Author: Oliver, Mars Finance

In the vast expanse of Texas, a grand experiment regarding the digital future is advancing at full speed with a clear goal and unified pace. Governor Greg Abbott has signed two seemingly different yet ultimately converging historic bills. The first authorizes the use of public funds to purchase Bitcoin, creating an unprecedented "Digital Fort Knox" for the Lone Star State; the second authorizes law enforcement to seize and hold crypto assets involved in cases for the long term.

This is not a coincidence or contradiction in policy, but rather a carefully designed and highly unified strategy. Texas is executing a grand state-level Bitcoin accumulation strategy through two distinctly different paths—market purchases and legal seizures. These two bills function like two engines of a powerful machine, driving Texas to become a massive "Bitcoin black hole," continuously absorbing assets from the circulating market and locking them away for the long term. The far-reaching impact of this strategy has already transcended Texas itself; it may not only reshape the global supply landscape of Bitcoin but also establish a new model for how a sovereign entity can systematically embrace digital assets at both interstate and international levels.

The Birth of a State-Level Buyer

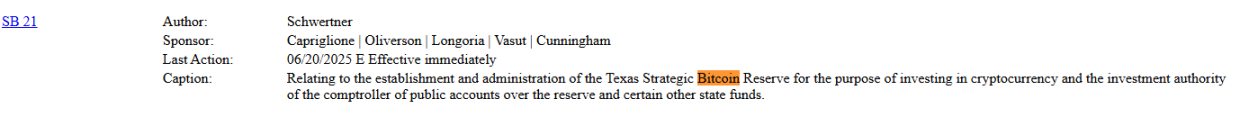

The SB 21 bill passed by Texas is far more than a financial investment. It is a strategic institutional construction aimed at officially elevating Bitcoin to the status of a state sovereign asset.

The starting point of this gamble is the legislative approval of an initial fund of $10 million. With Bitcoin priced at around $100,000, this amount can purchase approximately 100 Bitcoins. This quantity is negligible in the vast crypto market, but its symbolic significance is immense. This marks the first time in U.S. history that a state government has actively and publicly used taxpayer money to buy Bitcoin as a strategic reserve.

To ensure the security and independence of this "digital wealth," the bill has designed a sophisticated firewall. It creates an independent fund called the "Texas Strategic Bitcoin Reserve," directly managed by the state auditor. Most importantly, this fund is designed as a "special vault" independent of the state's regular financial system, meaning that politicians cannot access its assets due to short-term budget pressures. The bill explicitly states that the sources of reserve funds can include not only government allocations but also cryptocurrency donations, airdrops, and forked assets from around the world, opening up possibilities for its future growth.

For many Texas elites, this move is a political declaration to hedge against inflation and defend financial freedom, as well as a counterbalance to the potential central bank digital currency (CBDC) led by central banks in the future. By positioning itself as a sovereign-level buyer and holder, Texas is creating an unparalleled gravitational center for the entire institutional crypto ecosystem.

The National Machine of Forced HODL

If purchasing Bitcoin is Texas's "open market" operation, then the SB 1498 bill authorizing the seizure of crypto assets is its "covert" maneuver on another front. For the entire crypto ecosystem, this is not a negative development; rather, it is a stronger and more thorough supply-side locking mechanism.

The core of this bill is the "crypto modernization" upgrade of the civil asset forfeiture system, allowing police to seize and liquidate digital assets suspected of being related to crimes without a criminal conviction. The key lies in two provisions of the bill: first, law enforcement can seize not only the principal but also any "appreciated portion" generated during the asset's seizure period, which will belong to the state government; second, all seized assets must be transferred to an offline secure wallet supervised by law enforcement or the state attorney general.

The combination of these two clauses is a stroke of genius from a market perspective. It ensures that all crypto assets flowing into the state government through law enforcement channels will not be reintroduced into the market for sale. Instead, they will be directly sent to the "cold palace"—that is, a cold wallet controlled by the government, becoming part of the state's strategic reserves, akin to the Bitcoin acquired through purchases.

This creates a peculiar effect: the Texas government inadvertently becomes a massive "supply black hole." Whether through active purchases or passive seizures, the result is the extraction of Bitcoin from the circulating market and its long-term locking. For the entire Bitcoin ecosystem, a sovereign-level entity continuously absorbing supply without any outflow undoubtedly reinforces the scarcity of the asset. Therefore, Texas's dual-track strategy is not contradictory; rather, it employs two means to achieve the same goal: maximizing Bitcoin accumulation.

A Spark Igniting a Regulatory Race Among States

Texas's bold move is like a stone thrown into a calm lake, stirring up a "arms race" regarding crypto regulation across the United States. States are trying to seize the initiative in the ongoing regulatory vacuum created by the federal government, defining their own digital futures.

Before Texas, Wyoming had already established itself as a recognized "blockchain state" through its famous DAO LLC bill and crypto-friendly banking charter, providing a model for the legal status of digital assets. After Texas, this competitive atmosphere has intensified. For example, Oklahoma recently signed a bill explicitly protecting citizens' rights to self-custody crypto assets and run nodes, which, although small in scale, represents a regional pro-crypto wave.

Meanwhile, cities like Miami in Florida, under the leadership of Mayor Francis Suarez, are actively building a brand of "crypto-friendly cities," even allowing municipal fees and employee salaries to be paid in Bitcoin.

Of course, there are entirely opposite paths. For instance, New York's stringent "BitLicense" system represents another regulatory extreme—high barriers and strict scrutiny, contrasting sharply with the open stances of Texas and Wyoming.

The core of this interstate competition revolves around the game of "regulatory arbitrage" and attracting future industries. The stakes of the Texas model are that for the top players it truly wants to attract, this clear "certainty" of rewards and penalties is far more appealing than the unresolved "ambiguity" at the federal level.

The Unique Confidence of the Lone Star State

The reason Texas dares to make such a bold move is not due to the legislators' fanciful imagination but is rooted in a powerful "power nexus" that has already formed: energy and cryptocurrency mining.

In just a few years, Texas has risen to become the global center for Bitcoin mining, accounting for about 25%-40% of the hash rate share in the U.S. Statistics show that crypto mining brings approximately $1.7 billion in economic output to Texas each year and supports over 12,000 jobs. More importantly, these massive mining farms act like super "power banks," forming a unique symbiotic relationship with the Texas Electric Reliability Council (ERCOT) grid. During low electricity demand periods, they consume excess energy; during peak demand periods, they can instantly shut down, returning power to the grid and effectively preventing widespread blackouts.

This deep binding of energy and crypto is the economic and political cornerstone of Texas's entire crypto strategy. When the Bitcoin mining industry is no longer just an abstract financial speculator but a strategic partner that can genuinely help solve the state's energy problems, it earns unparalleled political legitimacy for the state government's pro-crypto policies.

The Final Stakes: I Set the Rules

Connecting all the dots, a complete and coherent strategic picture of Texas emerges. The purchasing bill is an open "buy" signal, a sovereign-level commitment to global institutional capital; the seizure bill is a covert "accumulation" channel, a mandatory supply locking mechanism. Together, they serve one goal: in the vacuum of federal regulatory absence, Texas sets the rules of the game and becomes the biggest winner in this game.

The ultimate outcome of this "Texas gamble," whether successful or not, will become a decisive case study for the future of digital asset regulation in the U.S. and even globally. If it succeeds, it may provide a blueprint for other states and eventually federal policy. If it fails, it will become a profound cautionary tale. Regardless, one thing is certain: the future of U.S. crypto policy is currently being forged in the Lone Star State, tempered by fire and contradiction.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。