Introduction

As the DeFi ecosystem continues to mature, ways to earn on-chain yields are no longer scarce. What truly deters users is not the opportunities themselves, but the barriers to entry. Obscure protocol mechanisms, specialized rules, lack of transparency in funds, and complicated operational processes lead many users, even when aware that their assets could operate more efficiently, to choose to wait and let their funds remain idle for long periods.

To address these pain points, BenPay launched DeFi Earn at the end of September 2025, serving as a unified entry point connecting multi-chain DeFi protocols. Users can easily connect their assets to protocols like Solana, Compound, and AAVE without mastering complex operations, achieving efficient value appreciation. Since its launch, DeFi Earn has received positive market feedback. For instance, as of January 2026, the total assets in the Solana protocol within BenFen holdings reached 10.75M BUSD, while the total network holdings surpassed 20.73M USD, accounting for nearly half of the total network holdings, demonstrating the high usage rate of BenPay DeFi Earn.

To further enhance user experience and cover different risk preferences and liquidity needs, BenPay DeFi Earn has officially added four new earning assets: Morpho USDC, Morpho USDT, Sky USD, Ethena USDe, providing users with more flexible and diverse on-chain value appreciation options.

1. BenPay DeFi Earn's Goal: Creating a Transparent, Simplified, and Diversified Earning Experience for Users

Since its launch, BenPay DeFi Earn has been committed to enhancing user experience by ensuring on-chain transparency, simplifying operations, and providing diversified earning strategies.

- On-chain Transparency and Traceability: Building a Foundation of Trust for Users

The asset operations and sources of income for each earning asset in BenPay DeFi Earn can be verified in real-time on the blockchain. User funds always operate directly within the underlying protocols, with the BenPay platform having zero touch, never privately holding or misappropriating assets. This design is based on the commitment to the BenFen self-custody model: users' private keys are always in their own hands, and the flow of funds is transparent and traceable in real-time.

- Simplified Operations and Optimized User Experience: From Complexity to One-Click

The operational threshold of DeFi is a pain point for many users. Traditional paths may involve multiple steps: cross-chain bridging, protocol interactions, yield reinvestment, etc. BenPay DeFi Earn places these complex processes in the background with one click; users only need to select an asset on the BenPay interface and invest with one click, while the system automatically handles cross-chain transfers, protocol interactions, and yield accumulation, making participation in on-chain earnings more intuitive and user-friendly.

- Diversified Earning Strategies: Matching Multi-dimensional Needs

BenPay DeFi Earn is not limited to a single type but has built a strategy matrix that meets users' different risk preferences, liquidity needs, and ecological preferences:

○ Conservative Type: Compound USDC/USDT earning assets, AAVE USDC/USDT earning assets, with relatively stable returns and high liquidity, suitable for users seeking capital safety and low volatility returns.

○ Growth Type: SOL USD earning assets, based on high-yield protocols in the Solana ecosystem, with potentially higher returns, suitable for users with a stronger risk tolerance seeking growth.

Although Solana, Compound, and AAVE provide users with on-chain earnings, these assets still have certain limitations. For example, while Solana offers high returns, some users have concerns about its risks, and redemptions require a 10-day wait, which may be inconvenient for users with high liquidity needs. While Compound and AAVE provide stable returns, they have not met the demand for higher yields during market fluctuations. To further enhance the product experience, BenPay DeFi Earn has introduced four more diversified assets to enrich user choices.

2. Detailed Explanation of the Four Newly Added Assets in BenPay DeFi Earn: Choices for Stable Returns in DeFi Protocols

The four newly added earning assets in BenPay DeFi Earn are selected from mainstream DeFi protocols that have been operating long-term and widely used within the Ethereum ecosystem. The relevant protocols carry on-chain funds amounting to hundreds of billions of dollars, with transparent mechanisms and publicly available operational records, having formed a relatively stable operational framework through long-term practice. For users, this not only lowers the understanding and participation threshold but also reduces uncertainty caused by immature protocols, making asset operations more secure and predictable.

- Morpho USDC Earning Asset: Institutional-Level Risk Control + On-chain Lending Interest

The Morpho USDC earning asset essentially does something very close to traditional finance: lending funds to borrowers with real needs to earn interest. The difference is that this is done on-chain and completed through Morpho's vault model. Users' USDC no longer enters a mixed large fund pool but is deposited into a lending vault managed by professional institutions, with funds allocated only to borrowers or decentralized protocols that have been whitelisted.

Under this mechanism, the interest paid by borrowers continuously counts towards the vault's assets, gradually increasing the overall size of the vault, thereby enhancing the asset value corresponding to each share of the vault. In the current market environment, this asset has an annualized yield of approximately 4.09%, with performance primarily derived from the relatively stable accumulation of lending interest.

Since funds always operate in a high liquidity on-chain lending market, this asset supports instant investment and redemption, maintaining fund availability while achieving relatively stable yield accumulation. The entire process's lending relationships, fund flows, and sources of income can be verified on-chain, reflecting the operational characteristics of “institutional-level risk control + on-chain transparency.”

- Morpho USDT Earning Asset: Algorithm-Driven Dynamic Lending Returns

The Morpho USDT earning asset is also based on the lending framework of the Morpho protocol, but there are significant differences in yield performance and user experience compared to the Morpho USDC earning asset. For users, the USDC asset leans towards relatively stable yield performance and clear structure, while the USDT asset more directly reflects changes in market supply and demand for funds, with slightly higher yield elasticity.

In terms of specific mechanisms, the Morpho USDT earning asset dynamically adjusts lending parameters through an algorithmic model. All loans are over-collateralized, and the collateral assets are screened by professional risk management institutions like Gauntlet, accepting only assets with sufficient liquidity and clear risk structures, thus allowing interest rates to naturally adjust with market changes while controlling risks.

In this model, users' earnings also come from the real interest paid by borrowers, but the interest rate fluctuates with market demand for USDT funds. Under current conditions, this asset has an annualized yield of approximately 3.55%: when market demand for funds rises, the yield level increases; when demand falls, the yield will correspondingly decrease.

For users, there is no need to understand complex collateral rate calculations or liquidation logic; assets will continuously be lent out and accumulate interest under a secure mechanism, while also supporting instant investment and redemption, making it more suitable for users who wish to maintain fund flexibility while participating in market elastic returns.

- Sky USD Earning Asset: The Closest Form to an “On-chain Savings Account”

Sky (formerly MakerDAO) is an important infrastructure within the stablecoin system. Its earning model does not use user funds solely for investing in a specific type of asset but distributes overall systemic income to participating users according to protocol-level operational mechanisms. The income sources are derived from the returns generated by investing in U.S. Treasury bonds, as well as the interest formed during on-chain lending and stablecoin issuance processes.

After users deposit funds, they receive a cumulative deposit certificate, with the number of certificates remaining unchanged, but the exchange rate with USD will unidirectionally rise over time. At the current stage, this asset has an annualized yield of approximately 4.04%, with overall performance primarily characterized by continuous, low-volatility accumulation.

Since the income comes from unified settlement and distribution at the protocol level, rather than relying on high-frequency operations or complex strategies, users do not need to frequently adjust positions or pay attention to market changes during use, while also supporting instant investment and redemption, making the overall experience closer to a clear-structured, stable operational form of on-chain earnings.

- Ethena USDe Earning Asset: Strategy-Based Value Appreciation Based on Market Structure

The Ethena USDe earning asset does not generate interest by lending funds to others but instead utilizes the operational methods of the crypto market itself to form returns. USDe is a synthetic dollar, primarily operating around mainstream crypto assets like Ethereum (ETH): the system holds these assets on one side while hedging corresponding prices in the futures market on the other, thereby minimizing the impact of price fluctuations and focusing returns on market-generated fees.

In this structure, the system can continuously obtain funding rates from the market, while the underlying held Ethereum assets also generate staking returns. In the current market environment, this asset has an annualized yield of approximately 4.79%, with overall returns more derived from the market structure itself rather than purely from price fluctuations.

Due to the need for orderly adjustments and settlements of related positions in these strategies, fund redemptions typically require a processing period of about 10 days. This arrangement stems from the operational nature of the strategy itself, rather than an additional imposed limitation, making it more suitable for users with lower liquidity requirements who wish to participate in strategy-based earnings.

Overall, these four newly added assets do not pursue short-term high volatility or complex structures but represent several repeatedly validated earning paths within the current DeFi ecosystem: there are on-chain lending models based on real borrowing demand that emphasize institutional-level risk control and liquidity, as well as systematic income distribution formed by protocol operations, and strategy-based solutions that capture rates using market structures. BenPay DeFi Earn aims to integrate these mature mechanisms into a unified entry point, allowing users to choose more suitable on-chain participation methods based on their asset situations without delving deeply into protocol details.

Note: The annualized yield is based on historical performance, and actual returns may vary with market conditions.

3. How to Choose: It's Not About Comparing Yields, But Matching Fund Attributes

After understanding the earning logic of different assets, the truly important question is not "which one yields higher," but rather: which one is more suitable for your fund usage?

Different assets have essential differences in their sources of income, usage scenarios, and asset liquidity: some emphasize liquidity for immediate access, some are more suitable for long-term holding with low-frequency management, and others rely on specific market structures, resulting in inherent differences in redemption rhythms.

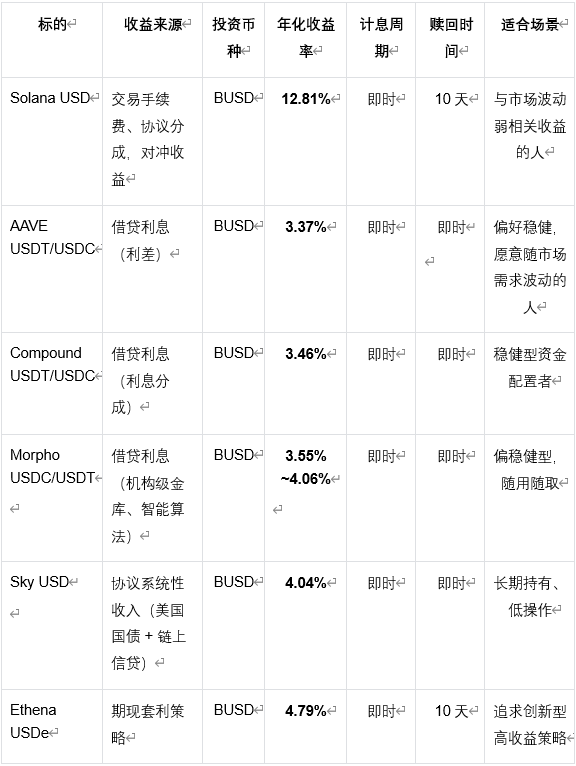

To help users quickly establish a clear understanding of their choices without delving into protocol details, the following will provide an intuitive comparison of the core assets already launched by BenPay DeFi Earn and the newly added earning assets, based on dimensions such as source of income, annualized yield, investment currency, interest calculation period, redemption time, and applicable scenarios.

The annualized yield is based on historical performance, and actual returns may vary with market conditions.

4. Future Evolution Direction: One-Click Access to BenPay's One-Stop On-Chain Financial Experience through DeFi Earn

As on-chain earnings are no longer just a feature used by a few users but gradually enter broader usage scenarios, users' focus has shifted from "whether there are earnings" to "whether it is stable, easy to use, and sustainable." In this trend, BenPay has not attempted to cover all complex DeFi scenarios but has made DeFi Earn the core entry point, allowing on-chain earnings to naturally integrate into daily fund management. The four newly added earning assets are a phased result of BenPay's continuous optimization of user experience and product functionality.

In terms of product design, the addition of new assets reflects BenPay's judgment on the long-term evolution direction of the DeFi Earn product. On one hand, by introducing assets with different earning mechanisms, it reduces reliance on a single earning path; on the other hand, during the asset selection process, greater emphasis is placed on redemption efficiency, clarity of income sources, and overall predictability, thereby continuously enhancing the stability and usability of DeFi Earn while expanding choices.

In terms of user experience, DeFi Earn still adheres to the simplification priority product principle. Users do not need to understand the differences in underlying protocols; they can complete investments, redemptions, and earnings viewing through a unified entry point. The complex protocol choices and risk structures are integrated and presented by the product backend, making on-chain earnings a method of asset allocation that can be used daily, rather than an exclusive tool for professional users.

Moreover, DeFi Earn is no longer an isolated earning module but an important starting point in BenPay's full-stack product system. Centered around the core needs of "earning, circulation, and security," BenPay is integrating on-chain earning capabilities with payment, trading, and liquidity tools: BenPay On-Chain Earning Card allows account balances to continuously participate in on-chain earnings during daily consumption; BenPay DEX provides efficient, low-fee decentralized trading support; BenPay Lending releases fund liquidity through decentralized collateralized lending; additionally, leveraging BenFen's on-chain privacy payment capabilities, BenPay further enhances security and privacy protection during fund circulation.

If DeFi Earn is the entry point for users into BenPay, then BenPay is connecting on-chain earnings, asset circulation, and daily use through this continuously evolving and mutually collaborative product system, gradually building a more stable, user-friendly, and closer to daily needs one-stop on-chain financial experience.

Conclusion

With the addition of the four earning assets: Morpho USDC, Morpho USDT, Sky USD, and Ethena USDe, BenPay DeFi Earn has further enriched users' on-chain value appreciation options. As the DeFi ecosystem moves towards institutionalization and sustainable earnings, BenPay adheres to the principles of non-custodial, one-click operation, and on-chain transparency, providing users with a low-threshold, high-efficiency unified entry point.

Whether for conservative users seeking immediate liquidity and capital safety or for aggressive players willing to embrace market structure innovations in pursuit of potentially higher returns, these four newly added assets can precisely meet different user needs, allowing idle funds to quietly appreciate without requiring complex operations.

In the future, BenPay DeFi Earn will continue to follow the trend, integrate more leading protocols, further refine products, enhance user experience, and help users easily seize on-chain opportunities.

Friendly Reminder

Although the above protocols have undergone multiple rounds of audits and have been operating long-term in practical applications, all on-chain protocols still carry risks of smart contracts, market volatility, and uncertainties in mechanism adjustments.

BenPay provides protocol access and operational integration services and does not guarantee the results of protocol operations. Users should make reasonable independent judgments based on their own situations.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。