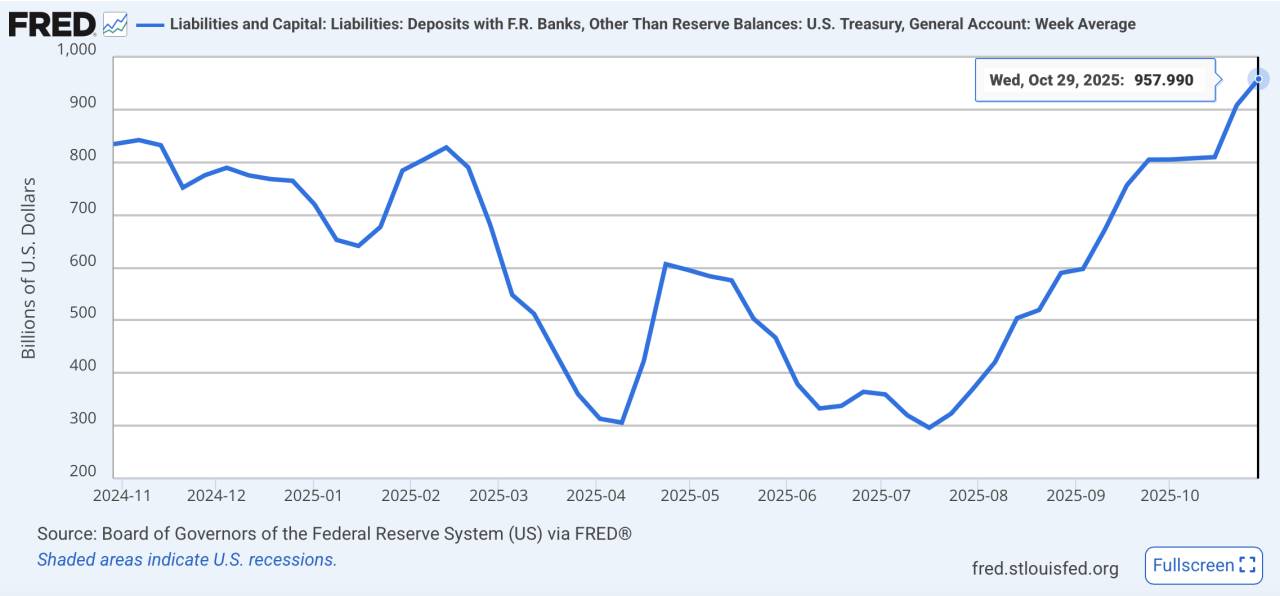

(Note: The TGA account, or Treasury General Account, can be understood as the U.S. Treasury's bank account, where the Treasury deposits funds from issuing government bonds and tax revenues for fiscal expenditures, such as salaries or infrastructure. Therefore, an increase in the TGA balance means that fiscal funds are locked in the account and not flowing into the economic system, leading to a tightening of fiscal liquidity in the short term. This situation has been exacerbated by the recent U.S. government shutdown.)

1. Fiscal side: The TGA account's "only in, no out" leads to locked funds.

The long-standing deadlock in Congress over budget appropriations has led to a record-breaking U.S. government shutdown, resulting in fiscal funds only coming in and not going out, creating a phase-specific liquidity withdrawal. As of October 29, 2025, the TGA account balance has increased to $957.8 billion, and on November 4, the U.S. government conducted a short-term debt auction of $274 billion;

TGA balance rises to a one-year high

Data source: FRED

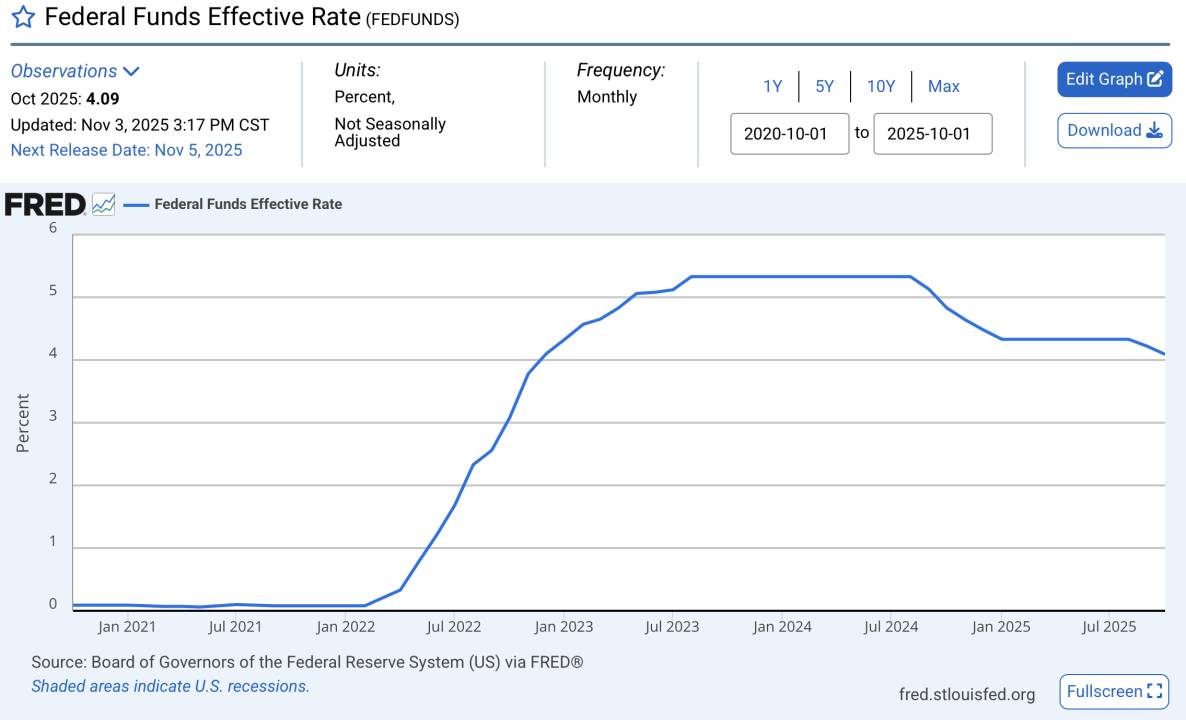

2. Monetary side: The pace of interest rate cuts is slower than expected.

Although we are currently in a Fed interest rate cut cycle, the pace of these cuts is far below market expectations; current real interest rates remain relatively high. In particular, Powell's recent statements at the FOMC meeting did not commit to a rate cut in December, further undermining market confidence. Additionally, this preventive interest rate cut is also accompanied by concerns about a recession.

Interest rates remain at historically high levels

Data source: FRED

3. U.S.-China friction leads to a decline in risk appetite, suppressing risk asset prices.

Recent events, such as China's restrictions on rare earth exports and the U.S. re-imposing tariffs, have increased risk-averse sentiment, causing the U.S. dollar index and the volatility index of U.S. stocks to rise simultaneously, reflecting a warming of global risk aversion.

U.S. dollar index continues to rise

Data source: TradingView

U.S. stock volatility amplifies

Data source: TradingView

3. The continuous rise of the stock markets in the U.S., China, and South Korea creates a strong attraction for risk capital, siphoning funds from the cryptocurrency market

When discussing bull markets, the market often compares to 2021. In the bull market of 2021, while quantitative easing led to a rapid expansion of liquidity, the stock market suffered severe EPS damage due to the pandemic (i.e., company revenues plummeted due to the pandemic, and the fundamentals of the stock market deteriorated to a point where they did not support secondary traders' purchases). The abundant liquidity had nowhere to go, triggering a violent bull run in the cryptocurrency market, with the total market capitalization of cryptocurrencies soaring from $300 billion to over $3 trillion within a year, and altcoins outperforming BTC, with small-cap assets seeing hundredfold increases.

2020.11-2021.11 Total, Total3 & SPX

Data source: TradingView

Now, the stock markets most relevant to the cryptocurrency market in the U.S., China, and South Korea are rising steadily. The U.S. stock market, driven by AI, continues to hit new highs, the A-share market has broken through 4000 points under policy support and expectations of liquidity recovery, and South Korea has also shown a strong trend due to a recovery in semiconductor exports, with the KOSPI index rising nearly 70% year-to-date, becoming the best-performing major index in 2025.

The limited high-risk capital in the market is being absorbed by assets with higher certainty, significantly diverting some of the funds that could be injected into the cryptocurrency market.

Stock market gains in South Korea, the U.S., and China over the past year

Data source: TradingView

Therefore, in the long term, if the upward trend of global stock markets continues and the Fed's liquidity injections remain mild, the cryptocurrency market may still be in a "capital marginalization" phase, generally characterized by growth in total market capitalization but weak price performance due to massive asset issuance. In the short term, the core focus should be on the U.S. government reopening timeline and the effective date of the Fed's balance sheet reduction (December 1), which may bring marginal liquidity improvements.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。