2025 年,以太坊创始人 Vitalik Buterin 通过卡通「牛」的形象,象征以太坊价值范式的转变。

撰文:Oliver,火星财经

2025 年 6 月 19 日,当以太坊的灵魂人物 Vitalik Buterin 在社交媒体上用一头卡通「牛」的形象,替换掉原本代表「数字石油」的油桶图标时,这并非一次随性的涂鸦。这个看似微小的举动,更像是一次精心策划的价值宣言,一次对以太坊牛市逻辑的深刻重塑。它暗示着,在现货 ETF 已经为华尔街铺开红毯的今天,以太坊的故事正在超越那个略显陈旧的「数字世界燃料」比喻,演化为一个更宏大、更稳固、也更复杂的价值范式。

Buterin 所转发并「编辑」的,是关于以太坊三大核心价值——「数字石油」、「价值存储」和「全球储备资产」的论述。这三个概念早已是社区耳熟能详的旋律,但当它们被这位创始者以一种全新的视觉语言并置在一起时,其内在的张力与协同效应便以前所未有的清晰度浮现出来。这头「牛」,不再是单一叙事的象征,而是三大支柱合力铸就的经济巨兽。本文旨在深入解构这一正在形成的新范式,探讨在以太坊迈向主流资产的征途中,其价值的根基究竟发生了怎样深刻而微妙的变迁。

从「数字石油」到「经济心脏」:L2 时代的价值重估

以太坊作为「数字石油」的叙事,是其最早也是最成功的价值定位。这个比喻直观地解释了 ETH 的根本用途:作为驱动全球最大智能合约平台运行的燃料(Gas)。每一次转账、每一次 DeFi 交互、每一次 NFT 铸造,都需要消耗 ETH。这种不可或缺的实用性,为 ETH 构建了坚实的需求基本盘。在过去,网络的拥堵和高昂的 Gas 费,甚至被视为网络繁荣的体现,直接与 ETH 的价值捕获挂钩。

然而,进入 2025 年,这个经典的叙事正面临一场由以太坊自身成功所引发的深刻挑战。2024 年 3 月的 Dencun 升级,尤其是 EIP-4844(Proto-Danksharding)的实施,彻底改变了游戏规则。通过为 Layer 2(L2)网络提供一个专属且廉价的数据发布通道(Blobs),以太坊成功地将大量交易活动「外包」给了 Arbitrum、Optimism 等扩容解决方案。这无疑是技术上的巨大胜利,实现了让普通用户以极低成本参与数字经济的宏伟蓝图。但它也带来了一个尖锐的经济悖论:当绝大多数经济活动迁移至廉价的 L2,主网(L1)的拥堵程度急剧下降,直接导致了 Gas 费的暴跌和 ETH 燃烧量的锐减。

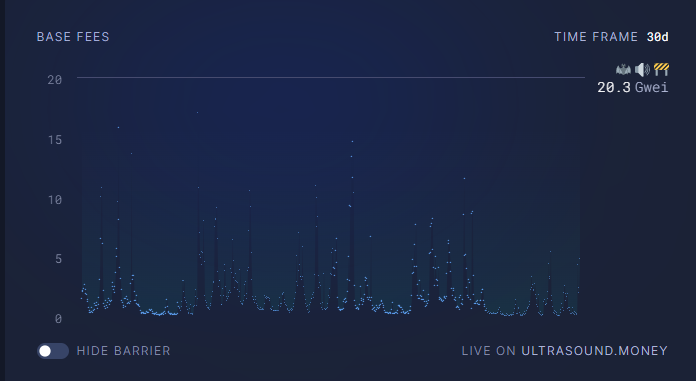

根据 Dune Analytics 上的数据显示,自 Dencun 升级以来,以太坊 L1 的平均 Gas 价格长期处于个位数的 Gwei,这在过去几年是难以想象的。费用降低,意味着通过 EIP-1559 机制被销毁的 ETH 数量也随之萎缩。这直接冲击了「数字石油」叙事的核心逻辑——即网络使用量与价值捕获(通缩)的正相关关系。如果「石油」的消耗量正在结构性地减少,我们又该如何评估它的价值?

这正是价值范式转移的关键所在。新的认知框架认为,ETH 的价值不再仅仅体现在作为 L1 上被「消耗」的燃料,而是升维为保障整个模块化生态系统安全的「经济心脏」。以太坊 L1 正在从一个拥挤的「世界计算机」,转变为一个高度安全的「全球结算与安全层」。它的核心任务,是为成百上千个 L2 提供最终的交易终局性(Finality)和数据可用性(Data Availability)保障。L2 们处理海量的交易,然后将压缩后的「证明」提交回 L1 进行最终确认。

在这个新模型中,ETH 的价值捕获机制变得更为间接,但可能也更为稳固。它的价值不再主要来自交易摩擦,而是来自其作为安全提供者的「租金」。虽然单个 L2 支付给 L1 的费用降低了,但随着未来数千个 L2 的涌现,这笔总「租金」的规模依然可观。更重要的是,整个生态系统的安全,完全依赖于 L1 上质押的 ETH 总价值。一个拥有数万亿美元经济活动的模块化生态,必须由一个同样体量、甚至更高量级的安全层来保护。因此,ETH 的需求从「交易性需求」转向了「安全性需求」。它不再是汽油,而是支撑起整个洲际公路网(所有 L2)地基的混凝土,其价值与公路网的总经济流量(所有 L2 的 TVL 和活动)正相关。这种转变,将 ETH 的价值从短期的费用波动中解放出来,锚定在了更长期的、整个生态系统的宏观增长之上。

「互联网债券」的崛起:当「超声波」归于沉寂

如果说「数字石油」的叙事正在经历一场深刻的自我进化,那么「价值存储」的故事则几乎是被彻底重写了。曾几何时,「超声波货币」(Ultrasound Money)是社区最引以为傲的口号。在「合并」(The Merge)大幅削减新增发行量和 EIP-1559 持续燃烧费用的双重作用下,ETH 一度进入了净通缩状态,被誉为比比特币的「健全货币」更「健全」的资产。ultrasound.money 网站上持续跳动的负通胀率,是无数投资者坚信 ETH 能够超越 BTC 的核心信仰。

然而,前文所述的 L2 悖论,同样也给这个美好的通缩神话蒙上了一层阴影。L1 费用的减少,使得燃烧机制的威力大打折扣。数据显示,自 Dencun 升级后,ETH 在多个时期已经重新回到了轻微通胀的状态。这让「超声波货币」的口号显得有些尴尬,也迫使市场去寻找一个更具韧性的价值支撑。

于是,「互联网债券」(The Internet Bond)的叙事应运而生,并迅速成为机构投资者眼中更具吸引力的故事。这个概念的核心在于,通过权益证明(PoS)机制,任何持有 ETH 的人都可以通过质押(Staking)来参与网络验证,并因此获得以 ETH 计价的稳定收益。截至 2025 年中,以太坊的质押年化收益率(APR)稳定在 3%-4% 左右。这笔收益并非凭空产生,它来自用户支付的交易费用(小费部分)和协议增发的 ETH 奖励,是对验证者维护网络安全所提供服务的合理报酬。

这种内生的、以协议原生资产计价的收益,使得 ETH 成为一种生产性资本资产(Productive Capital Asset)。它不再仅仅是一个等待升值的静态商品,而是一个能够持续产生「现金流」(尽管是 ETH 本位的)的生息资产。对于习惯了股息和债券利息的传统金融投资者而言,这是一个极易理解且极具吸引力的模型。VanEck 的分析师们就曾明确指出,ETH 的质押收益,可以被视为数字世界的「无风险利率」,所有建立在以太坊之上的 DeFi 协议的收益率,都可以基于此进行定价。

「互联网债券」的叙事,因为流动性质押代币(LSTs)的繁荣而变得更加强大。像 Lido 的 stETH 和 Rocket Pool 的 rETH 这样的 LST,让普通用户既能获得质押收益,又能保持其资产的流动性。这些 LST 随后被深度整合进 DeFi 的每一个角落,作为抵押品、交易对,创造了所谓的「LSTfi」生态。这形成了一个强大的价值飞轮:ETH 因其生息属性被大量质押,从而提升了网络的安全性和去中心化程度;产生的 LST 又反过来成为 DeFi 世界的基石,进一步增加了对 ETH 作为底层资产的需求。

这个叙事的转变至关重要。它将 ETH 的价值主张从一个依赖于网络拥堵和稀缺性预期的投机故事,转变为一个基于实际经济活动和可预测收益的投资故事。即使「超声波货币」的通缩光环褪去,只要以太坊生态持续繁荣,其作为「互联网债券」的收益属性就依然存在。这为 ETH 提供了一个坚实的价值底座,也为未来的 ETF 产品留下了巨大的想象空间——一个能够将质押收益直接分配给投资者的现货 ETF,无疑将成为引爆下一轮机构需求的核武器。

「信任之锚」:数字经济的终极结算层

无论「石油」的比喻如何演变,还是「债券」的收益多么诱人,以太坊的第三个、也是最坚固的价值支柱,在于其作为全球数字经济「信任之锚」的地位。这个角色,即「全球储备资产」,建立在去中心化、安全性和无可比拟的网络效应之上,使其成为数字世界中最值得信赖的底层结算层。

首先,在规模已达数千亿美元的 DeFi 世界里,ETH 是无可争议的抵押品之王。在 Aave、MakerDAO 等核心借贷协议中,ETH 及其 LST 衍生品占据了抵押品总量的绝对主导地位。Galaxy Research 的一份报告指出,市场之所以信任 ETH,是因为其深厚的流动性、相对较低的波动性(相比其他加密资产)以及经过时间检验的安全性。用户放心借出数十亿美元的稳定币,是因为他们相信其背后的 ETH 抵押品是稳固的。这种作为「DeFi 央行储备金」的地位,创造了对 ETH 的巨大、持续且具有粘性的需求。

其次,以太坊是全球稳定币生态系统的重心。尽管 Tron 等链在 USDT 发行量上占据一席之地,但绝大多数创新和核心的稳定币,如 USDC 和 DAI,其价值的最终结算都发生在以太坊上。以太坊承载着超过千亿美元的稳定币市值,这些稳定币构成了数字经济的血液,而 ETH 则是保障这些血液安全流动的血管系统。

更具深远意义的是,传统金融巨头们正在用脚投票。当贝莱德(BlackRock)选择在以太坊上推出其首个代币化货币市场基金 BUIDL 时,它所看重的绝非以太坊的交易速度或成本。恰恰相反,它选择的是以太坊「钻石般」的信任和安全性。Consensys 首席执行官 Joseph Lubin 曾言,以太坊提供了「强大到足以抵抗民族国家级别对手」的信任。这种经过十余年发展沉淀下来的「林迪效应」——存在越久,就越可能继续存在下去——是任何新兴公链在短期内都无法复制的护城河。随着现实世界资产(RWA)代币化的浪潮兴起,以太坊作为全球价值的终极结算层的地位将愈发不可动摇,其作为储备资产的价值也将被不断夯实。

结论:合力铸「牛」,而非独行

现在,我们再回头看 Vitalik 发出的那头「牛」。它不再仅仅代表着牛市的期望,而是对以太坊价值来源的一次精妙总结。这头牛,是由三股力量共同驱动的:

它拥有「经济心脏」的强劲搏动:作为整个模块化生态的安全基石,其价值与一个不断扩张的数字经济体的总规模同步增长。 它具备「互联网债券」的稳健收益:内生的质押收益为它提供了坚实的价值底座和清晰的估值模型,吸引着追求稳定回报的长期资本。 它身负「信任之锚」的千钧之重:作为 DeFi 的终极抵押品和全球价值的结算层,它沉淀了市场最宝贵的共识与信任。

这三大支柱并非孤立存在,而是相互依存,彼此强化。强大的「信任之锚 」地位,吸引了 DeFi 和 RWA 的繁荣,驱动了「经济心脏」的增长;而作为「互联网债券」的生息能力,又激励着海量资本被质押,为整个系统提供了坚不可摧的安全保障。

以太坊的牛市论点,已经告别了那个可以被一个词(如「通缩」)简单概括的时代。它变得更加成熟、更加多元,也更具韧性。它不再依赖单一的叙事,而是构建了一个内部逻辑自洽、能够抵御外部冲击的价值矩阵。对于习惯了分析复杂系统的机构投资者而言,这种充满内在张力与协同效应的宏大叙事,或许才刚刚开始展现其真正的魅力。V 神换上的那头牛,预示的正是这样一个时代的到来。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。