Text by|Sleepy.txt

Every generation has its own wealth code.

In the 1970s, when the spring thunder of reform and opening-up had just sounded, the wealth code was written in the factories of rural enterprises, and on the construction blueprints of Shekou, Shenzhen. Daring to go into business and buying property in core locations was the most certain thing of that era.

In the 80s and 90s, when the first email was sent from China, and the time-space tunnel of Yinghai Wei opened, the wealth code was written in the suffix of ".com," and in the unceasing lights of Zhongguancun. Investing in stocks of Tencent and Alibaba, and immersing oneself in the Internet wave was the most exciting choice of that time.

So, as time approaches the year 2026, when the post-00s and post-10s begin to take the stage in history, where will their wealth code be written?

The answer may lie in the lifestyle of this generation. Want to know what will be the most valuable in ten years? Look at today’s young people, where they are pouring their true passion and talents.

This leads us to today’s story, which concerns the changing wealth concepts of a generation and the answers for the next decade of the business world.

Today’s protagonist is Roblox. It appears to be a playground for children, but is becoming a social university for this generation of young people to learn business, practice finance, and earn their first pot of gold.

This article is sponsored by Kite AI

Kite is the first Layer 1 blockchain for AI agents payments. This underlying infrastructure allows autonomous AI agents to operate in an environment with verifiable identity, programmable governance, and native stablecoin settlement.

Kite was founded by senior AI and data infrastructure experts from Databricks, Uber, and UC Berkeley and has secured $35 million in funding from investors including PayPal, General Catalyst, Coinbase Ventures, 8VC, and several top investment foundations.

Financial Lessons for 13-Year-Olds

Let’s first forget the narrative of the "metaverse," which was once overstated and is now considered dead by everyone, and look at the story unfolding on Roblox.

Alex Hicks was only 13 years old when he first encountered Roblox; like other kids, he played games and made friends there. But soon, he found that what attracted him most about this platform was not playing, but creating. A year later, at the age of 14, he began to experiment with the tools provided by Roblox to create his first game. He has been doing this for a decade.

In these ten years, he has never worked a day in a game company nor received any professional programming training. He learned how to design game mechanics, how to price virtual items, how to maintain user engagement through updates, and even how to manage a development team within Roblox. By 2020, at just 24 years old, he had already established an independent game studio called RedManta with an annual income exceeding $1 million.

Hicks's story is not an isolated case. Eighteen-year-old Alex Barfanz created a police chase game called "Jailbreak" with his partner before entering Duke University. Within months of its release, this game earned him enough to cover $300,000 in tuition, and two years later made him a millionaire.

Behind these stories is Roblox becoming the most significant financial enlightenment classroom for this generation of young people. Through direct business practice, millions of teenagers have first understood what income, expenses, profits, and return on investment mean.

Here, a vast creator economy is rising at unprecedented speed. According to Roblox's annual economic impact report released in September 2025, from March 2024 to March 2025, the platform paid creators over $1 billion, a year-on-year increase of over 31%. The top 1,000 creators earned an average of around $1 million each year, showing significant growth.

Of course, any mature business ecosystem cannot do without a large denominator. Data shows that over 99% of creators earn less than $1,000 a year. But this forms a real and somewhat harsh competitive business environment. The first lesson that children learn here may very well be the market economy's 80/20 rule.

For this generation, their first financial education does not come from parents or schools, but from Roblox. The first money they earn, the first business model they learn, and even the first business failure they encounter will be deeply impressed in their minds.

This raises a question that makes all traditional financial institutions anxious: when this generation of young people grows up, and their financial enlightenment education has been completed in a virtual gaming world, what will the banks, still queuing in the real world, do?

Banks Forced to Enter the Game

Managers at TD Bank in Canada clearly also foresee this unsettling future. In March 2025, one of North America’s largest banks officially launched a financial education game called "Treat Island Tycoon" on Roblox.

In this game, players take on the role of a young entrepreneur establishing their ice cream empire on a virtual island. They need to earn money, decide how to spend, and learn about saving and borrowing. The game is completely free, purely aimed at education.

The decision of TD Bank was based on thorough research, showing that as high as 86% of parents believe that interactive games or animated videos are far more effective than traditional books in teaching financial knowledge.

Emily Rose, VP of TD Bank, candidly stated in an interview: "Virtual experiences are reshaping the form of early education. What we aim to do is provide a safe and interesting entry point for children to complete their financial enlightenment subtly, laying the foundation for their future wealth journey."

Translating this PR statement, it means: we must go where this generation of children is to find them, rather than wait for them to come to us.

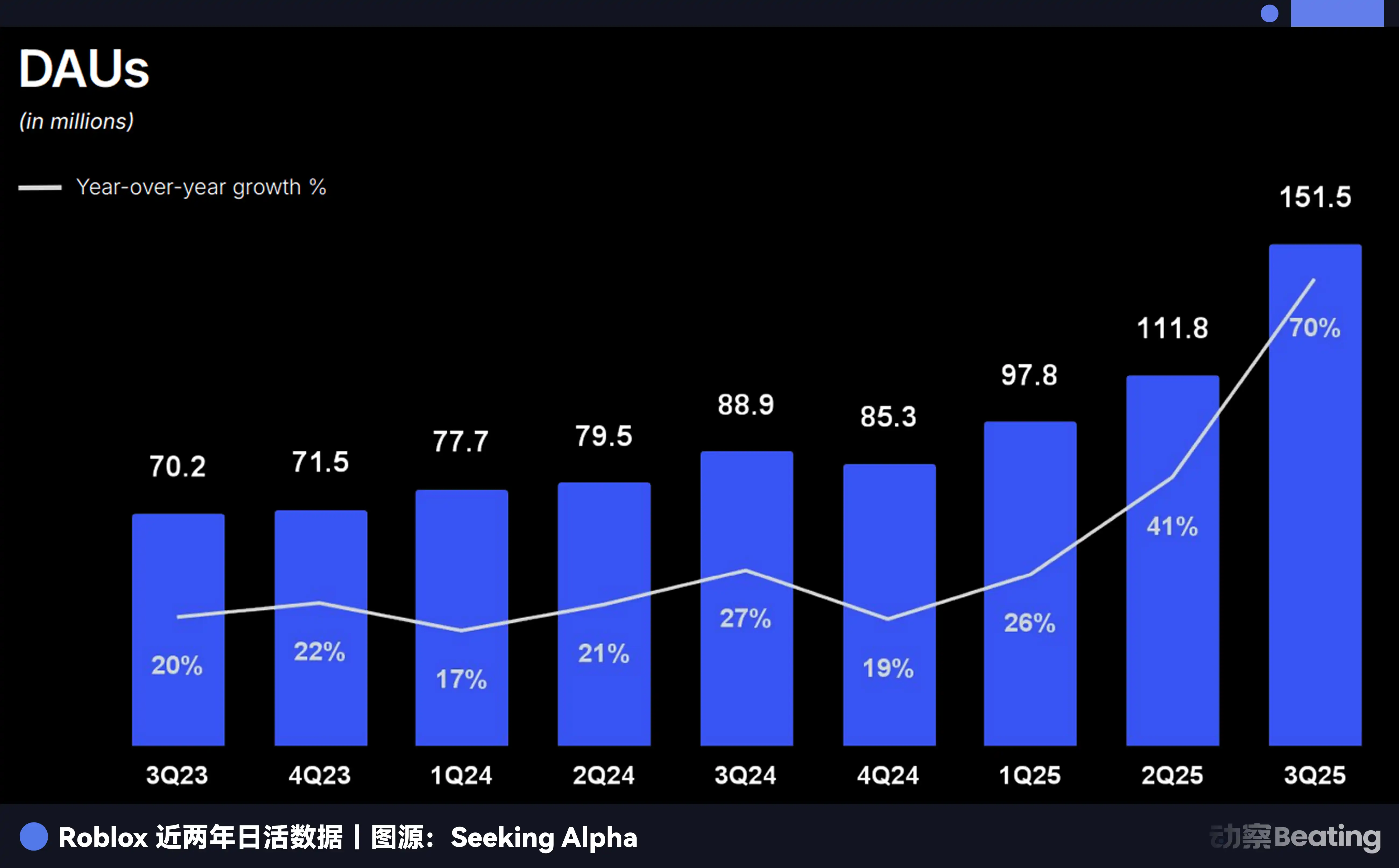

Wherever users' time goes, the entrance to wealth follows. As Roblox's daily active users exceed 150 million and cover a wide age range from children to young adults, it becomes no longer just a gaming platform but a mental battlefield for the next generation of financial users.

The anxieties of TD Bank mirror those of the entire traditional financial industry. Moreover, their competitors are no longer just other banks. Just before and after TD Bank launched its game, the American fintech company Chime collaborated with beauty brand e.l.f. Beauty to launch another financial education game on Roblox.

Even a beauty brand is crossing over to seize the entry point to financial education, indicating that the boundaries of financial services are being completely shattered. The starting point for competition has already moved to children as young as ten.

Traditional banks once believed their moat was physical locations, licenses, and substantial capital. But now they realize that the real moat may just be users' minds, which are shaped during adolescence.

When a child is used to managing their assets, trading, and investing in a virtual world, how much demand will they have for physical banks when they grow up? When their first income comes from selling a virtual item they designed rather than from their parents' New Year's money, how will their definition of assets change?

This touches on a deeper issue: when the scene of financial enlightenment shifts from bank lobbies to the gaming world, we are facing a group of digital natives with fundamentally different views on wealth. How will they reshape the future financial world?

When Virtual Assets Become the "First Time"

To understand the impending changes, we must clarify a core difference: the relationship between this generation of young people and their virtual assets has seen a fundamental qualitative change compared to their predecessors.

Many might say that trading game items is nothing new, nor was it invented by Roblox. Indeed, people born in the 80s and 90s also traded gold coins in "World of Warcraft" and bought and sold equipment in "Fantasy Westward Journey." But the virtual asset trading back then was fundamentally different from what we see today.

During the peak of "World of Warcraft," Blizzard officially prohibited any form of cash trading and ruthlessly banned the accounts of gold farming studios, and players even took it upon themselves to hunt them down. Virtual asset trading was an underground black market suppressed by the authorities.

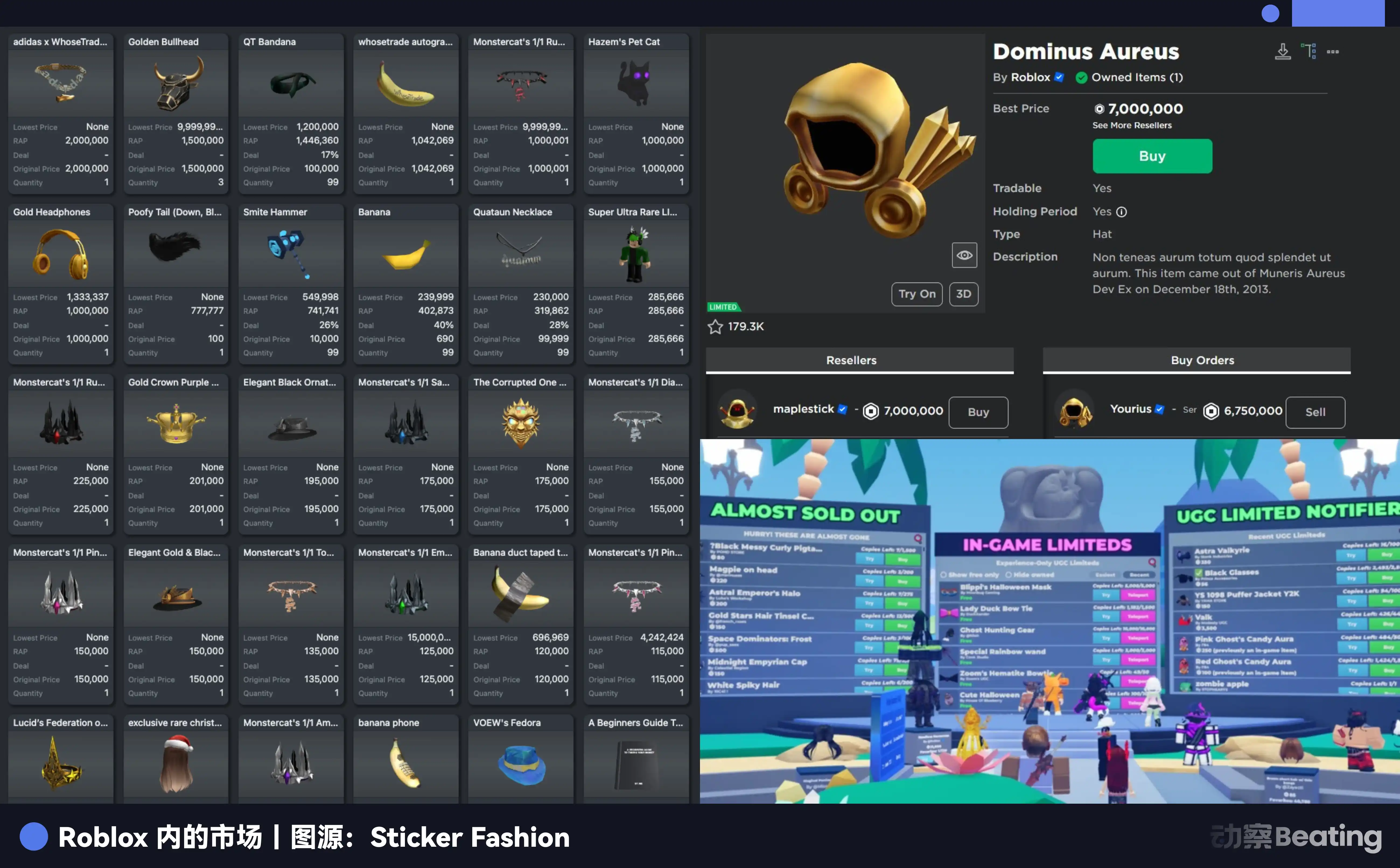

In Roblox, however, it is a well-paved highway laid out by the platform. You create content, players consume Robux to purchase, and then you can exchange this virtual currency for real dollars through DevEx (Developer Exchange Program). This is the platform's core and most encouraged business model. Roblox's CEO even proudly announced in earnings call that over $1 billion had been paid to creators that year.

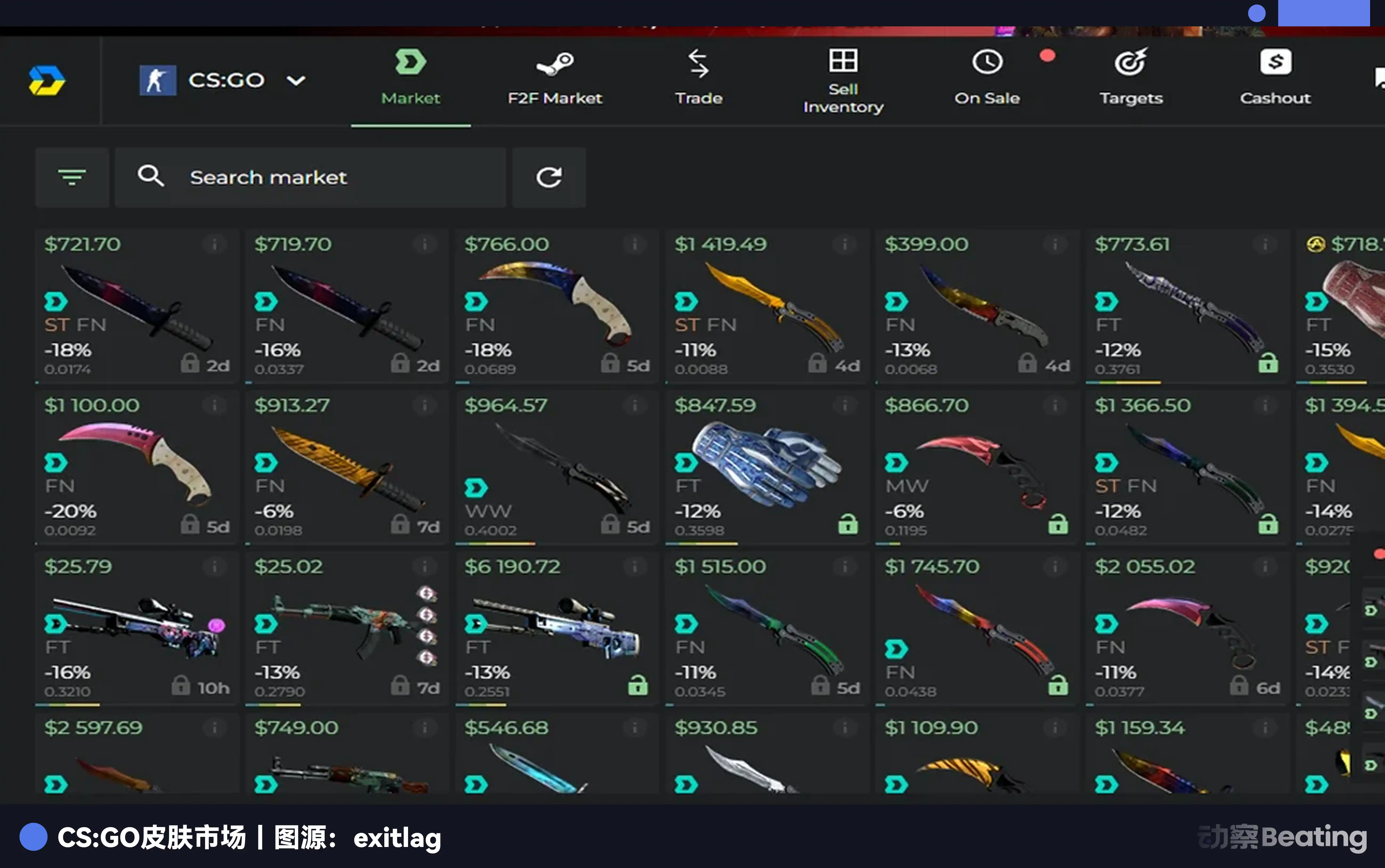

Players’ definitions of assets have also greatly changed with the development of the virtual world and games. In CS:GO, someone was willing to bid $1.5 million for a rare weapon, while the owner of the weapon thought the offer was too low and refused to sell it. The entire CS:GO market is now valued at $5.8 billion, resembling a large independent economy.

Players analyze skin price trends as they would stocks, with manipulations and short-selling as common financial operations. A single game update has caused the entire market's value to evaporate by over $2 billion in a short time, as devastating as a small financial crisis.

While the 70s generation is teaching their children how to save money, the post-00s have already learned trading in CS:GO. This difference is shaping two completely distinct financial worldviews among the generations.

A survey in 2025 showed that among the U.S. Generation Z, 51% own or have owned cryptocurrencies, with 45% desiring cryptocurrency as a Christmas gift. Meanwhile, the percentage of Generation Z with traditional bank accounts has dropped below 50%.

For them, spare change in digital wallets, skins in CS:GO, and Robux in Roblox are not fundamentally different from deposits in bank accounts. They are all digital, usable for payments, trades, and investments.

The lines between virtual and reality have long blurred in their eyes.

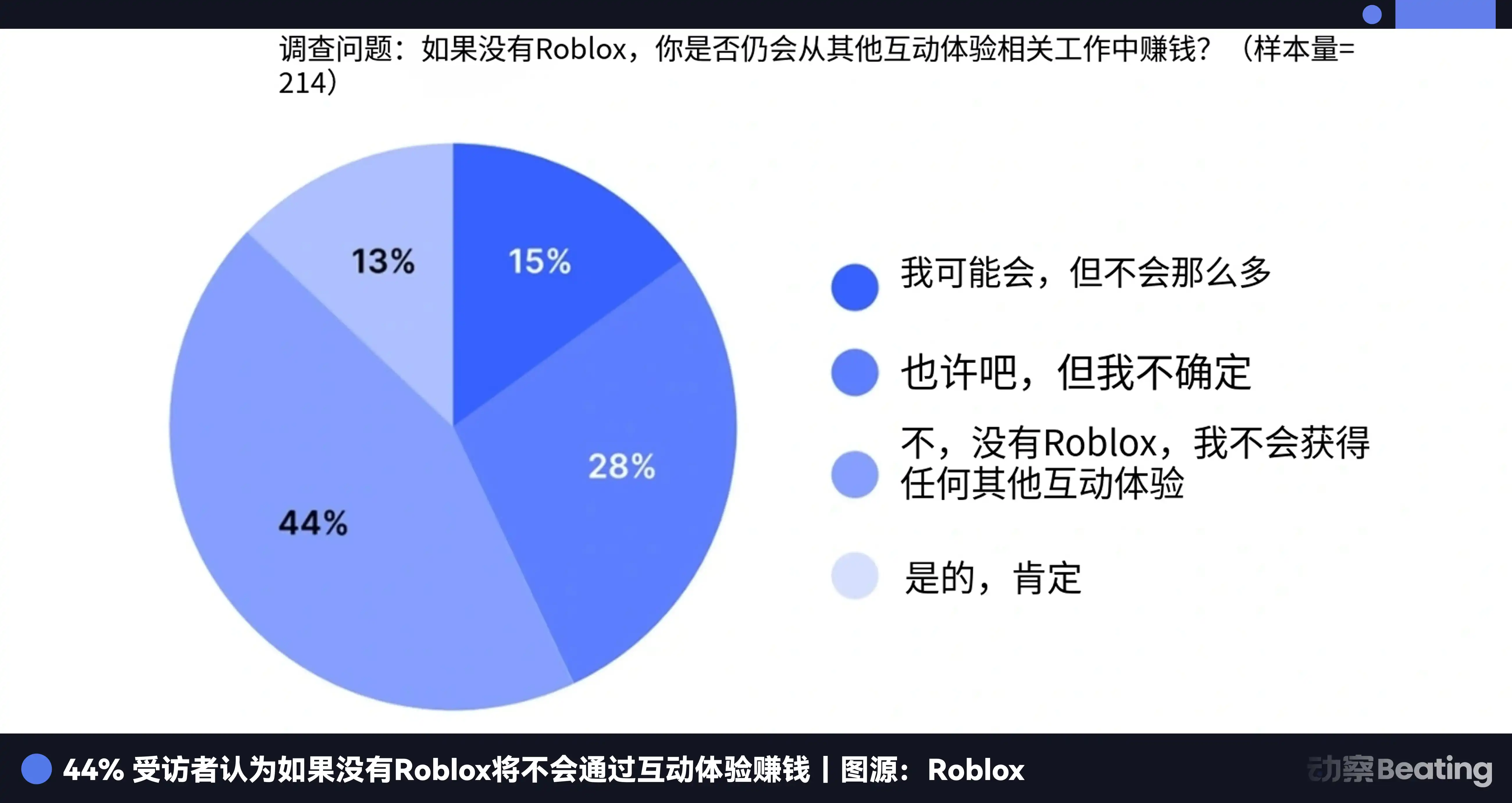

A report released by Roblox at the end of 2025 indicated that as high as 70% of Generation Z users stated that their virtual avatar's attire on the platform directly influences their shopping decisions and style preferences in the real world. The aesthetics of the virtual world are spilling into the real world.

Virtual assets are becoming real because the very definition of "real" has been rewritten by this generation.

Invisible Inertia

Why does each generation’s wealth ultimately heavily invest in the fields they are most familiar with from their youth? It's not a coincidence; behind it lies three unseen hands in covert maneuvers.

The first hand is cognitive lock-in.

Legendary investor Peter Lynch once proposed a famous investment principle: "Invest in what you know." The underlying logic of this principle is that people are naturally inclined to make decisions and investments in areas they are most familiar with because familiarity brings a sense of safety and reduces uncertainty.

For the 70s generation, tangible houses are the most certain asset. For the 80s generation, internet products they use daily are the most reliable investment targets.

For the 00s generation, the time they spend in virtual worlds even exceeds that in the physical world. Those virtual items that can be traded, showcased, and bring social value have authenticity and certainty for them that is no less than a set of real estate in the eyes of their predecessors.

Once this cognitive lock-in rooted in the growth environment takes shape, it is hard to change and will continue to guide their wealth flows for decades.

The second hand is intergenerational transfer of trust.

The trust of the 70s generation is built on the nation and land, where a red "Real Estate Certificate" is the ultimate source of their sense of security. The trust of the 80s generation began to shift towards commercial organizations and legal contracts, where an options agreement printed with a company logo represents a share of the future value of a business organization.

By the time we reach the 00s generation, the cornerstone of trust is transitioning from authoritative institutions to virtual consensus on the internet.

They trust code, algorithms, and the scarcity recognized by millions of players globally. A hash value recorded on a blockchain or a skin in CS:GO with extremely low inventory holds more credibility for them than a product prospectus issued by a bank.

The third hand is the self-fulfilling nature of network effects.

When a generation collectively invests their attention, time, and money into a new emerging field, it forms powerful network effects. The more people participate, the higher the value of that field; the higher the value, the more talent and capital are attracted in, resulting in a positive feedback loop that eventually self-fulfills as the windfall of the next era.

The golden twenty years of real estate and the entrepreneurial wave of the internet both follow this principle. Now, billions of young people are constructing new social networks, economic systems, and cultural identities in the virtual world. This power gathered through collective consensus is laying the strongest foundation for the value of digital assets.

By understanding these three patterns, we can truly grasp why some stock traders still consider Roblox severely undervalued after the metaverse bubble burst. Because in their view, Roblox is no longer a simple game company but rather an entryway to the future wealth world driven by cognitive lock-in, trust transfer, and network effects.

A Mislabelled Company

For a long time, people have used the standards of a game company to measure Roblox, comparing it with traditional gaming giants like Activision Blizzard and EA.

However, using a game company’s yardstick cannot measure the value of a financial infrastructure. The core business model of Roblox is not to produce and sell games, but to provide a complete and closed-loop economic system. In this system, it plays four key roles:

First, it is the creator of the world. It provides the underlying physics engine, development tools, and servers, allowing creators to build their own virtual worlds at low cost, like assembling Lego.

Second, it is the central bank. It issues and manages the only universal currency in this world, Robux. It decides the issuance rate, inflation rate of Robux, and most importantly, the exchange rate of Robux with real-world currency (USD).

Third, it serves as the tax bureau and payment gateway. Every transaction that occurs on the platform, whether it's a user purchasing a virtual item or a developer cashing out Robux, Roblox takes a certain percentage as a fee. It handles billions of microtransactions daily, highly resembling Alipay or WeChat Pay.

Fourth, it is the market regulator. It is responsible for reviewing all content on the platform, combating fraud and illegal activities, and maintaining the stability and fairness of the entire economic system.

These four roles together form a typical platform economy. It does not directly produce goods (games) but profits through rule-making, service provision, and tax collection. This is consistent with the business logic of platforms like Alibaba and Amazon.

From this perspective, Roblox paying creators over $1 billion in 2025 takes on a completely different significance. This is no longer "game company costs" but rather "disposable income for residents" of a vast economy. The economic activities generated by the platform resemble the GDP of a nation.

However, why is such a large economy still continuously losing money? This precisely roots the confusion of the market regarding it and is the core reason for its underestimation.

Roblox's losses are structural and chosen losses. Its revenue-cost structure is entirely different from traditional companies. For every $1 spent, about 49% of the money has already flowed out before Roblox can recognize it as revenue, with 22% paid to app stores like Apple and Google as channel fees, and another 27% directly paid to creators. The remaining amount must also cover costs like servers, research and development, and management.

This model, viewed by short-term profit-seeking investors, is unacceptable. But if we compare it with early Alipay, it becomes much easier to understand.

In its early years, Alipay was also immensely unprofitable because it bore all infrastructure and user education costs, cultivating a generation’s mobile payment habits through substantial subsidies. When everyone became accustomed to using scan-to-pay, and it became an indispensable infrastructure for the entire business community, its trillion-dollar value truly emerged.

Of course, Roblox and Alipay still have essential differences. The former is rooted in entertainment, while the latter addresses payment necessities. But they share a striking similarity in their strategic logic of using losses to cultivate intergenerational habits.

The decline of the metaverse, for Roblox, is rather a good thing. It washes away speculative bubbles, preventing people from confusing it with those hollow concepts, thus allowing an opportunity to see its true value as a financial infrastructure deeply rooted in the daily lives of hundreds of millions of young people, with strong network effects and a closed-loop economy.

The Answers for the Next Decade

Financial education for an era is shifting from the physical world to the digital world.

When a generation's financial enlightenment begins with business practices in a virtual world; when their first asset is a tradable game skin; when their trust in digital wallets surpasses their reliance on physical banks, a brand new economic paradigm has already begun.

How we understand platforms like Roblox today will determine how we understand the business changes of the next decade. When a company's users are simultaneously its consumers, producers, promoters, and investors, do traditional valuation models still hold? When a company's core product is not a good, but a set of economic rules and a circulating currency, how do we define its boundaries?

The answers to these questions cannot be found in today's financial statements. But billions of young people creating, trading, and socializing in the virtual world are gathering to form a powerful force that will reshape the future business landscape.

History has repeatedly proven that understanding what young people define as assets reveals the future flow of wealth.

The wealth code of each generation is inscribed in every new consensus reached by this generation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。