Written by: 1912212.eth, Foresight News

On July 14, the food consumption brand listed company—DDC Enterprise Limited (hereinafter referred to as DDC) saw its stock price rise to $20.8, setting a new historical high. In April of this year, its stock price was still hovering around $2, marking an increase of more than 10 times in just three months. Interestingly, a traditional food listed company, which could be considered unrelated, has ventured into the realm of crypto assets, choosing to establish a Bitcoin reserve, a move that is quite rare globally.

In 2025, the global financial market is undergoing significant changes, with BTC solidifying its status as "digital gold," and its price once breaking the $100,000 mark, continuously setting new historical highs. Some forward-thinking companies have already noticed the future potential of BTC, and various tech giants have begun to bet on BTC. DDC's decision to enter the crypto asset space earlier this year raises questions: Is it a case of Bitcoin's wave permeating traditional industries after sweeping through tech giants, or is it that traditional industries are uniquely positioned to ride the wave alongside Bitcoin? What underlying factors are driving the company's strategy, and what impacts does it bring?

Traditional Food Company Bets on BTC

DDC Enterprise Limited (NYSE: DDC) is a U.S. listed company founded in Hong Kong and headquartered in New York, originally known as DayDayCook, focusing on Asian-flavored ready-to-eat foods and cooking brands. The company was established in 2012 by Norma Chu, initially starting with online cooking videos, accumulating 200 million views within two years, and later expanding into pre-packaged foods, catering services, and brand licensing, boasting 80 million active users and 18 million paying customers globally.

As a traditional food enterprise, DDC's core business focuses on supply chain optimization and brand marketing. The company has several sub-brands, such as DayDayCook and Nona Lim, covering the Asian and North American markets. The 2024 financial report shows that its revenue mainly comes from e-commerce and offline retail, with a gross margin stable at over 30%.

In the face of the global wave of new technologies, the value of Bitcoin can no longer be ignored. In May 2025, the company released a "Bitcoin Declaration," officially positioning BTC as a core reserve asset. This is not a spur-of-the-moment decision but rather a long-term strategy by founder Norma Chu regarding the digital economy.

With its bet on BTC, DDC has become one of the few Chinese companies listed in the U.S. that have the courage to execute this strategy.

The Narrative of Digital Gold Becomes More Solid, Global Listed Companies Rush into BTC

The total supply of Bitcoin is fixed at 21 million, with over 19 million already mined, and its supply curve is similar to that of gold. In an era of fiat currency overproduction, Bitcoin's ability to preserve and increase value has become a consensus among investors. Since the beginning of this year, Bitcoin's price has risen from a low of $70,000 to around $120,000, an increase of over 70%. If calculated from its initial price since its inception in 2009, the return has reached an astonishing 47.2 million times (with the issuance price calculated at $0.0025). If calculated from the $2 price after the Mt. Gox incident, the return reaches 59,000 times. Even if calculated from Bitcoin's peak of $32 in June 2011, the return is still 3,687 times.

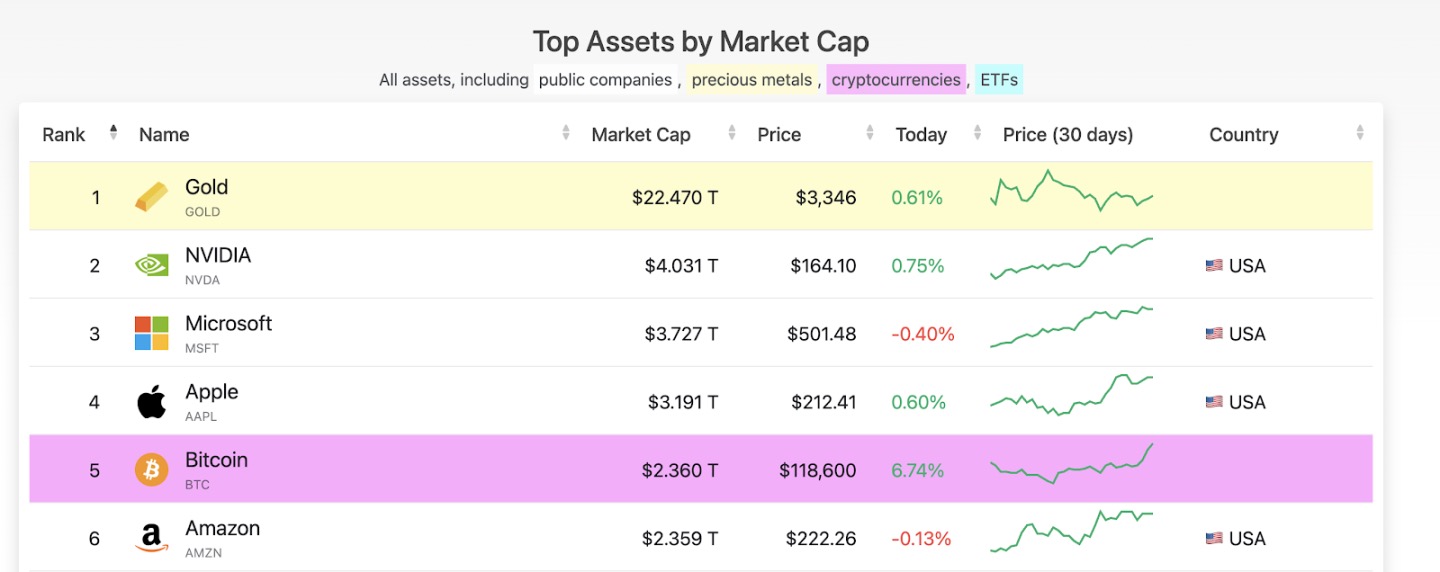

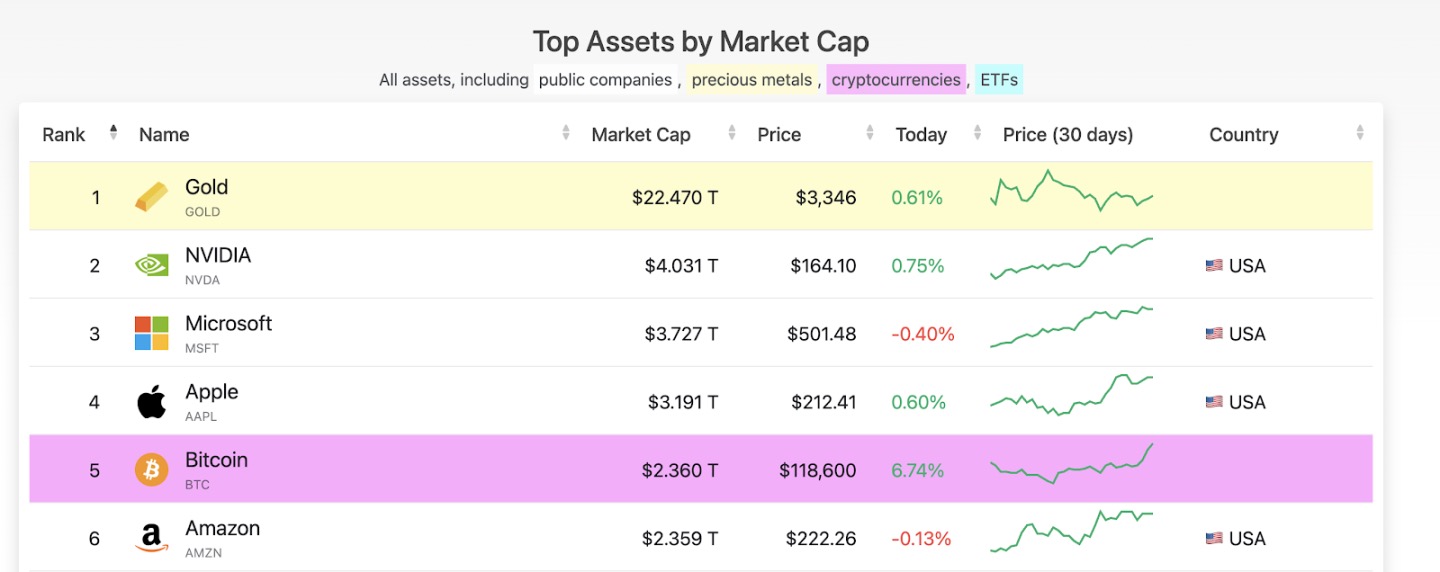

After breaking through $118,600, Bitcoin's market capitalization has surpassed Amazon, reaching $2.36 trillion, second only to Apple, and all of this has occurred in just 16 years.

Moreover, the approval of Bitcoin spot ETFs has opened up more channels for traditional companies to enter the market, and Trump, as a crypto advocate, has paved the way for regulatory policies. Crypto assets led by BTC have entered the mainstream market. With high liquidity, consensus, and the ability to hedge against fiat currency depreciation risks, BTC has become the top choice for wealthy listed companies.

Data from bitcointreasuries shows that as of July 17, 2025, the top 50 companies holding BTC include mining companies, exchanges, tech giants, and more, spanning regions such as the U.S., Japan, the U.K., Canada, and Hong Kong.

The rush of listed companies to acquire BTC has become an unstoppable trend.

Additionally, one major benefit of holding BTC is the indirect enhancement of the company's brand image. It is well-known that the tech and crypto circles are often associated with youth, trends, and the acceptance of new ideas, which overlaps with the interests of young food enthusiasts. Given that consumers are young and tech-savvy, DDC is in a favorable position to enter the Bitcoin asset management field.

Consistency and Diversification

Purchasing Bitcoin is the preferred choice for hedging against inflation. In 2025, global inflation rates remain high, with the U.S. CPI exceeding 4%, making the long-term depreciation trend of the dollar difficult to reverse.

DDC is using Bitcoin to hedge against the risk of dollar depreciation while diversifying its investment portfolio. Traditional food companies have stable cash flows but low returns. Since 2011, Bitcoin has achieved an approximate 72% compound annual growth rate (CAGR), surpassing all major asset classes, including stocks, real estate, and gold. Between 2011 and 2023, Bitcoin's performance outpaced 99.9% of global stocks, with the only exception being Nvidia.

Diversification is also reflected in risk management. DDC has partnered with Hex Trust and BitGo to provide custody and trading services, ensuring asset security.

Since its listing, the company has seen significant growth in both total revenue and gross income. Data shows that in 2023, total revenue reached 205 million RMB, a year-on-year increase of 14.42%, while gross income was 48.12 million RMB, a year-on-year increase of 18.81%. In 2024, total revenue reached 273 million RMB, a year-on-year increase of 3%, with gross income reaching 51.63 million RMB.

Behind the data growth, diversification in asset allocation has become necessary. DDC positions Bitcoin as a long-term, stable, strategic reserve asset for value preservation and shareholder returns.

From Zero to 368 BTC in 45 Days, Aiming for the Top Ten Globally by Year-End

Compared to other market players, DDC's acquisition quantity may not be the largest, but its growth rate is rapid.

In March 2025, DDC officially announced the establishment of a Bitcoin reserve, subsequently purchasing 21 BTC in May, and by June 21, the total holdings increased to 138 BTC, with an average cost of about $78,500 per coin. On July 7, DDC's Bitcoin holdings reached 368 BTC, with a current value of approximately $43.424 million based on Bitcoin's price of $118,000.

Norma Chu disclosed in a letter to shareholders that the goal is to accumulate 500 BTC within six months and reach 5,000 BTC within three years. Notably, in a recent blog interview on X, Norma set a higher strategic goal for the company, planning to purchase enough BTC to enter the top 10 globally among listed companies by the end of this year and the top 3 by the end of 2027.

DDC also announced the formation of a professional treasury management team and added members to its cryptocurrency advisory committee, including Adrian Morris, Lemar Ashhar, Magdalena Gronowska, and Tim Kotzman, all of whom are known for their expertise and significant contributions to the Bitcoin ecosystem. With the support of professionals, the company ensures that investment risks are properly managed and all operations remain highly transparent.

In early July, to ensure more funds for purchasing BTC, DDC announced a financing of $528 million, with investors including Anson Funds. This financing is expected to provide DDC with immediate funds to implement its corporate Bitcoin accumulation strategy. The company plans to use the net proceeds from this issuance to purchase Bitcoin.

On July 10, DDC signed a non-binding memorandum of understanding with Animoca Brands, which will invest up to $100 million in Bitcoin to enhance the revenue strategies operated by DDC. Additionally, Yat Siu, co-founder and executive chairman of Animoca Brands, will join DDC's newly established Bitcoin Vision Committee to provide strategic leadership and guidance.

DDC's steady accumulation of BTC and collaboration with the well-known institution Animoca undoubtedly paves the way for its exploration of crypto assets, and the partnership may better leverage the asset effects of BTC and drive the company's stock price steadily upward.

Traditional Finance Background, 10+ Years of Entrepreneurship to IPO, Now Embracing the BTC Wave

Norma Chu, originally from Raoping, comes from a traditional Chaoshan family. Born in Hong Kong, she moved to the United States during her childhood. At the age of 24, Norma joined HSBC Private Banking in Hong Kong, serving as the head of the securities research department in the investment management division. In her spare time, she relieved stress through cooking. At the same time, she discovered that her friends did not enjoy cooking, so she began sharing practical and interesting personal recipes in a visual format, hoping more people could experience the joy of cooking.

She was selected for the "Most Notable Female Entrepreneurs" list by Entrepreneur Magazine for three consecutive years (2017-2019). In 2023, Norma Chu led the company to be listed on the New York Stock Exchange, making her one of the few Asian female entrepreneurs to be publicly listed in the U.S.

Her traditional stock trading and financial background made her more attuned to the rise of the crypto wave. Initially, Norma Chu was skeptical about Bitcoin, but after in-depth research into its economic fundamentals and long-term performance, she recognized that Bitcoin has achieved an approximate 72% annual compound growth rate since 2011, continuing to grow through multiple market cycles and regulatory challenges, demonstrating its resilience and long-term investment value.

From stock trading to cooking, and from cooking to buying BTC, she firmly followed her inner choice and took bold action.

In her Bitcoin Declaration, Norma Chu stated, "Bitcoin is not a speculative asset—it is a strategically significant reserve asset that can provide our company with long-term security against fiat currency depreciation and macroeconomic shocks."

Bitcoin is indeed the bridge.

Conclusion

No matter when one buys, BTC has almost never let down any investor, and in terms of results, it has not disappointed any company that has included it in their reserves. DDC's choice to quickly embrace the trend, Bitcoin, and the underlying crypto technology undoubtedly demonstrates a high level of vision and decisiveness. Leveraging its young user base and trendsetting sensitivity, DDC has successfully utilized its first-mover advantage to establish a Bitcoin asset management reserve.

In the future, as more listed companies follow suit in acquiring BTC reserves, digital gold will reshape the global economic landscape. DDC's forward-looking vision provides valuable insights for investors: in the digital age, innovation and embrace are the keys to survival.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。