Original | Odaily Planet Daily Ethan

As the year comes to a close, the question of who will hold the "master key" to global liquidity—the Federal Reserve Chair—has become the most anticipated suspense of the year.

Months ago, when the benchmark interest rate ended its long pause with its first cut, the market was once certain that Christopher Waller was the chosen one _ (Recommended reading “The Academic's Counterattack: Small Town Professor Waller Becomes the Most Popular Candidate for Federal Reserve Chair”_). In October, the winds shifted dramatically, and Kevin Hassett surged ahead, with odds approaching 85%. He was seen as "the White House's mouthpiece; if he takes office, policies may completely follow Trump's will," even being humorously dubbed "the human printing press."

However, today we will not discuss the "top candidate" with the highest odds, but rather focus on the "second in line" with the most variables—Kevin Warsh.

If Hassett represents the market's "greed expectation" (lower interest rates, more liquidity), then Warsh represents the market's "fear and reverence" (tighter monetary policy, stricter rules). Why is the market reassessing this outsider, once hailed as "Wall Street's golden boy"? If he truly takes the helm of the Federal Reserve, what monumental changes will occur in the underlying logic of the crypto market? _ (Odaily Note: The core viewpoints of this article are based on Warsh's recent speeches and interviews.)_

Warsh's Evolution: From Wall Street Golden Boy to Federal Reserve Outsider

Kevin Warsh does not hold a PhD in macroeconomics, and his career began not in academia but in Morgan Stanley's mergers and acquisitions department. This experience gave him a mindset completely different from that of Bernanke or Yellen: in the eyes of academics, a crisis is merely a data anomaly in a model; but for Warsh, a crisis is the moment a counterparty defaults, the life-and-death moment when liquidity shifts from "available" to "non-existent."

In 2006, when 35-year-old Warsh was appointed as a Federal Reserve Governor, many questioned his qualifications. But history has a sense of humor; it was precisely this "Wall Street insider's" practical experience that made him an indispensable figure in the subsequent financial storm. During the darkest moments of 2008, Warsh's role transcended that of a regulator; he became the only "translator" between the Federal Reserve and Wall Street.

A clip of Warsh participating in an interview at Stanford University's Hoover Institution

On one hand, he had to translate the toxic assets of Bear Stearns, which became worthless overnight, into a language that academic officials could understand; on the other hand, he had to convey the Federal Reserve's obscure intentions to the panicked market. He experienced the frantic negotiations of the weekend before Lehman's collapse, and this close-quarters combat gave him a physiological sensitivity to "liquidity." He saw through the essence of quantitative easing (QE): central banks do need to act as "lenders of last resort" during a crisis, but this is essentially a transaction that overdraws future credit to buy time for survival in the present. He even pointed out sharply that the long-term blood transfusion after a crisis is actually "reverse Robin Hood," artificially inflating asset prices to rob the poor and benefit the rich, which not only distorts market signals but also sows the seeds for greater risks.

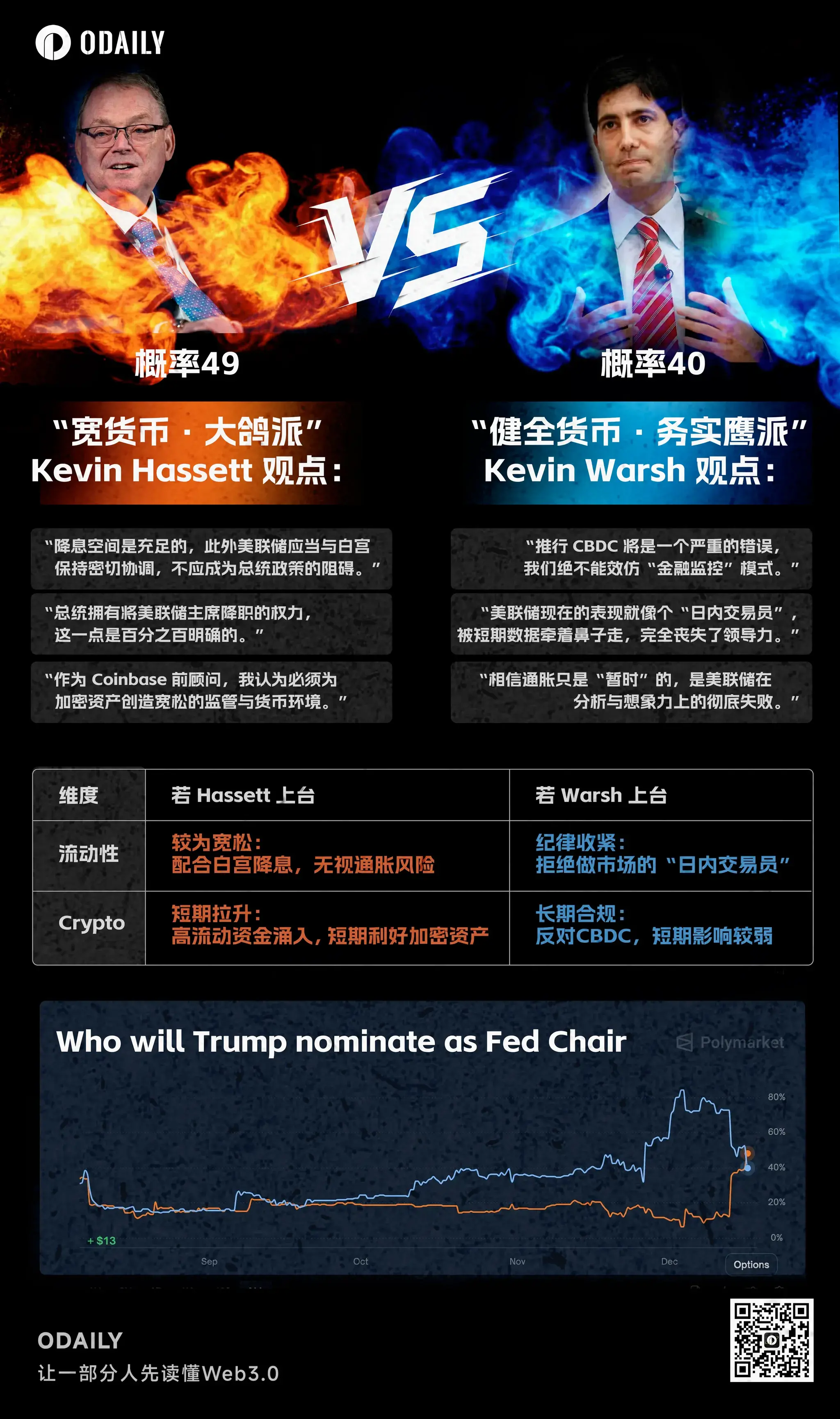

It is this keen sense of systemic fragility that became his core bargaining chip when Trump was selecting candidates for the next Federal Reserve Chair. On Trump's list, Warsh stood in stark contrast to another popular candidate, Kevin Hassett, and this contest was humorously dubbed the "Battle of the Two Kevins" by the media.

Federal Reserve Chair candidates: Hassett vs. Warsh, image source Odaily original

Hassett is a typical "growth-first" advocate, with a simple and direct logic: as long as the economy is growing, low interest rates are reasonable. The market generally believes that if Hassett takes office, he will likely cater to Trump's desire for low interest rates, even starting to cut rates before inflation is fully under control. This also explains why whenever Hassett's odds rise, long-term bond yields soar, as the market fears uncontrollable inflation.

In contrast, Warsh's logic is much more complex; it is difficult to simply define him as "hawkish" or "dovish." While he also advocates for rate cuts, his reasoning is entirely different. Warsh believes that the current inflationary pressures are not due to excessive consumer spending, but rather because of supply constraints and excessive monetary expansion over the past decade. The Federal Reserve's bloated balance sheet is actually "crowding out" private credit, distorting capital allocation.

Thus, the prescription Warsh offers is a highly experimental combination: aggressive balance sheet reduction (QT) coupled with moderate rate cuts. His intention is clear: to control inflation expectations by reducing the money supply and restore the purchasing power credibility of the dollar, essentially tightening liquidity; while simultaneously lowering nominal interest rates to ease the financing costs for businesses. This is a hardcore attempt to restart the economy without flooding it with liquidity.

The Butterfly Effect on the Crypto Market: Liquidity, Regulation, and Hawkish Undertones

If Powell is like a cautious "gentle stepfather" in the crypto market, not wanting to wake the child, then Warsh is more like a strict "boarding school headmaster" wielding a ruler. The storm triggered by this butterfly flapping its wings may be more intense than we anticipate.

This "strictness" is first reflected in his obsession with liquidity. The crypto market, especially Bitcoin, has, to some extent, been a derivative of the global dollar glut over the past decade. Warsh's policy core is a "strategic reset," returning to the sound monetary principles of the Volcker era. His previously mentioned "aggressive balance sheet reduction" is both a short-term nightmare and a long-term litmus test for Bitcoin.

Warsh has explicitly stated: "If we want to lower interest rates, we must first stop the printing press." This means the disappearance of the safety net for risk assets accustomed to the "Federal Reserve put." If he firmly implements his "strategic reset" after taking office, leading monetary policy back to more robust principles, the tightening of global liquidity will be the first domino to fall. As a "frontier risk asset" highly sensitive to liquidity, the cryptocurrency market will undoubtedly face pressure for valuation reassessment in the short term.

Kevin Warsh discussed Federal Reserve Chair Jerome Powell's interest rate strategy on the "Kudlow" show, source Fox Business

More importantly, if he truly achieves "non-inflationary growth" through supply-side reforms, keeping real yields positive in the long term, then holding fiat currency and government bonds will become profitable. This is in stark contrast to the negative interest rate era of 2020, where "everything rose, except cash was trash," and Bitcoin's appeal as a "zero-yield asset" may face severe challenges.

But there are always two sides to every story. Warsh is an extremely firm believer in "market discipline," and he would never rush to rescue the market like Powell does when it drops 10%. This "bottomless" market environment may instead give Bitcoin an opportunity to prove its worth: when the traditional financial system experiences credit cracks due to deleveraging (as seen in the Silicon Valley Bank crisis), can Bitcoin detach itself from the gravitational pull of the stock market and truly become a Noah's Ark for safe-haven funds? This is the ultimate exam Warsh has set for the crypto market.

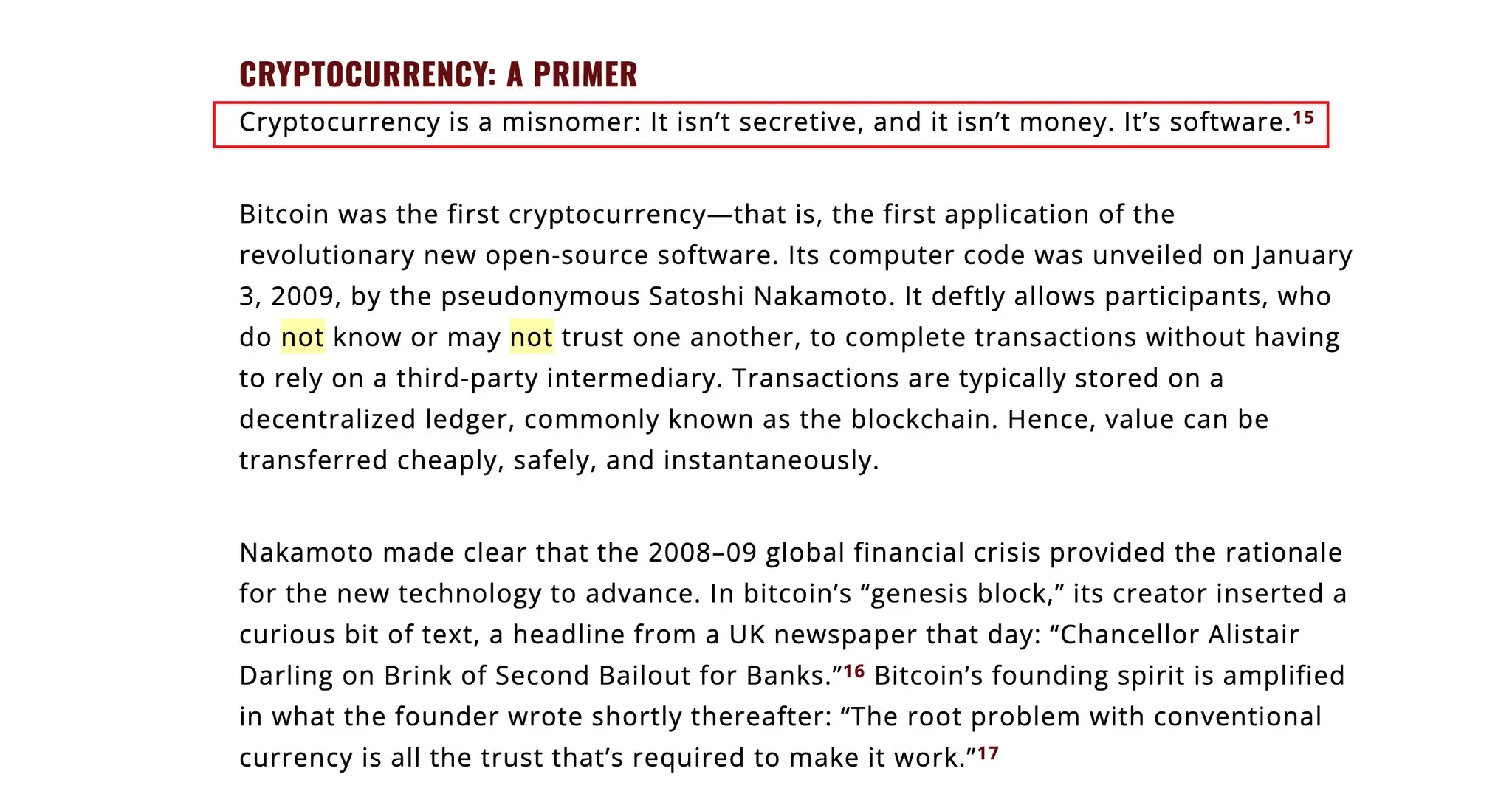

Behind this exam lies Warsh's unique definition of cryptocurrency. He once left a famous quote in The Wall Street Journal: "Cryptocurrency is a misnomer. It is not mysterious, nor is it money. It is software."

A segment from Kevin Warsh's column article “Money Matters: The U.S. Dollar, Cryptocurrency, and the National Interest”

This statement may sound harsh, but if you look through his resume, you will find that he is not a blind opponent but an insider who understands the technical mechanisms deeply. He is not only an advisor to the crypto index fund Bitwise but also an early angel investor in the algorithmic stablecoin project Basis. Basis attempted to mimic central bank open market operations through algorithms, and although the project ultimately failed due to regulation, this experience has given Warsh a better understanding than any bureaucrat of how "currency" is generated through code.

Because he understands, he is even harsher. Warsh is a typical "institutionalist"; he recognizes crypto assets as investment targets like commodities or tech stocks, but he has a very low tolerance for "private minting," which challenges the sovereignty of the dollar.

This binary attitude will directly determine the fate of stablecoins. Warsh is very likely to push for the inclusion of stablecoin issuers within a "narrow banking" regulatory framework: they must hold 100% cash or short-term debt reserves and be prohibited from engaging in fractional reserve lending like banks. This is a double-edged sword for Tether or Circle; they will gain a legal status similar to banks, creating a deep moat, but at the same time, they will lose the flexibility of "shadow banking," and their profit models will be completely locked into government bond interest. As for those small and medium-sized stablecoins attempting to engage in "credit creation," they will likely be directly eliminated under such high pressure. (Recommended reading: “Farewell to the ‘Agent Bank’ Era? Five Crypto Institutions Obtain Keys to Direct Access to the Federal Reserve Payment System”)

The same logic extends to CBDCs. Unlike many Republicans who oppose them outright, Warsh offers a more nuanced "American solution." He firmly opposes the Federal Reserve issuing "retail CBDCs" directly to individuals, viewing it as an invasion of privacy and an overreach of power, which aligns remarkably with the values of the crypto community. However, he is an advocate for "wholesale CBDCs," arguing for the use of blockchain technology to reform the interbank clearing system to address geopolitical challenges.

In this framework, a fascinating fusion may emerge in the future: the underlying settlement layer controlled by the Federal Reserve's wholesale chain, while the upper application layer is left to regulated public chains and Web3 institutions. For DeFi, this would mark the end of a "Wild West" era, but perhaps the true spring of RWA (Real World Assets) would begin. After all, in Warsh's logic, as long as you do not attempt to replace the dollar, improvements in technological efficiency will always be welcomed.

Conclusion

Kevin Warsh is not just an alternative on Trump's list; he embodies Wall Street's old order's attempt to redeem itself in the digital age. Perhaps under his leadership, RWA and DeFi, built on real utility and institutional compliance, are just beginning to usher in a true golden age.

However, just as the market was overinterpreting Warsh's resume, BitMEX founder Arthur Hayes poured a very sobering cold water on the situation. In Hayes's view, we may all be making a directional error: the key is not what that person "believes" before becoming chair, but whether he understands "who he is working for" after taking that position.

Looking back at the century-long history of the Federal Reserve, the power struggle between the president and the chair has never ceased. Back in the day, President Lyndon Johnson even resorted to physical intimidation against then-chairman William Martin to force the Federal Reserve to cut interest rates. In comparison, Trump's Twitter attacks seem trivial. Hayes's logic is harsh but true: the U.S. president will ultimately get the monetary policy he desires. And what Trump wants is always lower interest rates, a hotter market, and more abundant money supply; regardless of who occupies that position, they will ultimately have to use the tools at their disposal to accomplish the task.

This presents the ultimate suspense facing the crypto market:

Warsh is indeed someone who wants to place his hand on the printing press switch and attempt to turn it off. But when the gravitational pull of politics comes into play, when the growth demands of "Make America Great Again" collide with his ideal of "hard money," will he tame inflation, or will the game of power tame him?

In this contest, Warsh may be a respected "hawkish" opponent. But in the eyes of a seasoned trader like Hayes, who becomes chair is actually unimportant, because no matter how convoluted the process may be, as long as the political machine continues to operate, the valve of liquidity will ultimately be reopened.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。