When the world's largest retailers begin to bypass traditional banks to save billions in fees, it's not just about the popularity of cryptocurrency.

Written by: Thejaswini M A

Translated by: Block unicorn

Introduction

Yes, stablecoins are hot right now. Circle's stock price is soaring. The "GENIUS Act" is making its way through Congress. But that's not the main point.

The real change is hidden in plain sight. Stripe has just acquired a crypto wallet company, Shopify has made stablecoin payments the default option, and reports suggest that Amazon and Walmart are also developing their own stablecoins.

When the world's largest retailers start to bypass traditional banks to save billions in fees, it's not just about the popularity of cryptocurrency.

This means that the entire payment system is being disrupted by companies we have long trusted. There are four clear signs that cryptocurrency is being commercialized.

1/ The Importance of Privy is Beyond Your Imagination

Stripe's acquisition of Privy is not just another ordinary deal in the cryptocurrency space.

Why? Because they have acquired the last piece of the digital payment empire.

Earlier this year: Stripe acquired Bridge for $1.1 billion (stablecoin infrastructure).

Bridge is the infrastructure that allows stablecoins to serve businesses like regular currency. Their API enables seamless conversion between dollars and stablecoins, so businesses can make instant global payments without dealing with crypto wallets or complex blockchain technology. Bridge serves as a bridge between traditional banking and the new digital dollar economy.

This week: Stripe acquired Privy (crypto wallet integration).

Privy connects wallets to user-friendly interfaces (like email addresses) without requiring users to handle complex private keys or seed phrases. For Stripe's massive user base, this means access to crypto payments without needing to learn crypto technology.

What do I see? A complete crypto payment system from wallet to settlement.

This acquisition indicates Stripe's commitment to making stablecoin payments as convenient as traditional card processing. Companies already using Stripe (processing over $1 trillion annually) can now offer crypto payments without building new infrastructure or requiring customers to download wallet apps.

This is significant because Stripe provides payment processing services to millions of businesses worldwide.

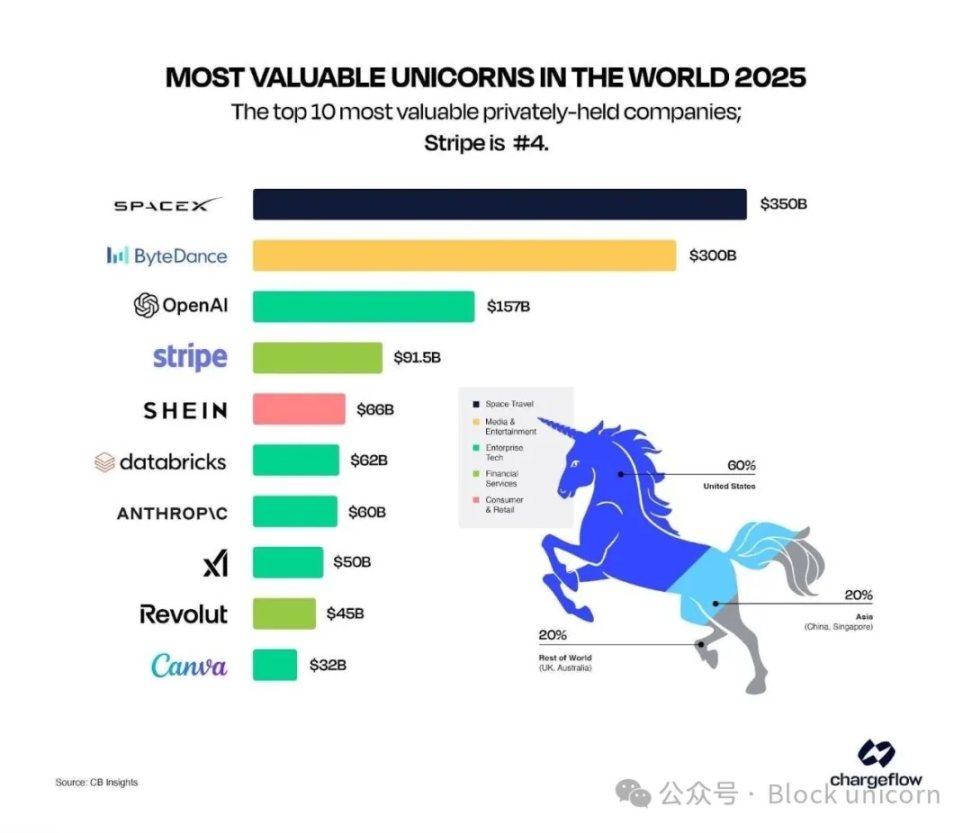

Stripe's reach is staggering: according to Chargeflow, 1.4 million active websites and 90% of adults have used Stripe for transactions. On Black Friday alone, the company processed over 465 million transactions.

When they integrate stablecoin support, it's not just one company adopting cryptocurrency, but an entire ecosystem driving the adoption of cryptocurrency.

Privy supports 75 million accounts across over 1,000 development teams. Stripe is essentially betting that crypto payments will become as ubiquitous as credit cards.

2/ When E-commerce is Disrupted by Its Own Platform

Shopify has just announced a move that could terrify traditional payment processors. USDC payments are being rolled out to millions of merchants, and unless sellers opt out, stablecoin payments will become the "default option."

What happens next?

The partnership with Coinbase and deployment on Base will create a complete payment system that handles everything from wallet creation to settlement. Customers can pay with USDC and receive 1% cashback, while merchants can enjoy faster settlement times and lower fees than traditional credit cards.

What does this indicate?

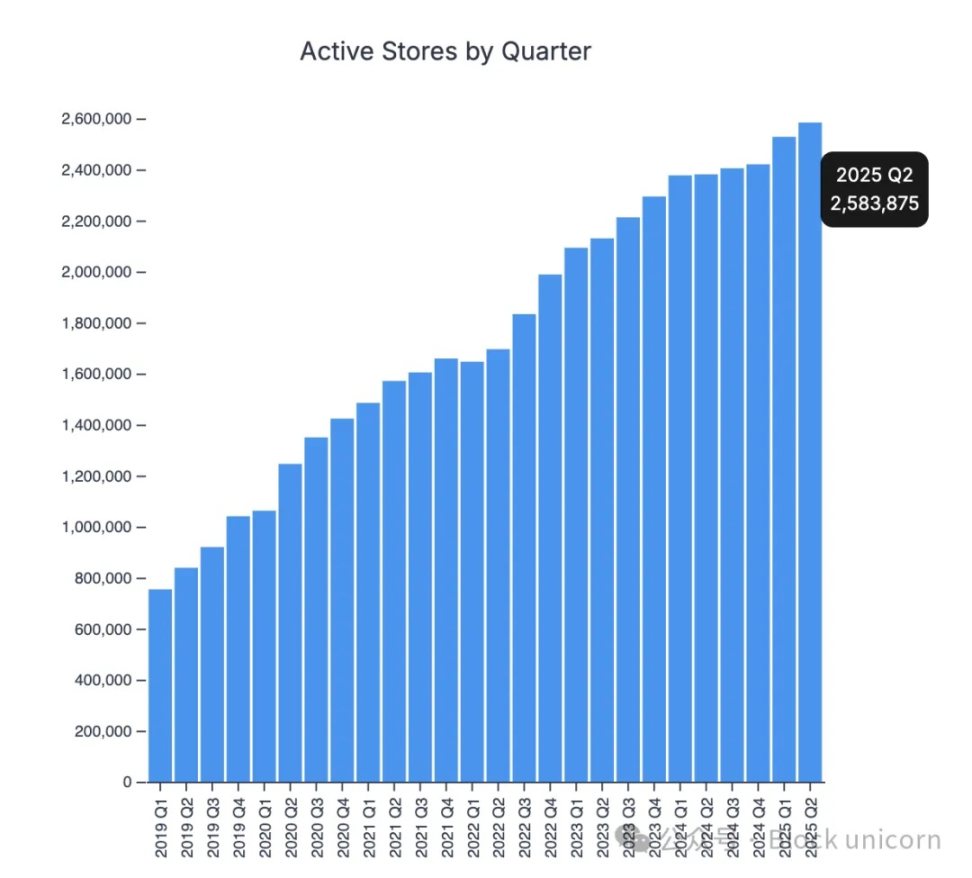

Shopify supports millions of online stores—2.6 million merchants across over 150 countries, from individual entrepreneurs to Fortune 500 companies.

Image source: storeleads.app

When they can simply press a button to allow all merchants to accept USDC payments and receive a 1% cashback reward, I want to call it a "revolution," and let me tell you why.

Traditional payment processing charges retailers 2% to 3% per transaction, while stablecoin payment fees are just a few cents.

For a $100 purchase:

- Traditional payment: $2 to $3 in fees.

- USDC on Base: about $0.05 in fees.

Amplifying this figure within Shopify's ecosystem, what you see is billions in savings.

What does this mean for you as a customer? These savings won't disappear into corporate profits. Retailers can either pocket the difference (thus enhancing competitiveness) or pass the savings directly back to consumers by lowering prices.

Shopify has already released an enticing incentive. They offer consumers 1% cashback in local currency for using USDC payments. So, you don't pay extra for convenient payments; instead, you are rewarded for using a cheaper payment method.

Once Shopify's merchants start saving over 90% on payment processing, other e-commerce platforms will face a dilemma: either adopt stablecoin payments or watch their merchants migrate to platforms that support stablecoins.

3/ When Retail Giants Build Their Own Stablecoins

According to The Wall Street Journal, both Amazon and Walmart are "considering issuing their own dollar-backed stablecoins for consumers." Similarly, the scale we are talking about… is enormous.

- Amazon: Annual revenue of $638 billion, e-commerce sales of $447 billion.

- Walmart: Annual e-commerce sales exceeding $100 billion.

If either of these companies launches its own stablecoin payment system, they could immediately shift billions in cash flow away from banking partners.

What does this mean for customers?

- Faster checkout—instant settlement instead of T+2 processing.

- Lower prices—retailers can pass on the savings from waived fees.

- Seamless international purchases—no fees or delays.

Once Amazon or Walmart customers experience buying products for $98 instead of $100 due to the absence of payment processing markups, they will expect the same from all other retailers. Suddenly, every business will need to integrate stablecoins, or risk losing customers to competitors who can offer the same products at lower prices of 2% to 3%.

The network effect becomes unstoppable: customers demand cost savings, retailers need to lower costs to remain competitive, and traditional payment processors watch their business models fade away.

4/ The Ultimate Irony: The Banks Themselves

According to a May report from The Wall Street Journal, major financial institutions, including JPMorgan Chase, Bank of America, Citigroup, and Wells Fargo, are exploring the creation of consortium-backed stablecoins. The four largest banks in the U.S. are collaborating to build the crypto infrastructure they have denied for years.

Now, JPMorgan—whose CEO Jamie Dimon has criticized Bitcoin for years—has just applied for a trademark for "JPMD," covering digital asset trading, exchange, transfer, clearing, and payment processing.

This bank, which processes $15 trillion annually through its private JPM Coin, is now building public-facing crypto services.

You know why this is important. Not because the largest banks in the U.S. love technology, but because they see their payment monopoly coming to an end and want to take control of this transformation.

Banks earn billions from payment processing fees. Stablecoins threaten to eliminate these fees entirely (and clearly, we are already on that path).

Their choice? Build crypto infrastructure or become irrelevant. Yes, you could call it "surrender."

Our Perspective

All these announcements about corporate stablecoins did not happen in a vacuum. Companies have been waiting for regulatory clarity before investing billions in building stablecoin infrastructure. The "GENIUS Act" provides that clarity, which is why we are suddenly seeing these headlines.

Regulatory momentum is paving the way for mainstream adoption of stablecoins, eliminating the uncertainties that have restricted corporate participation in other crypto assets.

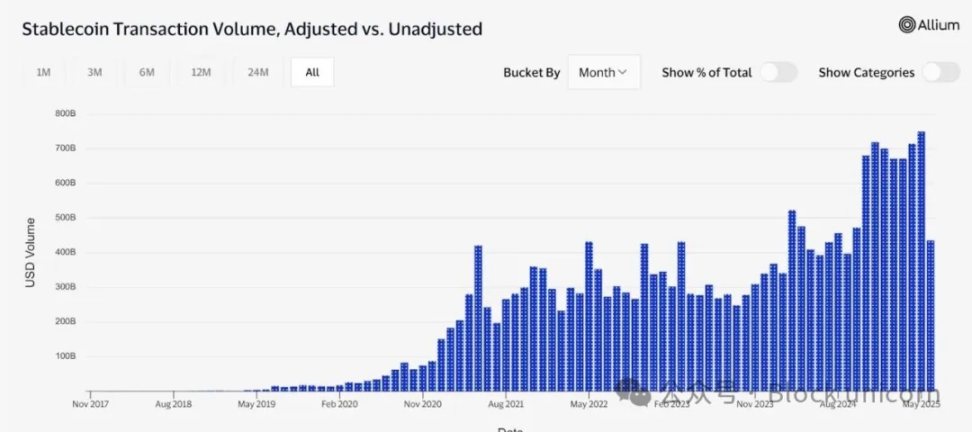

But I want to talk about the scale of reality. The data on stablecoin commercialization reveals why traditional companies are starting to pay attention. By May 2025 alone, stablecoin transaction volume reached $40 trillion, with an annual total of $34 trillion.

Visa's annual transaction volume is about $15.7 trillion, and PayPal's is about $1.7 trillion. This indicates the significance and growing influence of stablecoins in the global payments landscape.

Image source: Visa

B2B cross-border payments using stablecoins reach $3 billion monthly, while traditional card payments are only $1.1 billion. The speed and cost advantages of blockchain settlement are driving higher adoption rates among businesses compared to consumers.

18% of U.S. small and medium-sized enterprises are aware of cryptocurrency and currently use stablecoins to meet business needs, up from 8% in 2024. This adoption is for practical purposes rather than speculative investment.

When Shopify (with millions of merchants), Amazon (with $638 billion in revenue), and Walmart (with e-commerce sales exceeding $100 billion) start pushing for stablecoin adoption, digital growth will quickly become astonishing.

Even if only 10% of these companies' total transaction volume shifts to stablecoins, annual stablecoin usage will increase by over $75 billion.

Once a certain number of merchants accept stablecoins, consumers will demand them. Merchants must offer stablecoins, or they will lose business. We are witnessing the early stages of a migration in the payment system that could reshape the global business landscape in the next five years.

The craziest part? Most people won't even notice it happening. They will just wonder why their online shopping suddenly became faster and cheaper.

Whether this represents the ultimate victory for cryptocurrency or a shift towards something entirely different remains to be seen. But all of this suggests that the true impact of cryptocurrency may come from its evolution and its deep embedding into existing systems, making its presence almost invisible.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。