Author: 1912212.eth, Foresight News

The cryptocurrency market has recently experienced a significant rebound, with BTC even briefly breaking through $123,000 to set a new historical high. Ethereum has achieved a four-week consecutive increase, successfully surpassing $3,600, and market participation sentiment has notably improved, with the total market capitalization soaring to a historical high of $3.8 trillion. Meanwhile, the intersection of the cryptocurrency market and the U.S. stock market is also witnessing a significant rebound.

Coinbase Global (COIN) saw its stock price reach a high of $415.96 this week, now just a stone's throw away from its historical high of $429. Three months ago, its stock price was as low as $142. As the world's largest cryptocurrency exchange, Coinbase's revenue for 2024 has doubled to $6.6 billion. Although there was a significant decline in Q1 of this year, the recovery in the cryptocurrency market in Q2 may lead to a rebound in its revenue performance.

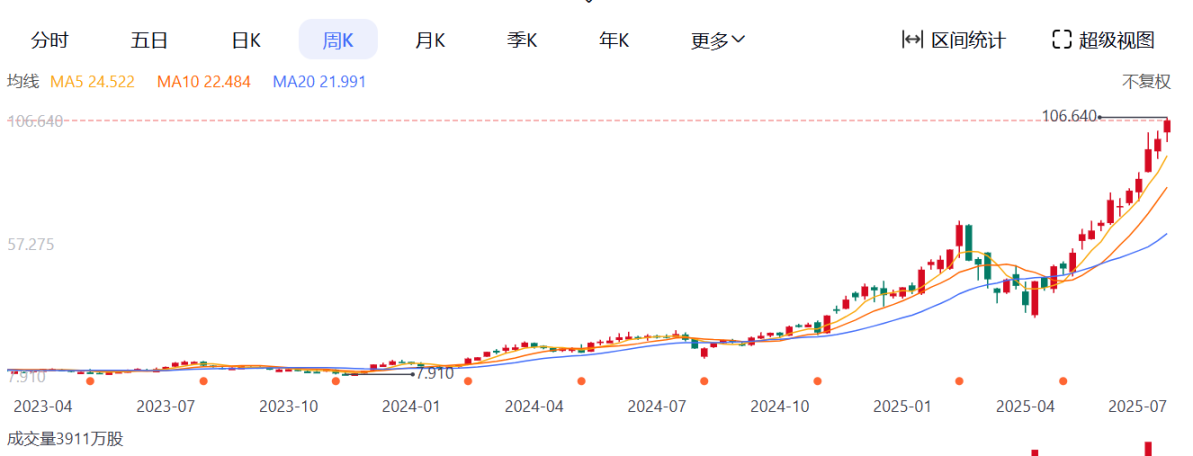

U.S. stocks and the cryptocurrency exchange Robinhood also reached their historical high of $106.64, more than tripling from the low of $30 in April this year.

MicroStrategy (MSTR), known as a "shadow stock" of Bitcoin, has seen its stock price reach $442, with its market capitalization now rising to $126.8 billion, setting a new historical high. In March of this year, its bottom was only $231, marking an increase of nearly 1 time. MicroStrategy is now among the top 100 publicly traded companies in the U.S. by market capitalization, whereas five years ago, its market cap was less than $2 billion. As of July 13, MicroStrategy holds 601,550 BTC, with a total value of approximately $72 billion and an average cost of $66,384. The MSTR stock price has risen accordingly.

Other mining stocks like Marathon Digital (MARA) and Riot Platforms (RIOT) have also seen weekly increases of 5%-10% due to the new highs in Bitcoin. Tesla (TSLA), while not a pure cryptocurrency stock, has also seen its stock price indirectly boosted by its Bitcoin reserves (approximately 10,000 coins), cumulatively rising about 20% since 2025.

The rise of U.S. stocks in the cryptocurrency sector is not only due to the significant increase in the cryptocurrency market but also due to several favorable factors brewing behind the scenes.

Trump to Allow Pension Funds to Invest in Cryptocurrency and Gold

The Financial Times reported that Trump is preparing to open up cryptocurrency, gold, and private equity to the $9 trillion U.S. retirement market, a move that will stimulate a fundamental change in how Americans manage their savings. According to three insiders, Trump is expected to sign an executive order as early as this week to allow alternative investments beyond traditional stocks and bonds in 401k retirement plans. These investments will cover a wide range of asset classes, from digital assets to metals, as well as funds focused on corporate acquisitions, private loans, and infrastructure deals.

The motivation behind this shift is to stimulate economic growth and innovation. The Trump administration believes that traditional retirement investment returns are low (averaging 5-7% annually), while assets like cryptocurrencies have performed strongly over the past decade. The biggest benefits of this policy are the influx of funds and the legitimization of the market. Even a 1-2% allocation of the $9 trillion retirement market to cryptocurrencies could bring in tens of billions of dollars in new funds. Additionally, the policy will accelerate institutional adoption and mainstreaming of cryptocurrencies. Retirement funds are long-term holders, and their entry will reduce market volatility and provide more stable liquidity.

This will directly boost the prices of mainstream cryptocurrencies like Bitcoin, Ethereum, and XRP. Historical data shows that similar events of institutional fund inflows (such as the approval of Bitcoin ETFs) have previously led to BTC prices rising over 30% in the short term. This incremental funding will amplify the bull market effect, driving up Bitcoin prices and stimulating the return of altcoin seasons.

Fed's Rate Cut Expectations for the Second Half of the Year

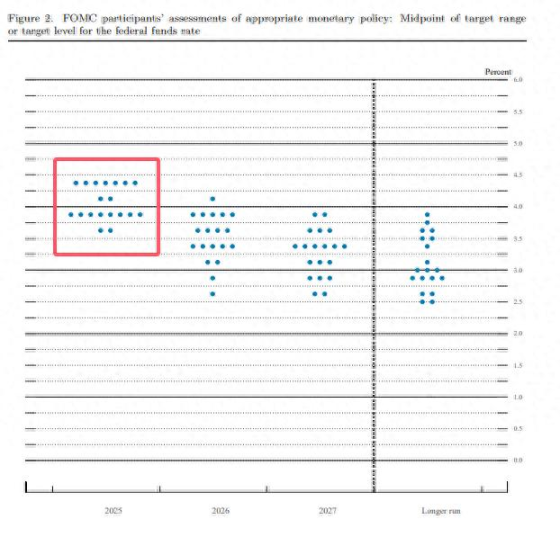

The latest economic forecasts released by the Federal Reserve in June already reflected this. At that time, the forecast indicated that among the 19 officials present, 10 expected at least two rate cuts by the end of this year, while 7 believed there would be no rate cuts until 2025, reflecting differing internal judgments on the inflation outlook.

(Fed's June SEP dot plot)

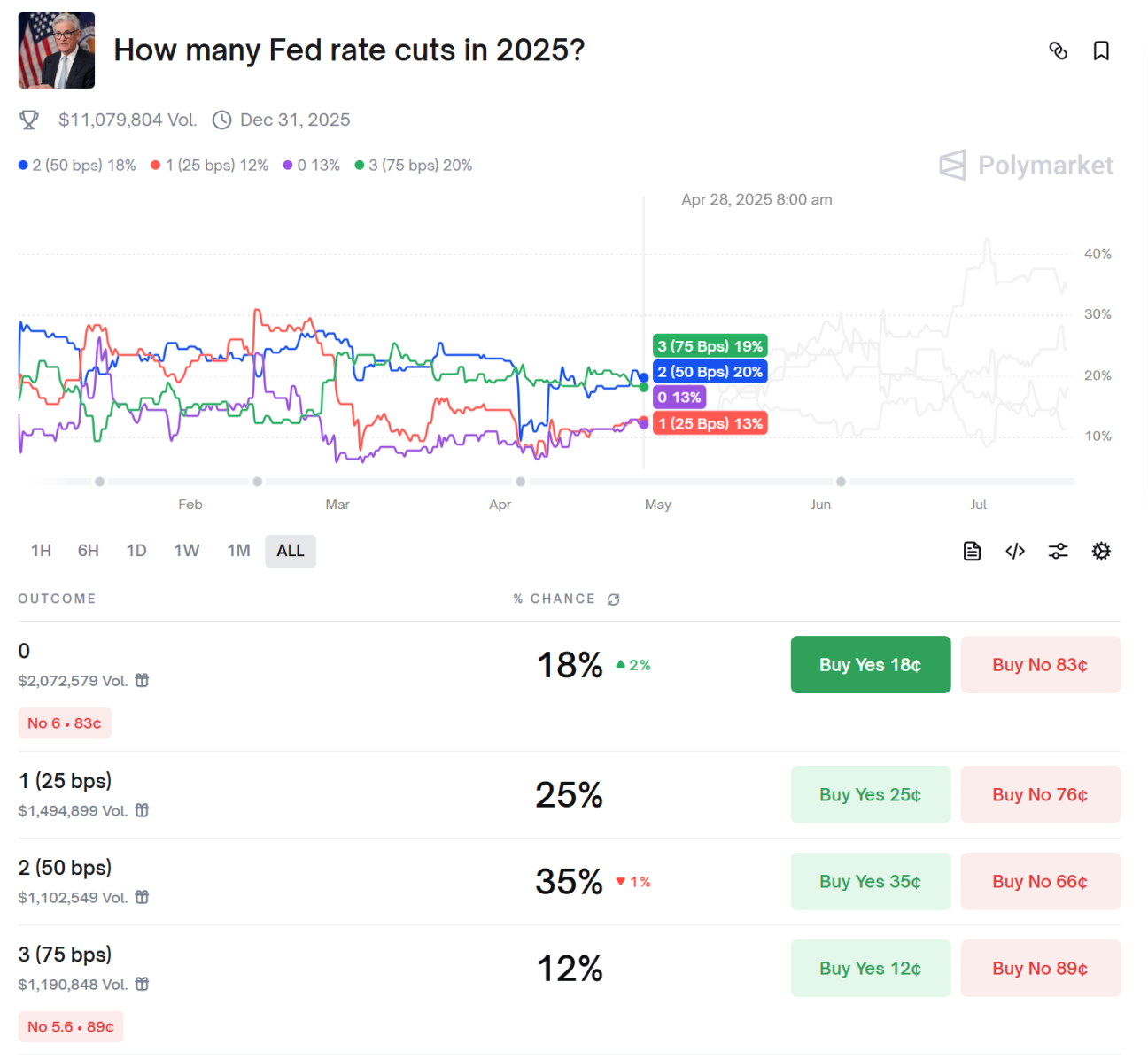

This divergence directly affects market policy expectations. Data from Polymarket shows that the current market bets on a 50 basis point rate cut this year have a probability of only 35%, while the probability of no rate cut has risen to 18%, indicating that market pessimism regarding rate cuts is increasing.

Despite several officials recently making hawkish statements, investors have not completely given up hope for a rate cut. The market believes that the likelihood of the Fed deciding to cut rates at the September policy meeting is slightly above 50%. According to CME's "FedWatch" data, the probability of a 25 basis point rate cut in July is 4.7%, while the probability of maintaining the current rate is 95.3%. The probability of the Fed maintaining rates until September is 33.9%, while the cumulative probability of a 25 basis point cut is 63.1%, and the cumulative probability of a 50 basis point cut is 3%.

Fed's Daly stated that two rate cuts this year are a reasonable expectation. Trump has also continued to publicly express dissatisfaction with Powell on social media, applying pressure for rate cuts.

As the Fed's rate cut expectations are about to solidify, risk assets will be prepared for a larger wave of increases.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。