Written by: Bitcoin Magazine Pro

Translated by: Baihua Blockchain

Bitcoin is facing a fundamental identity crisis that goes far beyond technical debates about block size or data storage. The core issue is not just what Bitcoin "is," but what it "should be." Is it a peer-to-peer electronic cash system, a settlement layer, an immutable ledger, or a store of value?

This definition is crucial because the design choices surrounding these questions will determine Bitcoin's long-term viability, degree of decentralization, and resistance to censorship. The tensions between different visions reveal deep governance challenges that may define Bitcoin's future.

What is Bitcoin?

Essentially, Bitcoin is information. When you send Bitcoin, you are not physically moving an object through space. You are moving data: numbers, strings of letters, and unspent transaction outputs (UTXOs) transferred from one address to another. Because this information represents stored energy and value, we refer to it as currency.

The function of Bitcoin depends on how you use it. Since Bitcoin is a protocol with a limited programming language that can store data, it can be used for various purposes. This flexibility is both Bitcoin's greatest strength and the root of its identity crisis.

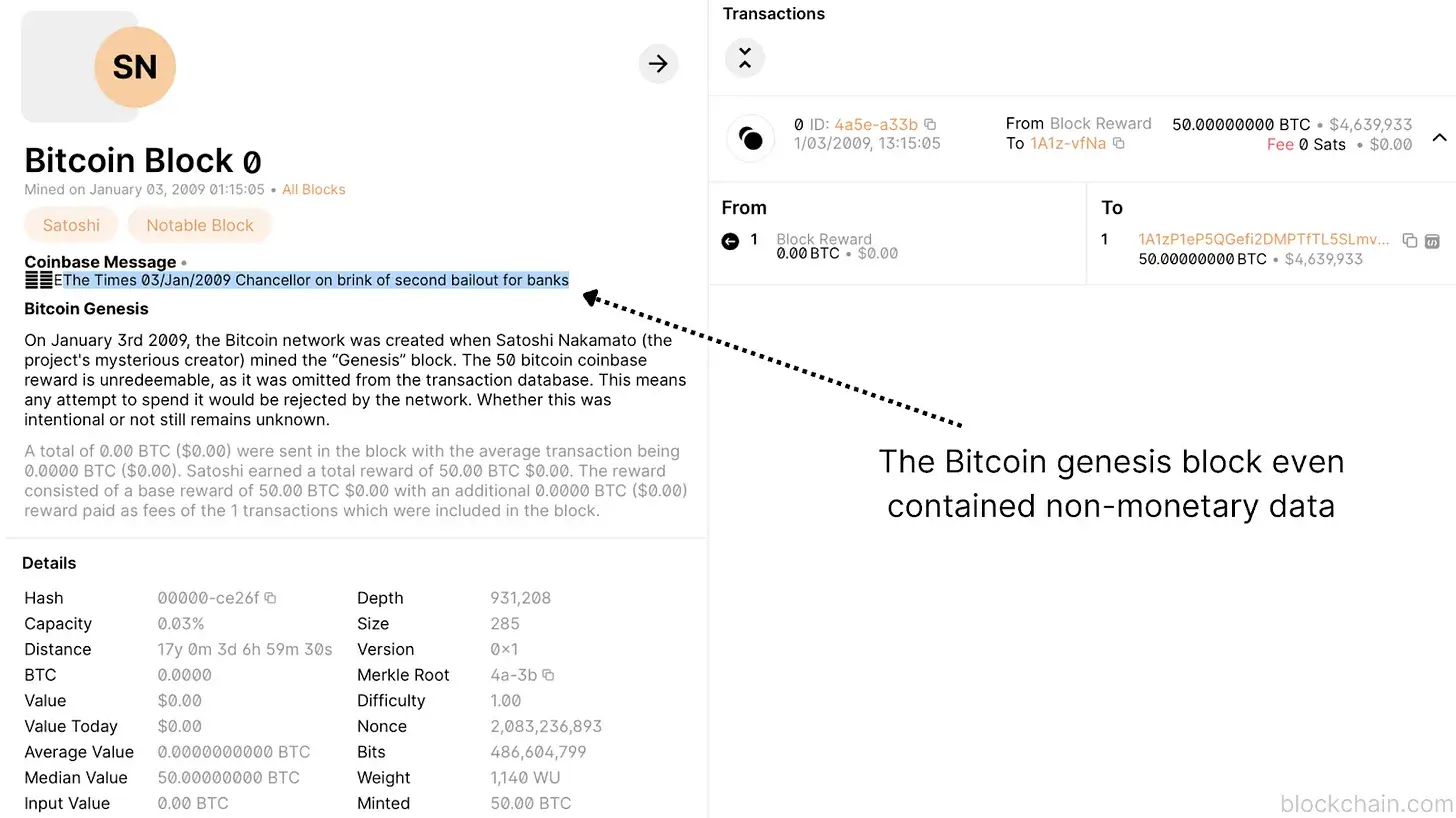

Figure 1: The Bitcoin genesis block and its famous encapsulated text message.

Figure 1: The Bitcoin genesis block and its famous encapsulated text message.

The Bitcoin white paper opens by declaring it "a peer-to-peer electronic cash system." Its intent is clear: Bitcoin aims to facilitate the flow of monetary information and value transfer. However, Bitcoin has never been limited to monetary information. Its protocol does not discriminate; it simply records information.

For many years, this was undisputed. But recently, we have seen an increasing amount of non-monetary data being stored on Bitcoin: JPEG images, videos, websites, and other irrelevant information permanently added to the blockchain. Some praise this as a victory for "censorship resistance" and "information preservation," while others label it "spam," arguing that this useless data leads to blockchain bloat.

The Spam Paradox

The core issue is not the images or data contained in the blockchain itself, but the positioning of Bitcoin's use case. Is Bitcoin a payment network specifically designed for financial transactions, or is it an immutable ledger that can permanently store any information based on market demand?

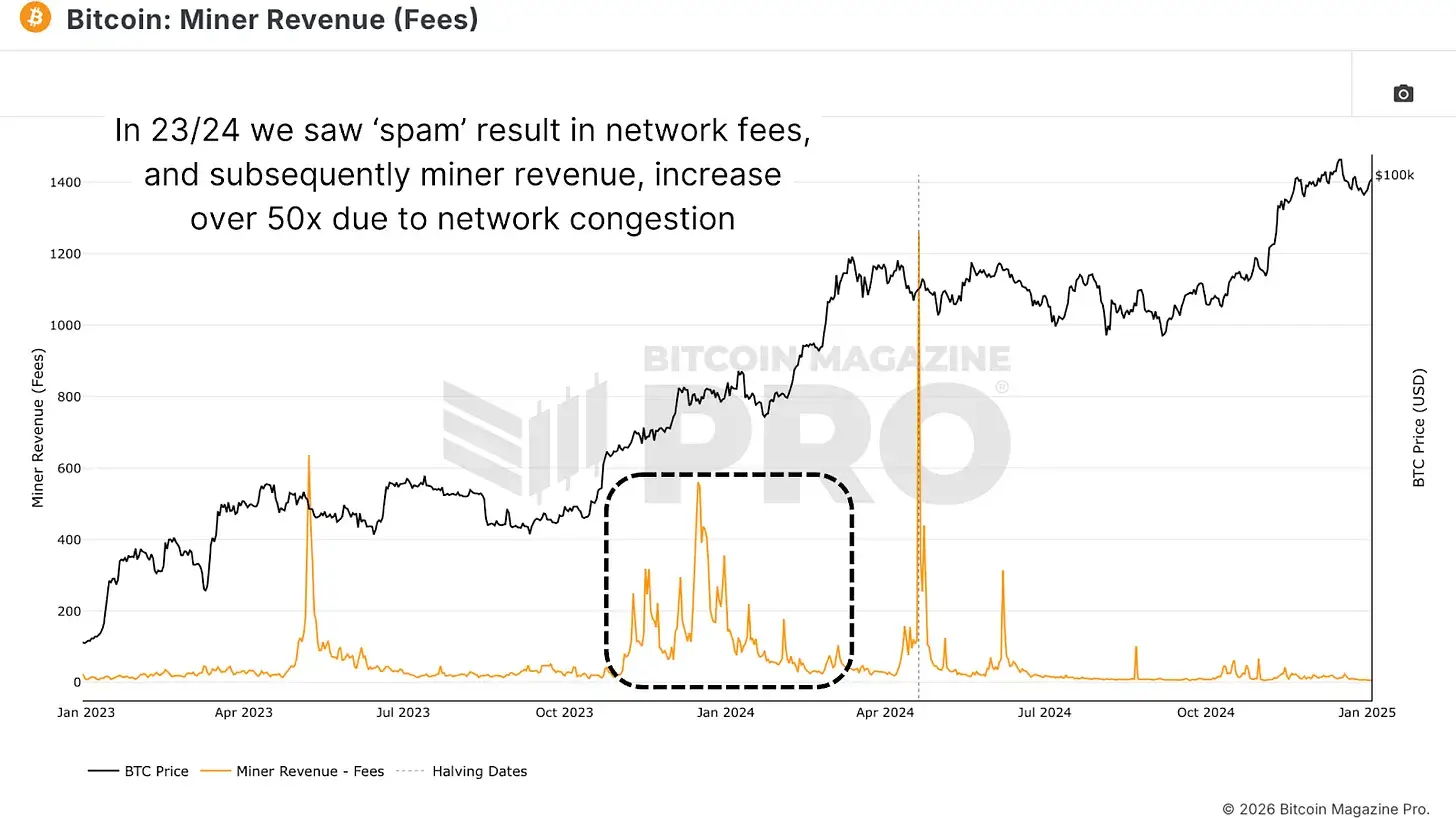

Figure 2: Network spam from late 2023 to 2024 significantly boosted miner revenues.

Figure 2: Network spam from late 2023 to 2024 significantly boosted miner revenues.

The Bitcoin protocol can handle arbitrary data and OP_Return, but this comes with the potential for abuse. However, proof of work (PoW) ensures that the cost of spamming the network is high. If you want to engage in such activities, you must pay the price.

There is currently insufficient evidence to suggest that the long-term storage of non-monetary data is damaging enough to threaten other users, nor is there evidence that running a node incurs legal liability as a result.

Block Size Wars

This is not the first time Bitcoin has faced an identity crisis. As early as 2015, Bitcoin experienced a genuine philosophical split.

Big Block Advocates: Some developers and miners advocated for larger blocks to accommodate more transactions, aiming to make Bitcoin a mainstream currency with scalability akin to Visa or Mastercard.

Small Block Advocates: Many opposed this proposal. They wanted to keep blocks small to maintain decentralization and utilize other layers (Layer 2) to process transactions. They believed Bitcoin's responsibilities were security and finality, not transaction speed.

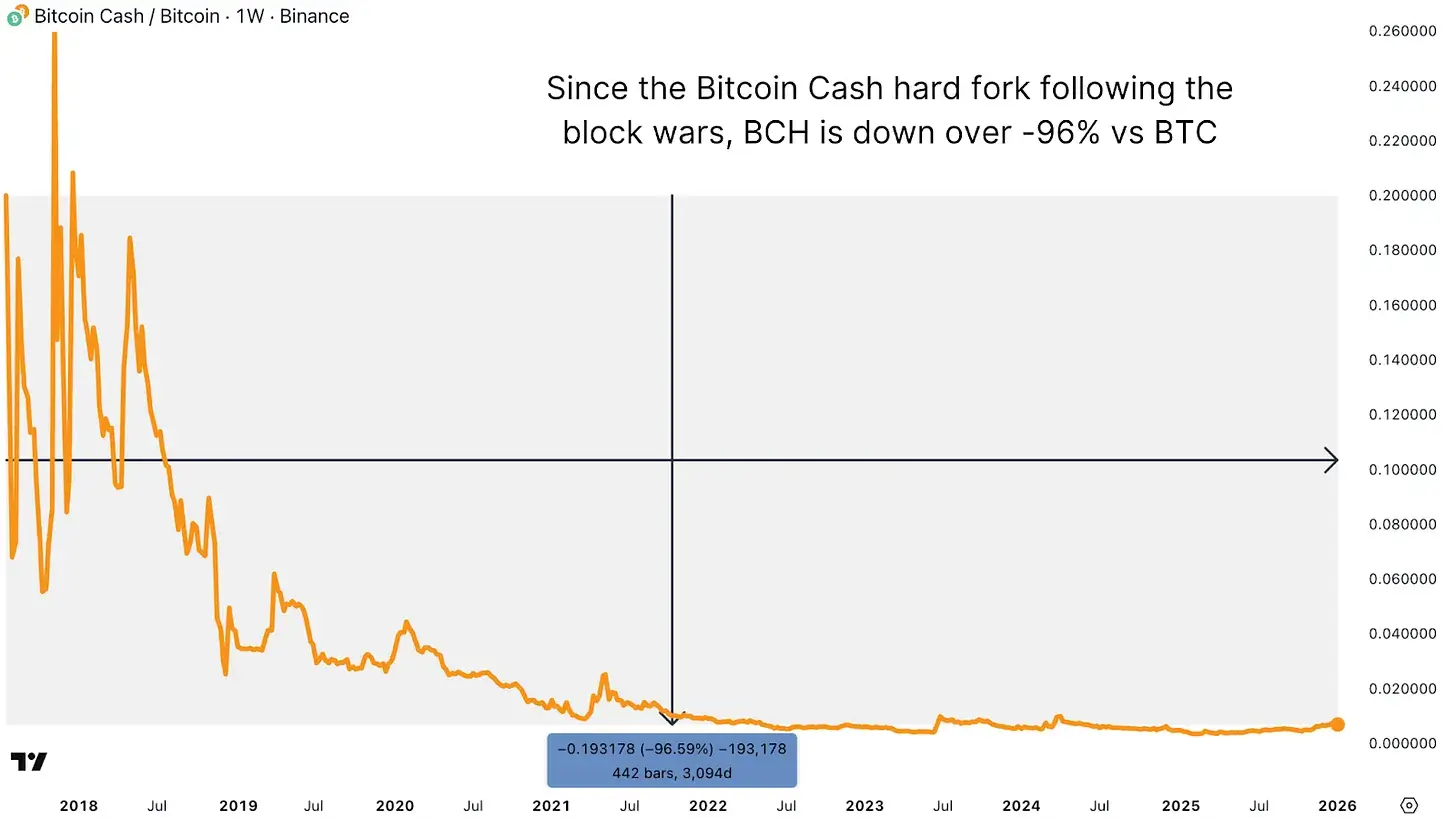

Figure 3: Bitcoin Cash (BCH) addressed some concerns about block size and speed but failed to gain significant market share.

Figure 3: Bitcoin Cash (BCH) addressed some concerns about block size and speed but failed to gain significant market share.

These positions are irreconcilable. Ultimately, Bitcoin forked. Bitcoin Cash emerged as an alternative for the big block vision, while Bitcoin retained the small block network.

In the end, it was the market and users who determined Bitcoin's direction. This precedent indicates that Bitcoin's governance is essentially chaotic and anarchic: anyone can freely use any code and attempt to enforce their governance claims.

Node Dilemma

This is crucial for Bitcoin's future: Bitcoin's decentralization relies on node operators who are responsible for verifying each transaction and checking every rule. Nodes are at the core of decentralization.

However, the economic incentives for running nodes have always been unclear. Miners have block rewards and transaction fees, users have the need to verify their own transactions, but for those who run nodes purely out of belief, it is purely an altruistic voluntary act.

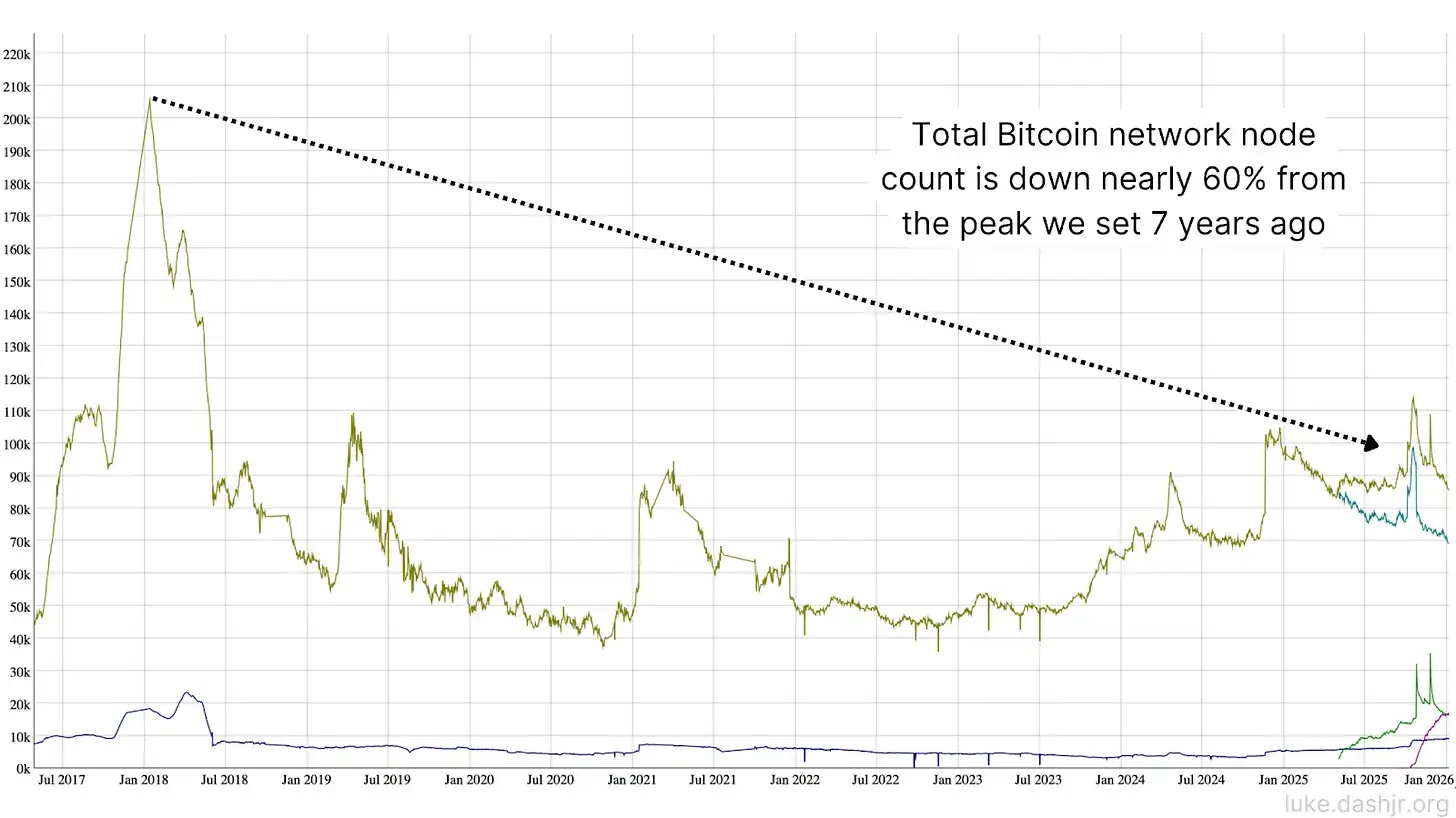

Figure 4: The number of Bitcoin network nodes has decreased by nearly 60% from its peak in 2018.

Figure 4: The number of Bitcoin network nodes has decreased by nearly 60% from its peak in 2018.

This poses a long-term threat. Bitcoin's decentralization depends on whether ordinary people are willing to verify the network for free. However, human nature often tends to centralize through specialization and outsourcing to trusted third parties, which is particularly evident in Bitcoin custodial services. If a significant portion of the ecosystem moves towards custodial solutions, it will pose significant centralization risks and systemic risks to Bitcoin.

Conclusion

The identity and governance challenges of Bitcoin are not just about code; they are about how to balance the interests of various parties. It is an art of compromise: users want low transaction fees, node operators want a compact blockchain, developers want an easy-to-develop underlying system, and miners need economic incentives to maintain network security.

The block size wars did not fully resolve this debate, and the discussions around spam and Ordinals have not reached a conclusion. The current censorship resistance paradox also fails to completely resolve these deep-seated contradictions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。