作者:Omnia.hl π

编译:深潮TechFlow

显而易见的总结

毫无疑问,Hyperliquid 再次迎来了属于它的一年,而且这一次的胜利堪称压倒性。这是我近6个月以来首次再度撰写关于这个生态系统的文章,或许也是我最长的一次“沉默期”。这篇文章将涵盖一系列观察,所有这些都支持 Hyperliquid 在长时间维度上的发展轨迹——以数量级的方式持续攀升。

到目前为止,Hyperliquid 的表现可以用“疯狂”来形容。它几乎每个月都在不断刷新自身的历史最高记录,从交易量到用户数量,再到收入以及其他各项指标,无一例外。毫无疑问,Hyperliquid 已经成为自电子交易兴起以来,对中心化交易平台构成的最大威胁,它对传统势力的冲击,正如互联网颠覆信息传播的方式一样深远。

如今,说有数百个团队正在 Hyperliquid 上构建已经不再是猜测。从我们自己的团队 @kinetiq_xyz,到 DeFi 的各个领域以及零售应用开发的众多团队,Hyperliquid 的生态正在迅速扩展。

然而,许多人可能一时无法理解这意味着多大的成功。也许有人会将其归因于其封闭源码、不与社区基础层面或团队层面深度互动(更直白地说:不提供任何资助或特殊待遇),或者认为它仅仅是因为每日永续合约交易量的表现而已。

但他们的误判和自满,正是(你)我们的机会所在。

Hyperliquid:打破常规的底层逻辑

在深入探讨之前,你必须明白,Hyperliquid 是一个完全的异类。它的存在突破了现有的行业格局,就像“方块试图嵌入圆孔”这一表达的极致体现,持续挑战并颠覆它所要摧毁的游戏规则。

目前存在的每一条区块链——是的,包括比特币(Bitcoin,最具争议的例外,作为“点对点电子现金系统”)和以太坊(Ethereum)——都不是围绕链本身设计的旗舰应用而构建的。几乎所有的应用都是基于 99.99999% 的区块链之上开发的,这意味着这些用例或应用程序是由核心团队或链的核心目的之外的外部力量开发的,然后迁移到或直接构建在底层网络之上。这种现象背后有多种原因,其中最常见的是明显不可持续的货币激励(例如直接偏向的资助、不良选择、保证的“神奇代币”等),而技术本身(如 TPS、隐私等)通常只是次要因素,尽管它们确实也有一定影响。

或许大多数人今天还不清楚(可以理解),但 Hyperliquid 最初是基于 Tendermint 共识机制构建的,直到 2024 年 5 月才转向完全自定义实现的 Hotstuff,共识机制被命名为 HyperBFT。

在我看来,@asxn_r 迄今为止对 HyperBFT 的研究仍然是最领先的,你可以通过以下链接了解更多:Hyperliquid: The Hyperoptimized Order。

一个有趣(且极其简短)的片段展示了 Hyperliquid 在更改共识机制之前的情况,那是通过 @pbr713 和 @iliensinc 在 2023 年 1 月(在我加入 Discord 的四个月前)的一次简短对话中透露的。

为了凸显 Hyperliquid 的开发速度:2024 年 4 月宣布 HyperBFT 后,仅两周时间就完成了主网部署。没有所谓的“去中心化表演”、付费媒体宣传、预发布巡回活动等形式主义。HyperBFT 的引入使 Hyperliquid 一跃成为当今性能最强的区块链,能够处理每秒 20 万笔交易(TPS)。Hyperliquid 持续打破“旧势力”试图围绕其建立的社会壁垒,例如在 2024 年底引入了无许可验证节点(permissionless validators),最初仅有 11 个节点,如今已增加至 24 个,其中包括 5 个基金会节点。

正如我之前提到的,有几个主要因素让我发现并追求使用 Hyperliquid:

由 @chameleon_jeff 主持的一期被严重低估的播客。

永续合约 DEX 并不是什么新鲜事,但基于自定义链构建的却是首次。

在高频交易(HFT)及其他交易形式极具吸引力的时期,Jeff 的智力魅力和亲和力深深吸引了 @0xmagnus 和我。

Hyperliquid 是你能找到的最理想的“信仰社区”。

极致的资本主义驱动,对典型基金会式“社会化”影响免疫。

极度偏好高风险,并为此感到自豪。

从单位数到三位数 IQ 的广泛人群,都被迫进入这个不断扩展的竞技场。

Hyperliquid 在运营中坚持绝对且不妥协的“内部禁欲”原则。

未从任何风险投资(VC)处筹集资金,迫使潜在买家只能在公开市场上购买,且所有交易透明公开;

未接受任何流动性提供者(LP)协议,也未支付做市商费用来获取流动性,却依靠自身吸引了巨量流动性(且仍在增长);

不向任何第三方泄露信息,所有公告均通过官方渠道同时对外发布,确保信息透明和公平。

要真正理解 Hyperliquid 的底层逻辑,你必须先了解行业游戏规则的常态,以及 Hyperliquid 如何实时打破这些规则,并将继续颠覆。

我关于剩余 HYPE 社区分配的猜想

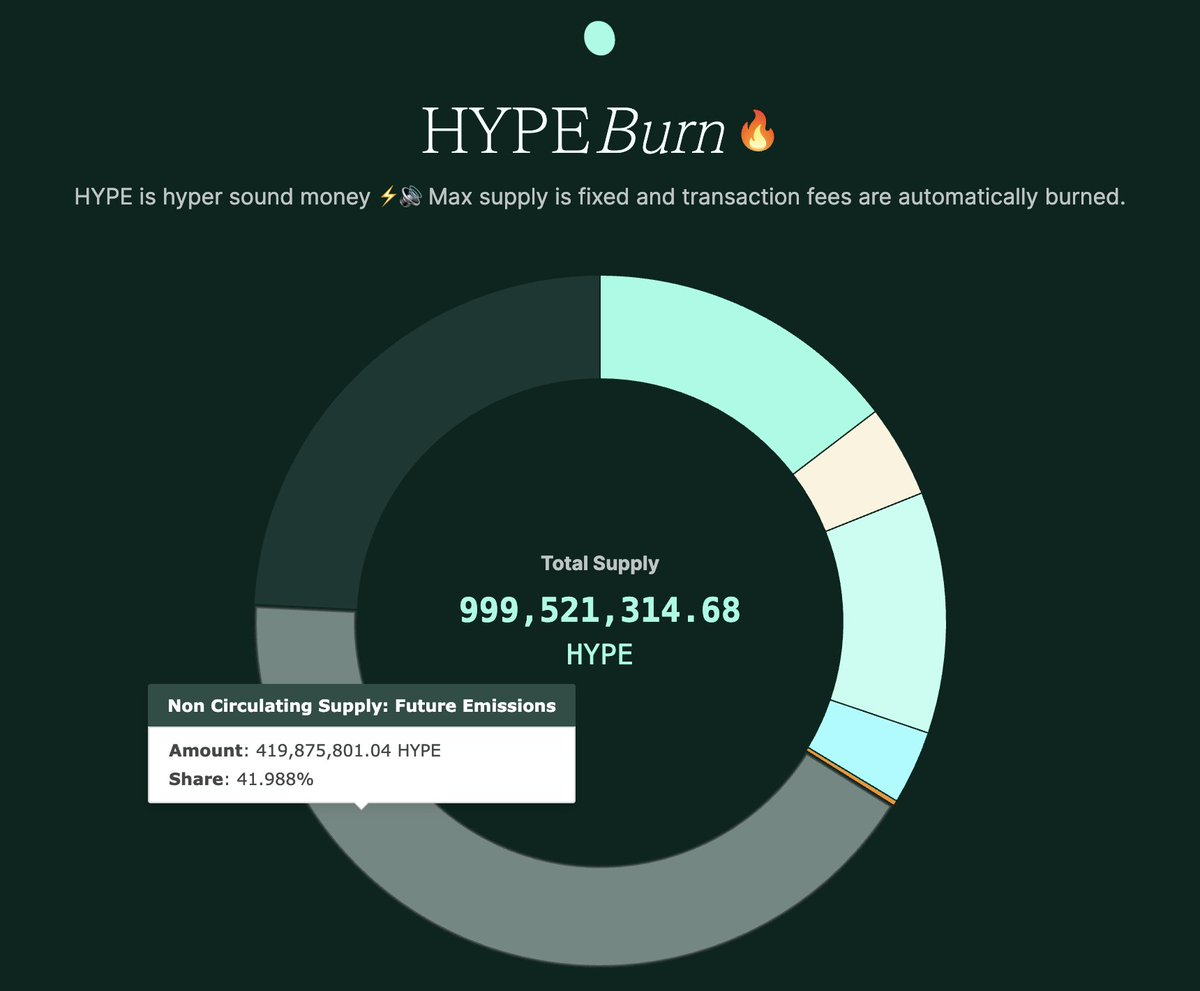

关于已经发生的两轮“赛季”之外的未来 HYPE 分配,外界有无数的猜测。虽然我认同一些关于剩余 HYPE 分配的观点,但随着 Hyperliquid 的影响力持续扩大,我愈发确信我的理论:剩余的 HYPE 将被逐步销毁,或者一次性全部销毁。

我主要的推论依据是:销毁 HYPE 是最客观的方式,可以清晰地为现有 HYPE 持有者反映出按比例且无偏的价值,而无需通过激励特定活动的方式来实现(类似于 BNB 的销毁机制,但完全没有任何不当行为)。这样一来,那些希望获得收益的人,只需做出一个简单且直接的选择——像我们其他人一样持有 HYPE。

参考:https://www.hypeburn.fun/ by @janklimo

针对我的理论的反驳:

如果销毁HYPE,团队的代币分配比例将会增加,除非团队减少其当前总供应份额以匹配已流通代币的~25%分配比例,形成最终供应量。

Hyperliquid可能将未来的激励视为最具战略意义的路径,专注于扩大其生态系统内的活动,从而实现增长,并对竞争产品和生态系统造成沉重打击。

或许两者兼而有之,一部分HYPE被销毁,另一部分用于增长计划。

或许在可预见的未来不会对此做出明确决策,而是等待最佳时机执行。

令人惊讶的是,无论我的理论是否正确,这个问题实际上并不重要。HYPE的成功几乎是注定的,无论最终选择如何。

数据表现

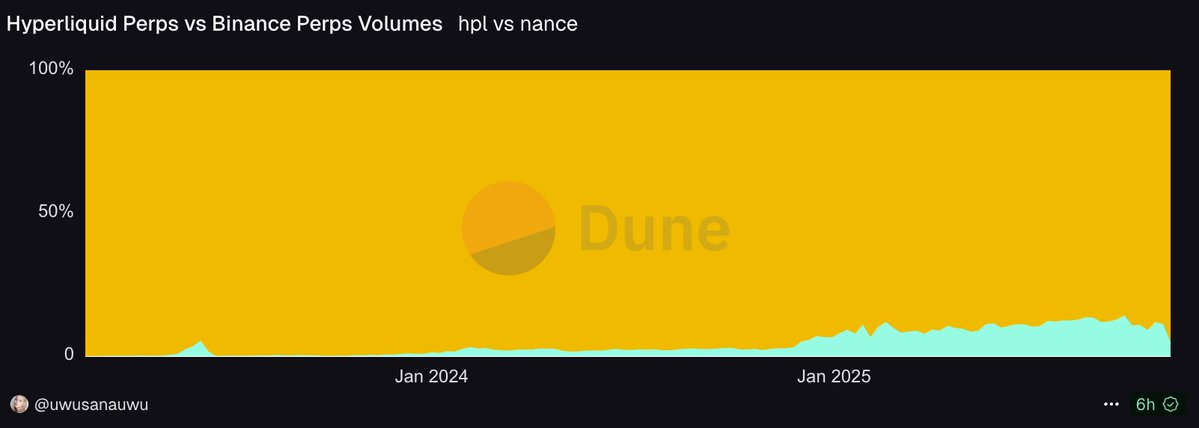

挑战巨头Binance:2024年9月底,Hyperliquid的交易量占据了Binance周交易量的约14%。

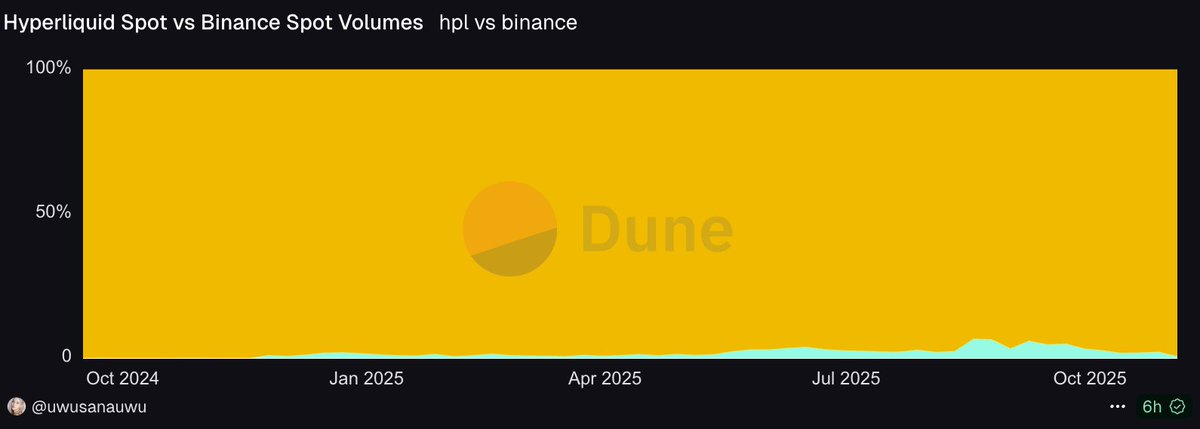

现货市场的冲击:2024年8月底,Hyperliquid在现货市场的交易量占比达到了约7%,显示出其进一步削弱Binance主导地位的潜力。例如,@hyperunit使Hyperliquid成为交易现货BTC的最便宜平台之一。

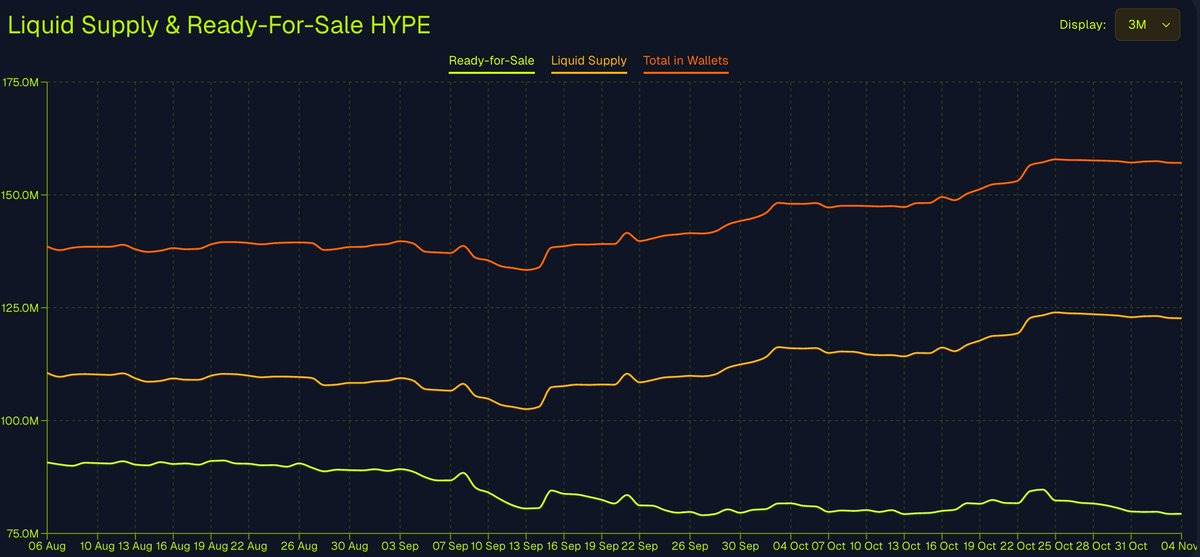

HYPE的供需动态:尽管市场最近有所下滑,RFS(Ready-For-Sale,可供出售)HYPE仍接近历史最低点,表明供应紧张。

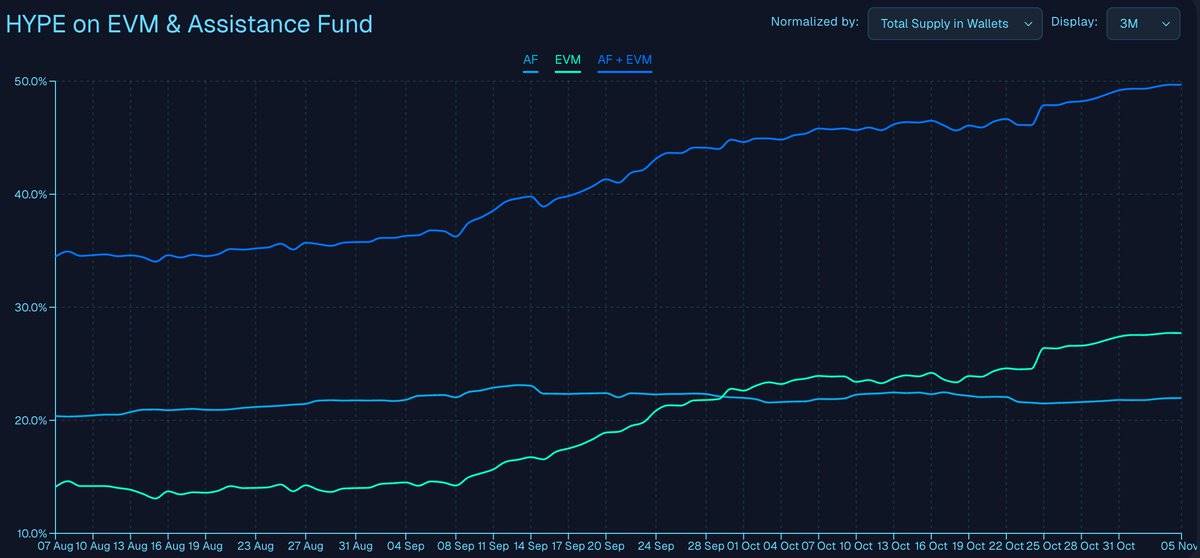

HyperEVM和援助基金的HYPE使用量持续增长,交易费用的99%直接用于回购HYPE,推动生态系统的扩展。

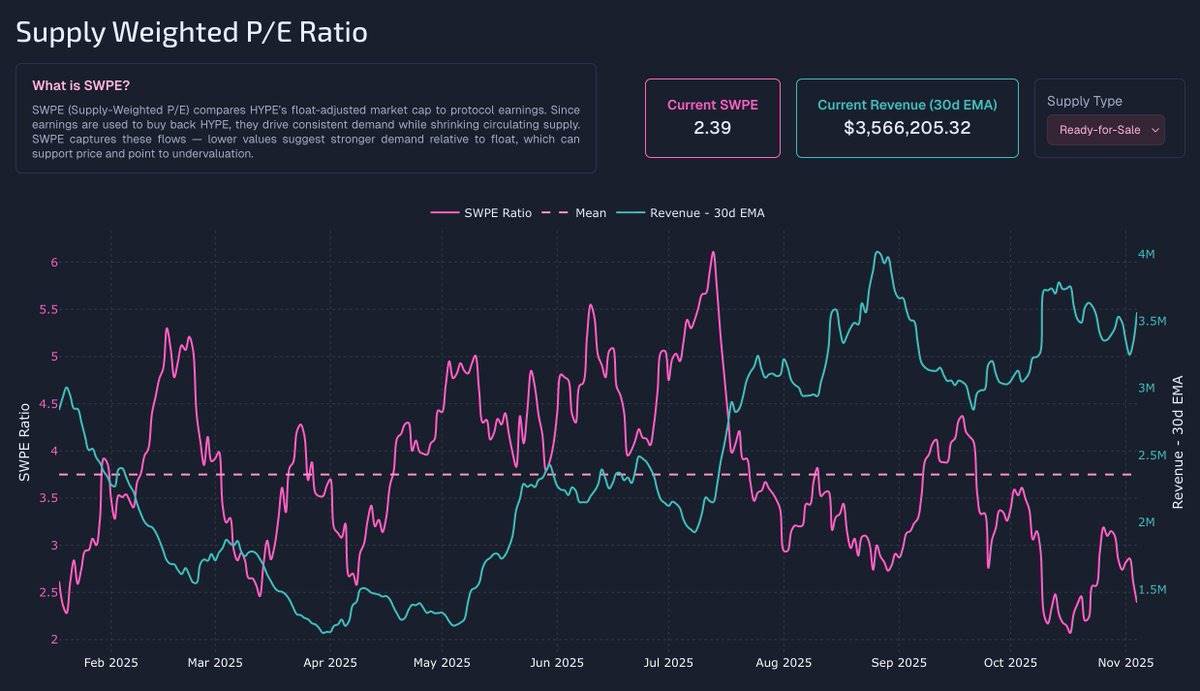

稀缺性与需求增长:SWPE(流通供应与价格弹性指标)处于历史最低点,而30天的EMA(指数移动平均线)收入接近历史最低和最高水平,显示流通供应减少与需求增加的趋势。

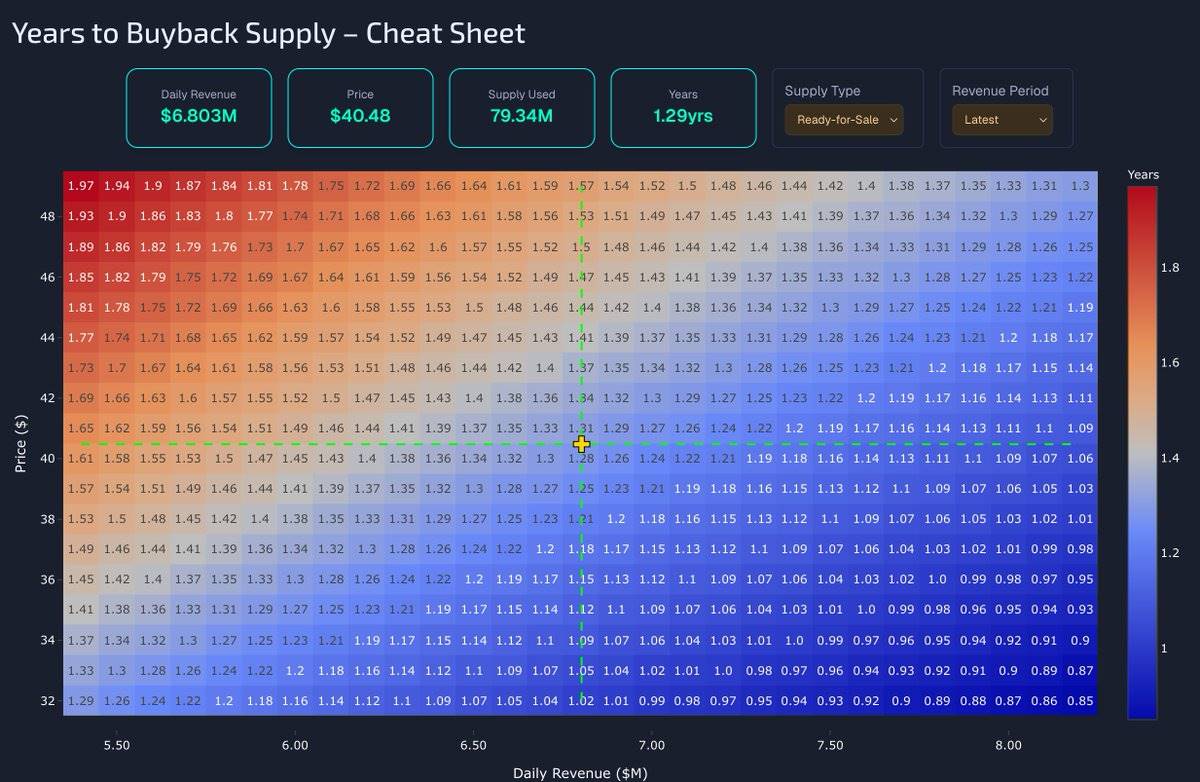

程序化回购机制:HYPE协议根据市场价格和波动性,自动从公开市场回购更多HYPE。在当前收入和价格水平下,援助基金仅需1.29年即可回购所有RFS供应的HYPE。

万亿美元

截至今日,Hyperliquid 的累计交易量已超过 3.13 万亿美元。

然而,全球金融市场规模高达数百万亿美元,甚至更多。对于 Hyperliquid 来说,这似乎是一个几乎不可能实现的目标,但这正是其最终瞄准的方向。

在 TBPN 的一次访谈中,当被问及“Hyperliquid 能有多大”时,Jeff 的回答耐人寻味。他的评论揭示了团队对 Hyperliquid 系统的深信不疑,即便目前的规模仍显微不足道,但他们相信有一天 Hyperliquid 能够承载全球金融的全部流动。

“如果 Hyperliquid 成功了,那么它将成为这个世界上前所未有的存在。”

Hyperliquid 已成为全球利润效率最高的企业之一,目前团队仅由 11 名成员组成,但年化收入已超过 15 亿美元,相当于每位员工创造约 1.36 亿美元的利润。而 Hyperliquid 的历史不过短短三年。

随着 Hyperliquid 的影响力不断扩大,华尔街已经开始注意到它的存在。无论以何种方式,传统金融领域终将参与其中。

Hyperliquid 的技术创新也不容忽视,包括 HIP-3、CoreWriter 等多项突破性成果,这些都通过每周持续的网络升级实现,且升级过程几乎没有超过几分钟的停机时间。

如今,Hyperliquid 已成为行业内首个同时结合高效链上交易平台与蓬勃发展的 DeFi 生态的项目。越来越多的开发者和交易者涌入这一生态,推动其发展成为一个独特的金融中心。从简单的数学逻辑来看,这种趋势只会让 Hyperliquid 的价值进一步提升。

预计在 2028 年之前,我们将会看到 HYPE 的价格将至少达到 2000 美元。这已经不是“是否会发生”的问题,而是“何时会发生”的问题。

“拥有 HYPE,便是赢家。”

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。