Core Accusations: It's Not Just About "Losing Money."

Written by: June, Deep Tide TechFlow

In January 2025, the meme coin market was at the peak of its frenzy. With U.S. President Trump launching the TRUMP coin, an unprecedented speculative wave swept through, and the myth of "hundredfold coins" captured the market's attention.

At the same time, a lawsuit against the Pump.fun platform was quietly initiated.

Fast forward to recent days.

Alon Cohen, co-founder and COO of Pump.fun, has not made any statements on social media for over a month. For someone who is usually active and always online "surfing and gossiping," this silence is particularly striking. Data shows that Pump.fun's weekly trading volume has plummeted from a peak of $3.3 billion in January to the current $481 million, a drop of over 80%. Meanwhile, the price of PUMP has fallen to $0.0019, a decline of about 78% from its historical high.

Looking back to July 12 a few months ago, the situation was entirely different. Pump.fun's public sale was issued at a uniform price of $0.004 per token, selling out in 12 minutes and raising approximately $600 million, with sentiment reaching a peak.

From the bustling atmosphere at the beginning of the year to the current quietness, the market's attitude has formed a stark contrast.

Amidst all these changes, the only thing that hasn't stopped is the buyback plan. The Pump.fun team is still diligently executing the daily buyback plan. As of now, the total buyback amount has reached $216 million, absorbing about 15.16% of the circulating supply.

Meanwhile, the lawsuit that was overlooked during the market frenzy is now quietly expanding.

Everything Started with the Loss of $PNUT

The story begins in January 2025.

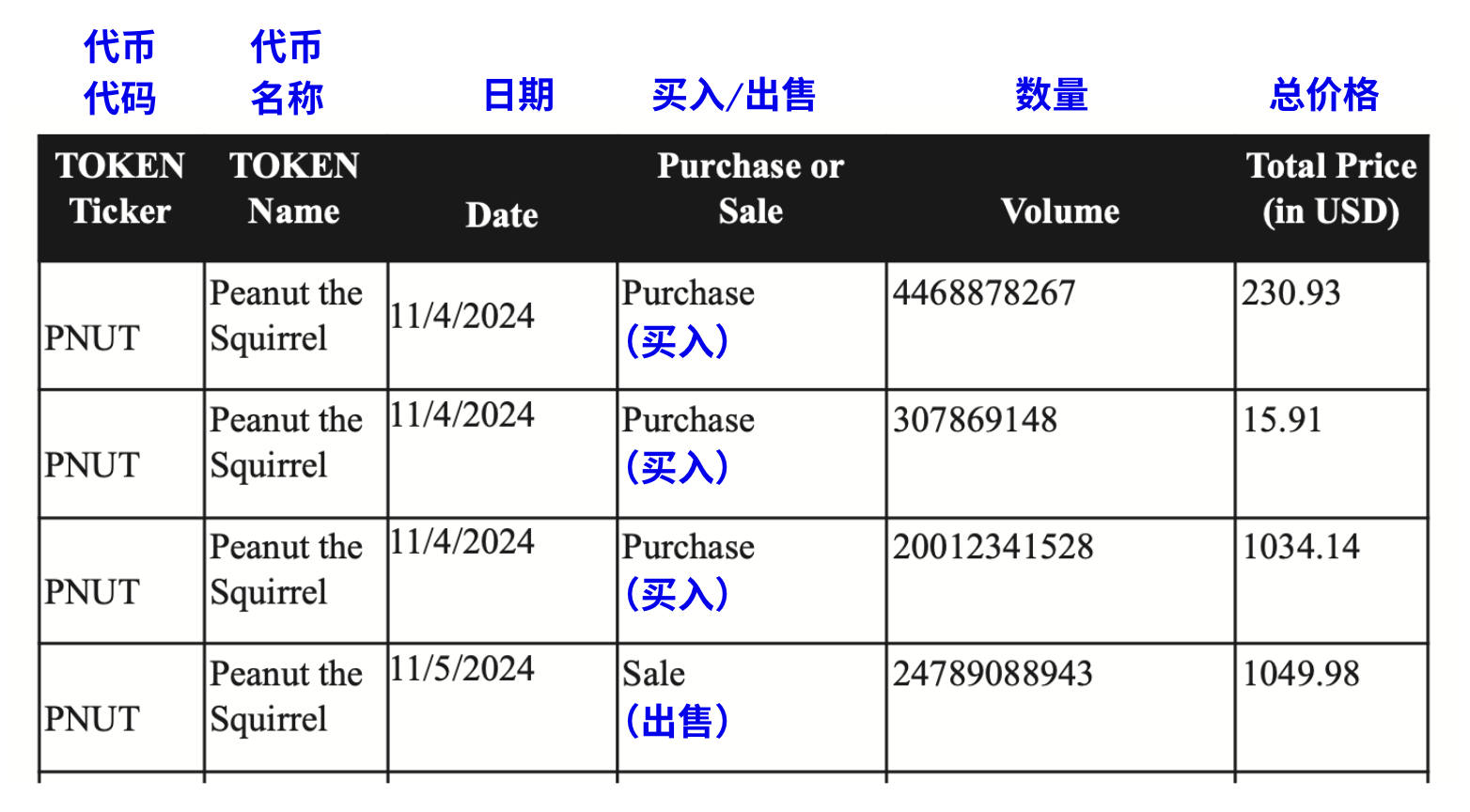

On January 16, investor Kendall Carnahan was the first to file a lawsuit (Case No: Carnahan v. Baton Corp.) in the Southern District of New York, directly targeting Pump.fun and its three founders. Carnahan's demand was clear: he suffered losses after purchasing $PNUT tokens on the platform and accused Pump.fun of selling unregistered securities, violating the U.S. Securities Act of 1933.

According to the lawsuit documents, the actual amount of loss for this investor was only $231.

Just two weeks later, on January 30, another investor, Diego Aguilar, filed a similar lawsuit (Case No: Aguilar v. Baton Corp.). Unlike Carnahan, Aguilar purchased a wider variety of tokens, including $FRED, $FWOG, $GRIFFAIN, and several other meme coins issued on the Pump.fun platform. His lawsuit had a broader scope, representing all investors who purchased unregistered tokens on the platform.

At this point, the two cases were proceeding independently, with the same group of defendants:

Pump.fun's operating company Baton Corporation Ltd and its three founders, Alon Cohen (COO), Dylan Kerler (CTO), and Noah Bernhard Hugo Tweedale (CEO).

Two Cases Consolidated, $240,000 Loser Becomes Lead Plaintiff

The two independent lawsuits quickly caught the court's attention. Judge Colleen McMahon of the Southern District of New York noticed a problem: both cases targeted the same group of defendants, the same platform, and the same illegal activities. Why should they be tried separately?

On June 18, 2025, Judge McMahon directly questioned the plaintiffs' legal team:

Why are there two independent lawsuits addressing the same issue? She asked the lawyers to explain why these two cases should not be consolidated.

The plaintiffs' lawyers initially attempted to defend, claiming they could maintain two separate cases, one specifically for the $PNUT token and the other for all tokens on the Pump.fun platform, and suggested appointing two lead plaintiffs separately.

But the judge was clearly not convinced. This "divide and conquer" strategy would not only waste judicial resources but could also lead to conflicting judgments in different cases. The key point is that all plaintiffs faced the same core issue; they all accused Pump.fun of selling unregistered securities and believed they were victims of the same fraudulent scheme.

On June 26, Judge McMahon ruled to officially consolidate the two cases. At the same time, the judge formally appointed Michael Okafor, who suffered the largest loss of approximately $242,000 in transactions on Pump.fun, as the lead plaintiff (according to court records, Okafor's losses far exceeded those of other plaintiffs).

Thus, the investors who were originally fighting their own battles formed a united front.

Focus Turns to Solana Labs and Jito

Just a month after the cases were consolidated, the plaintiffs dropped a bombshell.

On July 23, 2025, the plaintiffs submitted a “Consolidated Amended Complaint”, dramatically expanding the list of defendants. This time, the focus was no longer solely on Pump.fun and its three founders but directly targeted key participants in the entire Solana ecosystem.

The newly added defendants include:

Solana Labs, Solana Foundation, and their executives (Solana Defendants): The plaintiffs accused Solana of not merely providing blockchain technology. According to the lawsuit documents, there was close technical coordination and communication between Pump.fun and Solana Labs, far exceeding the typical developer-platform relationship.

Jito Labs and its executives (Jito Defendants): The plaintiffs believe that it was Jito's MEV technology that allowed insiders to pay extra fees to ensure their transactions were executed first, enabling them to buy tokens before ordinary users and achieve risk-free arbitrage.

The plaintiffs' strategy is clear; they are trying to prove that Pump.fun, Solana, and Jito do not operate independently but form a tight-knit community of interests. Solana provides the blockchain infrastructure, Jito provides MEV tools, and Pump.fun operates the platform, together constructing a system that appears decentralized but is actually manipulated.

Core Accusations: It's Not Just About "Losing Money"

Many may think this is just a group of investors acting out of anger after losing money in crypto trading. However, a careful reading of the hundreds of pages of court documents reveals that the plaintiffs' accusations point to a meticulously designed fraudulent system.

First Accusation: Sale of Unregistered Securities

This is the legal foundation of the entire case.

The plaintiffs argue that all meme tokens issued on the Pump.fun platform are essentially investment contracts, which, according to the Howey Test, meet the definition of securities. However, the defendants never submitted any registration statements to the U.S. Securities and Exchange Commission and publicly sold these tokens, violating Sections 5, 12(a)(1), and 15 of the Securities Act of 1933.

When the platform sold tokens through the "bonding curve" mechanism, it also completely failed to disclose necessary risk information, financial status, or project background to investors, all of which are required information when issuing registered securities.

Note: The Howey Test is a legal standard established by the U.S. Supreme Court in the 1946 SEC v. W.J. Howey Co. case to determine whether a specific transaction or scheme constitutes an "investment contract." If it meets the test's criteria, the asset is considered a "security," subject to regulation by the U.S. Securities and Exchange Commission (SEC) and must comply with the registration and disclosure requirements of the Securities Act of 1933 and the Securities Exchange Act of 1934.

Second Accusation: Operating an Illegal Gambling Business

The plaintiffs define Pump.fun as a "Meme Coin Casino." They point out that users investing SOL to purchase tokens is essentially "betting," with the outcome primarily dependent on luck and market speculation rather than the actual utility of the tokens. The platform acts as the "house," taking a 1% fee from each transaction, just like a casino takes a cut.

Third Accusation: Telecommunications Fraud and False Advertising

Pump.fun superficially promotes "Fair Launch," "No Presale," and "Rug-proof," giving the impression that all participants are on the same starting line. However, this is a complete lie.

The lawsuit documents indicate that Pump.fun secretly integrated MEV technology provided by Jito Labs. This means that those who know the "inside information" and are willing to pay extra "tips" can use "Jito bundles" to buy tokens before ordinary users' transactions are executed, and then immediately sell them for profit after the price rises, which is known as front-running.

Fourth Accusation: Money Laundering and Unlicensed Remittance

The plaintiffs accuse Pump.fun of receiving and transferring large amounts of money without obtaining any remittance licenses. The lawsuit documents claim that the platform even assisted the North Korean hacking organization Lazarus Group in laundering stolen funds. Specifically, hackers issued a meme token named "QinShihuang" on Pump.fun, using the platform's high traffic and liquidity to mix "dirty money" with the legitimate trading funds of ordinary retail investors.

Fifth Accusation: Complete Lack of Investor Protection

Unlike traditional financial platforms, Pump.fun has no "Know Your Customer" (KYC) processes, anti-money laundering (AML) protocols, or even the most basic age verification.

The plaintiffs' core argument can be summarized in one sentence: This is not a normal investment affected by market fluctuations, but a fraudulent system designed from the outset to cause retail investors to lose money while insiders profit.

This expansion signifies a fundamental shift in the nature of the lawsuit. The plaintiffs are no longer content to accuse Pump.fun of acting alone but describe it as part of a larger "criminal network."

A month later, on August 21, the plaintiffs further submitted a “RICO Case Statement”, formally accusing all defendants of collectively forming an "extortion group" that operates a manipulated "Meme Coin Casino" through the ostensibly "fair launch platform" Pump.fun.

The plaintiffs' logic is clear: Pump.fun does not operate independently; it is backed by Solana providing blockchain infrastructure and Jito supplying MEV technology tools. The three parties form a tight-knit community of interests, collectively defrauding ordinary investors.

But what evidence do the plaintiffs have to support these accusations? The answer will be revealed months later.

Key Evidence: Confidential Informant and Chat Records

After September 2025, the nature of the case underwent a fundamental transformation.

The plaintiffs obtained solid evidence.

A "confidential informant" provided the plaintiffs' legal team with the first batch of internal chat records, totaling about 5,000 messages. These chat records are said to come from communication channels within Pump.fun, Solana Labs, and Jito Labs, documenting the technical coordination and business interactions among the three parties.

The emergence of this evidence was a treasure trove for the plaintiffs. Previously, all accusations regarding technical collusion, MEV manipulation, and insider trading were speculative and lacked direct evidence.

These internal chat records are said to prove the "conspiratorial relationship" among the three parties.

A month later, on October 21, the mysterious informant provided a second batch of documents, this time even more astonishing, with over 10,000 chat records and related documents. These materials reportedly detail:

How Pump.fun coordinated technical integration with Solana Labs

How Jito's MEV tools were embedded into Pump.fun's trading system

How the three parties discussed ways to "optimize" trading processes (which the plaintiffs believe is a euphemism for market manipulation)

How insiders used information advantages to trade

The plaintiffs' lawyers stated in court documents that these chat records "reveal a carefully designed fraud network," proving that the relationship between Pump.fun, Solana, and Jito is far more complex than merely being "technical partners."

Application for Second Amended Complaint

Faced with such a massive new body of evidence, the plaintiffs needed time to organize and analyze it. On December 9, 2025, the court approved the plaintiffs' request to submit a "Second Amended Complaint," allowing them to incorporate this new evidence into the lawsuit.

However, the problem arose: over 15,000 chat records needed to be reviewed, filtered, translated (some may be non-English content), and analyzed for their legal significance, which is a huge workload. Coupled with the upcoming Christmas and New Year holidays, the plaintiffs' legal team clearly did not have enough time.

On December 10, the plaintiffs submitted a motion to the court requesting an extension for submitting the "Second Amended Complaint."

Just one day later, on December 11, Judge McMahon approved the extension request. The new deadline was set for January 7, 2026. This means that after the New Year, a "Second Amended Complaint" potentially containing more explosive accusations will be presented in court.

Current Status of the Case

As of now, this lawsuit has been ongoing for nearly a year, but the real battle is just beginning.

On January 7, 2026, the plaintiffs will submit the "Second Amended Complaint" containing all the new evidence, at which point we will see what the 15,000 chat records reveal. Meanwhile, the defendants have been surprisingly quiet. Pump.fun co-founder Alon Cohen has not spoken on social media for over a month, and executives from Solana and Jito have not made any public comments regarding the lawsuit.

Interestingly, despite the growing scale and impact of this lawsuit, the cryptocurrency market seems largely indifferent. The price of Solana has not experienced significant fluctuations due to the lawsuit, and while the price of the $PUMP token continues to decline, it is more due to the collapse of the overall meme coin narrative rather than the impact of the lawsuit itself.

Epilogue

This lawsuit, triggered by losses in trading meme coins, has evolved into a collective lawsuit against the entire Solana ecosystem.

The case has transcended the scope of "a few investors seeking justice for their losses." It touches on the core issues of the cryptocurrency industry: Is decentralization real, or is it a carefully packaged illusion? Is a fair launch truly fair?

However, many key questions remain unresolved:

Who is that mysterious informant? A former employee? A competitor? Or an undercover agent from a regulatory agency?

What exactly is contained in the 15,000 chat records? Are they conclusive evidence of collusion, or are they normal business communications taken out of context?

How will the defendants defend themselves?

In 2026, with the submission of the "Second Amended Complaint" and the progress of the case, we may finally get some answers.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。