Enjoy 7 major tools and evaluation dimensions to help you capture the next Aave-level potential project from on-chain data and mindshare.

Written by: Ignas | DeFi Research

Compiled by: Saoirse, Foresight News

Is the enthusiasm for chasing hot new projects still high?

I shared on the X platform that the motivation to chase new projects has dropped to its lowest point since I entered the crypto space in 2018. Even during the bear market, the mindset was better than it is now.

Is it just me? Maybe I’ve gotten lazy… or perhaps I’m just tired? But it seems like it’s not entirely that.

I’m more cautious now than before and won’t allocate a large proportion of my portfolio to new protocols.

In the past bull market, liquidity was stronger, and making money was easier, but now the altcoin season hasn’t arrived, and funds are relatively tight.

The risk-reward dynamic has also changed: although hacker attacks and protocol vulnerabilities have decreased compared to the past, the airdrop returns of the vast majority of projects have significantly shrunk.

Funds are diluted across a large number of protocols, leading to a lack of phenomenally explosive projects.

A more intuitive feeling is that many new projects are only at the level of incremental optimization, lacking the breakthrough innovation from 0 to 1. This view is also supported by Mike Dudas.

This phenomenon is not only present in DeFi protocols but is also common in the fields of L1 public chains and L2 scaling solutions.

Consider why we should pay attention to Kraken's Ink protocol? Or Soneium L2? Without truly innovative designs that create incremental value… it’s just a digital game of airdrop incentives and liquidity mining.

In this age of information overload, it’s increasingly difficult to filter projects worth investing time in. If there is a similar mindset in the market, it certainly poses challenges for new projects, but it also creates more opportunities for sharp-eyed crypto natives (degens).

However, we still need to continuously discover potential projects that are likely to become the next Aave, Ethena, or Pendle.

The key question is: how to determine which protocols are worth investing effort in? And where to find them? To this end, I will share a series of tools, methods, and information channels in this article to help you identify protocols that have shown initial development momentum. The evaluation dimensions include:

Mindshare (referring to the level of attention and influence a protocol or project has in the awareness of industry participants such as investors, users, and developers.)

On-chain adoption

Coverage of use cases by smart accounts

In addition, I will list a few typical projects I am paying attention to as reference cases, presented in the style of this sentence citation.

Risk Warning: The content of this article is for informational sharing and knowledge dissemination purposes only and does not constitute any investment advice. Please be sure to conduct your own due diligence and make decisions cautiously based on your personal financial situation.

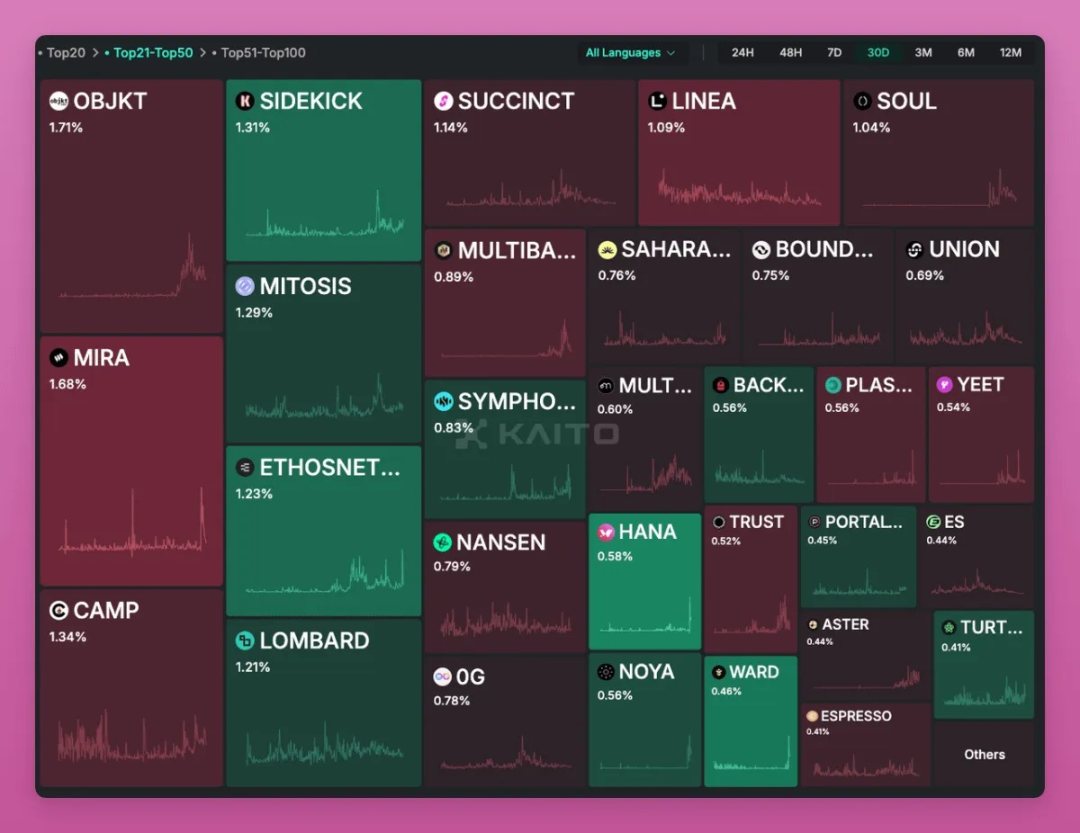

1. Kaito

Kaito's flagship portal subscription fee is $1,099/month (can be reduced to $750/month for a two-year package).

Notably, Kaito provides a free data dashboard that lists top non-token projects by "mindshare." Although screenshots of the Top 20 projects frequently flood the screen, how many projects from 21-50 can you recognize?

You can visit yaps.kaito.ai to learn about potential projects you are interested in.

Taking Multipli as an example, it provides yield solutions for native assets (like BTC), stablecoins, and real-world assets (RWAs). The project has backing from top venture capital firms like Pantera, Sequoia Capital, and Spartan Group, and is expected to launch its token issuance in a "low circulation + higher fully diluted valuation (FDV)" model. The current total value locked (TVL) of $70.3 million is in an ideal range: it avoids the potential risks of low TVL projects while not facing severe dilution pressure due to being too large (even though it is in the second phase of the incentive cycle).

Although Kaito's tools are powerful, there are industry concerns that it may distort the market, as KOLs often promote projects. If you have doubts about this, you can try the second tool that adopts differentiated algorithms to expand the selection dimensions of Alpha strategies.

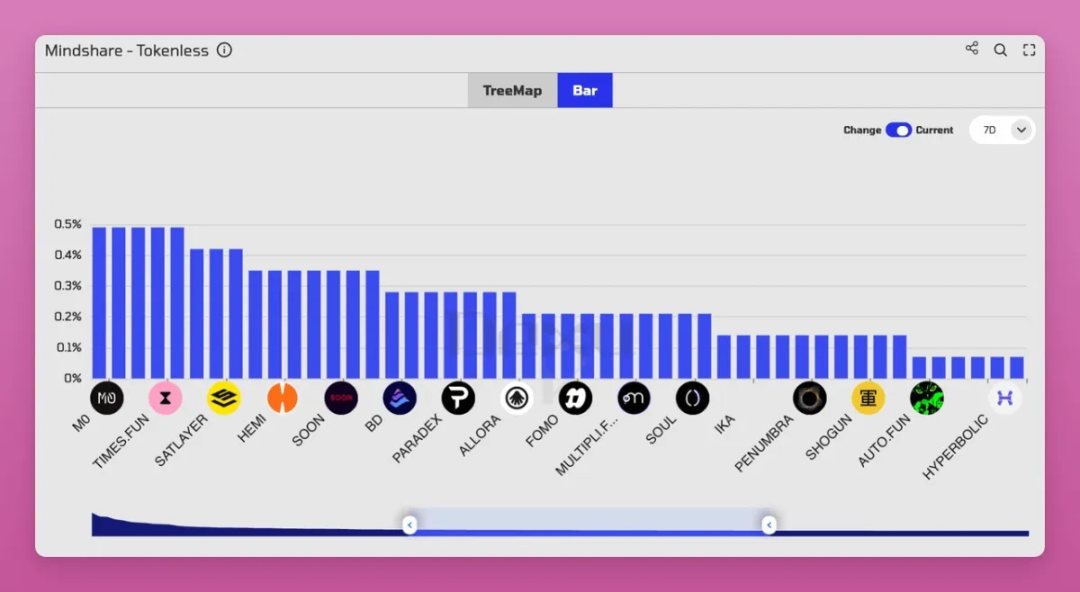

2. Dexu AI

"Acquire mindshare, market sentiment, narrative dissemination power, original tweet data, and crypto social (CT) smart account metrics, among other multidimensional information."

Here’s a guide to using Dexu to filter non-token projects:

Method 1:

Log in to Dexu AI → Go to "Sector analysis" → Select "Social"

Switch between different analysis dimensions: mindshare index, sentiment heat, distribution of high-value followers on the X platform, etc.

Customize the time period and adjust the data granularity using the slider

Method 2:

Click "Projects" → Go to the "Top Project" page

Scroll down to "Projects Leaderboard - top 5000"

Lower the "Seniority" filter value to discover emerging projects, and increase the "Network" proportion to filter out low-activity projects

For video tutorials, you can check the in-depth guide released by Dexu on the X platform

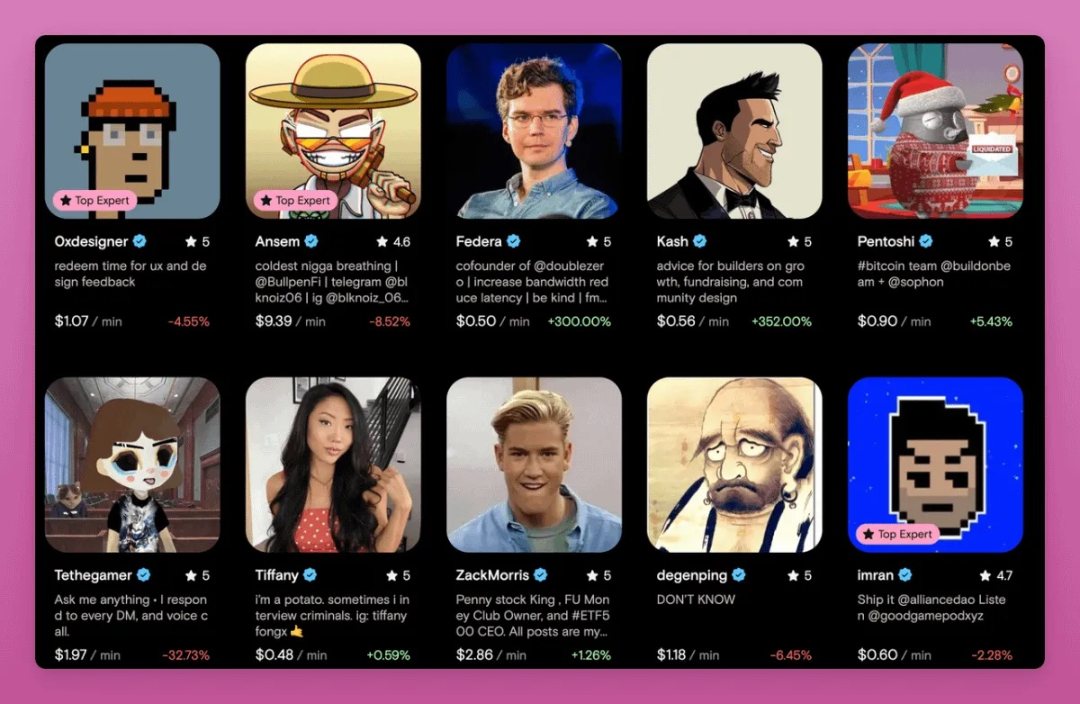

Project Case: Time.Fun has two core application scenarios: 1. Paid direct connection to crypto industry leaders: significantly increases the reply probability of high-value communication by sending private messages to founders and KOLs in the crypto field through payment. 2. Demand forecasting speculation mechanism: predicting and speculating on "which individuals' private message demands will explode."

Notably, the Solana team and core members are frequently using and actively promoting this platform, combined with the strategic investment background of institutions like Coinbase Ventures and Alliance DAO, its potential airdrop value is worth looking forward to.

3. 0xPPL

0xPPL is a top-tier crypto tool that I keep to myself, but very few truly understand and use it.

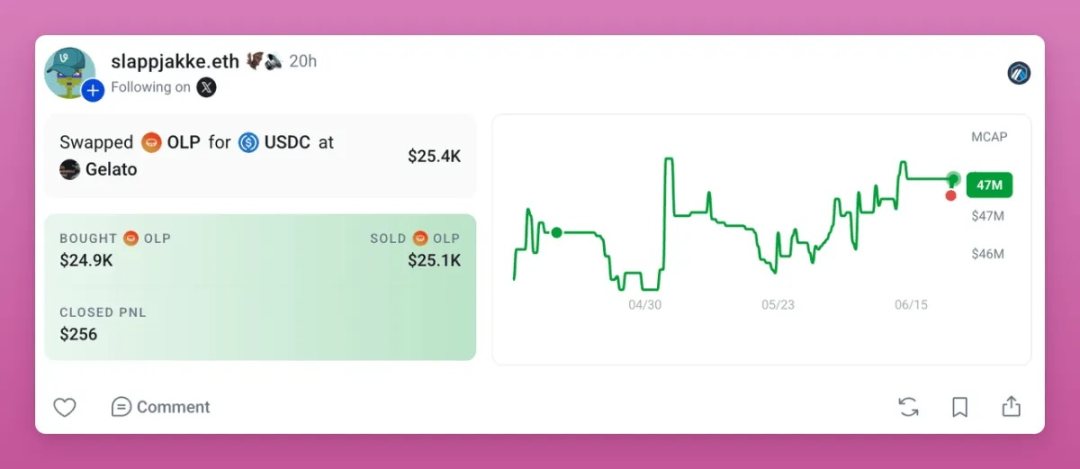

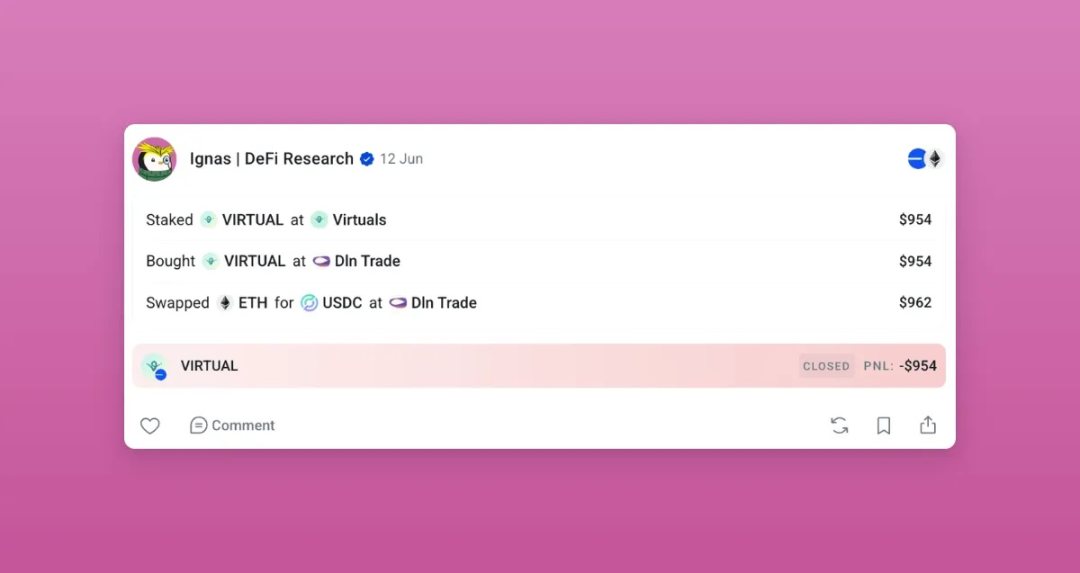

This is a revolutionary social platform that, while supporting posting functions similar to X, shines in displaying the wallet dynamics of the accounts you follow on X.

While Kaito and Dexu are still focused on follower counts and social mindshare, 0xPPL has already penetrated the surface of public opinion, directly presenting users' real on-chain operations.

Surprisingly, 0xPPL's wallet association system can accurately match KOL accounts with on-chain addresses. You can not only see token trading records but also capture their key actions of injecting funds into protocols.

Simply log in with your X account and associate it with a wallet that has transaction history to synchronize the on-chain trajectory of the accounts you follow in real-time; each person's dynamic stream is unique due to different follow lists.

If you follow many airdrop hunters, you can directly hit the protocols they are genuinely laying out, rather than staying in the hype discussions of public opinion.

Kudos to the team for their daily iterations: from interface polishing to detail optimization, every update genuinely enhances the user experience.

Although the team has not officially announced a token plan, given the product's maturity, it’s just a matter of time.

4. Nansen

Nansen's versatility is a benchmark in the industry. Previously, I shared how to use Nansen and other tools to discover "100x potential targets".

In addition, there are two major features worth highlighting:

First, the Nansen points incentive system. Points can be accumulated in the following ways:

Subscribe to the Pioneer or Professional paid plans

Participate in staking mining on the platform

Invite friends to register

In the current narrative explosion of InfoFi, Nansen, as a leading player in this track, is worth paying attention to.

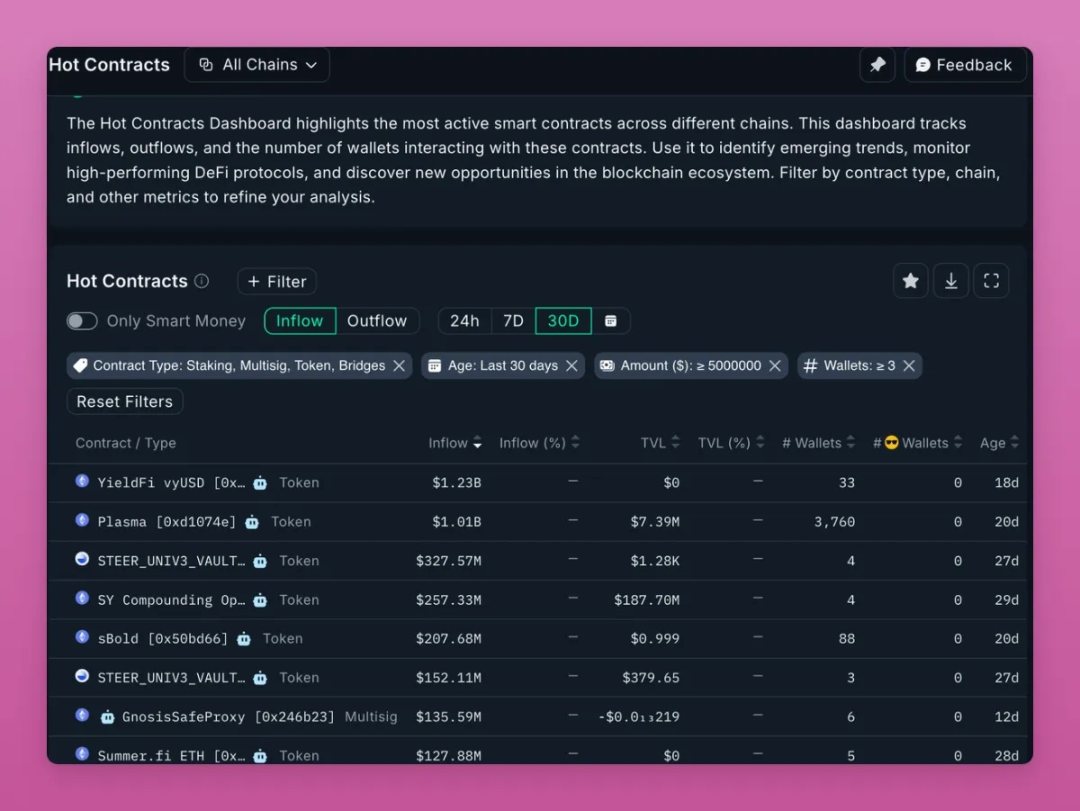

Second, tracking the capital flow of popular contracts. Operational suggestions: flexibly use the filtering function

I tend to exclude DEX and liquidity pools (this function is particularly useful if you are an active LP)

Set the minimum TVL to $5 million

Limit the contract creation time to within 30 days

Example of filtering results:

- YielFi's vyUSD stablecoin offers a 16% annual yield (current TVL $32 million, recommended to evaluate cautiously) - Plasma protocol's popularity has surged but has paused deposits - Liquity's newly launched BOLD stablecoin continues to expand in scale (during the same period, LQTY tokens have risen against the market downturn)

Additionally, there is Steer Protocol: a DeFi automated multi-position liquidity management tool that supports 27+ public chains and 32 DEXs (such as Quickswap, Camelot, Sushiswap). Core advantages: ✅ No need for manual management of concentrated liquidity ✅ Improved LP yield performance ✅ Built-in diversified market-making strategies. Funding background: raised $1.5 million in seed round investment from institutions like Druid Ventures, Republic Capital, and Big Brain Holdings.

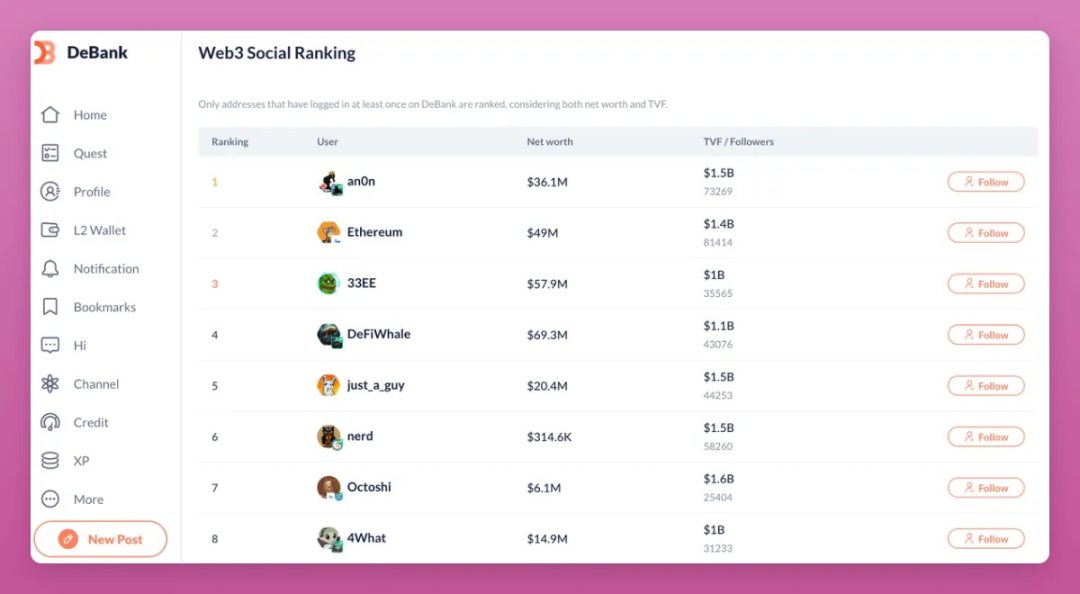

5. DeBank

Although DeBank's flagship portfolio feature has been integrated into the Rabby wallet, causing its mindshare on the X platform to decline, the address tracking feature of DeBank can still uncover numerous excess return opportunities.

Steps to operate:

Click "More" → Enter "Web3 Social Ranking"

Filter target accounts to see the airdrop projects they are currently participating in

Finding airdroppers and protocols that align with your investment style requires effort, but it is absolutely worth it. Compared to browsing the latest trending topics on the X platform, directly observing investors' capital movements is clearly more valuable.

At the time of writing this article, I discovered the LAGOON protocol through DeBank: it is a vault strategy provider with a total value locked of $70 million, offering a 9% annual yield on ETH deposits. (Note: Please be sure to conduct your own due diligence!)

6. DeFiLlama

Given that DeFiLlama is already a well-known tool in the industry, I will directly share core tips.

Patrick Scott, the growth lead at DeFiLlama, has shared two practical strategies:

Strategy 1: Precisely filter airdrop potential projects

Go to DeFiLlama's official website → Click on the "Airdrops" section

Check "Hide Forked protocols"

(Optional) Add TVL value filtering criteria

Next, you need to check each protocol one by one to filter projects that meet your standards.

Strategy 2: Capture the benefits of popular public chains

Lock in currently popular public chains (such as HyperEVM)

Sort all protocols on that chain by TVL

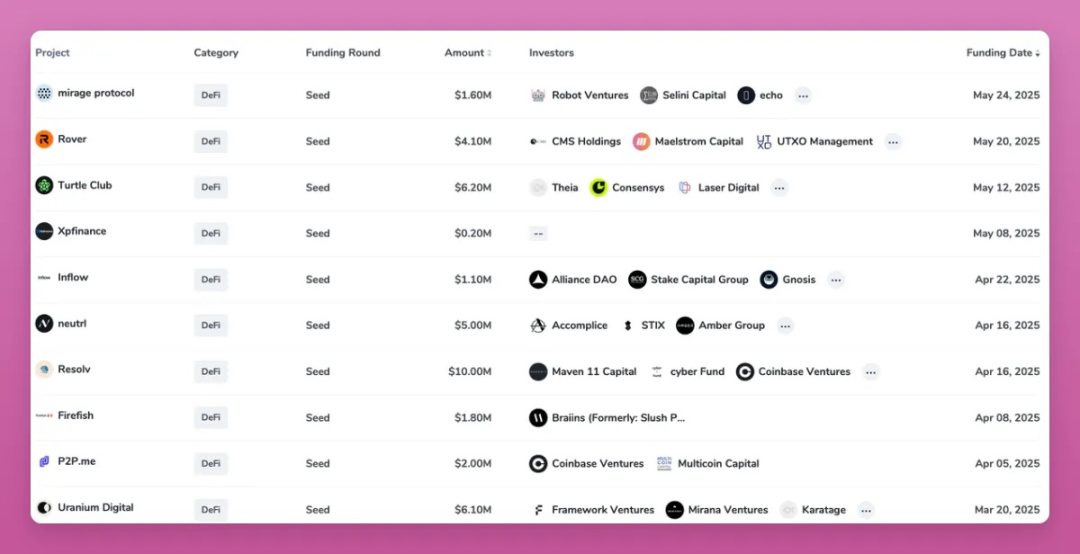

7. Coincarp - Tracking Financing Dynamics

Although the current market sentiment towards venture capital (VC) is at an all-time high, protocols with ample funds are still quality targets for airdrop mining.

I have always emphasized that tokens with "low circulation + high FDV (fully diluted valuation)" are most suitable for airdrop hunters. These types of projects have the capital strength to provide initial liquidity for token issuance (TGE).

Among many financing tracking tools, Coincarp is my first choice: completely free and extremely easy to use.

My filtering strategy:

Select the "DeFi" sector

Lock the financing stage to "Seed," focusing on the earliest projects

Surprisingly, the number of seed round financings in the DeFi sector has sharply decreased recently: only 4 projects in May and just 5 in April. Fortunately, the reduced number of projects makes it easier to study each one😉

Turtle Club Project Analysis This is a DeFi rewards platform that provides users with additional earnings through cooperative protocols, essentially a "cashback version of decentralized finance." Operating mechanism: 1. Wallet login (no need to deposit funds) 2. The system automatically tracks your liquidity mining/staking activities on cooperative platforms 3. Earn additional rewards and TURTLE tokens. Advantages: - Zero risk: funds always remain in the personal wallet - Earnings stacking: earn additional rewards on top of base earnings - Early bonuses: first users can enjoy higher returns.

Supplement: Recommendations from Crypto Bloggers

In this blog, I want to share my method for discovering emerging hot protocols.

I haven't mentioned randomly scrolling posts on the X platform, as everyone does that, and the proportion of effective information is simply too low.

In contrast, crypto bloggers are a high-quality source for discovering new protocols. Here are a few accounts I recommend subscribing to:

Alpha Please: Shares 3 alpha potential applications weekly. Click to subscribe on Substack

The DeFi Investor: Pushes updates on new project launches and developments. Substack subscription link

blockmates: Deep dives into popular projects. Website

The Daily Degen: Pay attention to their “New Projects” section

The DeFi Edge: Newsletter often covers emerging hot projects and market dynamics.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。