This week, stablecoins continued to be issued, with significant net inflows into the U.S. Bitcoin spot ETF and net inflows into the Ethereum spot ETF.

Author: Hotcoin Research

Cryptocurrency Market Performance

Currently, the total market capitalization of cryptocurrencies is $3.34 trillion, with BTC accounting for 61.55%, amounting to $2.06 trillion. The market cap of stablecoins is $251.7 billion, with a 7-day increase of 0.33%, of which USDT accounts for 62.23%.

This week, BTC's price showed range-bound fluctuations, currently priced at $106,000; ETH also showed range-bound fluctuations, currently priced at $2,555.

Among the top 200 projects on CoinMarketCap, a small number increased while most decreased, including: AERO with a 7-day increase of 40.29%, KAIA with a 7-day increase of 27.7%, T with a 7-day increase of 24.32%, and PNUT with a 7-day increase of 11.06%.

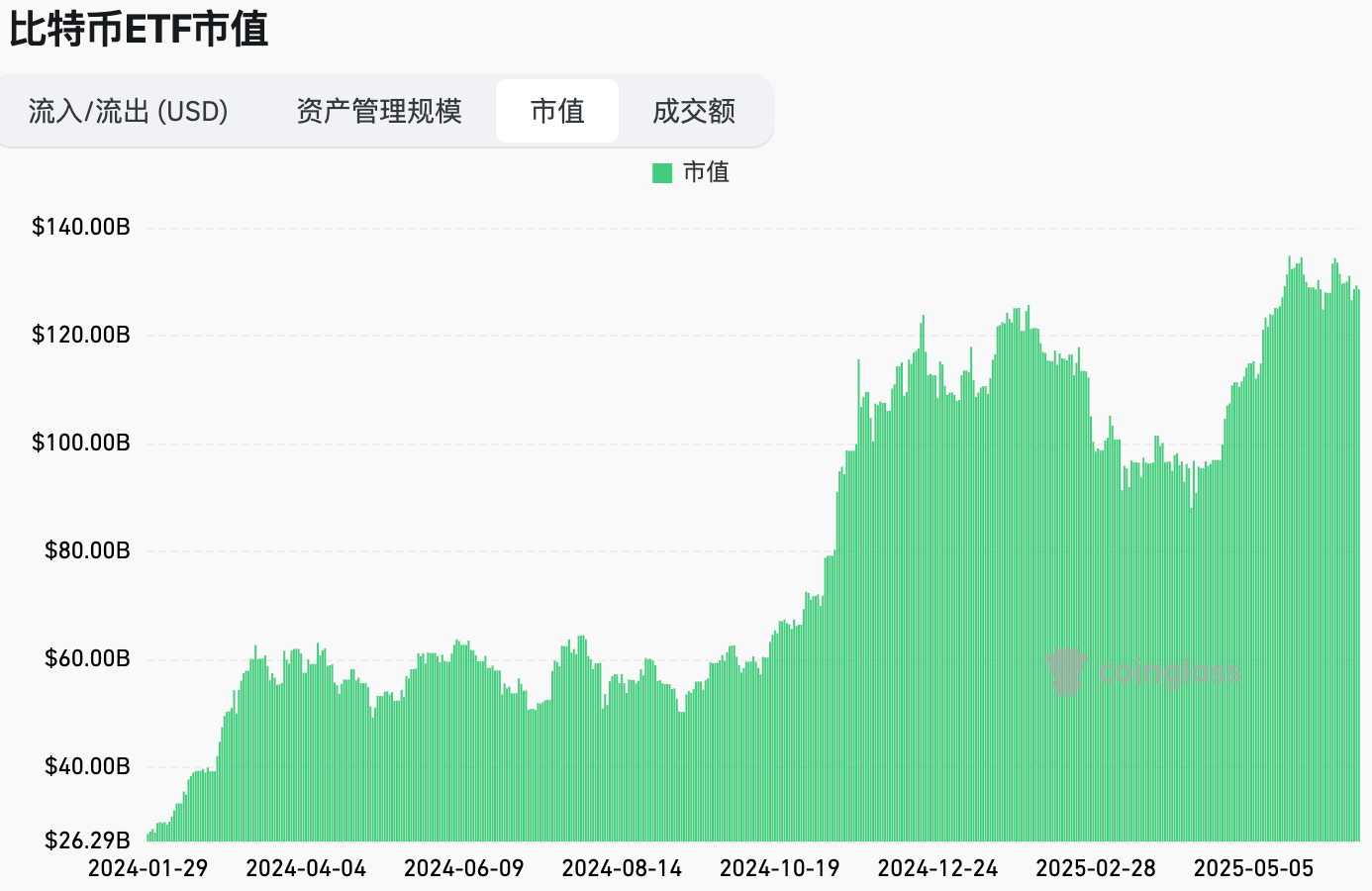

This week, the net inflow into the U.S. Bitcoin spot ETF was $1.0454 billion; the net inflow into the U.S. Ethereum spot ETF was $40.3 million.

On June 20, the "Fear & Greed Index" was at 48 (lower than last week), indicating a neutral sentiment over the past week.

Market Forecast:

This week, stablecoins continued to be issued, with significant net inflows into the U.S. Bitcoin spot ETF and net inflows into the Ethereum spot ETF. Both BTC and ETH maintained range-bound fluctuations. The RSI index is at 40.86, indicating neutrality. The U.S. interest rate decision for June was announced this week, in line with market expectations, hence prices did not experience significant fluctuations. The Fear & Greed Index remains neutral.

Although institutions and listed companies continue to purchase BTC, there is still invisible selling pressure in the market, and community sentiment has not been mobilized. Therefore, in the short term, the upward momentum appears weak, with an expected price range for BTC next week of $100,000 to $105,000. At this stage, it is recommended to accumulate small amounts on dips. In June and July, if there are no major macro policy impacts, the market will likely maintain range-bound fluctuations until the U.S. stablecoin bill is officially issued in August or the Federal Reserve cuts interest rates, at which point the market may see significant increases. "Trading during a lull," you can pay attention to some new coin opportunities, as Hotcoin has plenty of on-chain wealth codes worth noting.

Understanding Now

Review of Major Events of the Week

On June 15, Michael Saylor posted information related to Bitcoin Tracker on the X platform again, stating "bigger orange dots, better," typically revealing Bitcoin accumulation data for Strategy the day after he posts Bitcoin Tracker information;

On June 16, Tron will go public through a reverse merger with SRM Entertainment, which is listed on Nasdaq. The deal is managed by boutique investment bank Dominari Securities, based in New York, linked to Donald Trump Jr. and Eric Trump;

On June 18, the U.S. Senate passed the landmark cryptocurrency legislation known as the "GENIUS Act," aimed at promoting growth in the industry. This marks a historic lobbying victory for digital asset companies in the Senate's first vote on comprehensive regulatory reform for cryptocurrencies.

The U.S. Senate passed the bill with 68 votes in favor and 30 against, with 18 Democrats joining most Republicans in supporting its submission to the House for review.

This bill, led by Republican Senator Bill Hagerty of Tennessee, will establish a U.S. regulatory framework for stablecoins pegged to the value of the dollar for the first time;

On June 18, JPMorgan Chase & Co. will launch a pilot token called JPMD, representing dollar deposits from the world's largest bank, indicating that financial institutions are further deepening their involvement in the digital asset space. The deposit token JPMD will be piloted on a blockchain related to Coinbase;

On June 18, the VanEck Solana spot ETF has been listed on the DTCC website, with the code VSOL, showing D in the creation/redemption column.

Although this does not indicate that the ETF has received any regulatory approval or any clear approval process results, listing on the DTCC website is part of the "standard process" for launching new ETFs;

On June 17, Coinbase is seeking approval from the U.S. Securities and Exchange Commission to provide stock trading services based on blockchain;

On June 19, Linda Yaccarino, CEO of the social media platform "X," stated that users will soon be able to invest or trade on the platform. X is also exploring the introduction of credit or debit cards;

On June 20, London-based digital banking giant Revolut is actively exploring its own stablecoin issuance plan. Revolut serves 55 million individual users and 500,000 business customers across 160 countries, with a recent valuation of $48 billion. It previously launched the EU crypto trading platform Revolut X in 2024. Two sources confirmed that Revolut has engaged in discussions with at least one native crypto company regarding its stablecoin plan;

On June 20, Plasma is preparing to launch its mainnet in "late summer," which is a blockchain optimized for stablecoins;

On June 19, according to an analysis of the details on the World Liberty official website, a company under Donald Trump has reduced its stake in the crypto project World Liberty Financial from 60% to 40% over the past 11 days;

On June 19, over 16 billion login credentials from mainstream online service providers such as Apple, Google, and Facebook were leaked, which could have serious consequences for cryptocurrency holders. Login credentials refer to usernames and passwords (or other authentication information).

Macroeconomics

On June 19, the Federal Reserve maintained the benchmark interest rate at 4.25%-4.50%, marking the fourth consecutive meeting without changes, in line with market expectations;

On June 19, the Fed's dot plot indicated that the Fed still expects to cut rates by 50 basis points in 2025, but only by 25 basis points in 2026, down from the previous forecast of a 50 basis point cut. It is expected to cut rates by 25 basis points in both 2026 and 2027;

On June 19, the Bank of England maintained its policy rate at 4.25%, in line with market expectations, keeping rates at a more than two-year high;

On June 18, crypto asset management firm 3iQ launched the 3iQ XRP ETF (XRPQ) on the Toronto Stock Exchange in Canada. The 3iQ XRP ETF will launch with a 0% management fee for the first six months and can be invested through registered accounts in Canada, allowing global qualified investors to invest while complying with local regulations;

On June 17, Canadian listed company LQWD Technologies Corp. announced the purchase of 5 Bitcoins, increasing its total Bitcoin holdings to approximately 166 Bitcoins.

ETF

According to statistics, from June 16 to June 20, the net inflow into the U.S. Bitcoin spot ETF was $1.0454 billion; as of June 20, GBTC (Grayscale) had a total outflow of $23.197 billion, currently holding $19.126 billion, while IBIT (BlackRock) currently holds $70.27 billion. The total market capitalization of U.S. Bitcoin spot ETFs is $128.573 billion.

The net inflow into the U.S. Ethereum spot ETF was $40.3 million.

Envisioning the Future

Upcoming Events

NFT NYC 2026 will be held in New York, USA from June 23 to 25, 2025;

Permissionless IV will be held in New York, USA from June 24 to 26, 2025;

EthCC 8 will be held in Cannes, France from June 30 to July 3, 2025;

IVS2025 KYOTO will be held in Kyoto, Japan from July 2 to 4, 2025.

Project Progress

Chiliz's Web3 sports application and wallet Socios.com announced a partnership with the esports club Ninjas in Pyjamas (NIP) to launch the DOJO fan token. The token issuance (FTO) will take place on June 24, 2025, and will provide rewards for its fans through NIP's loyalty platform The Dojo;

The Pendle Cygnus stablecoin wcgUSD yield pool will expire on June 26;

Spanish coffee chain Vanadi Coffee SA will request authorization to implement a Bitcoin reserve strategy at its board meeting on June 29, planning to invest over $1.1 billion in Bitcoin and obtain financing permissions. The company has already completed its first purchase, acquiring 5 BTC for $500,000.

Important Events

The Governor of the Bank of Korea (BOK), Lee Chang-yong, will meet with commercial bank presidents at the Bank Hall in Jung-gu, Seoul on the 23rd of this month, expected to discuss the issuance of stablecoins based on the Korean won;

On June 24 at 22:00, Federal Reserve Chairman Jerome Powell will deliver semi-annual monetary policy report testimony before the House Financial Services Committee;

On June 26 at 20:30, the U.S. will announce the number of initial jobless claims for the week ending June 21 (in ten thousand);

On June 27 at 20:30, the U.S. will announce the year-on-year core PCE price index for May.

Token Unlocks

Eigenlayer (EIGEN) will unlock 1.29 million tokens on June 25, valued at approximately $1.43 million, accounting for 0.42% of the circulating supply;

IOTA (IOTA) will unlock 15.1 million tokens on June 25, valued at approximately $2.42 million, accounting for 0.39% of the circulating supply;

Venom (VENOM) will unlock 59.13 million tokens on June 25, valued at approximately $9.58 million, accounting for 2.84% of the circulating supply;

Moca Network (MOCA) will unlock 2.43 million tokens on June 27, valued at approximately $173,000, accounting for 0.08% of the circulating supply.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。