Written by: Bitpush News

The GENIUS Act has been passed and signed by Trump, marking the official birth of the first stablecoin regulatory framework in U.S. history. The crypto market is cheering, but if you think this is just good news for USDC and USDT, you underestimate its profound significance. The real protagonist is Ethereum. It is quietly transforming into a "global settlement network for on-chain dollars," and ETH is being revalued as the settlement fuel for future finance. A structural bull market is thus initiated.

1. The Evolution of Dollar Stablecoins: From Shadow Currency to National Machinery

1.1 Starting Point: A Shadow System "Born" from Bitfinex

Stablecoins are not a new concept. After the 2008 financial crisis, the "liquidity sovereignty" of the dollar was infinitely amplified globally. The first stablecoin in the crypto industry—USDT—was launched by Tether, an affiliate of Bitfinex, in 2014.

Its original intention was simple and direct:

"To give you dollars in the crypto world."

It had no central bank backing and no auditing mechanism. It merely stated, "I have dollars in my account, so I dare to issue tokens pegged 1:1." USDT began to circulate but was never accepted by regulators.

However, the market loved it. It solved a key problem—users needed a "safe haven," an asset that could stabilize pricing and temporarily store value between high-volatility assets like Bitcoin and Ethereum.

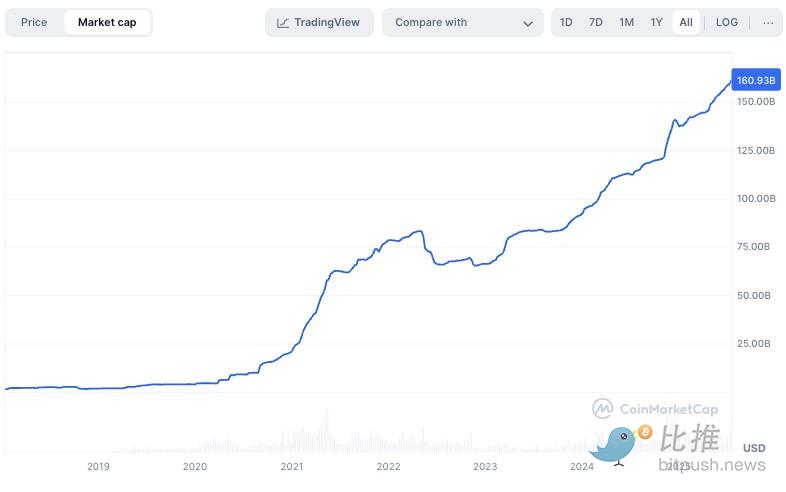

Thus, the use of stablecoins grew rapidly. Its market capitalization skyrocketed from $2 billion in 2018 to over $160 billion in 2025, with on-chain dollar transaction volumes even surpassing Visa's cross-border settlement volumes at one point in 2022.

1.2 The Libra Incident: The Awakening of the Federal Reserve

In 2019, Facebook launched Libra (later renamed Diem), aiming to build a global stablecoin system anchored to a basket of currencies.

"Global users can pay with Libra, bypassing SWIFT, banks, and even the dollar."

This terrified the Federal Reserve: if a tech platform could control the global circulation of dollars, what was the need for a central bank?

The U.S. Congress urgently halted Libra and began to consider—what we need is a regulated stablecoin system that we can control.

1.3 The Birth of the Act: GENIUS, Bringing Stablecoins into the "System"

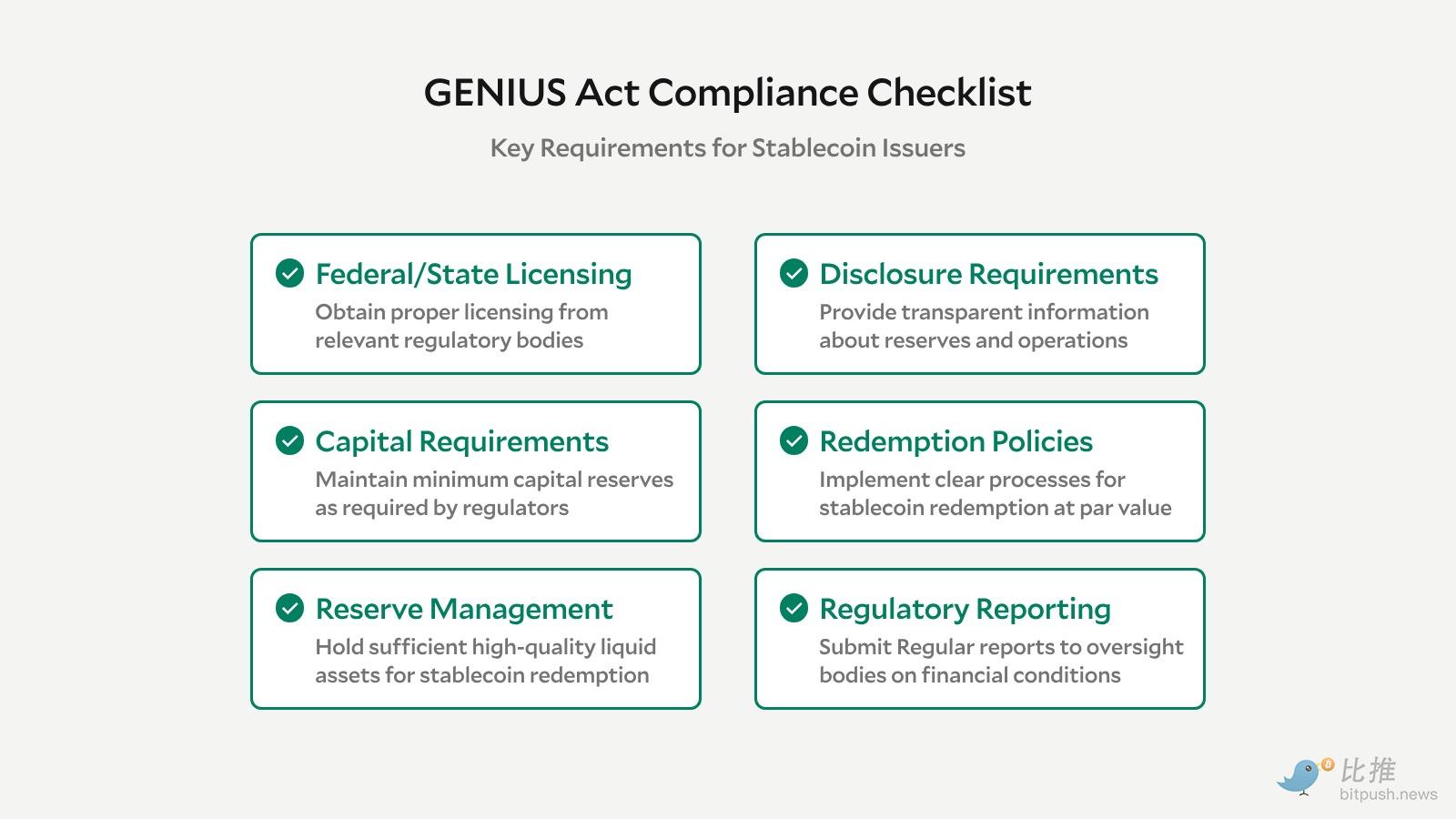

In 2025, the GENIUS Act was passed with a high vote in Congress. The core contents are as follows:

Stablecoins must be 100% backed by U.S. Treasury bonds or cash;

Issuers must obtain federal or state licenses;

Payment of interest is prohibited to eliminate shadow banking;

After a three-year transition period, illegal issuance of stablecoins will be banned;

Overseas issuers must register, be regulated, and cannot serve U.S. users otherwise.

This is not a regulatory "ban," but a formal "national takeover."

It legalizes dollar stablecoins and incorporates them into the U.S. financial infrastructure.

2. Ethereum: The "Engine" and "Foundation" of On-Chain Dollars

2.1 Which Chain Are Stablecoins Running On?

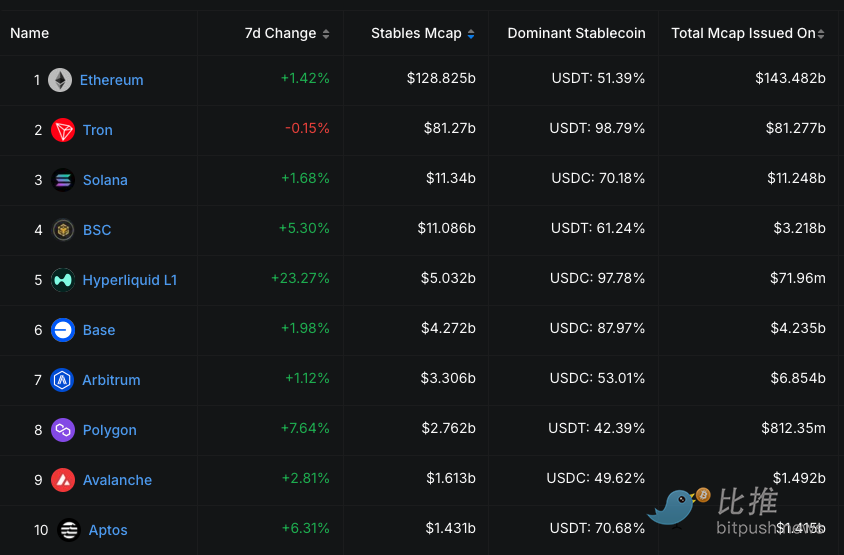

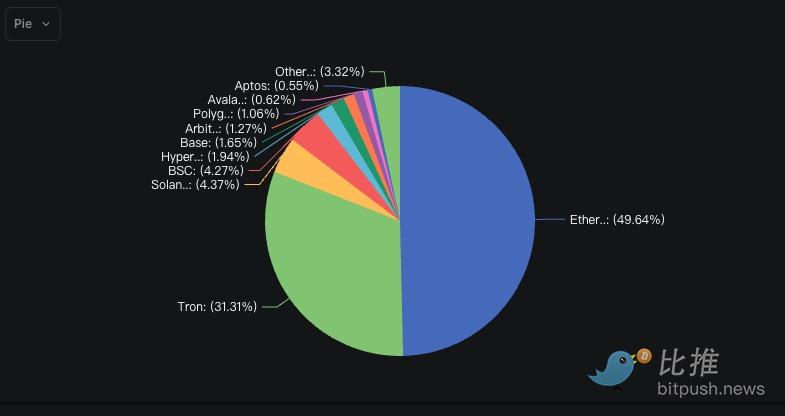

As of July 18, 2025:

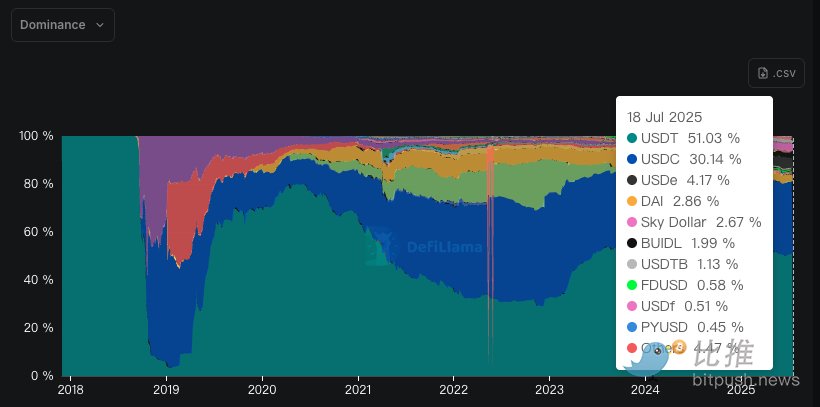

Source: defillama

It can be seen that:

The main battlefield for stablecoins is Ethereum, with a share of 49.61%, primarily used for DeFi, payments, and settlements.

Although Tron has a lot of USDT, it is mainly for internal off-chain transfers within Asian CEXs, rarely entering the real economy.

On Ethereum:

There are USDC settlements for Visa/Stripe/PayPal;

There is DAI, which earns interest through MakerDAO collateral;

There is an RWA collateral system being promoted by PayPal and BlackRock.

Ethereum is the "territory of on-chain dollars," with USDT/USDC being just the surface. Deeper than that is the birth of an on-chain dollar economy.

3. The "Dollar Engine": Revaluation of ETH's Role

3.1 Every On-Chain Dollar Transaction Consumes ETH

Ethereum's core sources of income are:

Gas fees (ETH burning)

MEV (Maximum Extractable Value)

Staking yield

And stablecoins are just right:

High-frequency usage (transfers, settlements, DeFi)

Easy integration (API-based)

Low barriers attracting both retail and institutional users

Stablecoins = Ethereum's killer "fuel consumer."

As of the first half of 2025, stablecoin transaction volume on Ethereum accounted for 61%; ETH burned from stablecoin-related contracts accounted for 48.2% of the total; daily ETH destruction peaks exceeded 3,500 ETH, approximately $12 million.

The more stablecoins are legally used, the scarcer ETH becomes.

3.2 ETH = Digital Settlement Gold? Valuation Model Upgrade

Traditional ETH valuation comes from "on-chain usage × market sentiment." However, after the legalization of stablecoins, the ETH valuation model should be upgraded to:

ETH public chain value = on-chain economic activity (stablecoins × RWA × payments) × Gas burn rate × staking security × on-chain TVL multiple

The more economic activity → the faster ETH burns → the stronger deflation

The larger the TVL → the higher the demand for ETH collateral/staking → the tighter circulation

The more users → the more stable the yield → ETH becomes more like a financial benchmark asset

From "speculative asset" to "settlement layer token," ETH's value will trend towards long-term stability + deflation model.

4. RWA Synergy: On-Chain Dollars Driving Real Assets On-Chain

4.1 What is RWA?

RWA (Real-World Assets) refers to "real assets on-chain":

Government bonds, corporate bonds

Accounts receivable, ownership rights

Shares of stocks and funds

Even real estate shares

If these assets can be bought and sold with "on-chain dollars," it requires a trifecta of stablecoins + smart contracts + settlement networks.

Ethereum is the foundation of this triangle.

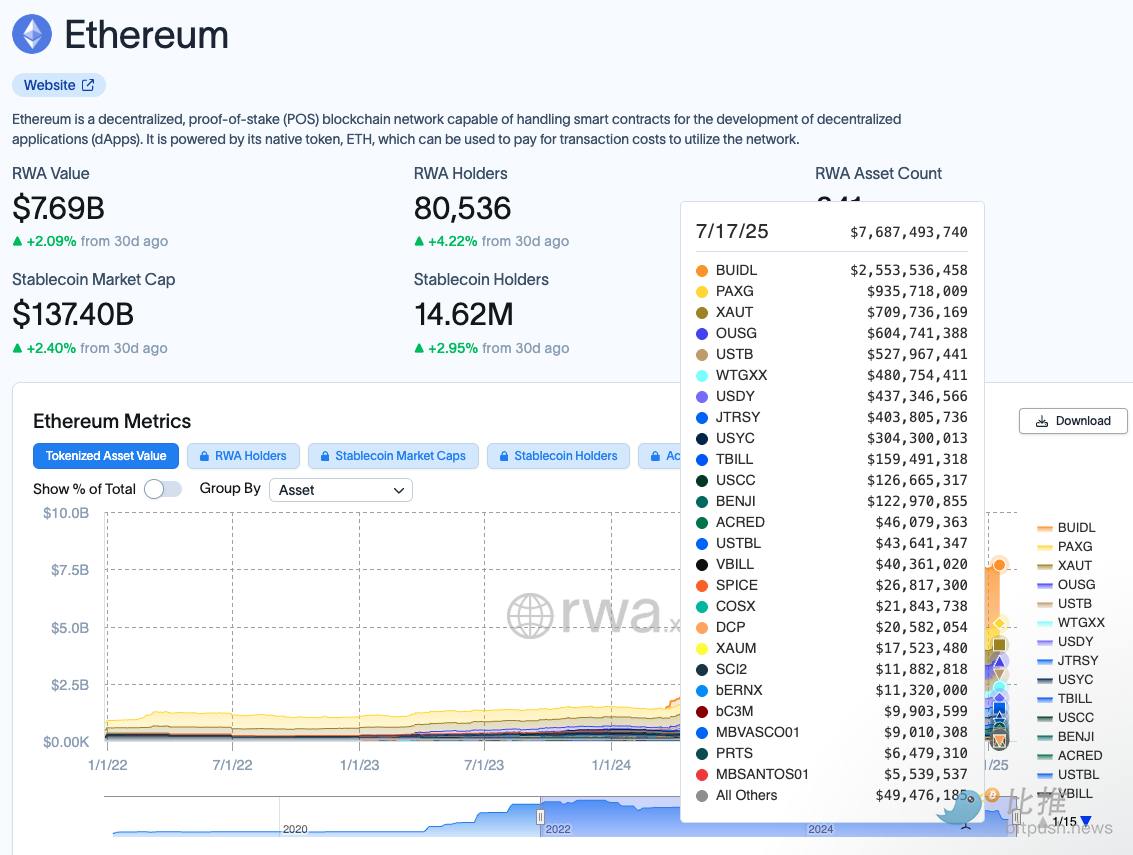

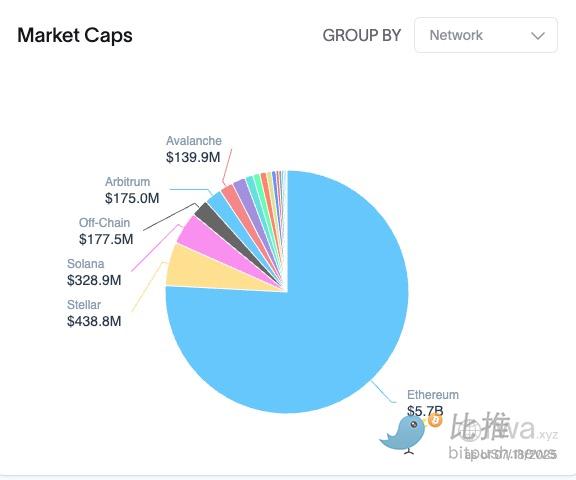

4.2 Experiments Have Already Begun: BlackRock and Franklin Have Gone On-Chain

BlackRock's BUIDL fund holds short-term U.S. Treasury bonds and allows redemptions in USDC;

Franklin Templeton has issued the FOBXX fund, supporting Ethereum settlements;

The on-chain T-Bill custody scale has surpassed $7.5 billion, with over 70% based on Ethereum or its L2.

What does this mean?

Dollars → On-chain stablecoins → Purchase of U.S. Treasury RWA → Gain returns → Continue to flow back on-chain.

Ethereum has become a "digital version of the Federal Reserve system": on-chain minting + on-chain Treasury market + on-chain clearinghouse.

ETH, as a fuel coin, will directly participate in these financial processes:

Providing Gas support;

Being staked as validation nodes;

Serving as the settlement asset for RWA transactions;

ETH is becoming the "credit coal mine" of the financial system.

5. Future Trends: Institutions, Nations, and Regulations Surrounding

5.1 Institutions are Buying, Nations are Watching, Regulations are Greenlighting

BlackRock and Fidelity are deploying RWA and stablecoin funds;

Visa and Stripe are building stablecoin settlement networks;

Circle is applying for a national trust license;

Hong Kong dollar stablecoins and Korean won stablecoins have begun pilot programs;

The European Central Bank and the Bank of Japan are researching a "regulatory-compliant stablecoin framework";

Stablecoins are no longer "Crypto," but the next step in global finance.

5.2 Potential Risks: Five Major Challenges Ethereum May Face

Risk Points

Possible Impacts

L2 Diverting ETH Revenue

More transactions may shift to L2s like Arbitrum and Base, diluting ETH main chain income.

Policy Reversal

If financial giants lose control, stablecoins may be tightened again.

Cross-Chain Challenges

Tron and Solana may squeeze ETH in specific scenarios (like payments and gaming).

Black Swan Events

On-chain dollar hacking attacks or large-scale de-pegging could undermine the foundation of trust.

Centralized ETH Staking

The trend of staking centralization (high Lido share) may affect network neutrality.

Thus, while Ethereum is leading in the "on-chain dollar battle," victory is by no means guaranteed.

6. Conclusion: It's Not Crypto Seeking the Dollar, But the Dollar Coming to Crypto

The GENIUS Act is a signal: "On-chain dollars are part of America's strategy."

Ethereum is the "execution layer" of this strategy. And ETH is the "internal fuel" of this engine.

We are entering a new financial era:

It is not BTC against fiat, but ETH becoming the fiat network;

It is not on-chain against off-chain, but on-chain absorbing off-chain;

It is not Crypto challenging the dollar, but the dollar invading Crypto, transforming into a digital entity.

ETH is not the next BTC; it is the next Swift + clearinghouse + Federal Reserve benchmark.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。