Author: Lawyer Liu Zhengyao

Introduction

In December last year, the Shanghai Second Intermediate People's Court published an article titled "Legal Uniformity in Cases Involving Virtual Currency Crimes," which mentioned issues related to the judicial identification of money laundering crimes and illegal business operations in criminal cases involving virtual currencies. Lawyer Liu wrote two articles titled "How to Identify 'Subjective Knowledge' in Virtual Currency Money Laundering Crimes? The Shanghai Court Provides a 'Standard Answer'" and "Does the Shanghai Court Support Virtual Currency? Don't Be Misled, This Is Actually the Latest Conviction Warning for Money Laundering Crimes!" analyzing and interpreting these issues.

Today, we will conduct an interpretation of the third and final article: what are the specific judicial standards for identifying illegal business operations involving virtual currency in practice?

1. Two Cases: From 'Arbitrage' to 'Cross-Border Matching'

To clarify the boundaries, the court selected two representative typical cases to demonstrate how subtle differences in behavior patterns can lead to entirely different classifications.

(1) Li's 'Arbitrage' Case

Li discovered price differences between virtual currencies domestically and abroad. He bought U coins at a low price through domestic accounts and then sold them at a high price through overseas accounts to exchange for US dollars; or he operated in reverse, achieving 'arbitrage' through low buying and high selling. Over several years, Li made a profit of up to 10 million yuan.

(2) Hu's 'Overseas Currency Exchange' Case

While operating a virtual currency business in the United States, Hu found that Chinese clients had a demand for exchanging yuan for US dollars, while American clients needed to exchange US dollars for yuan. Thus, he played the role of an 'intermediary':

For Chinese clients: They exchanged yuan for U coins to Hu, who then transferred US dollars to their designated overseas accounts;

For American clients: They exchanged US dollars for U coins to Hu, who then transferred yuan to their designated domestic accounts. Hu earned over 3 million yuan in fees through this method.

2. Standards for Identifying Illegal Business Operations Involving Virtual Currency

Regarding the legal evaluation of the actions of Li and Hu, some believe both constitute illegal business operations, while others believe only Hu constitutes illegal business operations.

In response to the above controversy, the Shanghai Second Intermediate People's Court proposed three key identification dimensions to distinguish between 'legal personal holding' and 'illegal business activities.'

(1) The 'Regularity' and 'Profitability' of Business Activities

The essence of illegal business operations is engaging in business activities without permission, specifically characterized by the following:

Regularity. Refers to the continuity and repetitiveness of the behavior. Occasional one-time exchanges are generally not considered business activities.

Profitability. Refers to the primary purpose of obtaining economic benefits.

Core distinction point. The court clearly distinguishes between non-business behaviors such as personal holding and trading of currencies, and business behaviors such as OTC trading, market-making, information intermediation, and token issuance financing.

(2) 'Substantial Harm' to Financial Order

Illegal business operations are administrative offenses that must violate national regulations and disrupt the order of the financial market.

Deceptive foreign exchange trading: If the actor uses virtual currency as a medium to bypass national foreign exchange regulations and provides currency exchange services for others, it essentially completes the cross-border transfer of funds.

Determination formula: 'Domestic currency - virtual currency - foreign currency.' As long as the characteristics of earning fees or exchange rate differences are present, conducting such transactions outside the locations specified by the state constitutes 'deceptive foreign exchange trading.'

(3) Subjective Awareness and Identification of Accomplices

In complex transactions with multiple layers, how to identify 'accomplices' (i.e., 'aiders' in criminal law)? This mainly considers two factors: first, the 'knowledge principle.' If the actor is aware that others are illegally buying and selling foreign exchange and still provides assistance through virtual currency transactions to facilitate the conversion of yuan and foreign currency, they will be treated as an 'accomplice' in illegal business operations; second, it is necessary to consider the overlap between illegal business operations and money laundering: if the same behavior meets the criteria for money laundering, it will be convicted and punished according to the more serious charge.

3. Court's Inclined Opinion: Who Constitutes a Crime?

In summary, the court ultimately concluded: "Li's behavior does not exhibit characteristics of business activities and is merely personal holding and trading of currencies, thus generally not recognized as illegal business operations"; "Hu's behavior exhibits characteristics of regularity and profitability, and he was aware that others intended to achieve mutual exchange between yuan and US dollars outside the state-specified trading venues, yet he still provided 'domestic currency - virtual currency - foreign currency' exchange and payment services, which constitutes deceptive foreign exchange trading."

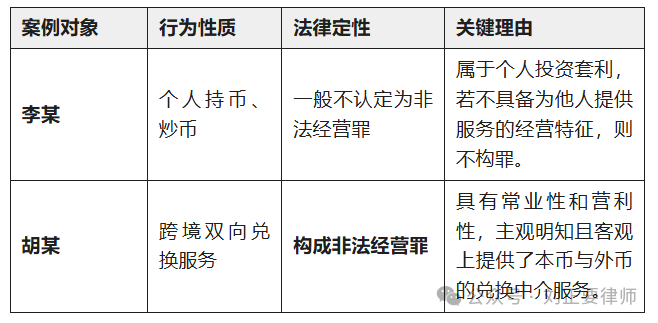

Based on the above standards, we can have a more intuitive understanding through the following table:

4. Conclusion

Lawyer Liu personally agrees with the views of the Shanghai Second Intermediate People's Court, and this 'standard answer' sends a clear signal: Cross-border exchanges of virtual currencies outside regulatory oversight easily touch the 'illegal business' red line.

Virtual currency is no longer a 'safe haven' outside the law. Legal identification not only considers whether the transaction form is 'digital code' but also examines whether the essence of the transaction bypasses national foreign exchange management. For practitioners or investors, understanding the boundary between 'personal arbitrage' and 'deceptive illegal currency exchange' is a necessary course to avoid criminal risks.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。