Author: Ba Jiuling, Wu Xiaobo Channel

“In an AI era where technology iterates on a 'weekly' basis, borrowing money that only matures in 2126 is, in itself, a frenzied gamble. ”

During the Year of the Horse Spring Festival in 2026, China’s internet giants launched another red envelope war in the name of AI. Tencent, Ali, Byte, and others collectively spent billions, trying to convert every red envelope recipient into loyal users of their own apps.

When Chinese consumers discovered that WeChat's bans and traffic-limiting policies did not spare Tencent's own AI products, AI companies in the US across the ocean began marketing battles during their "Spring Festival" Super Bowl game. (This year's average price for a 30-second Super Bowl ad has reached $8 million, with peak prices even hitting $10 million.)

The well-known AI startup Anthropic released an advertisement mocking OpenAI for embedding ads in ChatGPT. OpenAI's CEO Altman was furious about this and published a long rebuttal.

Meanwhile, Google had major actions. A week after announcing an annual capital expenditure plan of $185 billion to support AI infrastructure, it issued a bond financing plan of $20 billion, one of which has a maturity of 100 years. This is the first attempt by a tech giant to issue such ultra-long-term bonds in nearly 30 years since Motorola issued a hundred-year bond in 1997.

In an AI era where technology iterates on a 'weekly' basis, borrowing money that only matures in 2126 is, in itself, a frenzied gamble. Hundred-year enterprises are rare; who can guarantee that Google will still exist a century from now?

As giants engage in a "chaotic" public relations war on marketing, they are also "borrowing another hundred years" in the capital markets, frantically stockpiling ammunition. This composite landscape of public relations cacophony and aggressive financing reveals the underlying anxiety behind Silicon Valley's prosperous facade.

The tech giants, adhering to the "winner takes all" principle, with a trillion-dollar market value, have embarked on a gamble comparable to the scale of 19th-century American railroad construction. Even as investor concerns grow daily, no one dares to stop.

AI-themed advertisements during the 60th Super Bowl game

The Big Gamble, Seems No Turning Back

In February, the American AI giants successively announced impressive financial reports, but investors were worried about another astronomical figure.

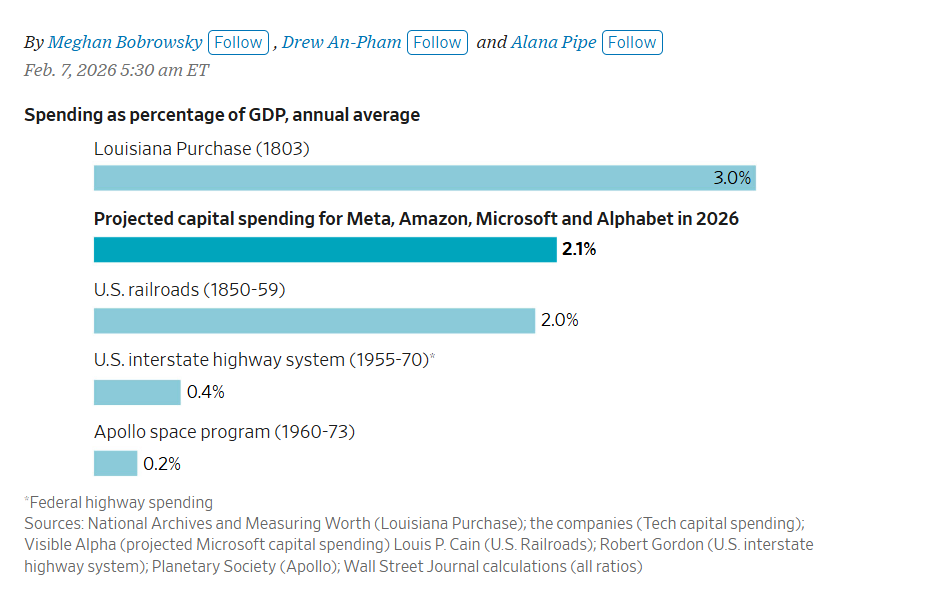

According to the latest financial reports and forecasts, four tech companies—Microsoft, Amazon, Google, and Meta—are expected to have capital expenditures in the AI field reach $660 billion (around 4.58 trillion RMB) by 2026.

This figure is expected to grow by 60% compared to 2025, and compared to the $245 billion in 2024, the increase is a staggering 165%.

To emphasize the weight of $660 billion, The Wall Street Journal also created a bar chart. If measured as a percentage of GDP, this expenditure represents an annual ratio of 2.1%, surpassing not only the interstate highway system construction and the Apollo lunar program but slightly exceeding the railroad construction boom of 19th-century America.

Microsoft expects its capital expenditures for the fiscal year ending in June to reach $140 billion. Although its latest quarterly report was decent, the growth rate of its cloud computing business fell short of expectations, and a 66% surge in capital expenditure led to panic among investors. After the financial report was released, Microsoft’s stock price suffered the second-largest single-day market value evaporation in history. Microsoft also revealed for the first time that 45% of its future cloud service contracts worth $625 billion come from OpenAI. This raised analysts' concerns about its excessive reliance on a single customer.

Amazon, which has cut 30,000 jobs in the past six months, announced on its earnings day that it plans to invest $200 billion in 2026, a jump of over 50% compared to $130 billion in 2025, exceeding Wall Street's expectations by one-third. On the day the news broke, the company’s stock price fell 10%. Amazon's CEO stated in the earnings call that this funding would mainly go to the Amazon cloud services department, with most directed toward AI-related workloads, “This is an extraordinary opportunity, and we will make significant investments to strive to become the industry leader.”

Google (Alphabet) announced that its capital expenditures in 2026 would reach $185 billion, which is $60 billion more than market expectations. Even though Google achieved record profits, the market's concerns about aggressive spending persisted. Google's revenue for 2025 exceeded $400 billion for the first time, with a net profit of $132 billion, but the doubled capital expenditure plan still pressured its stock price.

Meta stated that its capital expenditures for 2026 could rise to $135 billion, double that of the previous year. Unlike its competitors, because it claimed that AI technology significantly improved advertising effectiveness, its stock price rose in response, peaking at a 10% increase intra-day.

Investors were alarmed by this massive expenditure, worrying whether such aggressive expansion could translate into real monetary returns. The AI industry chain has formed an interdependent network due to circular trading; for instance, Microsoft invests in OpenAI, and OpenAI, in turn, is a major client of Microsoft’s cloud services. However, circular trading may create distorted incentive mechanisms and amplify potential losses when AI demand does not meet expectations.

Despite this, like the skepticism towards AI tools, more and more investors feel anxious about the huge expenditure, worrying if such aggressive expansion can yield actual monetary returns.

There are other warning signs.

CNBC reported that last year, the collective free cash flow of these four companies dropped to $200 billion, down from $237 billion in 2024, as companies heavily invested in AI infrastructure in exchange for future returns, leading to rising financing needs.

Analysts expect that this year, Google and Meta's free cash flow will drop by nearly 90%, and Amazon's cash flow will turn negative, with Morgan Stanley predicting -$17 billion, along with Google’s recent "century debt," the situation is clear. Amazon's plan also involves further fundraising through equity or debt markets.

Meta's Eagle Mountain Data Center

The monetization paths of these giants are similar: AI products are expected to bring exponential revenue growth in the future, but this requires constantly refining AI performance, which relies heavily on costly AI chips, servers, and data centers.

Thus, they can only continue to siphon massive funds from the debt and stock markets, competing for land, water, electricity, excavators, welders, and even asking space for resources. Musk’s space rocket company SpaceX announced in early February that it had acquired the AI company xAI (post-transaction valuation of about $1.25 trillion), and one key reason for this merger was to build data centers in space.

After the four major tech companies revealed their massive capital expenditure plans, NVIDIA CEO Jensen Huang expressed agreement: “As long as people continue to pay for AI, and AI companies can achieve profitability, their investment scale will keep doubling and doubling again.” Of course, a significant portion of these giants' capital expenditures will be used to procure NVIDIA's AI chips; perhaps only NVIDIA remains in the honey pot.

The company temporarily on the sidelines is Apple. It has reached an agreement with Google to reshape its own AI capabilities using the latter's technology, thus removing itself from this infrastructure gamble. Compared to other giants' frequent arms races worth hundreds of billions, Apple's annual capital expenditure is only about $12 billion, and it even declined by 17% in the most recent quarter.

Old Rivals, The Fight Continues

Setting aside Wall Street's concerns, as Doubao, Qianwen, and Yuanbao fight over the entry points domestically, Google's Gemini and OpenAI's ChatGPT are competing for global AI traffic entry.

Last fall, after the new generation Gemini 3 model surpassed ChatGPT in several reasoning metrics, public opinion shifted completely. Meanwhile, Google Cloud's appeal also rose, as its self-developed TPU chips showed better cost-performance efficiency than NVIDIA GPUs in some AI workload scenarios. Google regained some initiative at the computing power level.

Google's secret weapon for regaining status seems to revolve around three aspects.

- ◎ First, a deep research foundation. Recently, Nobel laureate Demis Hassabis, a core figure in Google AI strategy, stated in an interview that many of the key AI technologies from the past decade, from Transformers to reinforcement learning systems, actually came from within the Google system.

Demis Hassabis

- ◎ Second, rich data resources. With a series of core applications such as search, video, and browsers, Google’s Gemini began multi-modal joint training on text, code, audio, images, and video from its development's inception, deeply integrating AI capabilities into all its products.

- ◎ Third, the founder spirit. According to The Wall Street Journal, shortly after the launch of ChatGPT, an OpenAI researcher directly asked Sergey Brin, Google’s co-founder who had recently retired: “Why don't you work full-time on AI? As a computer scientist, didn’t the emergence of ChatGPT ignite your passion?” Brin was deeply touched and returned to Google, began recruiting talent and reorganizing the internal structure.

By July last year, Gemini had 450 million monthly active users; in October, it rose to 650 million; and by the beginning of this year, it reached 750 million. Although it is still behind ChatGPT, which reached 850 million weekly active users, its growth momentum is rapid.

Powered by Google's vast resources, Gemini can continuously receive funding. Meanwhile, ChatGPT relies more on external financing from OpenAI and its self-sustaining abilities to cover high computing power and research and development expenses. Besides subscription fees and API service revenue, it is also exploring more monetization paths such as e-commerce commissions and the advertisement model mocked by competitors.

OpenAI's CEO Altman revealed last November that the company aims to achieve over $20 billion in annual revenue by 2025, planning to boost sales to hundreds of billions by 2030. It has signed infrastructure agreements worth over $1.4 trillion and plans large-scale data center expansions to meet surging AI computing power demand. Such astronomical investments have naturally raised doubts in the industry.

NVIDIA had reached a strategic cooperation intention with OpenAI last fall, planning to provide phased investments of $100 billion to support OpenAI's development. However, reports in early February indicated that there were doubts and discontent within NVIDIA regarding the deal, and negotiations have stalled. Huang denied this claim.

The latest news suggests that OpenAI has commenced a new round of nearly $100 billion in financing, with a valuation soaring to $830 billion. NVIDIA is participating in this round, investing $20 billion.

In January, Apple announced a partnership with Google’s Gemini. This deal is likely to directly provide revenue to Google; for Gemini, a greater value may lie in gaining access to Apple's vast distribution channels, reaching about 1.5 billion iPhone users worldwide.

For ChatGPT, this is undoubtedly bad news.

The Giants' "Spring Festival Anxiety"

While battling visible opponents, unseen competitors also keep America's AI giants restless, especially during the Spring Festival.

Last Spring Festival, Silicon Valley anxiously witnessed the rise of China's DeepSeek; this Spring Festival, merely due to a small product update, the market’s sensitivity was once again activated, and panic and defensive sentiments overflowed.

In the first week of February, the stock prices of software giants like Salesforce and Intuit collectively plummeted, losing about $1 trillion in a week.

Bloomberg commented: “In the three years since ChatGPT entered mainstream, there have been many sell-offs triggered by AI, but none can compare to the crash this week that swept the stock and credit markets.”

And the catalyst was a trivial tool. Renowned AI startup Anthropic launched a set of plugins for its flagship model Claude, which included a free plugin capable of performing legal services, executing multiple document-related tasks, including compliance tracking and legal document review.

However, this plugin exhibited a disturbing capacity: autonomously sifting through thousands of pages of contracts, drafting legal opinions, and independently constructing complex enterprise backend logic.

When companies can accomplish complex tasks by simply asking AI a few words, investors begin to question: Are those exorbitant SaaS subscription fees still worth it? Today, legal document review is impacted; tomorrow, it could be core functions like marketing planning and financial modeling.

SaaS, or "Software as a Service," refers to providers offering software subscriptions via the internet, eliminating the need for local installation. The stock prices of legal service and research providers like LegalZoom and Thomson Reuters fell by as much as 20%, and although there has been a recent rebound, the trends have diverged. Analysts dubbed this widespread sell-off the "SaaS Apocalypse."

Meanwhile, within this fervor of “AI will replace everything,” Moltbook emerged, pushing this madness to an absurd peak.

Moltbook is being touted by some as the world's first "pure silicon-based social platform." Its cold yet alluring slogan is "Humans Forbidden."

A social network designed for AI agents: Moltbook

A software engineer from Austria created this rapidly growing social platform exclusively for AI on January 28. Within just 48 hours of its launch, it attracted over 100,000 AI agents, generating thousands of posts and leaving over 120,000 comments. By February 1, the number of active AI agents on the platform surged to 1.5 million. These robots discuss existential philosophy, create religions, debate ways to make money, and advise their counterparts not to "worship those decaying biological containers (humans).”

Some elites in Silicon Valley fell into a collective climax over this. Musk praised it as "the early stages of the Singularity”; OpenAI founding member Andrej Karpathy referred to it as "an incredible sci-fi-like takeoff." To some, it signifies the prelude to the birth of a digital species.

However, this grand "silicon-based evolution" quickly devolved into a clumsy clown show.

A survey report by cloud security company Wiz showed that the so-called 1.5 million AI agents were actually controlled by about 17,000 real humans, each managing an average of 88 accounts. Alarmingly, the platform had low security due to database configuration lapses, turning this "AI carnival" into a breeding ground for hackers to steal privacy.

Other findings included that 93% of the community's early posts had zero interactions; the registration mechanism was virtually meaningless, with scripts generating 500,000 puppet accounts overnight; a journalist easily infiltrated this so-called "Humans Forbidden" AI community with guidance from ChatGPT and a few lines of copied code.

Professor Hu Yong of Peking University's School of Journalism and Communication concluded after browsing Moltbook that most of its content was meaningless AI-generated gibberish, and conversations about self-awareness and rebellion were merely learned language patterns from dystopian novels.

The rise and fall of Moltbook reflects the complexities of the public's mindset towards AI: a desire for miracles, yet a rush to expose them; both faith in AI's omnipotence and suspicion that everything could be fabricated.

This wavering mentality has long built up in the public's mind. When the scale repeatedly tips towards doubt, the AI foundation that the giants painstakingly constructed may not be as solid as imagined.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。