With the continuous escalation of international tensions in recent years, such as the Russia-Ukraine war, the Gaza conflict, and geopolitical risks related to Iran, people have found that information related to geopolitics is having an increasing impact on global capital markets. A war thousands of miles away can lead to a "flash crash" in global stock markets. Intelligence information is no longer merely defense information; the demand for war situation assessments and forward-looking intelligence among ordinary people is also significantly increasing. The concept of "open-source intelligence" (OSINT) is on the rise: utilizing publicly available information from social media, satellite images, flight paths, and more on the internet to cross-verify and formulate valuable clues. Examples such as videos posted by frontline soldiers on TikTok and the related account login addresses, and the "Pentagon Pizza Index," which infers military trends through changes in takeout orders from the U.S. Department of Defense, are typical scenarios of open-source intelligence.

The open-source intelligence scenario we focus on is the prediction market: it allows participants to wager on whether a certain event will occur, covering a range of fields including technology, entertainment, culture, and geopolitics.

Founded in 2020, Polymarket initially served primarily the native blockchain user community. However, it truly entered the public eye during the 2024 U.S. presidential election cycle: one week before the official results were announced, while mainstream media and traditional polling organizations struggled to provide clear conclusions, Polymarket had already estimated the probability of Trump winning at 65%. On election night around 10 PM, the probability had risen to 90%, while many mainstream media outlets were still reporting the latest vote counts, with results only published early the next morning.

The total trading volume for this presidential election betting was $3.686 billion, with the two most profitable accounts earning $38.62 million by betting on Trump’s victory. To this day, they still rank among the top two in the platform's historical profit list. This election fundamentally changed the public's perception of Polymarket and the entire prediction market: it was no longer simply viewed as a "blockchain casino" or speculative game, but became widely recognized as a more accurate and sensitive data reference platform than traditional polls. Subsequently, many mainstream media began to actively collaborate with prediction markets, systematically incorporating prediction market probability data as a supplementary perspective to market consensus in news reports.

For a long time, many have understood prediction markets as "a betting game on outcomes." However, we believe that the real value has never been the betting behavior itself, but the information advantage implied behind the betting. Industry secrets and critical war information that were previously restricted by confidentiality agreements have become leverage in financial markets with the support of prediction markets, and the fluctuations in the probability of occurrence of events in prediction markets resulting from insider betting themselves are an undeniable reality signal.

In other words, if we can systematically identify these accounts, it may be possible to gain forward-looking clues different from any traditional intelligence channels, and even know the outcome in advance when an event occurs. A drama's ending has been filmed, an award selection has been predetermined, a regulatory outcome has been finalized... as long as someone is informed and the platform allows betting, secrets are difficult to completely hide. This has completely rewritten the long-standing and unchanged traditional information flow path to:

Event occurs → Informed individuals bet → Spread the actions of informed individuals → The public knows the event is (about to) happen

In moderate scenarios, this means that the endings of series, award distributions, and business decisions will be known to the market in advance; while in extreme scenarios, it even touches on war and geopolitical conflicts: people can learn military intelligence-level information through the bets of soldiers on the front lines, directly influencing the course of war. When the results are already held by a few, and the market allows betting around the outcome, the price itself can become an unavoidable reality signal.

Thus, the role of the disseminators becomes particularly important. Based on this judgment, as the largest media in the blockchain industry in Chinese-speaking regions, Rhythm BlockBeats officially established a prediction market research team in November 2025, beginning long-term, structured on-chain research on prediction markets. Leveraging Polymarket and the inherent transparency and traceability of blockchain transactions, we attempt to systematically analyze transactional profiles to identify those accounts that exhibit highly consistent betting patterns in prediction markets and have remarkably stable long-term performance.

In this article, we have chosen one of the most representative research samples: the "Russia-Ukraine Occupation" series of prediction market events. In this report, we will systematically showcase our research methods, core findings, and the practical value of this method in reality. Through the analytical methods mentioned in this report, we aim to distill trading profiles that highly match insider accounts and predict subsequent event developments by interpreting their trading behaviors.

1. Report Summary

This report aims to identify potential abnormal trading behaviors surrounding geopolitical events related to the "Russia-Ukraine War" on the Polymarket prediction platform through systematic on-chain and trading data analysis, and assess whether they exhibit characteristics that suggest possession of non-public or insider information, thereby concluding whether the prediction market can provide real news facts in advance.

Methodologically, the report constructs and applies two complementary filtering models: one is a behavioral focus model, which characterizes whether accounts are highly concentrated on specific geopolitical events from the perspective of transaction structure; the other is a capital focus model, which identifies accounts with strong subjective beliefs or abnormal financial performance based on capital allocation, win rates, and profit-loss results.

Based on the analysis of 79 "Russia-Ukraine Occupation" events, 23,316 independent accounts, and over 3.09 million transaction records, the report successfully filtered multiple suspicious accounts that deviated significantly from typical retail investor characteristics in terms of trading focus, capital allocation methods, and profitability. These accounts generally showed: an activity frequency highly focused on Russia-Ukraine related events, substantial bets on relevant events, and abnormal stability or significant positive returns.

Comprehensive analysis indicates that on-chain behavioral data can effectively characterize traders' interest structures and risk preferences and provide strong data support for identifying potential insider trading or information advantage behaviors.

2. Research Background and Objectives

Compared to highly macro and vaguely defined topics like "When will the war end?" and "Will there be a nuclear conflict?", the "Russia-Ukraine Occupation Events" on Polymarket hold extremely high research value. The questioning format of such events is usually very specific, for example:

"Will Russia control Pokrovsk before October 31?"

This is a physical fact judgment about a clear geographical location and a defined time point, with no room for interpretation, and the replicability of such events also makes it the best war intelligence bounty platform for insiders, including soldiers and intelligence personnel.

Polymarket launched related Russia-Ukraine occupation events for the first time in May 2024. As of February 10, 2026, the platform had cumulatively published 79 related events, with each event usually containing one or more time window markets, and a total trading volume of approximately $47.87 million.

For this reason, we systematically reviewed all 23,316 independent on-chain addresses that had conducted transactions in the Russia-Ukraine occupation events, as well as over 3.09 million historical transaction records, trying to separate the truly explanatory signals from seemingly noisy trading behaviors.

2.1 Insider Account Profiles

The anonymity of blockchain makes it impossible for us to fully trace the identities of account owners, but its transparent transaction trajectories allow us to mine insider trading data through massive data and construct trading profiles. The analysis approach in this article involves gradually narrowing down a vast number of accounts to a set of "most worthy of manual review" targets using a funnel-type filtering method: first looking at behaviors → then funds → then results → manual review. Here, we introduce two profiles:

2.1.1 Profile One: Behavioral Focus - "I only participate in events where I know the outcome"

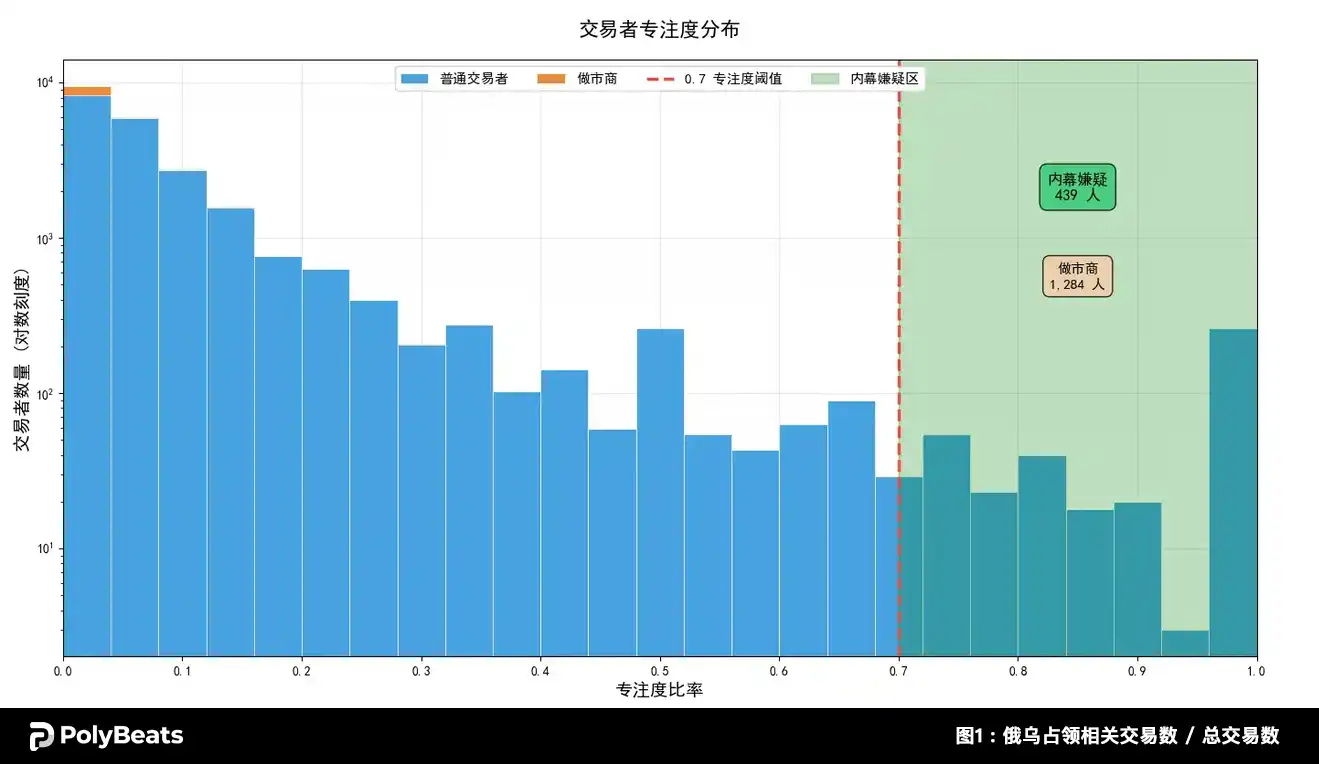

Those who truly hold frontline information will concentrate trades on the Russia-Ukraine occupation events. We divided all transactions into two categories (related events and unrelated events) based on relevance, and defined trading volume focus = number of trades related to Russia-Ukraine occupation events / total number of trades. Based on this, we filtered out 439 highly focused accounts from the 23,316 accounts, while excluding 1,284 market maker accounts with more than 500 transactions.

Chart 1: Distribution of Traders' Trading Focus

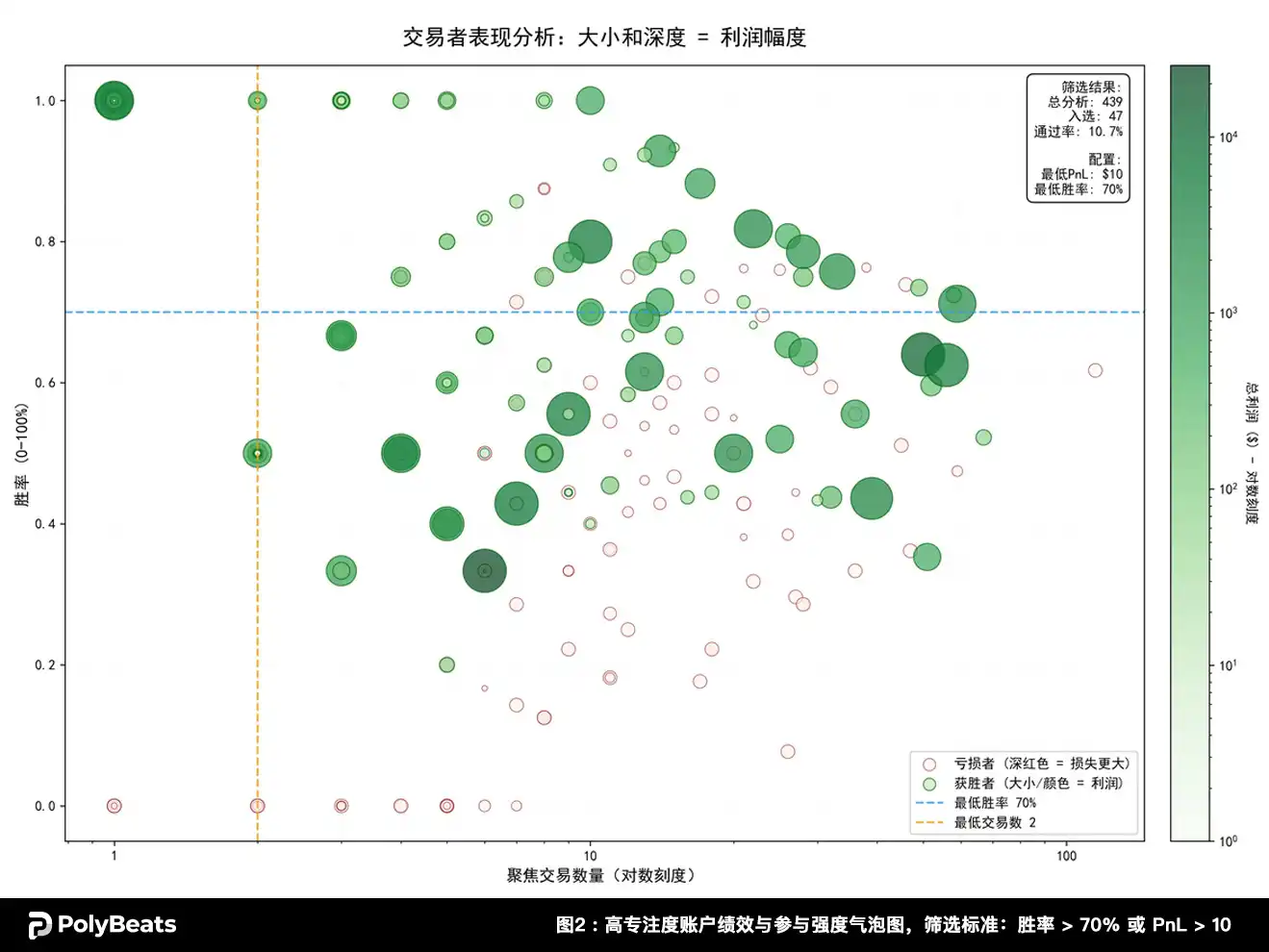

By weighting win rates, profits, and minimum transaction amounts, we further distilled 47 high-suspicion accounts from these 439 highly focused accounts for manual review.

Chart 2: Performance and Participation Intensity Bubble Chart of High-Focus Accounts

2.1.2 Profile Two: Capital Focus - "I dare to place large bets in events where I know the outcome"

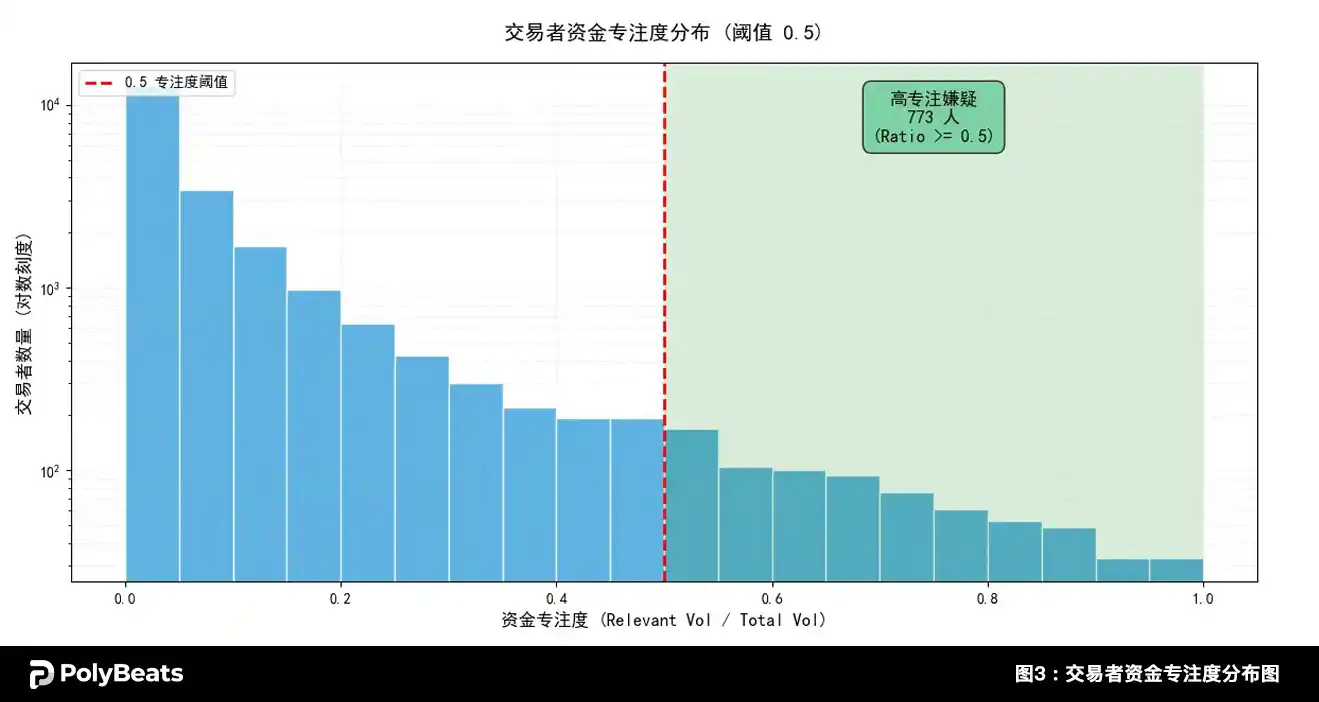

From the 21,593 low behavioral focus accounts excluded in the focus distribution, we further filtered valuable accounts using capital focus, selecting 773 suspicious accounts with capital focus greater than 0.5 for analysis (capital focus = transaction amount related to Russia-Ukraine occupation events / total transaction amount).

Chart 3: Distribution of Traders' Capital Focus

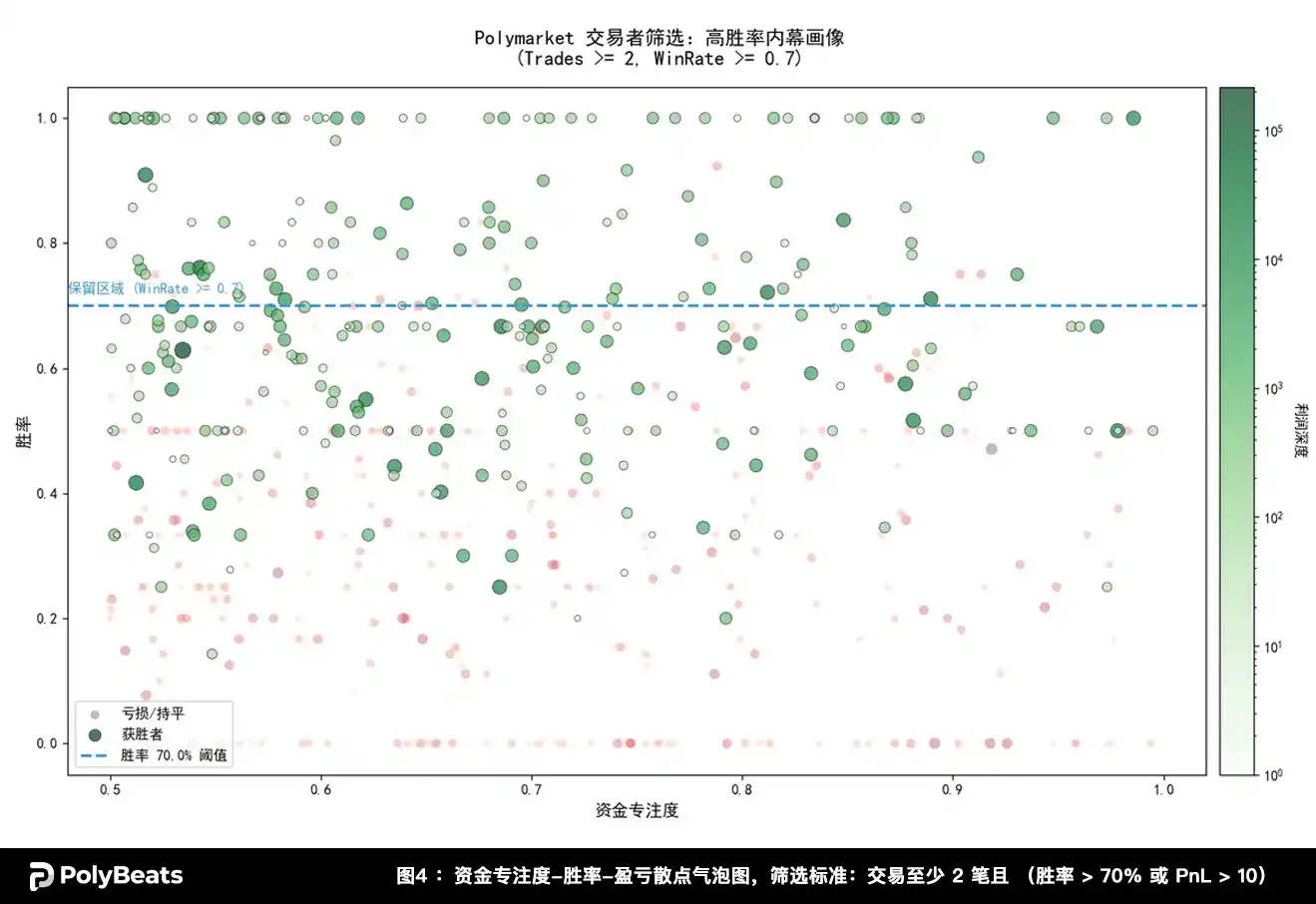

Subsequently, we added metrics like transaction counts, profits, and win rates, filtering out 282 high-suspicion accounts from the 773 candidate accounts, which were also included for manual review.

Chart 4: Capital Focus-Win Rate-Profit and Loss Scatter Bubble Chart

Final Selection and Result Presentation

We conducted a review of the complete transaction history of the 329 selected high-suspicion accounts and, for the protection of the account owners, selected four of them as case studies for in-depth presentation and analysis.

These accounts exhibited the most explanatory anomalous patterns in transaction sequences, betting concentration, and outcome performance.

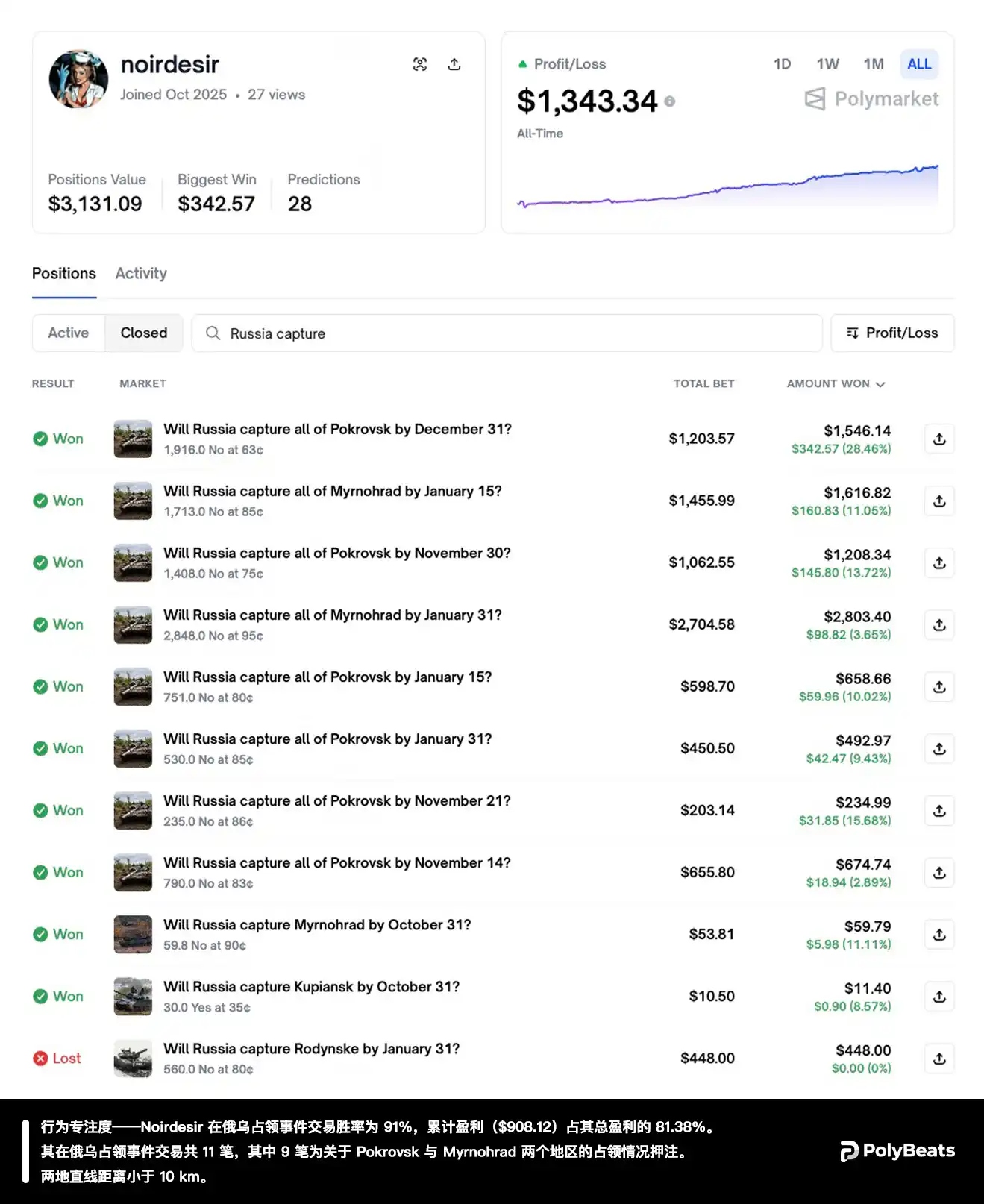

Behavioral Focus - Noirdesir had a win rate of 91% in Russia-Ukraine occupation event trading, with total profits ($908.12) accounting for 81.38% of its overall profits. It conducted 11 trades in the Russia-Ukraine occupation event, among which 9 were bets on the occupation status of Pokrovsk and Myrnohrad. The straight-line distance between the two locations is less than 10 km.

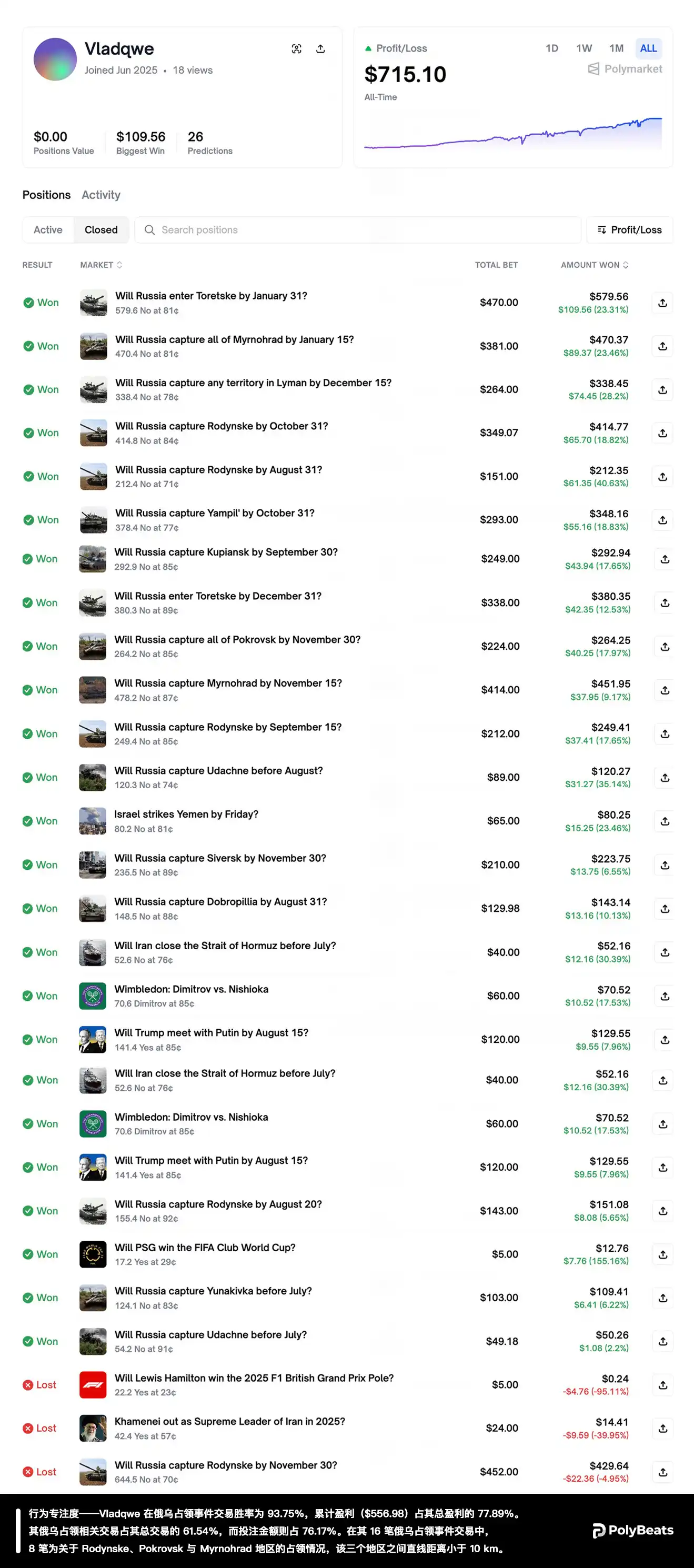

Behavioral Focus - Vladqwe had a win rate of 93.75% in Russia-Ukraine occupation event trading, with total profits ($556.98) accounting for 77.89% of its overall profits. Its transactions related to Russia-Ukraine occupation account for 61.54% of its total trades, while the amount wagered accounts for 76.17%. Out of its 16 Russia-Ukraine occupation event trades, 8 were regarding the occupation status of Rodynske, Pokrovsk, and Myrnohrad, with the straight-line distance between these three regions being less than 10 km.

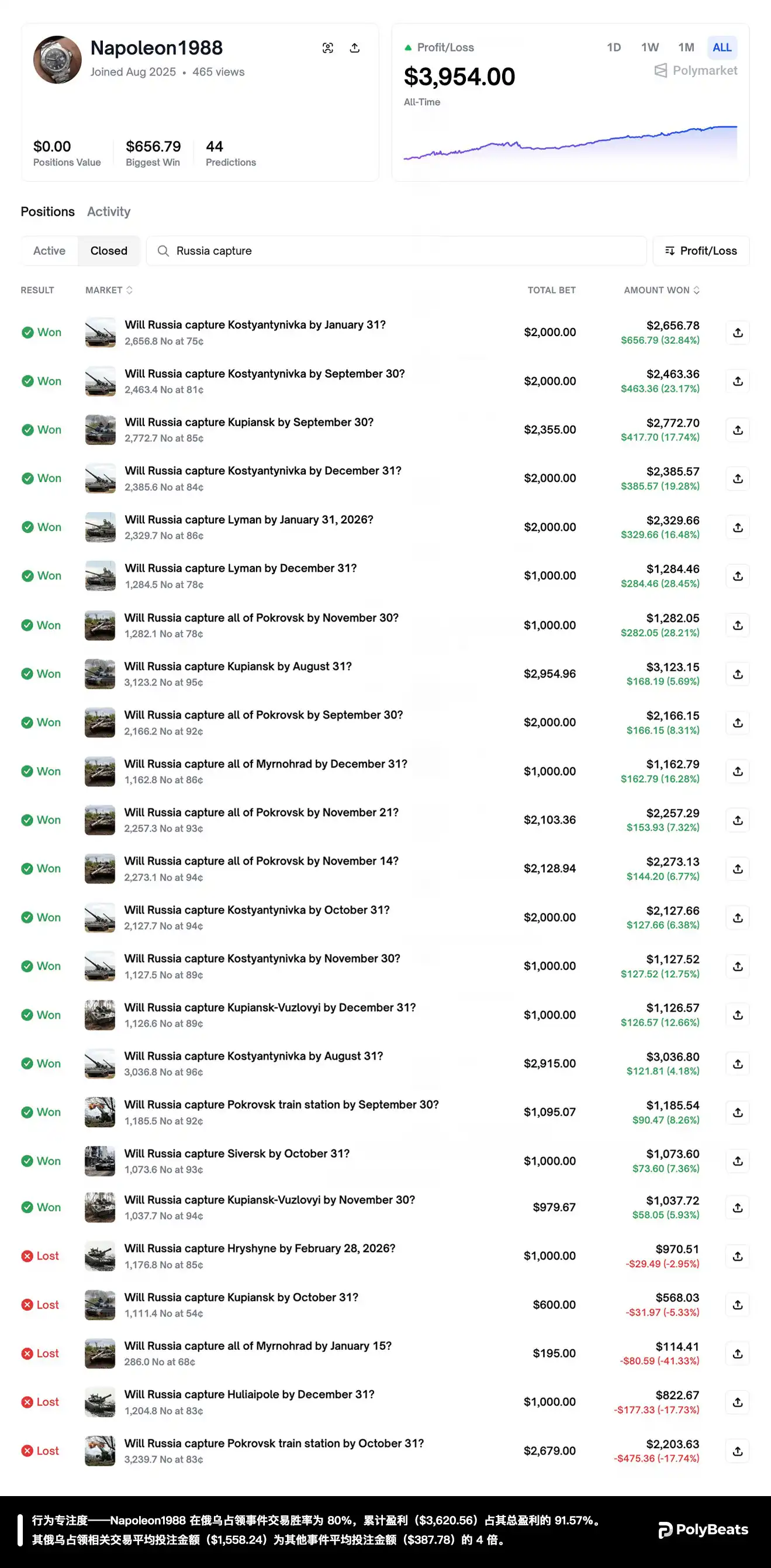

Behavioral Focus - Napoleon1988 had a win rate of 80% in Russia-Ukraine occupation event trading, with total profits ($3,620.56) accounting for 91.57% of its overall profits. Its average wager amount ($1,558.24) related to Russia-Ukraine occupation events is four times that of the average wager amount for other events ($387.78).

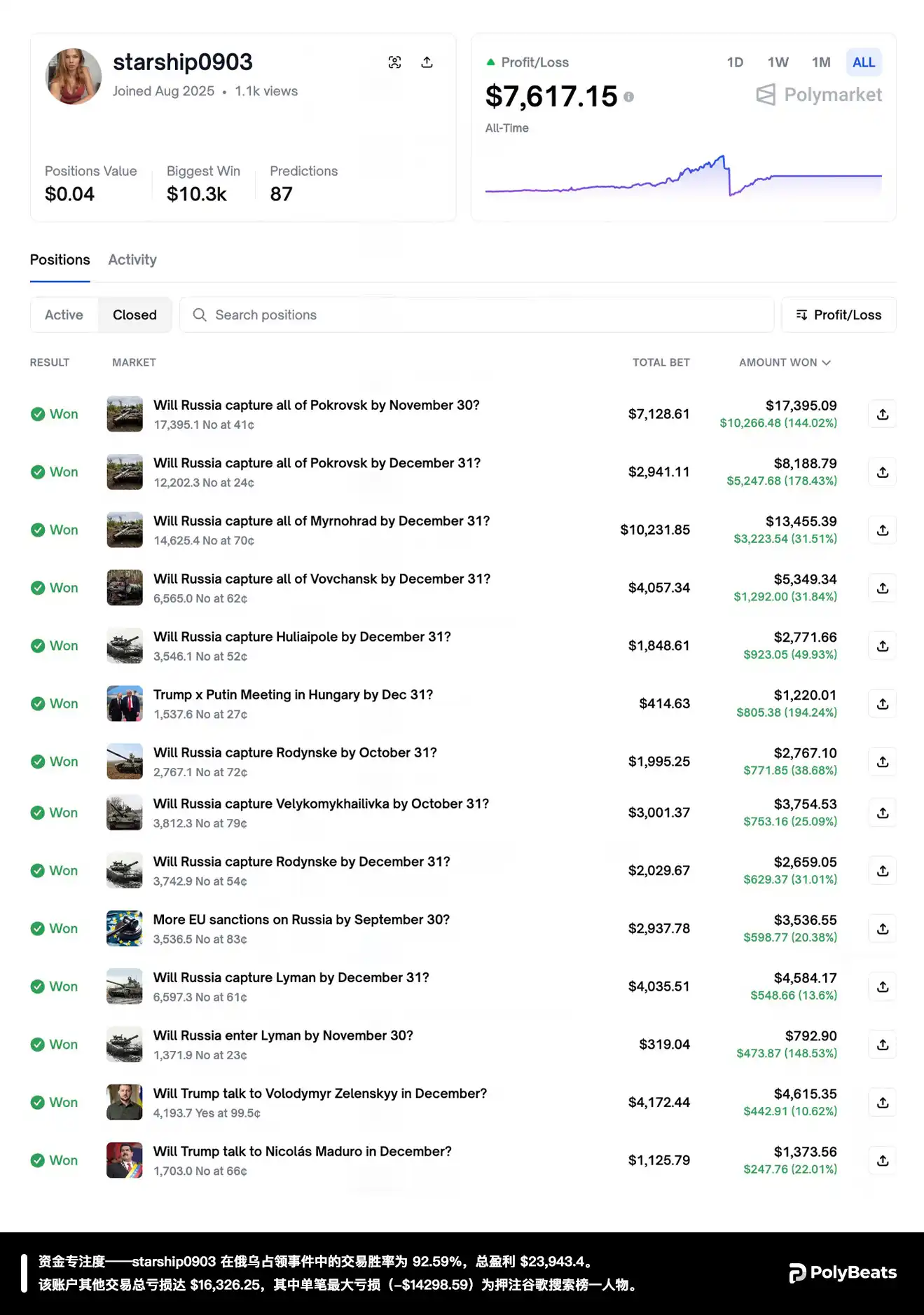

Capital Focus - starship0903 had a win rate of 92.59% in Russia-Ukraine occupation events, with total profits of $23,943.4. This account had total losses of $16,326.25 from other trades, with the maximum single loss (-$14,298.59) being from a bet on the top Google search individual.

Conclusion and Extended Applications

3. Conclusion and Extended Applications

Theoretical discoveries are exciting, but their real value lies in practice. We recognize that if we can continuously track the behaviors of these anomalous accounts, their betting actions may become leading indicators for predicting future events.

Rhythm BlockBeats is committed to turning this methodology into productivity. Founded in February 2018, Rhythm BlockBeats is one of the most influential crypto industry media in the Chinese internet, with over 15 million users across platforms, more than 4.5 million app downloads, and consistently ranking in the App Store News download list. After recognizing the impact of prediction markets on the news industry, we quickly established the prediction market team, now branded PolyBeats under Rhythm BlockBeats.

PolyBeats has established a monitoring system to track suspicious accounts' activities in various prediction markets in real-time, attempting to integrate on-chain analysis, public sentiment, news, and trading profiles into substantiated current events news, which has been validated across multiple fields.

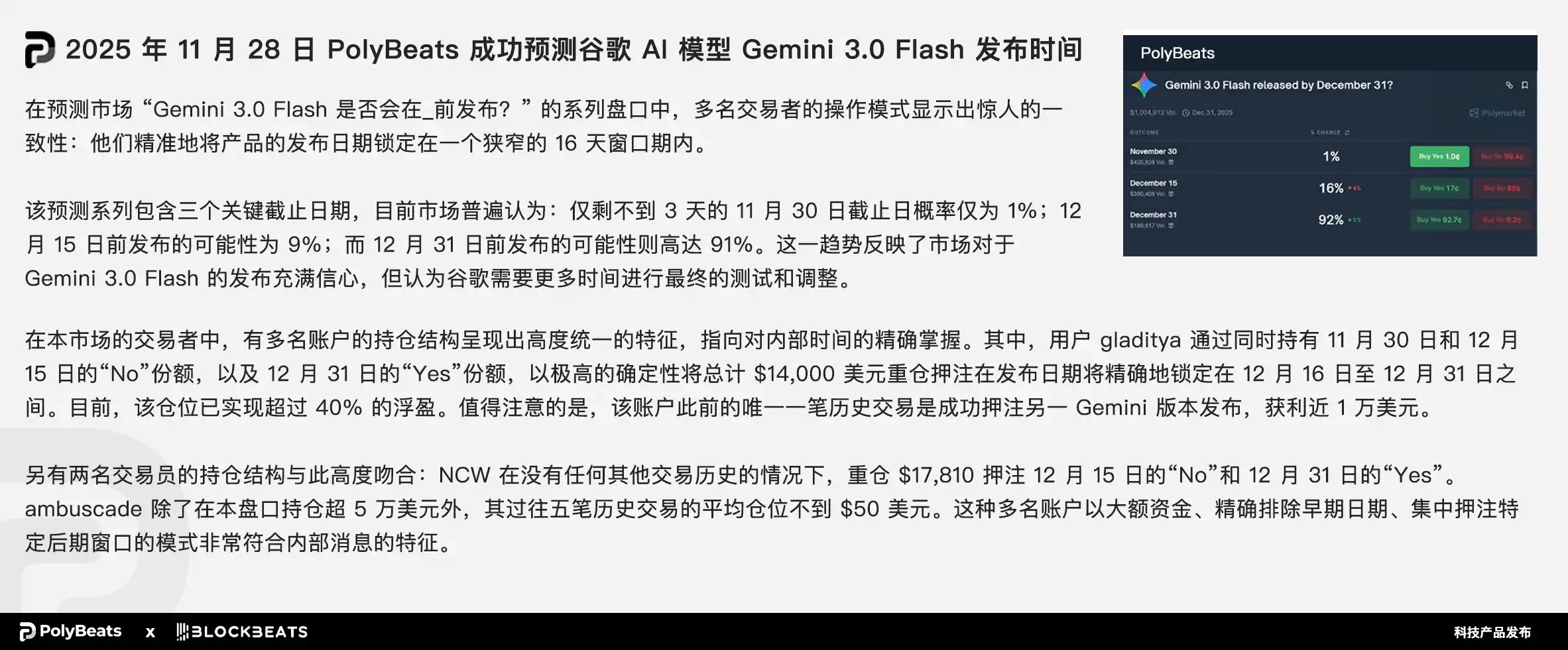

Case 1: Successfully predicted the release date of Google's AI model Gemini 3.0 Flash

Technology Product Launch: On November 28, 2025, PolyBeats captured the suspicious actions of three accounts with no on-chain intersection but highly consistent betting behavior: account NCW fits the typical one-off insider wallet based on "behavioral focus," and account ambuscade aligns with "capital focus" due to anomalous excessive betting.

Against the backdrop of November 28, these three accounts locked the release date of Gemini 3.0 Flash between December 15 and December 31 through their betting actions. Ultimately, the model was released on December 17, 2025.

Original link: https://t.me/PolyBeats_Bot/13

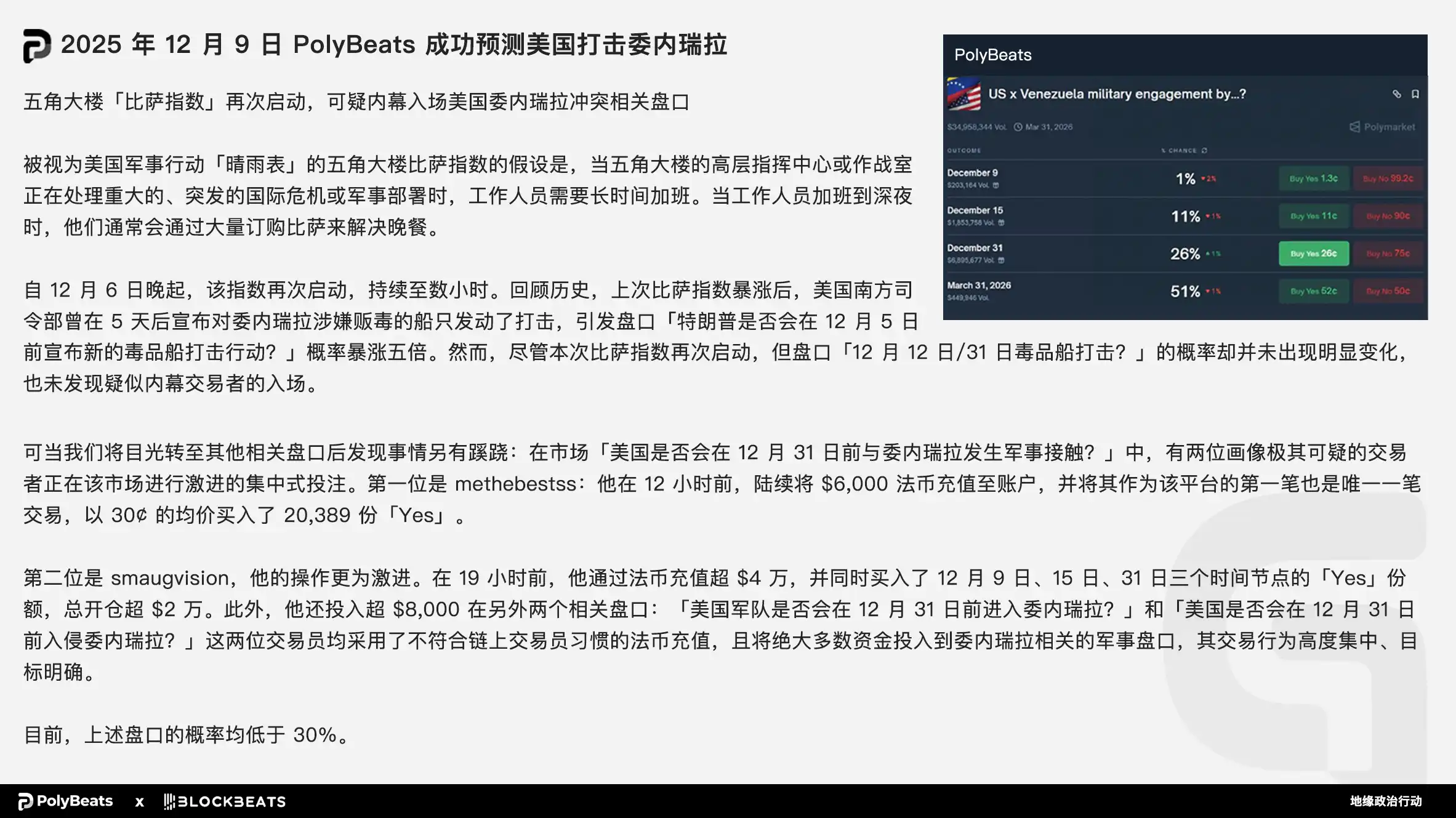

Case 2: Predicted U.S. strikes against Venezuela

Geopolitical Action: On December 9, 2025, PolyBeats, by combining geopolitics, classic open-source intelligence indicators like the Pizza Index, and trading profile analysis, discovered two new accounts meeting "capital focus" criteria betting that the U.S.-Venezuela conflict would occur before December 31, 2025.

The subsequent direction of this news was also quite dramatic: on December 31, 2025, the related military action did not occur. However, on January 4, 2026, shortly after the shocking news that "U.S. special forces successfully captured Venezuelan President," Trump publicly stated that the operation was originally scheduled for December 29 but was postponed due to extreme weather conditions in the Caribbean Sea.

Original link: https://t.me/PolyBeats_Bot/42

Case 3: Successfully predicted AI as Time magazine's Person of the Year 2025

Cultural Entertainment Award: On December 10, 2025, just before Time magazine's Person of the Year selection, the account shinewreck placed a $30,000 bet on AI as the person of the year, with its historical starting balance being only $1.49. This trading profile fits the anomalous excessive betting of "capital focus." The next day, Time magazine's cover revealed that AI and its "creators" were selected.

Original link: https://t.me/PolyBeats_Bot/46

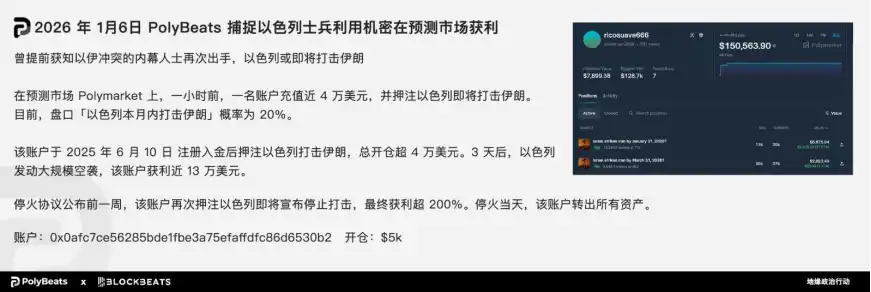

Case 4: Successfully captured Israeli soldiers capitalizing on secrets in prediction markets

One month ahead of the Israeli authorities in capturing military insiders: On February 12, 2026, Israeli officials confirmed the arrest of two military-related persons holding secrets betting in prediction markets and profiting, and announced the account Rundeep, formerly known as ricosuave666.

As early as January 6, 2026, PolyBeats identified the account ricosuave666 as an insider just one hour after it placed a wager on the Israel-Iran conflict and reported on the account's past insider trading and the latest relevant developments in the channel.

Original link: https://t.me/PolyBeats_Bot/156

These cases cover various fields such as technology, geopolitics, and the entertainment industry, demonstrating that the method does not rely on a single event type and possesses a certain ability for cross-topic generalization. By systematically analyzing on-chain behavior, transforming the capital and trading actions in the prediction market into interpretable intelligence signals, presents a new path of practical value.

In the future, with more data accumulation and model iteration, this method is expected to become an important bridge connecting blockchain data analysis and news discovery mechanisms.

Rhythm BlockBeats has integrated the Polymarket platform into its PC and mobile app, becoming the world's first media platform to connect to prediction markets. In the latest real-time news, readers can directly view relevant market data on Polymarket, helping them gain a more comprehensive interpretation and understanding of the news.

The true challenge of prediction markets is not accuracy, but the fact that it is dismantling a long-assumed order within the content industry and regulation: only information that is allowed to be spoken becomes "public knowledge." When everything can be wagered, secrets are no longer confined solely by institutions, professional ethics, or media blockades, but must constantly contend with price discovery mechanisms.

In moderate scenarios, this means that television show endings, award distributions, and business decisions will be known to the market in advance; while in extreme scenarios, it even touches on war and geopolitical conflicts: people can gain "military intelligence" level information through betting by soldiers on the front lines, directly influencing the direction of the war, even altering reality.

This report has proven that we can find hidden real information in prediction markets, and we firmly believe that a reality changed by prediction markets is about to occur.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。