Author: Todd Wenning

Translation: Deep Tide TechFlow

Deep Tide Guide: Academic financial theory divides risk into systemic risk and idiosyncratic risk. Similarly, stock pullbacks are also categorized into two types: market-driven systemic pullbacks (like the financial crisis of 2008) and company-specific idiosyncratic pullbacks (like the current software stock crash caused by AI concerns).

Todd Wenning points to FactSet as an example: during systemic pullbacks, you can leverage behavioral advantages (patiently waiting for the market to recover); but during idiosyncratic pullbacks, you need analytical advantages—having a vision for the company ten years out that is more accurate than the market’s.

In the current impact of AI on software stocks, investors must distinguish: is this temporary market panic, or is the moat really collapsing?

Do not use blunt behavioral solutions to address issues that require nuanced analysis.

The full text is as follows:

Academic financial theory identifies two types of risk: systemic and idiosyncratic.

- Systemic risk is market risk that is unavoidable. It cannot be eliminated through diversification, and it is the only type of risk for which you can be compensated.

- On the other hand, idiosyncratic risk is company-specific risk. Because you can cheaply acquire a diversified portfolio of uncorrelated businesses, you will not be rewarded for taking on this type of risk.

We can discuss Modern Portfolio Theory another day, but the systemic-idiosyncratic framework is very helpful for understanding different types of pullbacks (the percentage decrease from peak to trough in investments) and how we as investors should assess opportunities.

From the moment we pick up our first value investing book, we are taught to take advantage of Mr. Market's discontent during stock sell-offs. If we stay calm while he loses his mind, we will prove ourselves as steadfast value investors.

But not all pullbacks are the same. Some are market-driven (systemic), while others are company-specific (idiosyncratic). Before you act, you need to know which type you are looking at.

Gemini generated

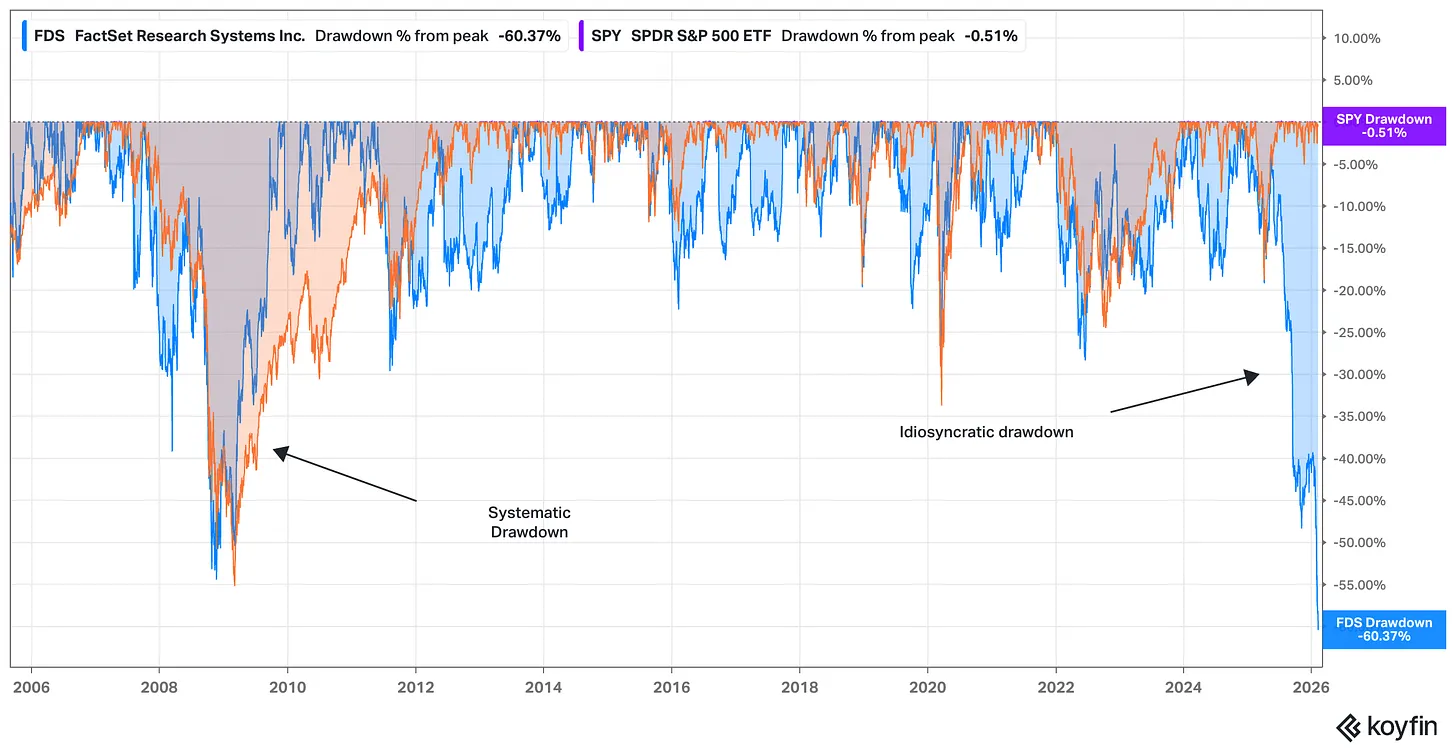

The recent sell-off of software stocks caused by AI concerns illustrates this point. Let's look at the 20-year pullback history between FactSet (FDS, blue) and the S&P 500 (measured by the SPY ETF, orange).

Source: Koyfin, as of February 12, 2026

FactSet's pullback during the financial crisis was mainly systemic. In 2008/09, the entire market was worried about the durability of the financial system, and FactSet could not escape these concerns, especially as it sold products to financial professionals.

At that time, the pullback in shares had little to do with FactSet's economic moat; it was more about whether FactSet's moat would matter if the financial system collapsed.

The pullback of FactSet in 2025/26 represents the opposite situation. Here, concerns almost entirely focused on FactSet's moat and growth potential, as well as widespread worries about the disruptive pricing power of accelerated AI capabilities in the software industry.

During systemic pullbacks, you can more reasonably make bets on timing arbitrage. History shows that the market tends to rebound, and companies with a solid moat could emerge even stronger than before, so if you are willing and able to maintain patience while others panic, you can leverage strong appetite to take advantage of behavioral advantages.

Photo by Walker Fenton on Unsplash

However, during idiosyncratic pullbacks, the market tells you there is something wrong with the business itself. Specifically, it implies that the future value of the business is becoming increasingly uncertain.

Therefore, if you hope to take advantage of idiosyncratic pullbacks, you need to possess not only behavioral advantages but also analytical advantages.

To succeed, you need to have a more accurate vision of what the company will look like in ten years than what the current market price suggests.

Even if you know a company very well, this is not easy to achieve. Stocks typically do not decline 50% relative to the market without reason. Many once-stable holders—possibly some investors you respect because of their in-depth research—had to capitulate for this to happen.

If you are going to intervene as a buyer during idiosyncratic pullbacks, you need to have an answer to explain why these once-informed and well-considered investors selling is wrong, and why your vision is correct.

There is only a fine line between belief and arrogance.

Whether you hold stocks that are in a pullback or want to start new positions within them, it is important to understand what type of bet you are making.

Idiosyncratic pullbacks may entice value investors to start looking for opportunities. Before you take risks, make sure you are not using blunt behavioral solutions to address problems that require nuanced analysis.

Stay patient, stay focused.

Todd

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。