Written by: Liu Honglin, Shao Jiadian

Introduction

In 2025, the Monetary Authority of Singapore (MAS) saw long queues at its "doorstep," with countless crypto projects from Asian digital asset exchanges to North American stablecoin issuers, and global asset management and economic services, all submitting materials to apply for a cryptocurrency "license" in Singapore. Some even jokingly remarked: "If you haven't received MAS approval, you shouldn't even claim to be a compliant project."

In the realm of cryptocurrency, where global regulations are not yet unified, why are crypto projects so eager to obtain a Singapore cryptocurrency license? This article will provide a comprehensive analysis in an easy-to-understand manner of the advantages of the Singapore license, the types of cryptocurrency licenses available in Singapore, the application requirements, and how companies should apply for a Singapore cryptocurrency license.

Why is the Singapore license so popular?

When it comes to Singapore, everyone knows its license has a "high threshold" and "expensive costs," but the consensus is also that "if you really want to grow big, you will eventually need to obtain one."

This precisely indicates that the Singapore license is not an "entry ticket" for everyone, but rather a "special ticket" designed for specific strategies. Choosing Singapore is not because it is cheap or easy, but because after calculating the costs, you find that it can exactly exchange for what you ultimately want: a "legal identity" widely recognized in the global mainstream financial circle—helping you gain trust, access to markets, and long-term survival rights.

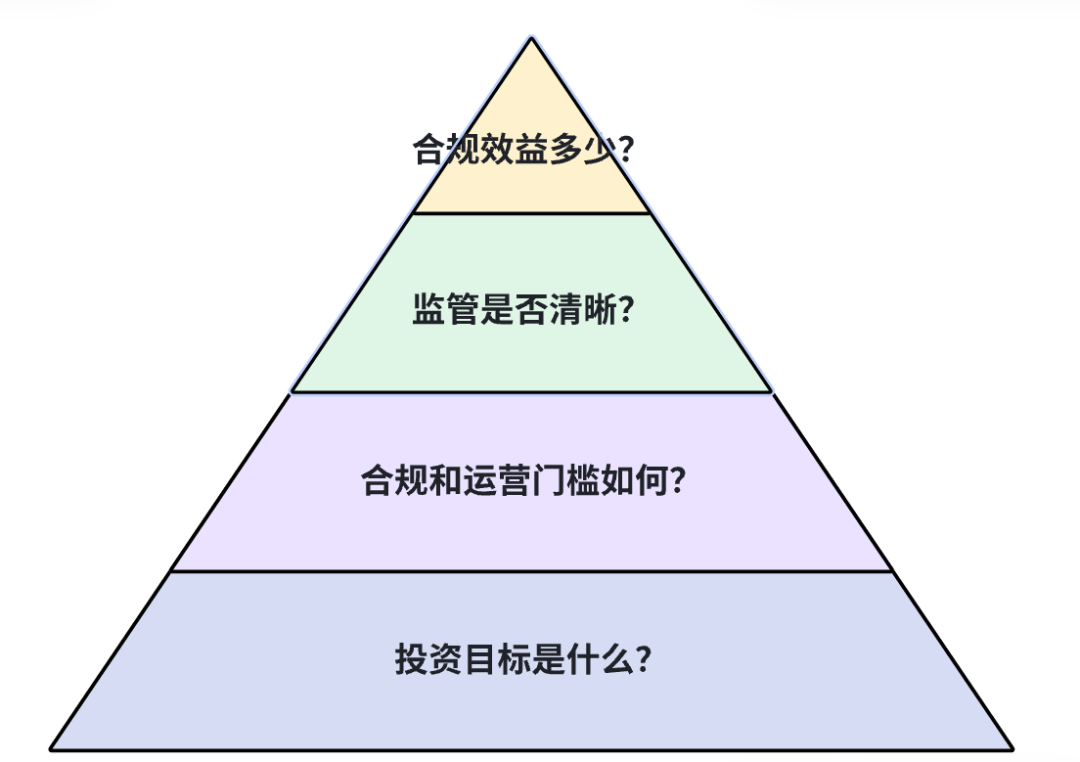

Specifically, Singapore's value is reflected in four dimensions:

- First, it uses "precise strategic positioning" to align with your "investment goals."

If your model serves markets with weak financial infrastructure and extreme price sensitivity, pursuing lightness and flexibility, then Singapore's "heavy equipment" may not be suitable.

However, if you aim for "mainstream acceptance," your goal is to safely attract global institutional funds, allow your issued assets to gain recognition in traditional markets, or establish a compliant headquarters in the high-growth region of Southeast Asia, then the high costs paid for a Singapore license are no longer ordinary expenses, but necessary facilities on the specific track leading to the "mainstream financial world."

- Second, it uses "a mature ecosystem" to match your planning for "operational costs."

The costs in Singapore are systemic, with high requirements leading to high expenditures: from capital, local compliance teams, to legal and audit opinions required from recognized institutions. However, behind this is an efficient ecosystem prepared for the "regular army": from law firms and audit firms proficient in crypto to banks and tax advisors who understand blockchain, the entire industry chain is complete. You pay a premium to acquire a mature solution, without needing to adapt to the market from scratch. More importantly, participants here compete under the same set of established standards, focusing on business and innovation rather than regulatory arbitrage, creating a clearer and fairer environment.

- Third, it uses "regulatory certainty" to address your concerns about "policy future."

In the crypto world, the biggest hidden cost is "uncertainty." Singapore's current regulatory environment features clear compliance requirements coexisting with long-term opportunities for innovation, adopting "categorical management": if the business is related to payments, it clearly falls under the Payment Services Act (PSA); if it has securities attributes, it clearly applies to the Securities and Futures Act (SFA). Moreover, Singapore has long operated a regulatory sandbox mechanism, allowing innovative projects to test business models in a controlled environment. This is akin to having the venue, sidelines, and rules clearly laid out before the game starts; although the referee (MAS) enforces strict penalties, you need not worry about sudden rule changes or the venue being arbitrarily reduced mid-game. This certainty makes long-term technological investment and business planning possible, serving as an important resource for the future.

- Fourth, it uses "trust premium" to fulfill your expectations for "compliance benefits."

The strictness of the Monetary Authority of Singapore (MAS) is world-renowned, but precisely because of this, its license is a highly valuable "global credit passport." In the eyes of traditional financial institutions and large capital, it equates to a "credit endorsement." This means that once you are licensed, when you connect with international banks, mainstream custodians, or seek cooperation with hedge funds and family offices, the doors of their risk control will open more easily for you. Because the most challenging part of the qualification review has already been completed by MAS. This passport is expensive, but it can open many doors that cannot be unlocked merely with funds.

Choosing Singapore is not because it is "the best," but because the "ticket" it provides aligns perfectly with the future you desire.

What types of cryptocurrency licenses are available in Singapore?

The types of licenses in Singapore are categorized by business area, and those related to cryptocurrency business can generally involve the following categories:

Before applying for the corresponding license, we must first identify our business positioning, understand what the company wants to do, what it can do, and what effects it can achieve, so that we have a direction for applying for the license.

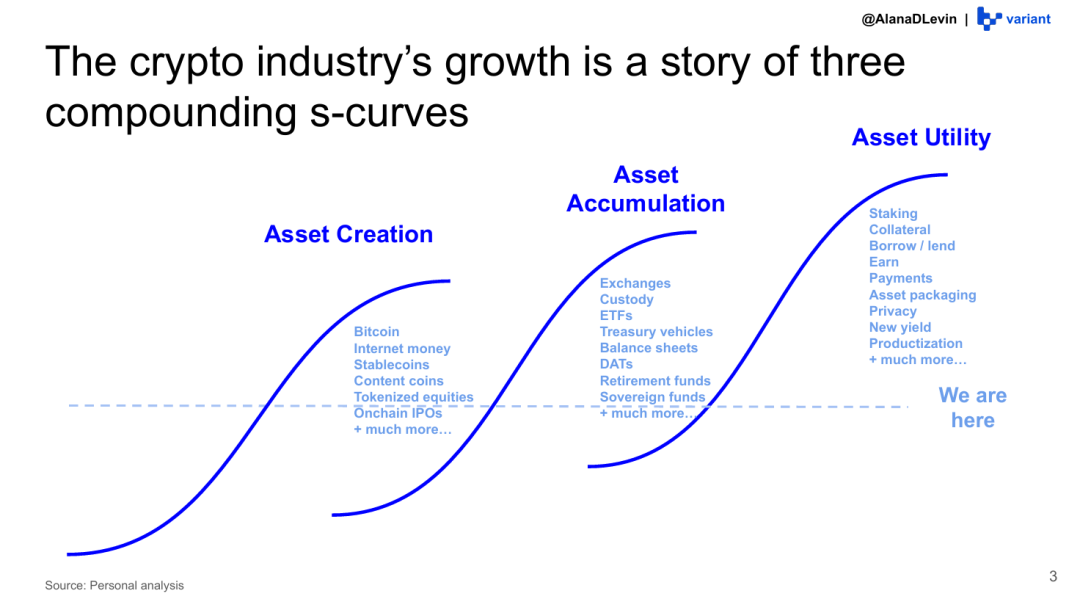

Specifically, the composition and development history of the cryptocurrency industry is not a one-step process, but rather a wave upon wave; the entire industry can be seen as three "S-shaped curves" stacked together, corresponding to: creating assets, accumulating assets, and utilizing assets.

- First curve: From 0 to 1 "Creating tools" (Asset creation)

This phase began with the emergence of Bitcoin in 2009, focusing on inventing new "tools" from nothing. From the initial currency assets to later stablecoins, NFTs, meme coins, and tokenized stocks, the variety of assets has increased significantly. By 2024-2025, this wave of "tool creation" reached its peak, with the number of listed tokens exploding from tens of thousands to millions.

Now, the most disruptive "from 0 to 1" has basically been completed, like a house structure that has been capped. Of course, there is still plenty of room for fine decoration, such as turning credit and more real assets into on-chain tokens, but these are more like optimizations from "1 to N."

- Second curve: Real money "Accumulating wealth" (Asset accumulation)

With tools created, naturally, people want to own and hoard them. The logic is simple: the more there is, the more valuable it becomes, and the more people want to buy and hold it. This demand for "hoarding" has directly supported a wave of businesses: wallets and custodians for asset storage, exchanges for buying and selling assets (established players like Coinbase have seen trading volumes soar, while traditional players like Robinhood have also increased their investments), institutions ensuring asset security, crypto funds/asset management, etc.

More importantly, the nature of the "wealth accumulation" group has changed: from early retail investors and geeks to asset management companies (putting cryptocurrencies into retirement accounts), publicly listed companies (writing Bitcoin and stablecoins into their balance sheets), and even some sovereign wealth funds. The industry has just embarked on the steepest ascent of this curve, and the influx of "regular armies" and "large funds" has only just begun.

- Third curve: Actively utilizing "Money making money" (Asset utilization)

Having accumulated assets, the next step is naturally to use them and generate value. Crypto assets, being composable and programmable, are excellent "financial Legos." There are now stablecoin payments, earning interest through lending protocols, providing liquidity for trading to earn fees, and staking for returns.

However, this third curve has only just begun, with the vast majority of assets still in a "sleeping" state, and there are still too few and too early scenarios for utilization. Therefore, the future fields that can effectively utilize these assets and innovate may represent the largest "blue ocean."

Currently, if we conduct a "financial check-up" of the entire Web3 industry, we will find a reality: there are actually not many truly profitable tracks and businesses, roughly falling into these categories: First, Bitcoin mining. Based on current mainstream mining machines and electricity prices, the production cost of each Bitcoin is about $60,000, while this year the highest price of Bitcoin reached $127,000, and is currently around $90,000; theoretically, this is a profitable business. Second, compliant digital asset trading service providers. They earn transaction fees for every trade, with larger trading volumes leading to higher earnings. Third, compliant funds/asset management. The traditional fund logic is applied here: managing crypto assets for clients and earning through management fees + profit-sharing. Fourth, which has both commercial value and significance for industrial upgrading, is crypto digital asset payments.

Therefore, our interpretation of Singapore's policies can focus on the regulatory and licensing requirements for cryptocurrency issuance, digital asset trading services (including fund/asset management), and crypto payments.

How to apply for these cryptocurrency licenses?

(1) Cryptocurrency Issuance

Applying for a license in Singapore is a complex technical task. For Web3 projects, the first step is not to rush to fill out forms, but to clarify a fundamental question: What exactly is your token?

MAS looks at substance over form; whether your token is a "security" (promising returns) or a "payment tool" (used for exchange) determines which law it falls under, and this is the starting point for all compliance.

Singapore broadly categorizes tokens into four types: security tokens (governed by the Securities and Futures Act SFA), payment tokens (governed by the Payment Services Act PSA), utility tokens, and governance tokens (mainly guided by industry guidelines and self-regulation). In simple terms, it ensures that "securities belong to securities, payments belong to payments," while the rest can explore within a self-regulatory framework. This kind of categorical regulation not only manages risks but also does not stifle innovation.

(1) Issuance of Security Tokens

Specifically, when evaluating whether a cryptocurrency constitutes a security token, MAS examines the entire project like a detective, including the white paper, promotional materials, social media statements, etc., focusing mainly on the following core questions:

1. What rights does the token confer? Does holding the token grant real rights (such as company ownership, profit-sharing rights, voting rights), or is it merely a vague concept of "potential future utility"?

2. What is the fundamental purpose of the issuance? Is it to raise funds and promise returns to investors (e.g., fixed interest, future buybacks), or is it to provide a specific product or service (such as using it to exchange for storage space or game items)?

3. How does the funding operate? Does the project gather participants' funds through a special legal entity similar to a traditional fund (such as an SPV) and manage investments with a professional team, distributing profits to participants accordingly?

4. Where do the returns come from? Are the returns for holders derived from the project's own generated cash flows (such as interest or dividends), or are they entirely dependent on buying low and selling high in the secondary market?

If the answer leans towards investment and returns, then your token is likely to be classified as a security token.

Issuing security tokens in Singapore is essentially a "trust-building" compliance process, with the core focus on proving your credibility to regulators and the market. According to the Securities and Futures Act (SFA), the entire process must follow a clear compliance path, primarily revolving around the following three key steps:

First, choose the issuance path: Different issuance paths determine the foundational compliance framework.

Public or Collective Investment Scheme (CIS) issuance: This is aimed at the public and has the strictest requirements, necessitating the preparation and registration of a prospectus, subject to substantial review by MAS. CIS must comply with the Collective Investment Schemes Regulations to obtain additional MAS authorization.

Private placement (not exceeding 50 people), qualified investors (only for institutional/accredited investors), small issuance (total not exceeding 5 million SGD in December): Typically exempt from registering a prospectus, but the issuer will face resale restrictions.

Second, prepare core documents: Exchange "transparency" for "trustworthiness." Regardless of the chosen path, information disclosure must meet the statutory requirements of "truthfulness, accuracy, and completeness," focusing on:

Clarifying the business model: Replace vague vision descriptions with specific profit models and financial forecasts.

Disclosing all risks: All significant risks, including technical, regulatory, and market liquidity risks, must be thoroughly disclosed without concealment or minimization.

Disclosing key interests: Fully explain the team background, token distribution plan (especially the shares of the team and early investors, lock-up and release conditions), and any conflicts of interest.

Third, leverage professional advisors: The "navigator" of the compliance process.

Due to the complexity of the process, it is advisable to hire a licensed corporate financial advisor in Singapore to ensure the issuance structure is compliant.

(2) Issuance of Payment Tokens

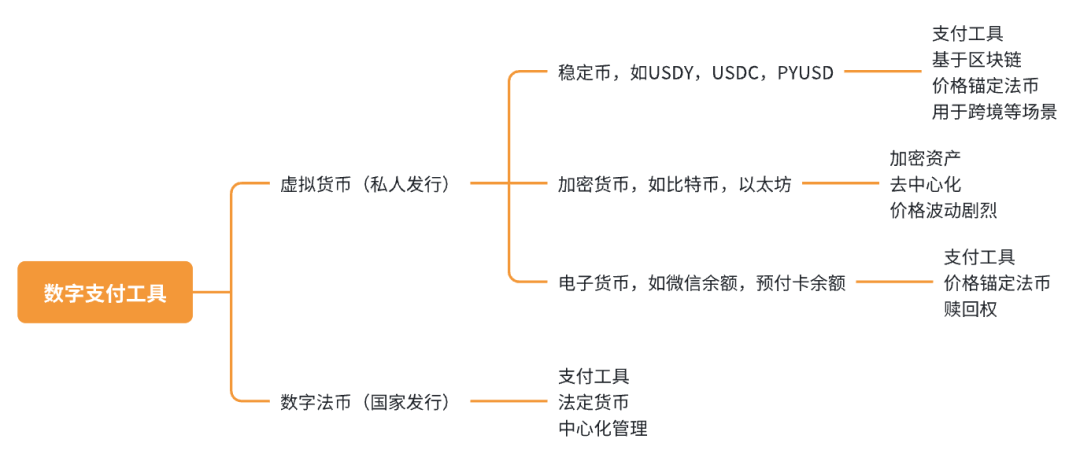

In the traditional economy, currency serves three main functions: unit of account, medium of exchange, and store of value. Currently, there are four types of tools available for payment:

Fiat currency (including digital fiat currency), such as the Singapore dollar, issued by the central bank and possessing legal tender status.

Electronic money, such as balances in Alipay, WeChat Pay, prepaid card balances, etc., typically pegged 1:1 to fiat currency (like the Renminbi), representing stored monetary value in electronic form, with users having redemption rights against the issuer.

Digital Payment Tokens (DPT), such as Bitcoin and Ethereum, which are highly volatile cryptocurrencies that represent a digital value that can be electronically transferred, stored, or traded, and do not necessarily represent a claim against the issuer.

Stablecoins, such as USDT and USDC, are cryptocurrencies pegged to real assets (like fiat currencies, gold, or a basket of assets), designed to maintain a relatively stable price through specific mechanisms. Their core goal is to address the price volatility issues of traditional cryptocurrencies (like Bitcoin), acting as a "safe haven" and efficient payment tool in the crypto economy. For example, a stablecoin pegged to the US dollar (like USDT, USDC, PYUSD) typically has a value equal to 1 US dollar.

The payment cryptocurrencies we will discuss fall into two categories: stablecoins and DPTs. The criteria for identifying stablecoins mainly focus on whether they have a pegging mechanism, while the criteria for DPTs depend on whether they meet the following characteristics:

1. Not priced in or pegged to any fiat currency by the issuer

The fundamental characteristic of DPTs is that their unit of value is independent of any sovereign currency like the US dollar or Singapore dollar. The issuer does not promise or is responsible for maintaining a fixed exchange rate with any fiat currency. This is the "gold standard" that distinguishes them from stablecoins or electronic money.

2. Can serve as (or is intended to serve as) a medium of exchange for the public

This asset is designed to be or is actually widely used as a payment tool for purchasing goods, services, or settling debts. It needs to be accepted as a "universal currency" within a specific community or a broader range. For example, Bitcoin and Ethereum are categorized as DPTs because they are used as means of payment and value transfer.

3. Its value is not supported by the issuer's promise, but generated through trading

The value of DPTs does not have the issuer's promises (such as interest, dividends, or redemption guarantees) as support. Its price is entirely determined by supply and demand in market transactions, reflected in real-time quotes on exchanges. The gains and losses for holders come purely from market buying and selling ("buy low, sell high"), rather than the issuer's credit.

In short, a true DPT has independent value, serves the function of payment, and has a market-driven price.

For Digital Payment Tokens (DPT), MAS's regulatory focus is on the related service activities (such as exchange, custody, transmission, brokerage, etc.), rather than the issuance of the tokens themselves; therefore, when providing specific functions or products, the issuer only needs to ensure that the relevant business complies with the regulatory requirements for DPT services under the PSA.

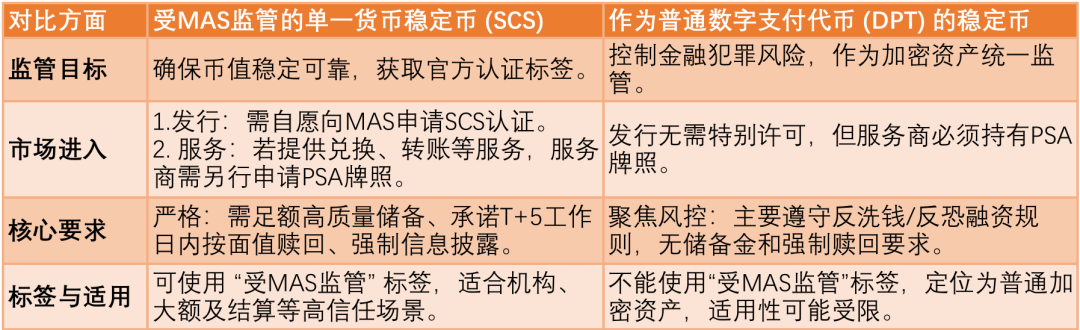

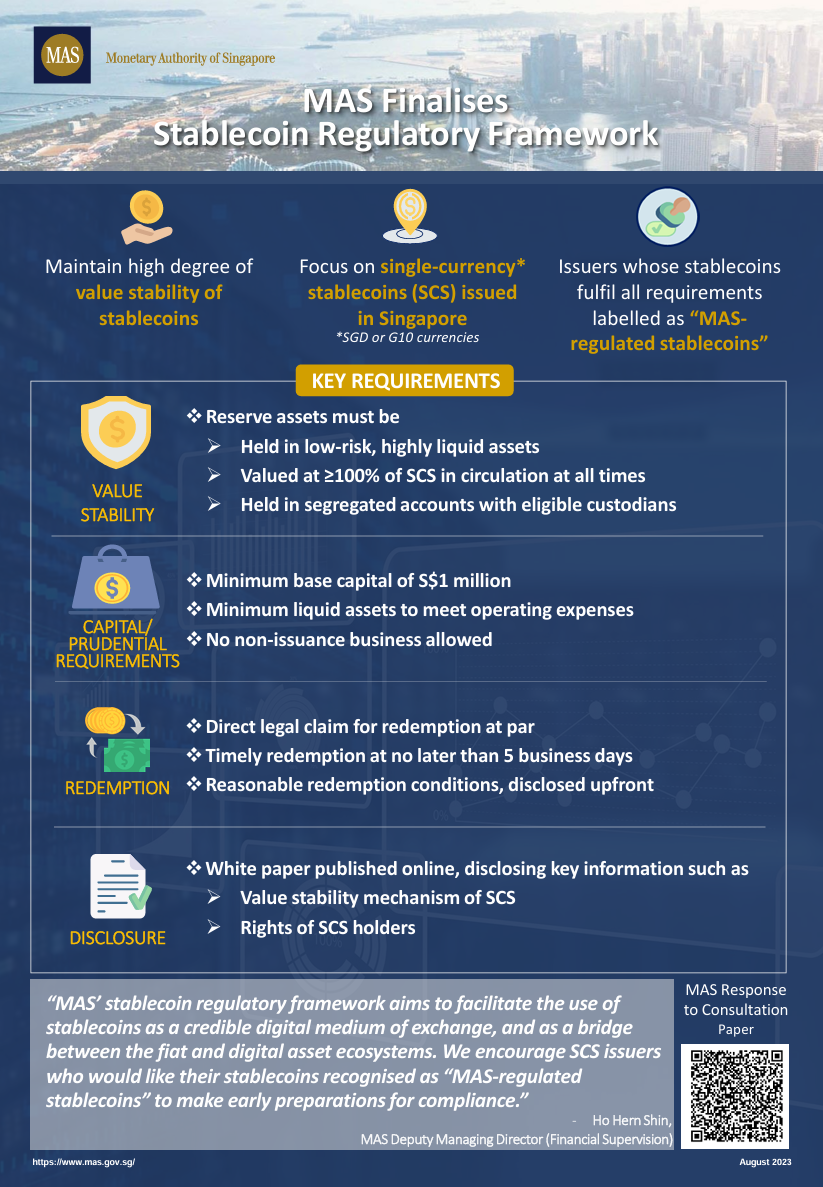

The issuance of stablecoins is primarily regulated by the Payment Services Act (PSA) and the Stablecoin Regulatory Framework, as they possess the lineage of electronic money stability and fiat currency pegging, along with the freedom and programmability of digital payment tokens (DPT). This dual identity also determines that regulation is a "mixed approach." If the issuer wishes to enhance the credibility of stablecoins by accepting stricter regulations and attract institutional and large transaction users, they can voluntarily apply to launch "MAS-regulated stablecoins" (meeting high-quality reserve requirements similar to electronic money issuance, independent custody, redemption guarantees, and information disclosure requirements) to obtain single-currency stablecoin (SCS) certification from MAS; if the issuer

(2) Digital Asset Service Providers (including fund/asset management)

(1) Service Types

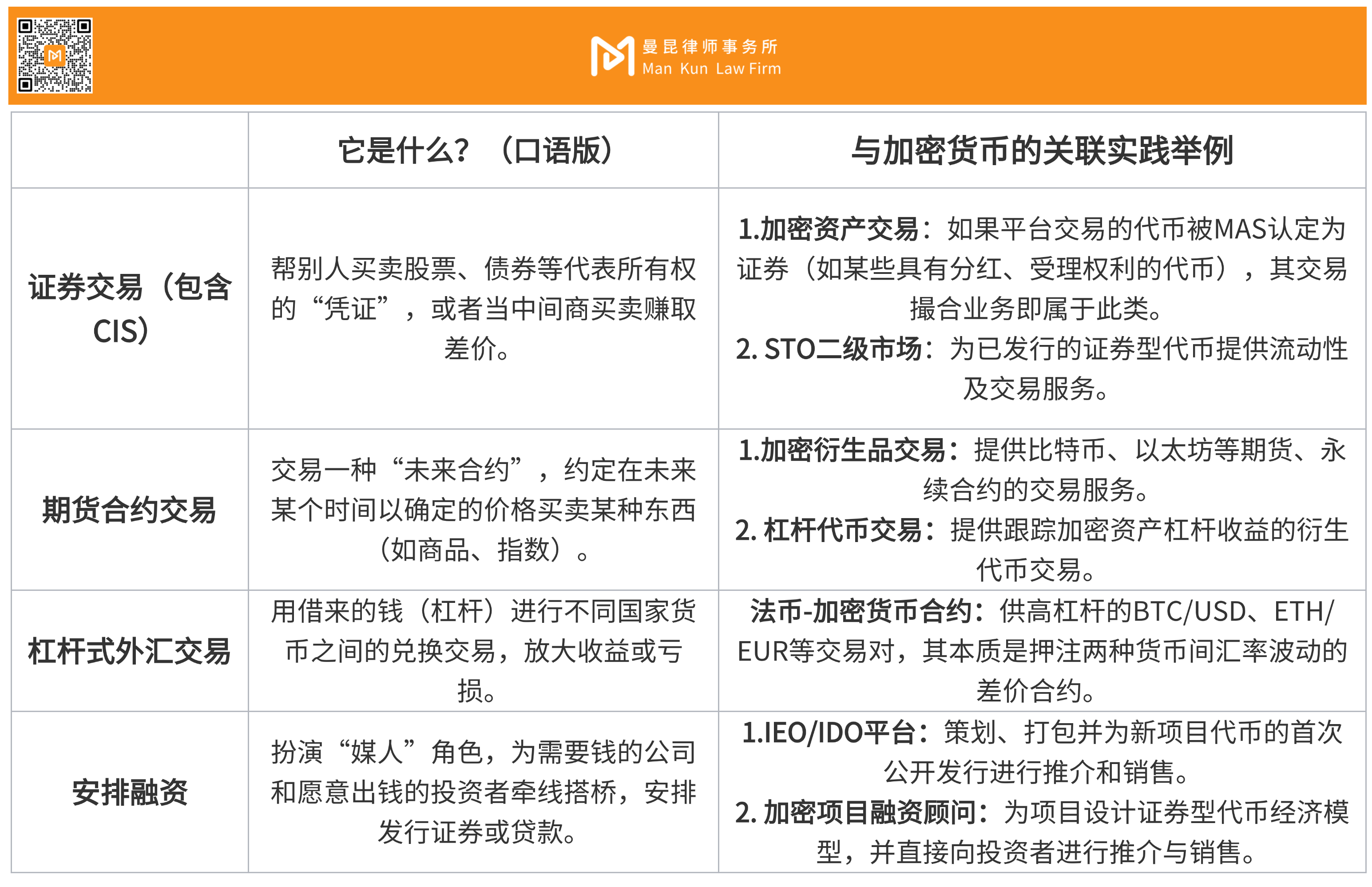

Specifically, the types of digital asset services permitted in Singapore are listed in the Second Schedule of the SFA. To help everyone understand what these "financial activities" are and how they relate to cryptocurrencies, we can categorize these activities into three main types:

- Trading and Financing

The core of these activities is buying, selling, issuing, or facilitating the trading of financial products.

- Custody and Management

The core of these activities is safeguarding assets for others or managing investments for others. As long as you control or manage someone else's financial assets (whether fiat, traditional securities, or crypto assets) and provide services based on that, it falls into this category.

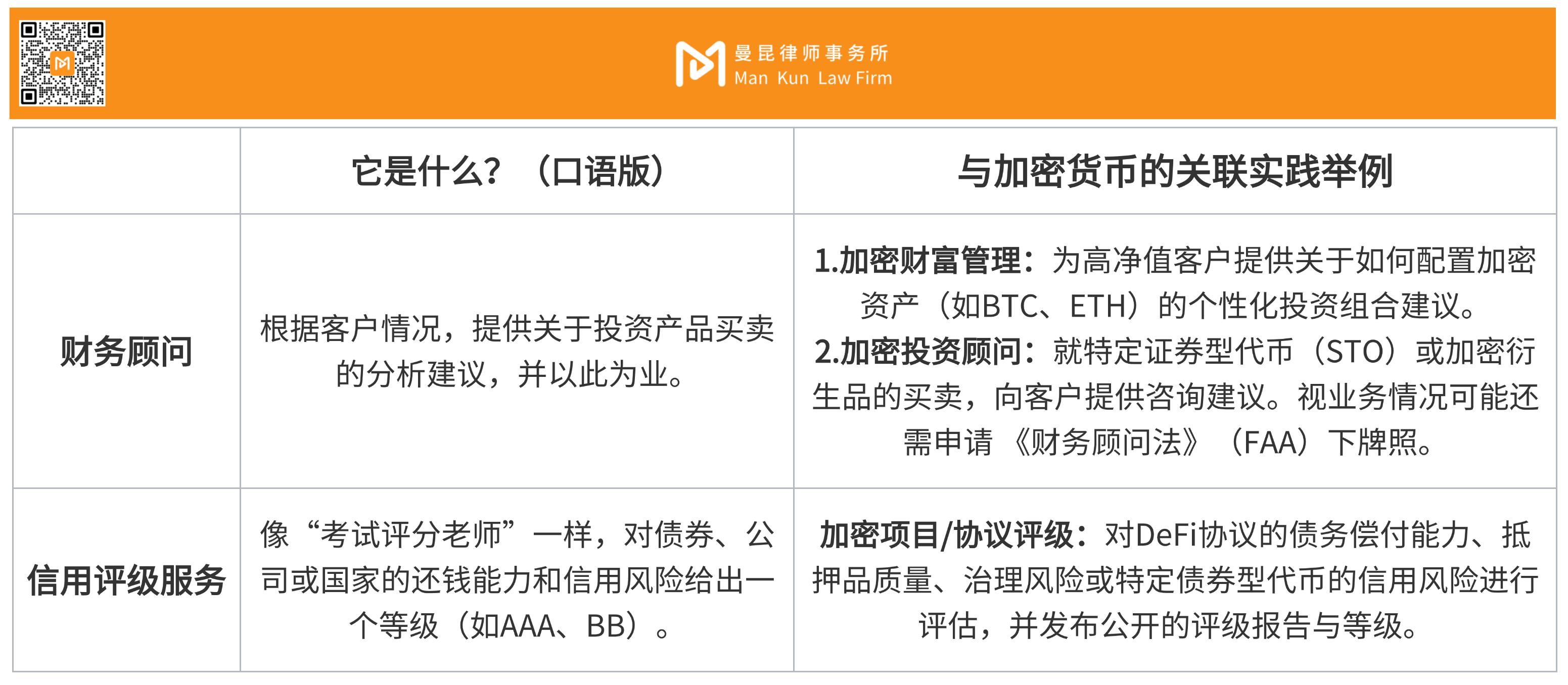

- Advisory and Rating Services

The core of these activities is providing professional advice, assessments, or research to influence investment decisions. If your business does not directly trade or manage assets but instead influences others' investment behavior through professional opinions, analyses, or assessments for profit, it belongs to this category.

(2) Licensing System (CMS License)

According to the SFA, the licensing system for digital asset services in Singapore is centered around "one main license + multiple regulated activities."

The Monetary Authority of Singapore (MAS) only issues one core "main account"—the Capital Markets Services License (CMS License). Any company wishing to operate capital market business in compliance here must first register this "main account."

The real key lies in the "skill package": After obtaining the main account, you can load one or more "regulated activity" licenses based on business needs. For example, a company can simultaneously load both "fund management" and "securities trading" skill packages. However, you need to clearly specify which skills to apply for at the outset, as each skill package has independent and detailed operational rules and requirements that cannot be mixed.

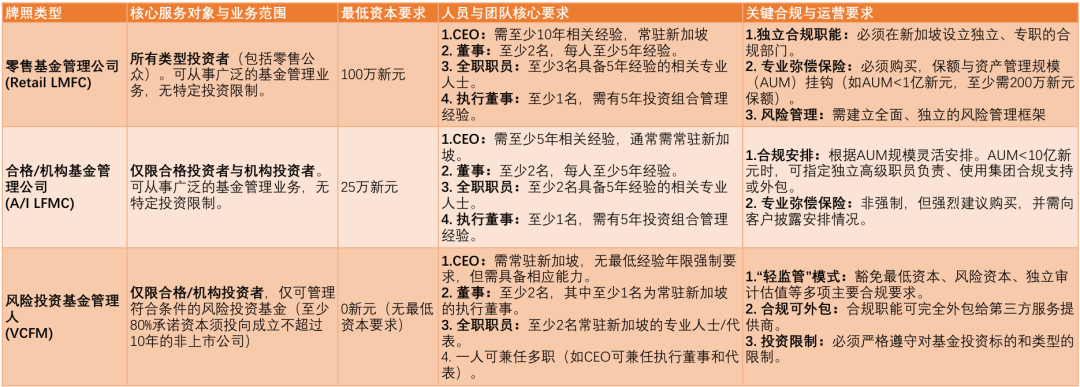

It is worth mentioning that Singapore's fund/asset management business can be further subdivided into three models based on target clients, business scope, and scale: Retail Fund Management Companies (Retail LMFC), Qualified/Institutional Fund Management Companies (A/I LFMC), and Venture Capital Fund Managers (VCFM). Among them, VCFM is a "lightly regulated" system established by MAS to promote early-stage venture capital, with clearly defined business scopes that cannot be expanded to other capital market services.

(3) License Application Requirements

Obtaining a CMS license in Singapore not only involves meeting regulatory requirements but also represents a comprehensive upgrade of corporate governance, risk control capabilities, and professional standards. MAS's review primarily evaluates the following four dimensions:

First, the company entity and foundational qualifications

Qualified legal entity: The applicant must be a compliant entity registered in Singapore, which can be a company, sole proprietorship, or partnership (in specific cases).

Substantive operations to eliminate "shell" companies: MAS explicitly opposes regulatory arbitrage; companies must have a real office, core operational team, and decision-making functions in Singapore, capable of independently executing the applied business.

Good business record and reputation: The company and its major shareholders and directors must have a good reputation, and the core team should possess a certain number of years of work experience in the financial sector.

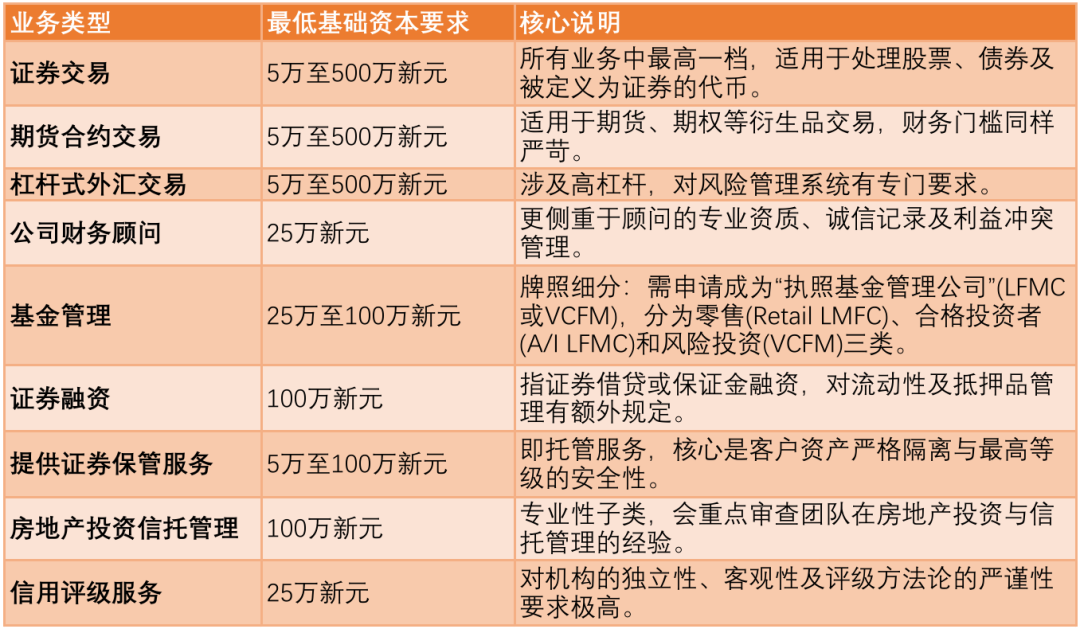

Second, key financial threshold requirements: Financial soundness is a key focus of MAS's evaluation, with significant differences in minimum capital requirements corresponding to different businesses.

Overall, the level of capital requirements directly reflects MAS's judgment of the risk levels associated with various businesses. When planning an application, in addition to meeting capital thresholds, it is essential to pay attention to the unique compliance focuses of each business.

Third, core personnel and team requirements:

Local Core Management Team: The company must appoint at least one executive director residing in Singapore, fully responsible for local business and compliance; the CEO usually must also reside in Singapore and be approved by MAS.

Key Appointed Personnel and Representatives: Each regulated activity must appoint "key appointed personnel" with the appropriate qualifications and experience, and pass the regulatory examinations and filings required by MAS.

Overall Team Competence: MAS will comprehensively assess whether the entire team possesses the integrity and professional capabilities necessary to effectively operate the applied business.

Fourth, Internal Governance, Compliance, and Risk Control System:

Internal Governance and Monitoring System: Establish a clear organizational structure with defined responsibilities to ensure the independence of compliance, audit, and other supervisory functions, and develop standard operating procedures covering all business processes.

Risk Management Framework: Develop a systematic process to establish a structured risk management framework that continuously identifies and manages market, credit, operational, liquidity, and legal risks.

Client Asset Protection: Ensure that client assets are separated from the company's own assets and are securely safeguarded. For businesses involving digital assets, specific measures must be implemented for cold/hot wallet management, private key custody, and multi-signature security solutions.

Anti-Money Laundering/Counter-Terrorism Financing (AML/CFT) System: A comprehensive AML/CFT system must be established, including on-chain transaction analysis tools, customer due diligence (CDD), enhanced due diligence for high-risk areas, ongoing transaction monitoring, and suspicious transaction reporting (STR).

Promotion Restrictions: Unlicensed or exempt institutions are strictly prohibited from actively soliciting or advertising to the public in Singapore. Permitted information disclosure channels are limited to proprietary channels (such as official websites and apps), and the content must primarily focus on risk warnings and education, objectively describing the product without any inducements or statements that could stimulate trading impulses.

(4) License Application Process

Applying for the Capital Markets Services License (CMS Licence) in Singapore is a rigorous and interactive process, typically taking 4 to 12 months. The entire process is not only a review of the company's qualifications but also a comprehensive shaping of its operational compliance.

1. Preliminary Preparation and Planning: Clearly define the business scope, design a compliance structure, assemble a qualified team, and prepare financial resources. Depending on the company's target business type, it must ensure that the paid-up capital and working capital meet the minimum requirements and prepare a detailed financial budget for the coming months to demonstrate the company's ability to sustain operations.

2. Document Preparation: With the assistance of professional advisors, prepare a complete set of application documents, including but not limited to a business plan, financial forecasts, internal policy manuals, personnel resumes, and qualification certificates. Among these, the internal policy manual is the core document of the compliance system, which must independently draft policies for anti-money laundering/counter-terrorism financing (AML/CFT), risk management frameworks, compliance manuals, information security policies, and client asset protection rules.

3. Formal Submission: Submit the application through MAS's online application portal (MASNET) and pay the fees.

4. MAS Review and Interaction: Typically divided into integrity checks (preliminary review) and substantive assessments (detailed review), during which several rounds of inquiries (RFI) are common. Depending on the project, the review generally takes between 4 to 9 months, during which additional materials or clarifications may be requested multiple times. Complex or novel business models (such as those involving crypto assets) may take longer.

5. Final Approval: After passing the review, MAS may issue a principle approval (IPA), which is not a formal license but a conditional pre-approval. Upon meeting all additional conditions, MAS will issue the formal CMS license, allowing the company to commence regulated activities.

(3) Crypto Payments

(1) Service Types

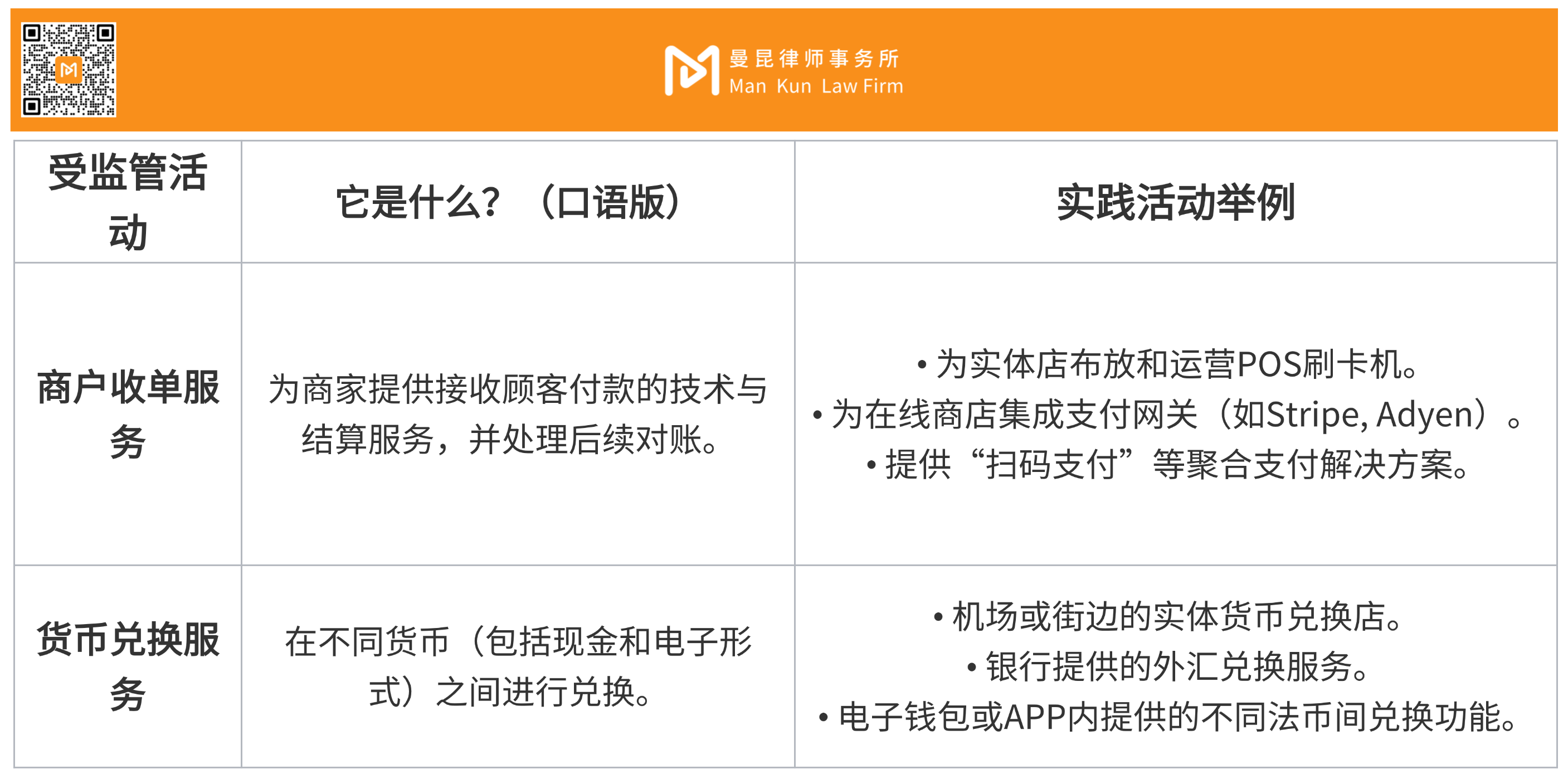

The PSA lists a "Payment Services List" in its First Schedule. If your business in Singapore falls under any item on the list, you need to apply for the corresponding payment institution license based on the scale and type of business. The categories related to cryptocurrency payments can be divided as follows:

- Account and Value Transfer Services

The core of these services is opening and managing payment accounts or facilitating the flow and exchange of value. Whether it involves traditional currency exchange or buying and selling digital assets, as long as it provides channels for value transfer, it falls into this category.

- Merchant and Commercial Payment Services

The core of these services is processing commercial transactions or issuing specific digital value, primarily aimed at merchants and commercial scenarios.

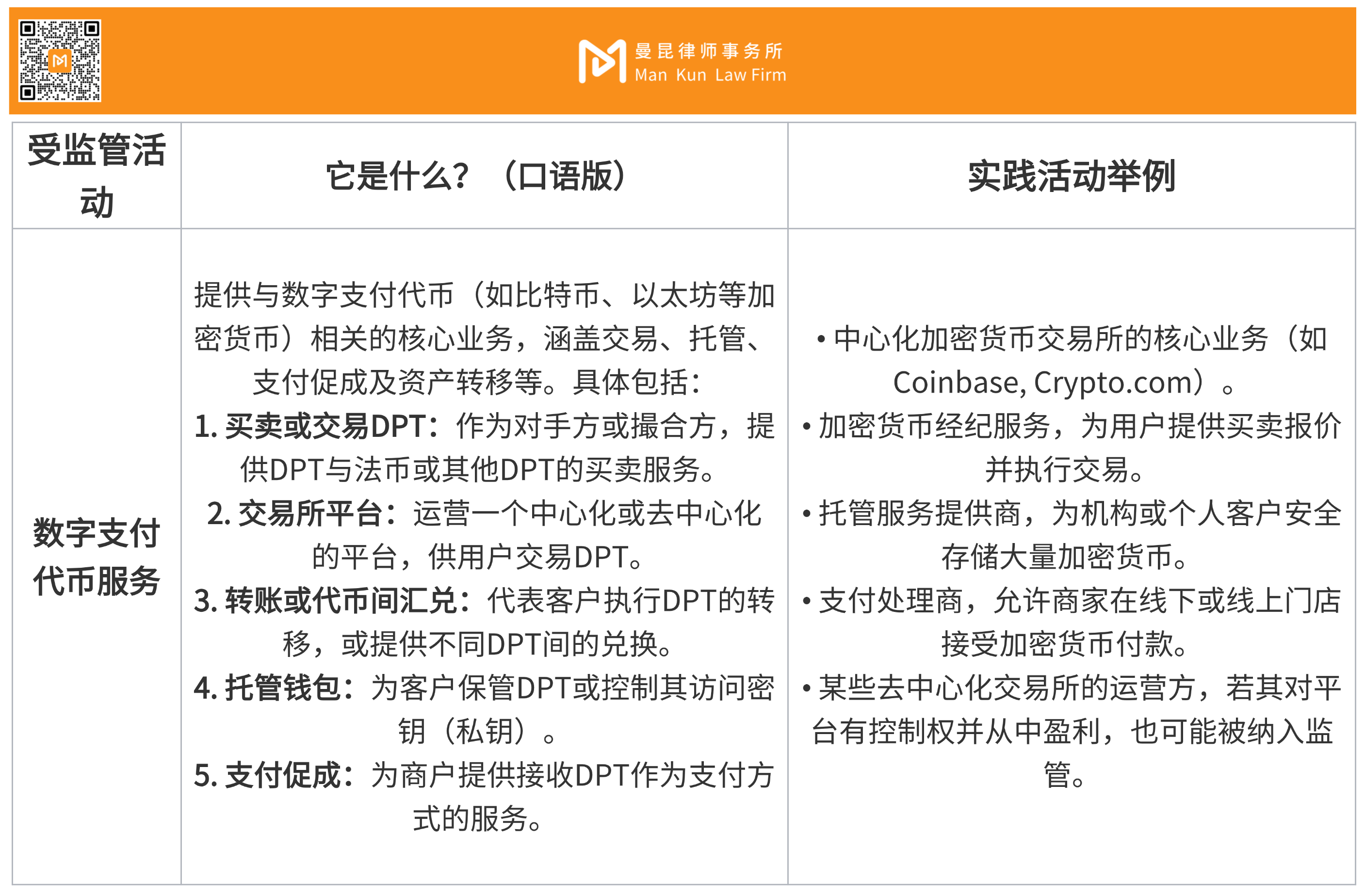

- Digital Payment Token (DPT) Related Services

This is a regulatory category specifically for digital payment tokens (such as Bitcoin, Ethereum, etc.), and is the part most relevant to Web3 projects. Its core involves directly engaging in the buying, selling, or exchange of digital payment tokens or providing related transaction facilitation.

- Stablecoin Payments

In terms of trading, transferring, acquiring, and custody services for stablecoins, since specific regulations for stablecoins have not yet been issued, they are still regarded as a special type of digital payment currency under the "Stablecoin Regulatory Framework" released by Singapore in 2023, and are currently subject to the relevant DPT regulations under the PSA.

(2) Licensing System

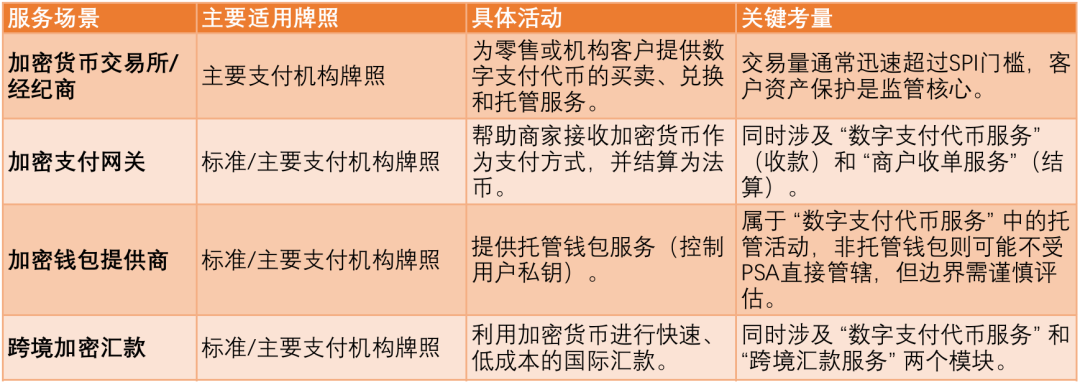

For companies engaged in digital payment token services, Singapore's Payment Services Act (PSA) has established a "one main license, multi-layer business module" regulatory system.

In simple terms, MAS issues a "Payment Institution License," and companies apply for the corresponding tier of license based on their business scale and type, obtaining permission to engage in one or more "regulated payment services" under that license. Similar to the SFA framework, you can layer multiple business modules under a single payment institution license, such as "Digital Payment Token Services" + "Cross-Border Remittance Services." The key is that you need to establish corresponding compliance capabilities for each "business module."

Specifically, the PSA sets three tiers of licenses, forming a clear pyramid structure, with higher tiers having stricter regulatory requirements.

- Currency Exchange License: This is the most basic and narrowly defined license.

Core Business: Engaging only in the exchange of different fiat currencies (e.g., SGD to USD), without involving any form of digital payment tokens or electronic money.

Regulatory Requirements: Relatively minimal, primarily focusing on anti-money laundering and operational compliance.

2. Standard Payment Institution License (SPI): This is a common starting point for small to medium-sized or startup crypto service providers.

Entry Conditions: Engaging in one or more of the following businesses, but with a monthly transaction total not exceeding the statutory threshold. For DPT-related businesses, the monthly transaction volume must be below 3 million SGD.

Core Business: Account issuance, domestic/cross-border remittance, merchant acquiring, digital payment token services, electronic money issuance.

Regulatory Requirements: Must meet core compliance requirements for anti-money laundering, cybersecurity, customer information disclosure, and basic capital requirements.

Major Payment Institution License (MPI): This is the license required by most mainstream cryptocurrency exchanges and large payment platforms.

Entry Conditions: Engaging in the above businesses, with any business module's monthly transaction volume exceeding the statutory threshold. Once triggered, it must upgrade to MPI.

Regulatory Requirements: The strictest requirements, in addition to all SPI requirements, must also meet higher paid-up capital requirements (usually starting at 250,000 SGD), stricter customer fund segregation and custody (such as requiring statutory trust accounts), a more comprehensive risk management framework, and regular independent audit obligations.

In Singapore, companies engaged in cryptocurrency-related services (i.e., "Digital Payment Token Services") primarily involve the latter two types of licenses, with common service scenarios as follows:

License Application Conditions

MAS's license qualification review typically revolves around the following four dimensions.

First, Company Entity and Basic Qualifications: The applicant must be a legitimate entity rooted in Singapore with substantial operations.

Qualified Legal Entity: The applicant must be a compliant entity registered in Singapore, which can be a company, sole proprietorship, or partnership (in specific cases).

Substantive Operations to Eliminate "Shell" Companies: MAS explicitly opposes regulatory arbitrage; companies must have a real office, core operational team, and decision-making functions in Singapore, capable of independently executing the applied business.

Good Business Record and Reputation: The company and its ultimate beneficiaries, directors, and key management personnel must have a good reputation, with no bankruptcy, criminal, or serious violation records.

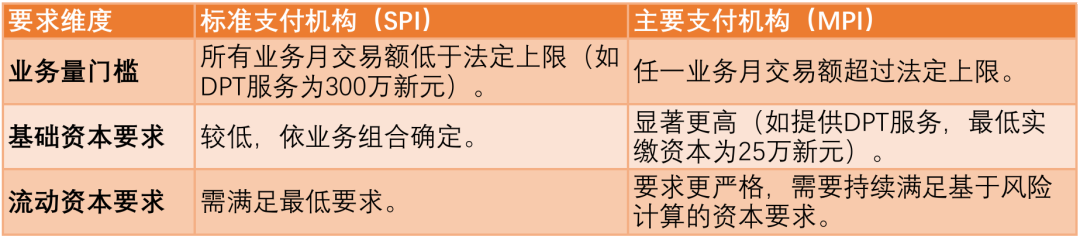

Second, Key Financial Threshold Requirements: In simple terms, the business scale (measured by monthly transaction volume) determines the application category: Standard Payment Institution (SPI) or Major Payment Institution (MPI). MPI, due to its larger scale and higher risk, must meet stricter capital and liquidity requirements, and the enterprise must monitor its transaction volume; exceeding the threshold requires upgrading to MPI.

Third, Core Personnel and Team Requirements:

Local Core Management Team: The company must appoint at least one executive director residing in Singapore, fully responsible for local business and compliance; the CEO usually must also reside in Singapore and be approved by MAS.

Key Appointed Personnel and Representatives: Each regulated activity (such as digital payment token services) must have "key appointed personnel" (such as compliance officers, anti-money laundering officers) who pass MAS-recognized examinations and undergo background checks.

Overall Team Competence: The team as a whole must possess integrity and comprehensive business capabilities, with a composite team that has both blockchain technology and financial compliance experience being more recognized.

Fourth, Internal Governance, Compliance, and Risk Control System:

Internal Governance and Monitoring System: Establish a clear organizational structure with defined responsibilities to ensure the independence of compliance, audit, and other supervisory functions, and develop standard operating procedures covering all business processes.

Risk Management Framework: A risk management system for payments (especially cryptocurrencies) must be established, covering operational risks (such as technical failures, cyberattacks), liquidity, credit, and legal risks, while properly managing unique risks such as price volatility, wallet security, and private key custody.

Client Asset Protection: Ensure that client assets are separated from the company's own assets and are securely safeguarded. Statutory funds must be held in designated bank trust accounts. For businesses involving digital assets, specific measures must be implemented for cold/hot wallet management, private key custody, and multi-signature security solutions.

Anti-Money Laundering/Counter-Terrorism Financing (AML/CFT) System: A comprehensive AML/CFT system must be established, including on-chain transaction analysis tools, customer due diligence (CDD), enhanced due diligence for high-risk areas, ongoing transaction monitoring, and suspicious transaction reporting (STR).

Technical Security and Business Continuity: Reliable technical security and business continuity plans must be in place, including system architecture, cybersecurity protocols, data encryption, and disaster recovery plans, to ensure resilience against attacks and rapid service recovery.

(4) License Application Process

Applying for the Digital Payment Token Service License (DPT Licence) in Singapore is a rigorous and interactive process, typically taking 6 months or longer.

1. Preliminary Preparation and Planning: Clearly define the service types (such as DPT trading, exchange + cross-border remittance services) to determine whether to apply for a Major Payment Institution (MPI) or Standard Payment Institution (SPI) license. Build a compliance structure, assemble a management team with industry experience (at least one Singapore resident as an executive director), and ensure that paid-up capital and ongoing operational funds are in place.

2. Document and Legal Assessment Preparation: With the assistance of professional advisors, prepare a complete set of application documents, including a business plan, organizational structure, internal policies, and qualifications of key personnel. Starting from August 2024, two core legal assessments will be added: a legal opinion issued by a law firm regarding the business being regulated under the Payment Services Act, and an independent assessment report on AML/CFT and consumer protection measures completed by an independent auditor.

3. Formal Submission: Submit the complete application form and all required documents through the online portal designated by MAS.

4. MAS Review and Interaction: MAS will conduct a rigorous review, during which multiple rounds of inquiries (RFI) and requests for additional materials are common. The review period varies depending on the complexity of the business and typically lasts several months. If significant changes occur in the company during the application period, the process may be suspended.

5. Final Approval: After passing the review, MAS may issue a principle approval (IPA) with conditions to be fulfilled. Once the company meets all conditions within the specified time (such as completing a system audit), it can obtain the formal payment license and begin operations.

Conclusion

When we look back at the "long queue" at the entrance of the Monetary Authority of Singapore (MAS), it symbolizes much more than companies vying for a piece of paper; it reflects a profound cognitive shift: industry participants are beginning to realize that in the quest for legitimate identity and mainstream recognition in the crypto world, strict and clear regulation is an indispensable, high-value "public good."

The significance of cryptocurrency licenses has long transcended the baseline of "compliance survival." It is a "standardized trust certificate" issued by regulatory authorities, backed by their credibility, to the market. It paves the way for companies to connect with traditional finance, provides a measurable access benchmark for institutional funds, and ultimately lays the most scarce foundation for the long-term prosperity of the entire ecosystem—systemic trust.

Singapore's practice clearly illustrates that the core function of modern financial regulation is not merely to impose restrictions and constraints, but to reduce the friction and trust costs of the entire market by providing certainty of rules, transparency of processes, and legitimacy of identities as key public services. Choosing Singapore is essentially a proactive decision by companies to access this efficient and stable "trust infrastructure," using current compliance investments to exchange for long-term access rights to the global mainstream financial stage.

Ultimately, this "compliance journey" of global project teams heading to Singapore reveals a fundamental trend: the future of the crypto economy will no longer be defined by "de-regulation," but will emerge from the creative intersection of innovation vitality and financial responsibility, technological freedom and institutional guarantees. Here, clear regulation and cutting-edge innovation are not adversaries, but collaborators in shaping the next era of digital finance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。