Key Information Overview

This wave of increase has fundamental support: Since early June, ETH has risen nearly 80%, driven by continuous buying from whales, a decrease in exchange circulation, and a significant increase in staking scale.

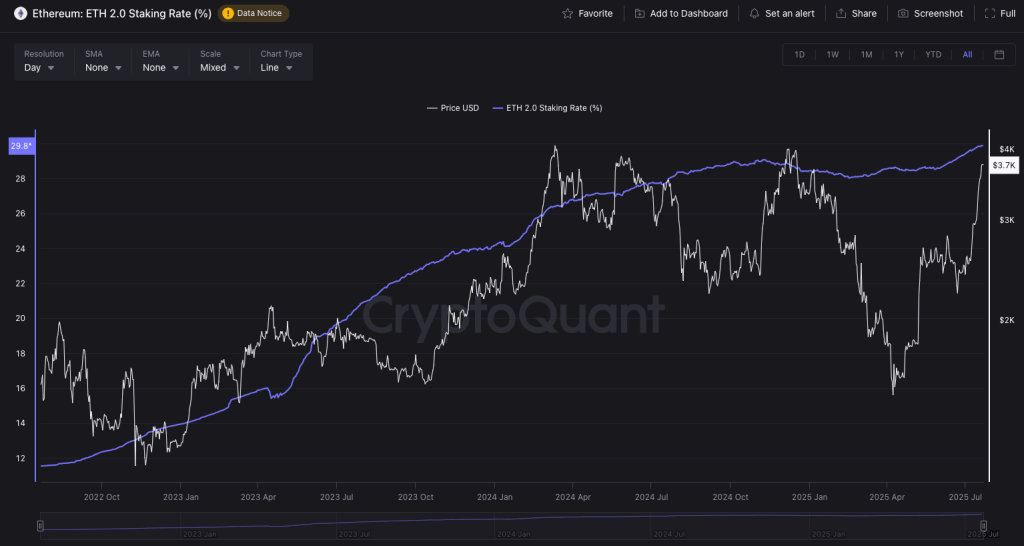

Staking activity continues to accelerate, tightening ETH supply: Currently, about 30% of ETH has been locked for staking, with over 1.5 million ETH added between June and mid-July alone.

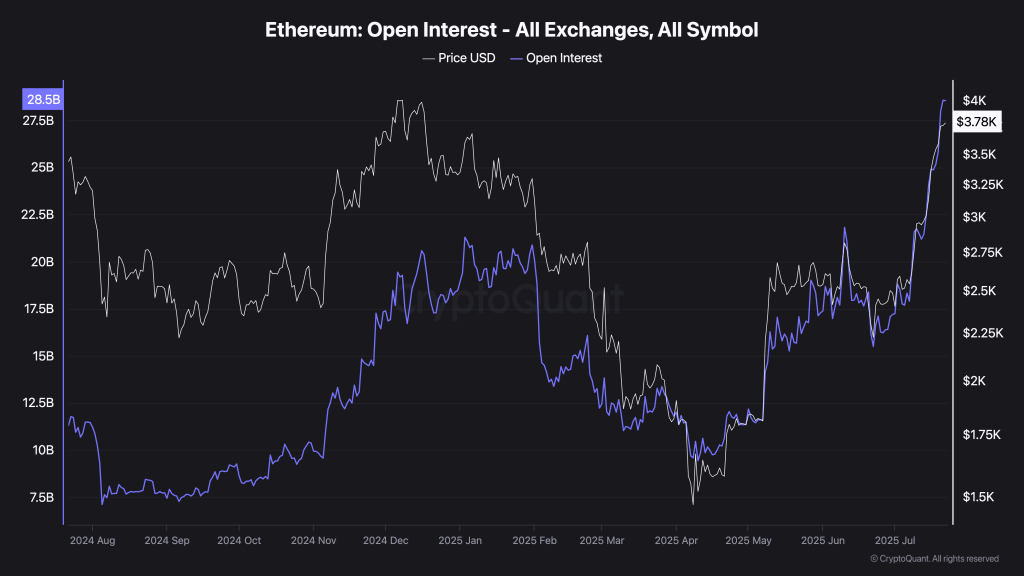

The derivatives market is hot but balanced: The open interest in ETH perpetual contracts has reached an all-time high, while the funding rate remains neutral, indicating that both bulls and bears are relatively rational.

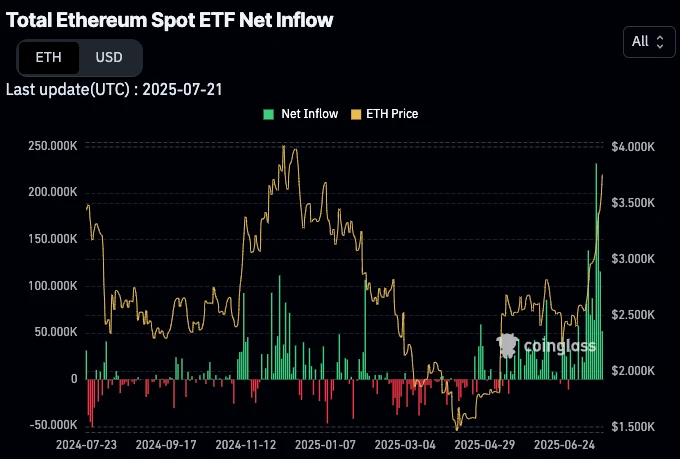

Institutional entry is accelerating: More than 10 listed companies have included ETH in their balance sheets, and the net inflow into Ethereum spot ETFs has exceeded $3 billion in two months.

Ethereum leads the altcoin sector rotation: As Bitcoin's market cap share declines, ETH/BTC continues to strengthen, making Ethereum the core asset in this round of market rotation.

Ethereum is hot again! After several months of silence, ETH suddenly surged in early June, rising nearly 80% in just a few weeks. By mid-July, the price was approaching $4,000, outperforming most mainstream cryptocurrencies.

This is not a bubble inflated by "pump and dump" schemes. On-chain data and market dynamics are sending strong signals: whales are buying in large quantities, the ETH balance on exchanges continues to decline, and the number of participants in staking has reached new highs. Interestingly, the trading volume of ETH perpetual contracts has significantly increased, and some institutions and listed companies have started to allocate real capital to ETH.

In this article, we will analyze the driving forces behind this round of ETH market movement from multiple perspectives, including on-chain data, derivatives trading, and institutional trends. Whether you already hold ETH, are considering participating in ETH staking, or are preparing to trade the ETH/USDT pair, this information will help you see the potential direction of Ethereum.

Article Directory

ETH Price Performance: What is Supporting This Wave of Increase?

On-Chain Signals: Whale Buying, Supply Tightening

Ethereum Staking: The More ETH Locked, the Less Supply

ETH Perpetual Contracts: Leverage Heating Up, but Market Remains Stable

Institutional Entry: More Big Players are Buying ETH

Market Rotation: BTC Market Share Declines, ETH Takes the Lead

Analyst Opinions: How Much Further Can Ethereum Rise?

ETH Price Performance: What is Supporting This Wave of Increase?

Ethereum has truly gained momentum this time. Since early June, ETH has soared from around $2,100 to nearly $3,800. In just the past week, it has increased by over 20%, second only to Dogecoin among the top 20 cryptocurrencies.

This wave of increase has pushed ETH to a critical psychological level: $4,000.

Why is $4,000 So Important?

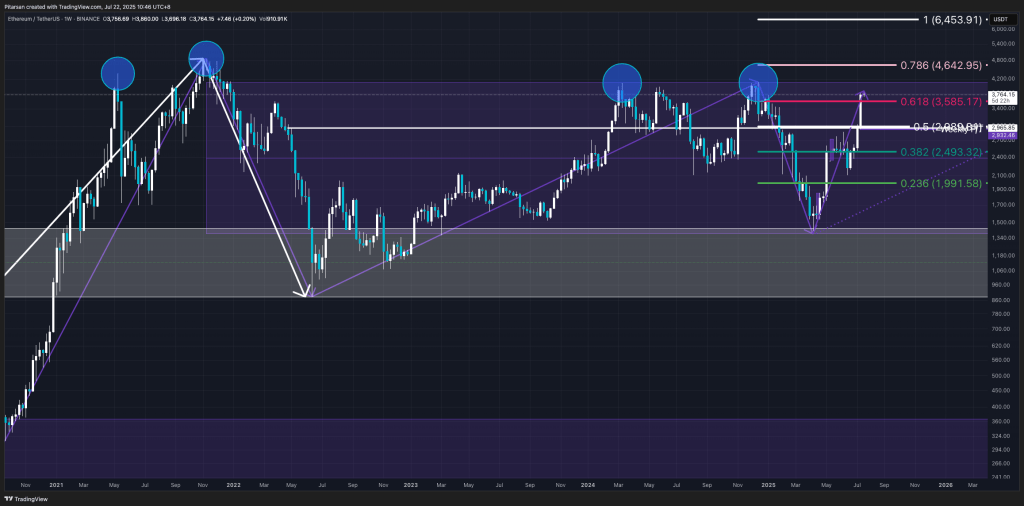

For many traders, $4,000 is not just an integer; it is a very critical technical level in Ethereum's past market movements:

It was one of the historical highs during the 2021 bull market;

ETH has challenged this price level multiple times in 2022 and 2024 but has failed to break through;

If it can break through and hold this level, the next target may be $4,200 to $4,500;

However, if it is suppressed again, it may fall back to the $3,300 to $3,500 range.

Image Credit: TradingView

Technical Signals and Market Sentiment

Short-term indicators (such as the Relative Strength Index (RSI) and Stochastic Oscillator) show that ETH is currently in an "overbought" state. This usually indicates that the price may experience some pullback or consolidation.

However, this wave of increase appears to be more "solid" than previous ones. Several important signals support this view:

On-chain data shows that whales are continuously accumulating;

An increasing amount of ETH is flowing out of exchanges, reducing selling pressure;

A large amount of ETH is being staked, further decreasing the circulating supply.

When both technical and fundamental factors are at play, prices are often more likely to stabilize. This time, Ethereum seems to have truly "solidified its foundation," with the potential to go further.

On-Chain Signals: Whale Buying, Supply Tightening

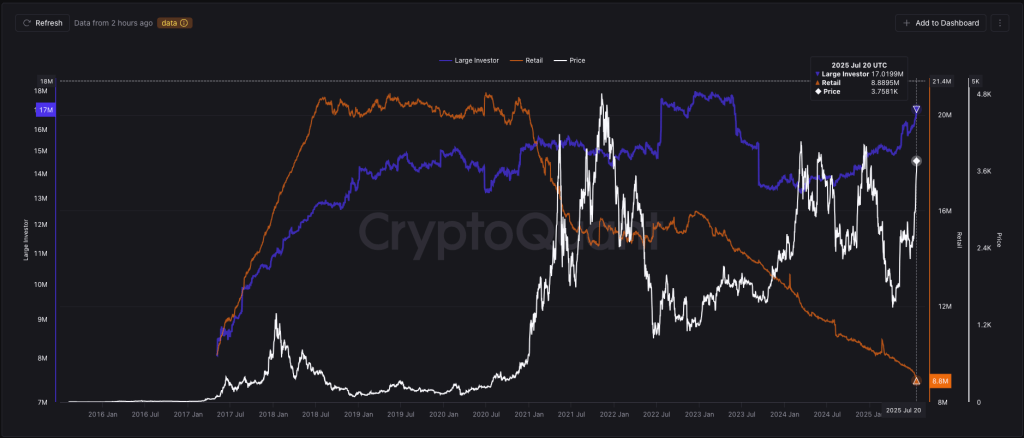

This wave of increase in Ethereum is not without reason; on-chain data has provided very clear signals. The most noteworthy is the movement of "whales"—these large holders are quietly buying large amounts of ETH, providing solid support for this round of market movement.

Whales are Accumulating

In the past two weeks, on-chain data shows that large holders have added over 500,000 ETH in total. One address even bought nearly $50 million worth of ETH at an average price of around $3,700. Such a large-scale buying action is clearly not for short-term speculation but rather for long-term positioning.

Image Credit: CryptoQuant

Continuous Outflow of Funds from Exchanges

After buying, the behavior of these large holders further illustrates the situation—they are not keeping ETH on exchanges but are transferring it to cold wallets or staking contracts, indicating no intention to sell in the short term.

Some key data includes:

The ETH reserves on exchanges have dropped to about 19.7 million, a new low for the year;

On July 16 alone, over 147,000 ETH were transferred out of exchanges;

Throughout July, the trend of net outflow of ETH has been very evident.

When the available ETH on exchanges decreases, even small buying pressure can quickly drive prices up.

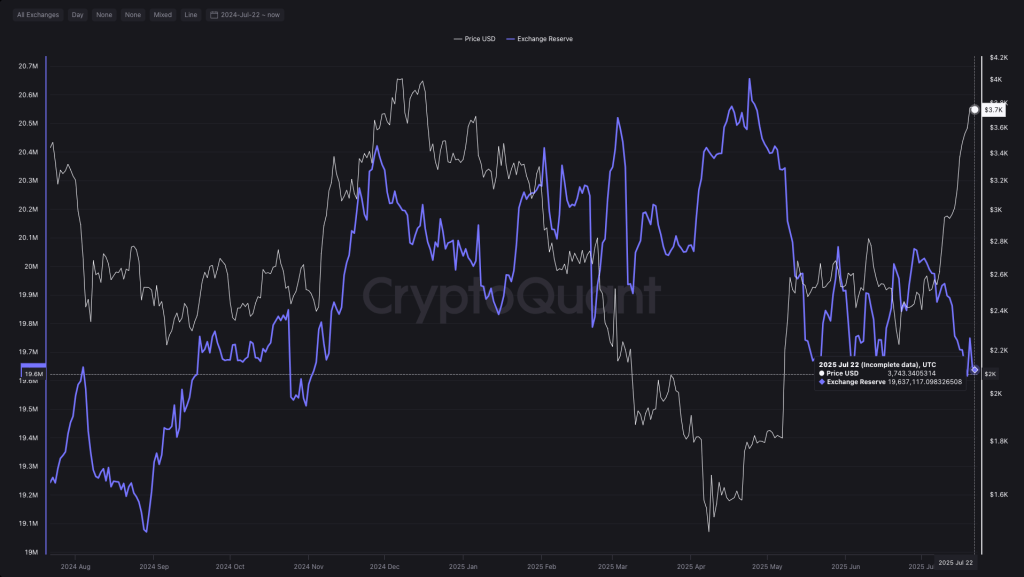

Image Credit: CryptoQuant

Staking is Also a Key Force

It is worth noting that a significant portion of the ETH being transferred out of exchanges is being used for staking. According to on-chain data, nearly 30% of ETH is currently in a staked state, meaning it is "locked up" and cannot circulate in the short term.

In other words:

Whales are buying;

Retail investors are transferring out;

Staking is increasing;

The amount of ETH that can actually circulate in the market is decreasing.

Supply is tightening while demand continues to strengthen, which is the underlying logic driving the increase in ETH prices.

Ethereum Staking: The More ETH Locked, the Less Supply

The recent surge in ETH can be attributed to staking, which has played a crucial role. Since Ethereum fully upgraded to the PoS (Proof of Stake) mechanism, ETH holders can earn rewards through staking. This mechanism is quietly changing the supply and demand dynamics of the entire market.

How Much ETH is Currently Staked?

According to on-chain data, nearly 30% of ETH is locked in staking contracts. This means that this portion of ETH has "exited circulation" and will not appear on exchanges or in buy/sell orders in the short term.

The implications for the market are clear:

The circulating supply in the market has decreased;

Once demand increases, prices are more likely to be pushed higher.

Image Credit: CryptoQuant

Staking Speed is Accelerating

In the past six weeks, the pace of ETH staking has noticeably accelerated:

From June to mid-July, over 1.5 million ETH were newly staked;

Not only retail investors are participating, but many institutions are also entering the market;

Some listed companies have even allocated part of their corporate funds to stake ETH.

This is not just about "earning interest" but is a vote of confidence in the future development of Ethereum.

What Does This Mean for ETH Prices?

The essence of staking is locking up assets. As more ETH is locked into validator nodes, the available supply on exchanges naturally decreases. Coupled with continuous buying from whales and rising market enthusiasm, the supply side is tightening, providing a foundation for price increases.

If this trend continues, ETH may become increasingly "scarce" in the future. Those looking to buy at a low price may indeed have to "wait in line."

ETH Perpetual Contracts: Leverage Heating Up, but Market Remains Stable

This surge is not only driven by the ETH spot market but also significantly contributed by the derivatives market. Data shows that the open interest in ETH perpetual contracts has continued to rise, reaching an all-time high. On one day, trading volume even surged by 27%, indicating that traders' confidence in entering the market is increasing.

Image Credit: CryptoQuant

What is the Market Sentiment?

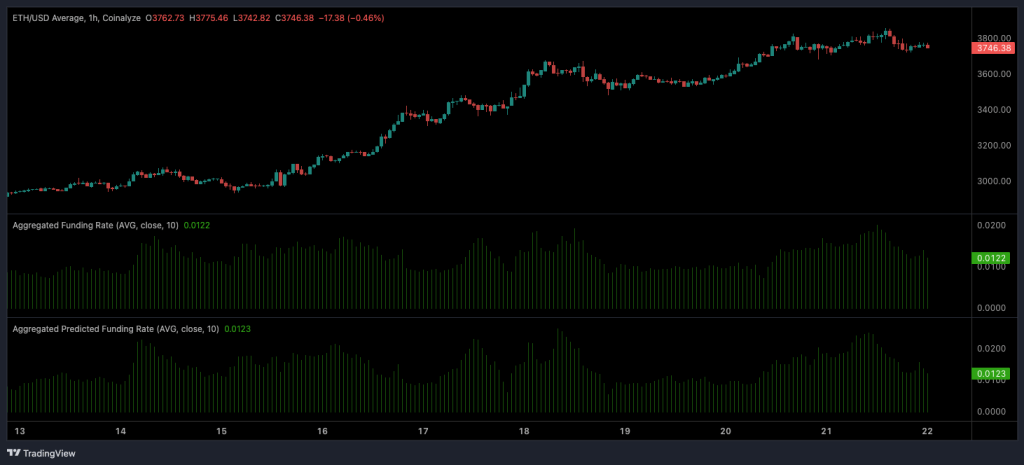

Generally, an increase in open interest indicates that leverage is building up. However, this time, the funding rate has provided a different signal. Simply put, the funding rate is the interest settlement mechanism between long and short positions.

Current funding rate conditions:

Close to neutral, with no significant bias towards long or short;

Both long and short positions are evenly matched;

The market structure is relatively healthy and not extreme.

In other words, the current market is not as "one-sided" as before, nor is it as prone to cascading liquidations as during high-leverage periods.

Image Credit: Coinalyze

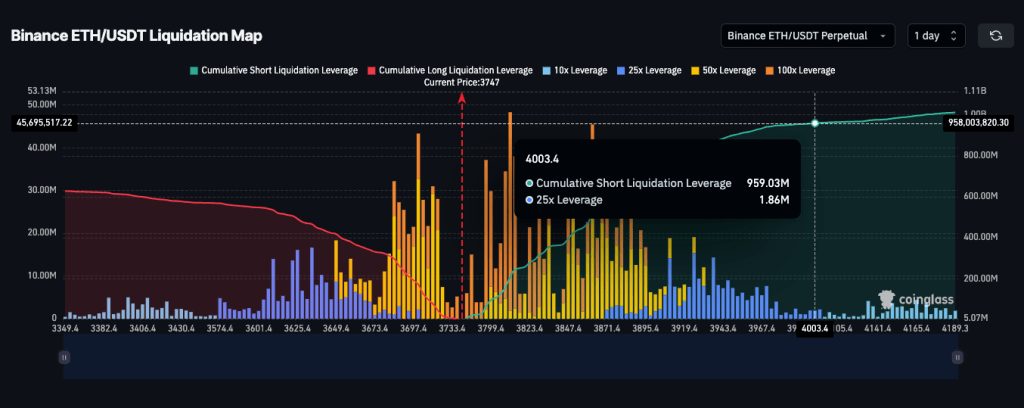

Is There a Possibility of "Short Squeeze"?

Although ETH has risen significantly, the number of short positions has not decreased noticeably. Moreover, as we approach the end of July, there are signs that short positions are still increasing.

According to Coinglass data, if ETH breaks $4,000 on the Binance platform, nearly $960 million in short positions could be liquidated. These forced buy orders could further push prices higher.

Image Credit: Coinglass

Summary

The ETH perpetual contracts market is currently quite active, but it has not reached an "overheated" state. As long as market sentiment remains cautious and the funding rate stable, the futures market may continue to serve as a "booster" for price increases without immediately triggering a market reversal.

Institutional Entry: More Big Players are Buying ETH

Ethereum is gaining increasing favor among institutional investors. In the past, corporate treasuries preferred Bitcoin, but now ETH is rapidly "rising" to become a new focus. More and more companies, funds, and even publicly listed enterprises are incorporating Ethereum into their investment portfolios.

Companies are Buying ETH in Bulk

Since May, more than 10 publicly listed companies have disclosed that they have increased their holdings of ETH on their balance sheets, including:

SharpLink Gaming

BitMine Immersion

BTCS Inc.

Bit Digital

These companies have collectively purchased over 570,000 ETH. More importantly, some companies have even raised funds specifically to buy ETH. This operation is clearly not for short-term speculation but reflects a long-term bullish outlook on Ethereum's value.

ETH-Related Investment Products are Also Hot

Investment tools focused on ETH are also continuously attracting capital. Ethereum spot ETFs and other products have seen a net inflow of over $3 billion in the past two months. For institutional investors, these products provide a compliant and convenient way to allocate ETH without needing to self-custody assets.

The mainstream American trading platform Coinbase also reflects this trend. The ETH price on the platform has long been above the global average, indicating that many institutions are willing to pay a "premium" to buy coins—as long as the platform is legitimate and the funds are secure, they are willing to pay a bit more.

Image Credit: Coinglass

ETH is Becoming "Digital Infrastructure"

DeFi, staking, NFTs, real assets on-chain… ETH is permeating every aspect of blockchain. Many institutions no longer view ETH as just an ordinary altcoin, but rather as the "operating system of the digital world."

This change in perception is also attracting more long-term capital into the market. If you are an investor with a long-term view on blockchain development, now is the time to reassess ETH's strategic position.

Market Rotation: BTC Market Share Declines, ETH Takes the Lead

The recent surge in ETH is not happening in isolation; it is part of a broader "rotation" in the entire crypto market. Bitcoin's market position is quietly changing, with more and more capital flowing into Ethereum and other quality projects.

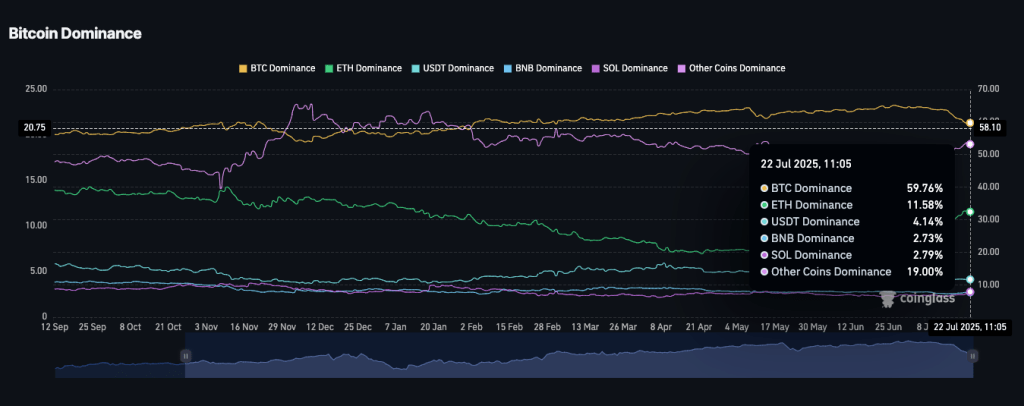

BTC Market Share is Shrinking

In the past month, Bitcoin's market cap share has dropped from about 65% to nearly 60%. In a multi-trillion-dollar market, this 5% change is quite significant.

Generally, when BTC's market dominance declines, it indicates that capital is flowing from Bitcoin to other crypto assets.

Image Credit: Coinglass

ETH Takes the Lead, Center Stage

In this rotation, one of the biggest beneficiaries is ETH. You can see several very clear signals:

The ETH/BTC exchange rate rose nearly 32% in a week;

As investor interest in altcoins rises, ETH's market share has also increased;

Among the top ten mainstream coins, ETH's performance is second only to Dogecoin, far surpassing other coins.

These all indicate that capital is shifting towards ETH, and investors' focus is moving away from Bitcoin.

Image Credit: TradingView

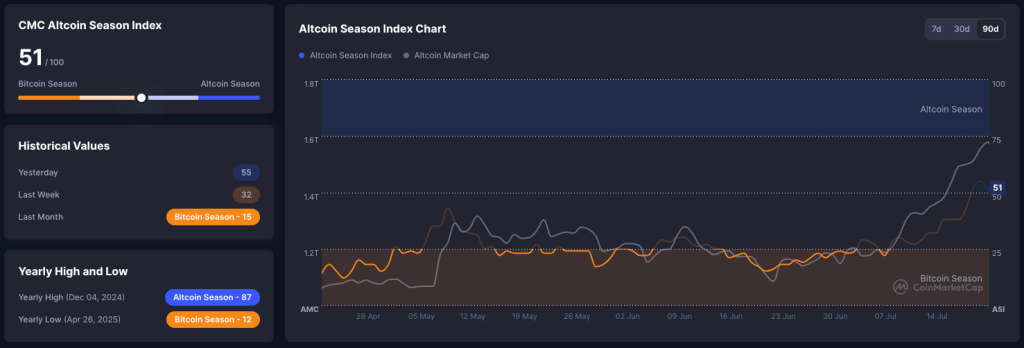

Is an Altcoin Rally Brewing?

Not only ETH, but the entire altcoin sector's market cap has risen by over 40% since mid-June. This is a very clear signal indicating that market risk appetite is returning.

At the same time, the "Altcoin Season Index" has also surpassed 50, entering a range that historically often signals the start of an altcoin bull market.

Image Credit: CoinMarketCap

Why is ETH Always at the Forefront?

As the most mature and ecologically deep altcoin, ETH often leads the first wave of price increases during market rotations. It has strong liquidity, high recognition, a stable ecological foundation, and an increasing long-term holding ratio among holders.

If this market rotation continues to evolve, ETH is likely to continue leading the entire altcoin sector, with other projects following suit.

Analyst Views: How High Can Ethereum Go?

The recent rise in ETH has prompted many institutions and analysts to provide their predictions. In the short term, most are focused on a key level: $4,000.

Short-Term Focus: Watch for a Break of $4,000

Currently, there are generally two judgments in the market:

If ETH successfully breaks through $4,000, the next target may be $4,200 to $4,500;

However, if it is suppressed again, it may retrace to consolidate between $3,200 and $3,500.

From a technical perspective, the RSI (Relative Strength Index) and stochastic oscillator both indicate that ETH is somewhat "overbought," and a short-term pullback may occur. However, considering the ongoing inflow of on-chain data and institutional capital, many view a short-term pullback as an opportunity to accumulate.

Medium to Long-Term Outlook: Divergence Emerges

Looking further ahead, analysts' predictions are starting to diverge:

Tom Lee from Fundstrat believes that by the end of 2025, ETH could reach $10,000 to $15,000;

Crypto blogger Wu Says Blockchain is even more optimistic, directly calling for a target of $15,000 to $20,000;

More conservative institutions predict that by the end of this year, ETH could rise to $6,000 to $8,000 if staking and institutional demand remain stable.

What Factors Do Analysts Focus On?

Regardless of the predictions' highs or lows, the core logic that everyone values is roughly consistent:

Whales are continuously accumulating, and the ETH inventory on exchanges is steadily decreasing;

The ETH staking rate is rising, and the circulating supply is decreasing;

Inflows into spot Ethereum ETFs are stable, and overall market capital is shifting from BTC to ETH and other quality altcoins.

Even the most conservative models generally agree that the long-term outlook for ETH is much healthier than it was a year ago.

Final Thoughts: Is ETH Really Ready to Break $4,000?

This wave of Ethereum's market movement does not appear to be a flash in the pan. The price trend is strong, on-chain data is supportive, and institutions are continuously entering the market. Whether it is whales accumulating, corporate staking, or the surge in ETH contract trading volume, all indicate one thing: the market is pushing upward.

However, the $4,000 "hurdle" remains a key psychological and technical level. If it breaks through smoothly, it may open the door to a larger cycle of new market movements; but if it is suppressed again, we may have to wait a bit longer.

So whether you want to trade ETH/USDT, participate in ETH staking to earn rewards, or hold ETH for the long term, this moment is very critical. Ethereum is no longer just a "smart contract platform"; it is gradually evolving into the underlying structure of the blockchain economy, poised to stand alongside Bitcoin in the crypto world.

The coming weeks may determine whether ETH has the "staying power" for this round of movement. But one thing is certain: Ethereum is not slowing down, and the capital and users behind it are not idle.

Frequently Asked Questions (FAQs)

- Why has ETH risen so quickly in mid-2025?

This surge is the result of multiple overlapping factors, including continuous accumulation by whales, decreasing ETH inventory on exchanges, a significant increase in staking volume, and institutional-level buying from ETFs and corporate funds.

- How important is the $4,000 level for ETH?

$4,000 has been a strong resistance level in 2021, 2022, and 2024, failing to break through effectively each time. If it can successfully hold above this level, it may further push towards $4,200 or even $4,500.

- How will ETH staking affect prices?

Staked ETH will be locked up and unable to circulate in the market. Currently, about 30% of ETH is staked, significantly reducing the available liquidity in the market. Once demand rises, prices will naturally be pushed higher.

- Is leverage being heavily used in this market movement?

Although contract open interest has reached new highs, the funding rate remains neutral, indicating that market sentiment is relatively rational, with low risks of excessive leverage and manageable liquidation risks for now.

- How do analysts view ETH's future?

In the short term, if it breaks $4,000, the target is set towards $4,200–$4,500. Predictions for the medium to long term vary widely, ranging from a conservative $6,000 to an optimistic $20,000, primarily depending on the pace of staking growth, institutional inflows, and the overall market environment.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。