Compiled by: Jerry, ChainCatcher

Performance of Crypto Spot ETFs Last Week

US Bitcoin Spot ETF Net Outflow of $1.208 Billion

Last week, the US Bitcoin spot ETFs experienced a net outflow over four days, totaling $1.208 billion.

Six ETFs were in a net outflow state last week, with the outflows primarily coming from IBIT, FBTC, and ARKB, which saw outflows of $581 million, $438 million, and $129 million, respectively.

Data Source: Farside Investors

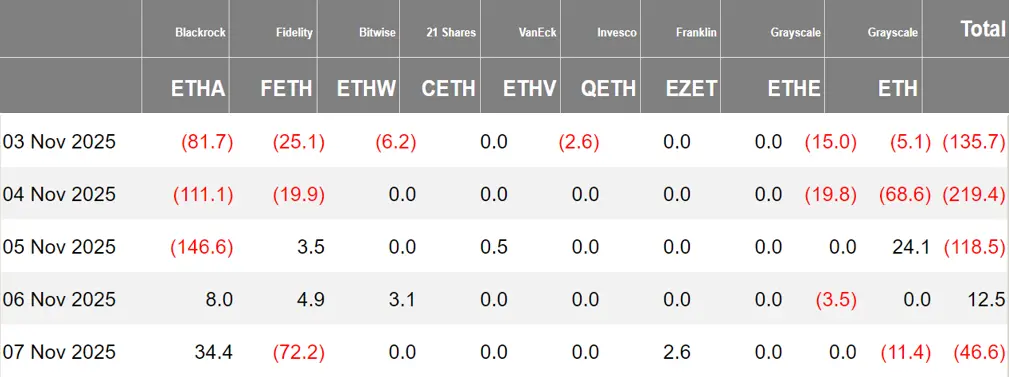

US Ethereum Spot ETF Net Outflow of $507 Million

Last week, the US Ethereum spot ETFs experienced a net outflow over four days, totaling $507 million.

The outflow last week mainly came from BlackRock's ETHA, with a net outflow of $2.97 billion. Six Ethereum spot ETFs were in a net outflow state.

Data Source: Farside Investors

Overview of Crypto ETF Developments Last Week

21Shares Submits 8(A) Form to US SEC for Proposed XRP Spot ETF

Bloomberg ETF analyst Eric Balchunas posted on social media that 21Shares has submitted a new 8(a) form to the US SEC to issue its XRP spot ETF. This application will undergo a 20-day review period.

JPMorgan Significantly Increases Bitcoin ETF Holdings, Bullish on BTC Rising to $170,000

According to The Block, JPMorgan significantly increased its Bitcoin ETF holdings in the third quarter, with BlackRock's iShares BTC Trust (IBIT) shares growing by 64% to 5.28 million shares, valued at approximately $333 million. Meanwhile, the bank nearly cleared its Ethereum ETF holdings, retaining only 66 shares, valued at about $1,700.

JPMorgan analysts predict that Bitcoin's price could reach $170,000 within the next 6-12 months.

Franklin Templeton's XRP ETF Listed on DTCC Website, Code: XRPZ

According to Cryptopolitan, Franklin Templeton's XRP exchange-traded fund (ETF) has appeared on the website of the US Depository Trust & Clearing Corporation (DTCC), with the trading code XRPZ. This listing is merely a preparatory step and does not indicate approval or the start of trading.

It is reported that Franklin Templeton submitted a revised S-1 registration statement on Tuesday, including a shortened "8(a)" clause, which allows registration to automatically take effect after 20 days without direct approval from the SEC, unless the agency intervenes.

Grayscale Announces Waiver of Management Fees for Solana ETF Until Fund AUM Reaches $1 Billion

According to official news, digital asset investment platform Grayscale Investments announced on the X platform that it will waive the sponsor fees for the Grayscale Solana Trust ETF (code: GSOL) and reduce related fees during the staking period for up to three months, or until the fund's assets under management (AUM) reach $1 billion, whichever comes first.

The fund has now staked up to 100% of SOL, offering a staking yield of 7.23%. The fee waiver policy applies to both new investors and existing GSOL investors.

Franklin Templeton Submits XRP ETF S-1 Update, Aiming for Launch This Month

Bloomberg analyst James Seyffart stated that Franklin Templeton has submitted an update to the XRP ETF S-1, shortening the 8(a) clause, with the goal of launching this month.

BlackRock to Launch Bitcoin ETF in Australia in Mid-November

BlackRock has confirmed it will launch the iShares Bitcoin ETF (ASX:IBIT), providing Australian investors with a more convenient way to access cryptocurrencies in the local market. BlackRock stated that the ETF is expected to be listed on the Australian Securities Exchange in mid-November 2025. BlackRock noted that IBIT will charge a management fee of 0.39%, providing investors with a low-cost, regulated channel to access Bitcoin through the packaged iShares Bitcoin Trust (NASDAQ code: IBIT) listed in the US, without the technical and operational complexities of directly holding the asset.

Previously, the Australian Securities and Investments Commission (ASIC) updated its guidelines last week, reclassifying most digital assets, including stablecoins, wrapped tokens, security tokens, and digital asset wallets, as financial products. Although Bitcoin itself does not constitute a financial product, services and products that include this cryptocurrency can be considered financial products under the updated guidelines of Information Sheet No. 225.

Grayscale Lists Shiba as One of the Assets Meeting Spot ETF Listing Criteria

Grayscale Investments has listed Shiba Inu as one of the cryptocurrencies meeting the listing criteria for US spot exchange-traded funds (ETFs). Grayscale mentioned this in a recent blog post titled "Market Byte: Here Come the Altcoins." Following the launch of Bitcoin and Ethereum ETFs, Grayscale acknowledged that the process for launching similar ETF products for altcoins like Shiba Inu has been streamlined.

Reports indicate that the launch of the first Bitcoin spot exchange-traded product (ETP) took over a decade—from the initial proposal in 2013 to final approval in January 2024. However, the SEC's approval of the Generic Listing Standards (GLS) framework has accelerated the launch of cryptocurrency exchange-traded products (ETPs).

Bitwise and Grayscale Disclose XRP and Dogecoin Spot ETF Fees, May Launch Without SEC Approval

According to The Block, Bitwise plans to charge a fee of 0.34% for the Bitwise XRP ETF, while Grayscale will charge 0.35% for its XRP and Dogecoin ETFs. Both companies have previously launched SOL spot ETFs, with Bitwise raising approximately $56 million on its first day.

Against the backdrop of the US government shutdown and limited SEC personnel, institutions can submit S-1 forms without "delaying amendments" and meet listing standards, allowing products to automatically take effect after 20 days, meaning some crypto ETFs may be listed without prior SEC approval. NovaDius stated that the first XRP spot ETF may be seen within two weeks.

Views and Analysis on Crypto ETFs

Bloomberg ETF Analyst: Bitwise Dogecoin Spot ETF to Launch Within 20 Days

Bloomberg ETF analyst Eric Balchunas posted on social media that Bitwise is conducting 8(a) operations for its Dogecoin spot ETF, which essentially means they plan to take effect within 20 days unless intervened.

Citi: Weakness in Cryptocurrency Due to Slowing ETF Inflows and Weakened Risk Appetite

According to CoinDesk, Wall Street bank Citi stated that while the stock market is performing strongly, the cryptocurrency market has weakened again recently, with significant liquidations in October undermining investor confidence.

The sell-off has led to reduced risk appetite among leveraged traders and new spot ETF investors, who have withdrawn their investments. Recently, inflows into US spot Bitcoin ETFs have significantly decreased, weakening a key factor supporting the market's optimistic outlook.

Citi had originally predicted that ETF inflows would continue as financial advisors increased Bitcoin exposure, but now the momentum has stalled, and market sentiment may remain subdued.

On-chain data has also added to the cautious atmosphere, with a decrease in the number of large Bitcoin holders and an increase in the number of small retail wallets, along with lower financing rates, indicating that long-term investors may be selling off, and leverage demand is also weakening. Technically, Bitcoin has fallen below the 200-day moving average, which may further suppress demand. Citi also linked Bitcoin's weakness to tightening bank liquidity. The report concluded that the flow of funds into spot ETFs is a key signal for observing shifts in cryptocurrency market sentiment.

Bloomberg senior ETF analyst Eric Balchunas posted on the X platform stating that despite price pullbacks, Bitcoin's price has increased by 300% since BlackRock submitted its Bitcoin ETF (IBIT) application 30 months ago, equivalent to nearly 80% annualized returns, so there is no need for the market to worry.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。