Original | Odaily Planet Daily (@OdailyChina)

Author | Azuma (@azuma_eth)

This column aims to cover low-risk yield strategies primarily based on stablecoins (and their derivative tokens) in the current market (Odaily Note: code risks can never be completely eliminated), to help users who wish to gradually increase their capital through U-based financial management find more ideal earning opportunities.

Past Records

Lazy Financial Strategy | Huma 2.0 reopens; BounceBit launches USD1 incentive campaign (June 9);

New Opportunities

Falcon Series Assets Launch on Euler

Last week, the lending protocol Euler Finance announced support for a basket of Falcon Finance series assets, including USDf, sUSDf, and PT-sUSDf. Since the yields of Falcon Finance series assets are generally higher than the market's base interest rates (introduced in the April 7 and May 6 issues), the introduction of the lending mechanism opens up opportunities for users to further amplify their returns through circular loans.

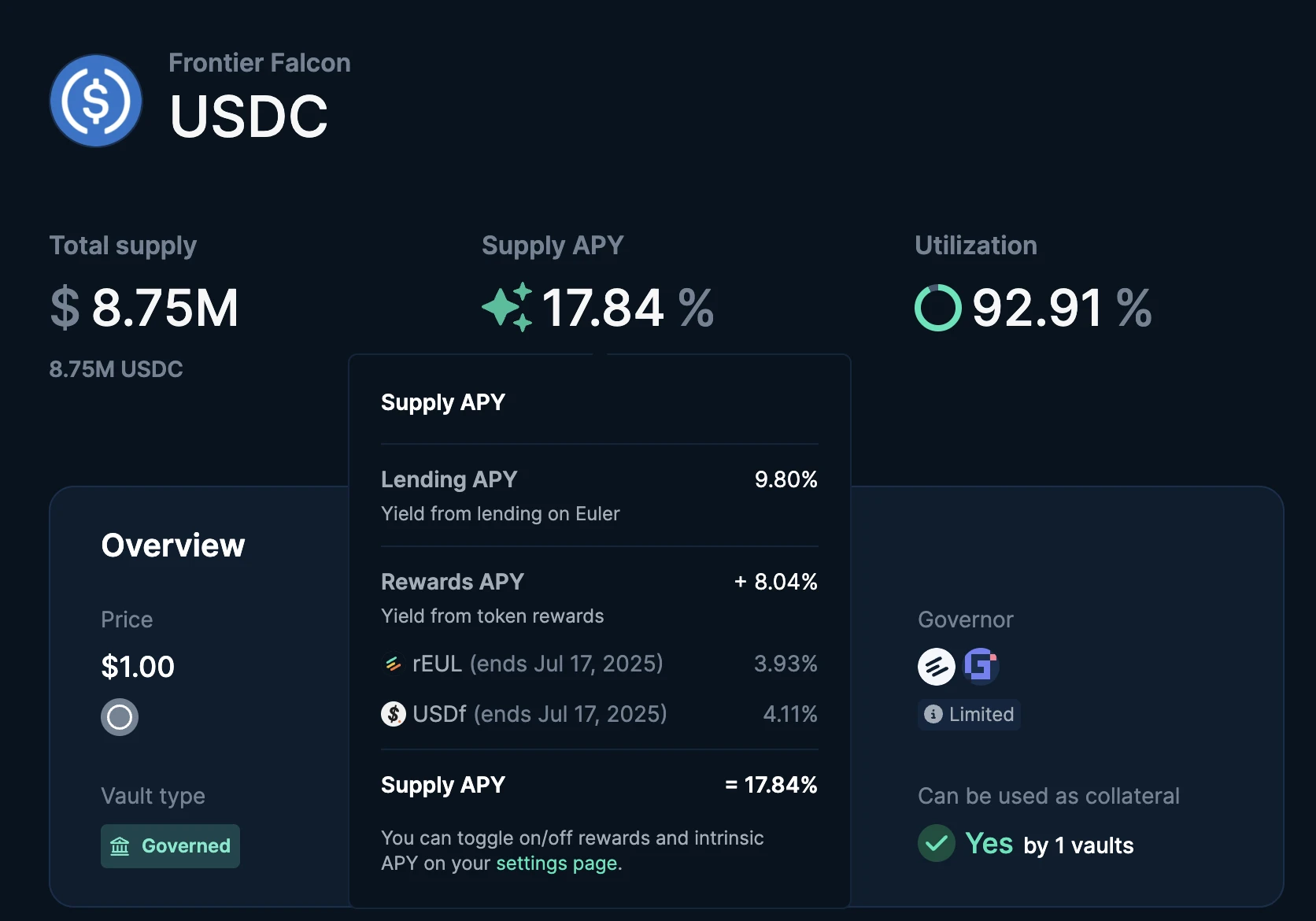

Users familiar with circular loan strategies (especially PT circular loans) can start operating immediately to pursue higher yields; users who are less familiar or reluctant to engage can choose to provide USDC as a lender, currently under the incentives offered by Euler Finance, the APY for providing USDC can reach 17.84%, which is quite attractive.

SyrupUSDC Launches on Solana

At the beginning of this month, the yield-generating stablecoin SyrupUSDC issued by the institutional lending protocol Maple was officially deployed on Solana.

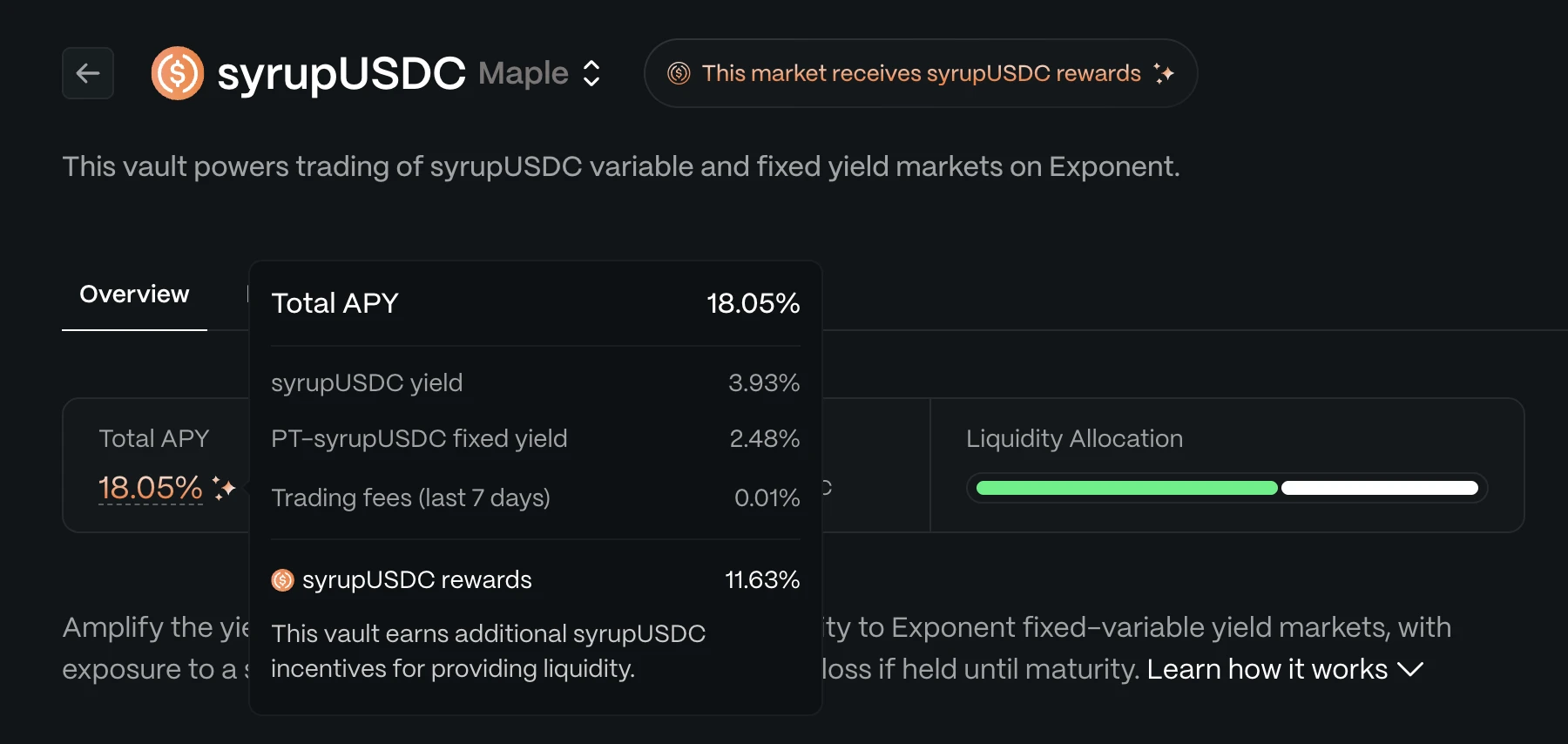

Although the yield of SyrupUSDC itself and its related Pendle pools is already quite ideal, after expanding to Solana, we can find some places with even higher yields. For example, currently depositing SyrupUSDC in the Exponent (the Solana version of Pendle, which has been introduced many times) pool, under Maple's incentives, can yield 18.05%.

It is worth mentioning that this pool has a limit of $2 million, so it is recommended that interested users participate as early as possible.

Unitas Mining Launch

On June 10, the stablecoin project Unitas, spun off from Unipay, officially announced its launch.

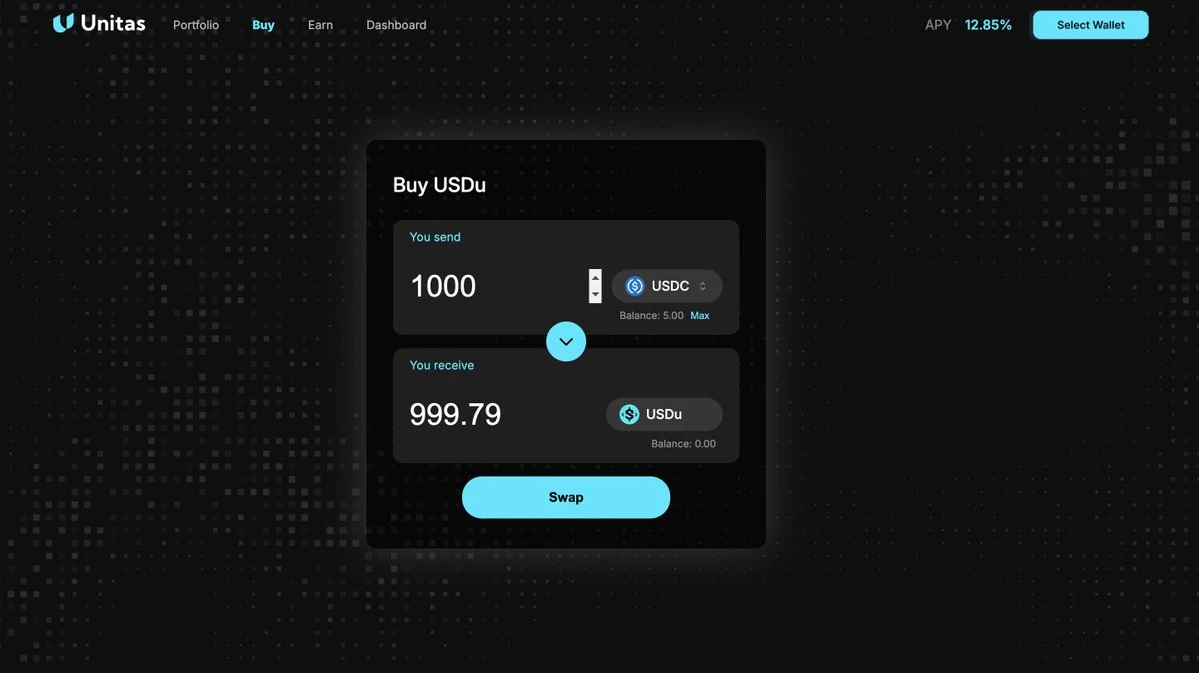

Unitas allows users to mint the stablecoin USDu and stake it to generate yields (unstaking requires 7 days), with a yield model similar to Ethena's arbitrage, currently offering a real-time APY of 12.85%.

Overall, the project is still relatively early, and the yield performance is quite good, making it suitable for small capital investments.

Mirage Protocol Launches Mainnet Phase One

Another project to pay attention to is the stablecoin project Mirage Protocol on Movement, which has previously secured $1.6 million in funding from Robot Ventures, Selini Capital, Ambush Capital, and Aptos co-founder Mo Shaikh (who has since left).

The project has launched the first phase of its mainnet today, opening a minting limit of $500,000 for mUSD.

However, the overall website of Mirage Protocol is still quite rudimentary, and it currently does not display yield information, so aside from users wanting to secure an early position, it is more advisable to remain observant for now.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。