Author: Robert Miller, Flashbots

Compiled by: Saoirse, Foresight News

Today, we present a new argument: MEV (Maximal Extractable Value) has become the primary limiting factor for blockchain scalability.

As Ethereum and its Layer 2 networks, along with mainstream public chains like Solana, compete to scale at the fastest pace, the economic constraints brought by MEV have become evident across the industry. On-chain search behaviors are beginning to occupy the majority of capacity in high-throughput blockchains in a remarkably resource-wasting manner.

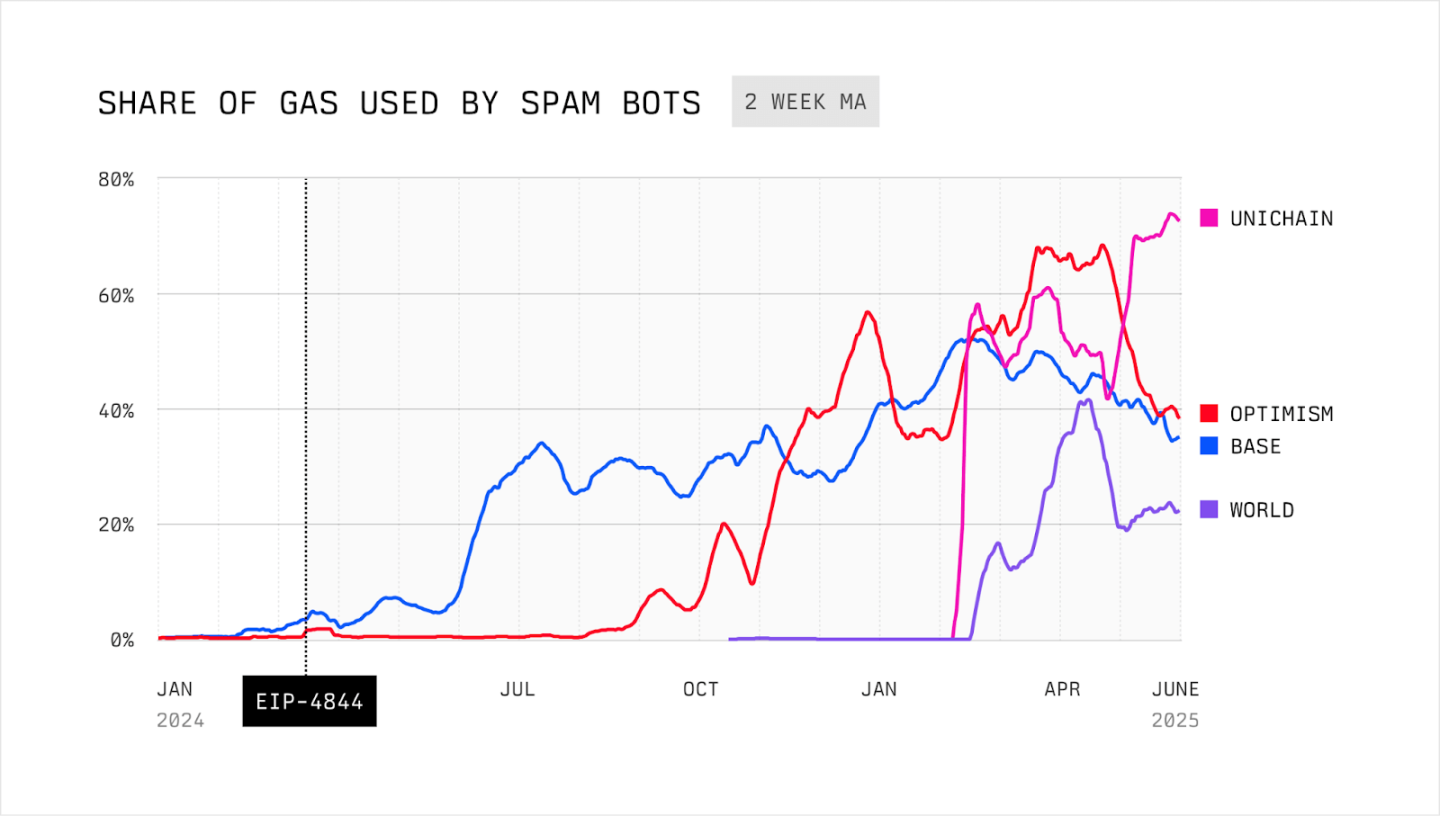

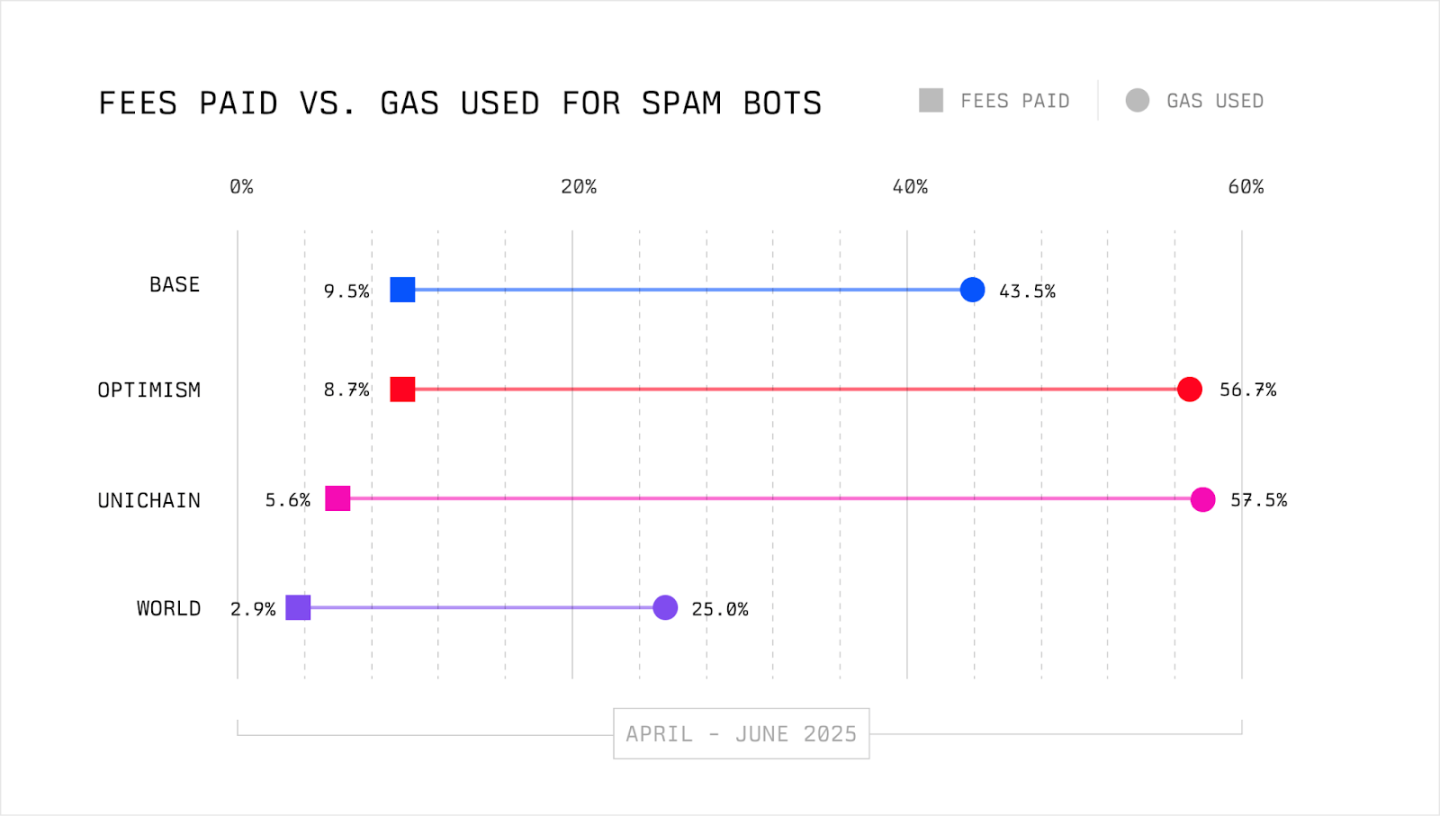

This is not a theoretical assumption or an isolated phenomenon. From Solana (where MEV bots consume 40% of block space) to the Ethereum Layer 2 ecosystem, this situation is ubiquitous. To quantify the impact, we conducted an in-depth analysis of top OP-Stack Rollups supporting specific tracking endpoints, revealing an industry-wide issue:

- Garbage trading bots in multiple Rollups consume over 50% of Gas but pay less than 10% of the fees;

- Between November 2024 and February 2025, the Base network will increase Gas processing capacity to 11 million Gas/second, but nearly all of it will be occupied by garbage bots (equivalent to the capacity of three Ethereum mainnet blocks!);

- The sustained demand for Gas from garbage bots drives up user fees;

- The garbage trading market is highly concentrated, with over 80% of garbage trades on Base dominated by two searchers.

While technical scaling methods such as database sharding (like Rollups), validity proofs, and optimizations of databases or consensus mechanisms are important, relying solely on technology cannot solve the problem. Although we have mastered methods to build foundational technical throughput, the current market structure imposes economic constraints on scalability.

This article will analyze this market failure phenomenon, demonstrate its impact with data, and propose a new MEV auction mechanism aimed at addressing the issue.

Analysis of Garbage Trading

To understand why block space is being wasted, let’s break down a successful arbitrage trade:

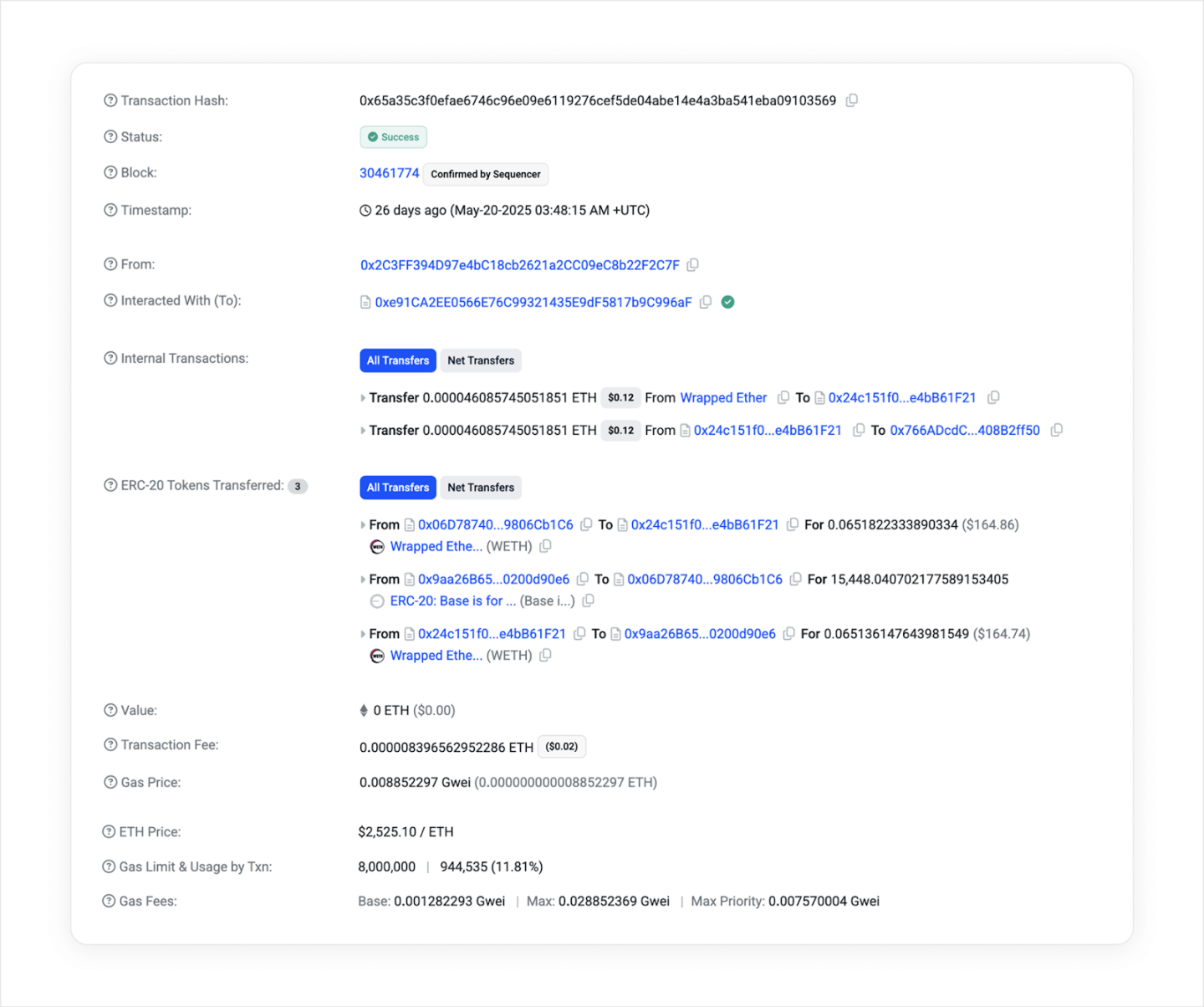

Example of a successful arbitrage trade on Base

At first glance, this seems to be a model of efficiency: the search bot executes precise arbitrage, earning $0.12 and paying $0.02 in fees.

However, the true cost of this successful arbitrage is shocking: for each successful arbitrage, the bot sends about 350 attempted arbitrage transactions (most of which fail). On average, a single successful arbitrage consumes about 132 million Gas—equivalent to nearly 4 complete Ethereum blocks. It is important to note that this is just one of many bots participating in the competition, and the actual cost to the chain is even higher.

Now let’s look at a typical failed attempt to understand the on-chain behavior of the bots:

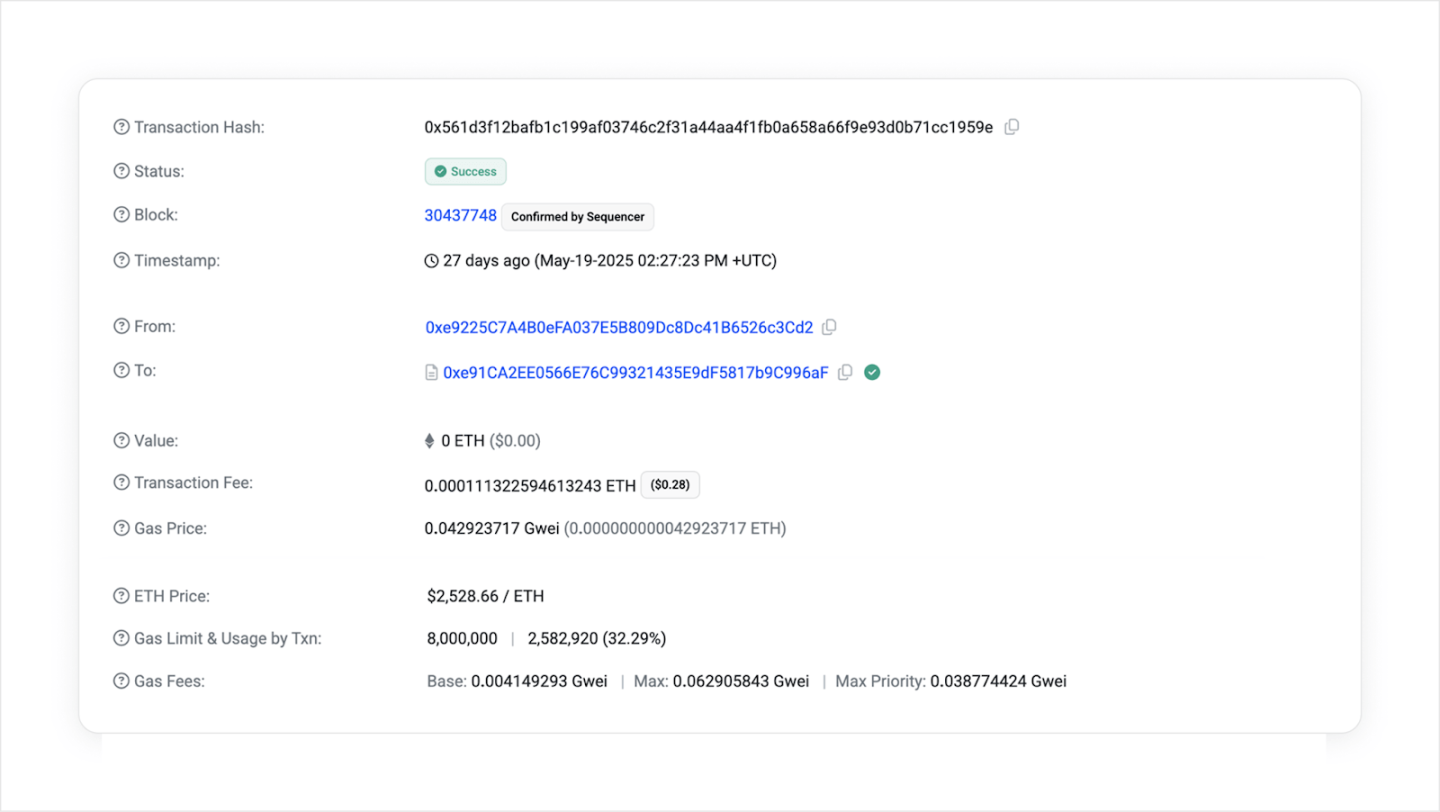

Example of a failed transaction blindly seeking arbitrage opportunities

At first glance, this transaction appears unremarkable: it executed successfully and did not transfer any tokens. The only clue is that it consumed about 2.6 million Gas (as shown in the image above).

A deeper trace of its internal calls reveals that it initiated a series of calls to dozens of different DEX pools, querying the pool status through getReserves() and slot0(). These calls are essentially fetching asset prices across different DEXs.

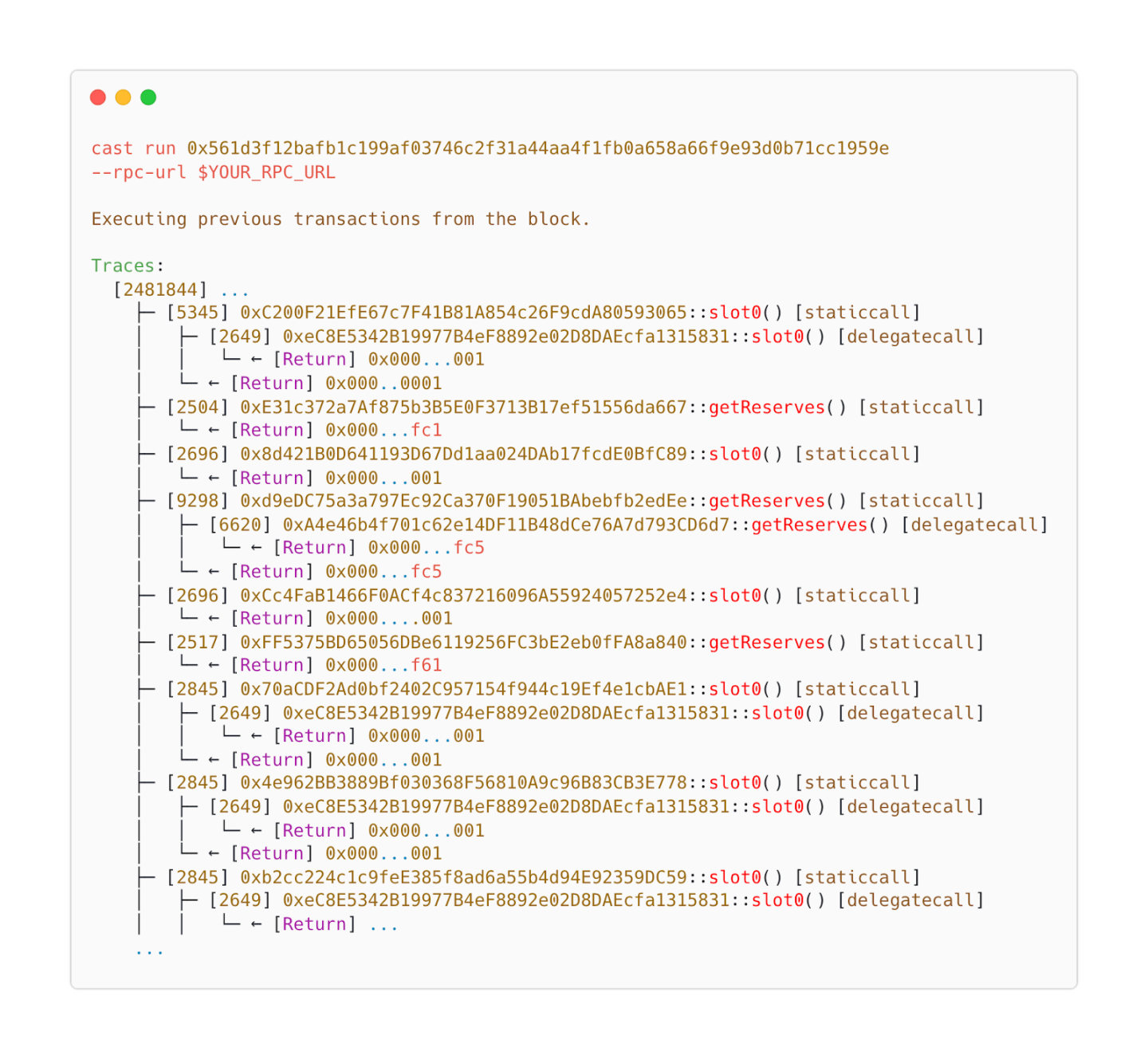

Example of tracing repeated calls to slot0() and getReserves()

The core logic of the bot is simple:

- Send a transaction to the chain

- Query prices from multiple DEX pools during execution

- Execute if an arbitrage opportunity exists

- Terminate if none exists

The above transaction reflects these four steps, ultimately terminating without executing any operations. In reality, it was merely a high-intensity price query, consuming about 2.6 million Gas while only reading market states without any substantive action.

On public chains like Base, World, and Solana, this strategy has become the mainstream method for extracting MEV. A few successful trades must pay for a large number of failed attempts, which is a rational choice for searchers but causes systemic inefficiency for the network.

A large amount of resources is used to read prices without generating substantive value. Moreover, it is not just this one searcher; all searchers must adopt this strategy to capture atomic-level MEV. The end result, as the data shows, is that public chains are clogged with garbage trades, and fees are driven up due to these trades. (Note: Atomic-level MEV emphasizes value extraction achieved in a single on-chain operation, such as a single transaction or within a single block, commonly seen in arbitrage, front-running, and other scenarios that leverage blockchain immediacy and transaction order.)

Fundamental Causes of Garbage Trading

The clogging of high-throughput public chains by garbage trading is not coincidental but a direct and "rational" response to market structure flaws: if searchers want to profit by reading the latest state of the block, they must blindly initiate transactions within the same block.

The arbitrage bot analyzed earlier is a typical case. While off-chain queries can obtain the state of the last confirmed block, this lags behind the MEV opportunities being created by transactions in the current block being built. In networks like Base or Solana, the native mempool is private, meaning searchers cannot know the execution status of user transactions and the opportunities they create before the block is published. The only way to discover and capture arbitrage space is to have their transactions included in the same block immediately after user transactions. If they wait for the next block, the opportunity will be taken.

The rampant on-chain search phenomenon stems from the interaction of the following factors:

1. Transaction Expressiveness

Unlike traditional finance where traders submit simple static orders (like "buy at price X"), searchers can create transactions as on-chain programs, embedding condition logic based on the market's immediate state to achieve complex responsive strategies that were previously impossible.

2. Shift to Private Mempools

To protect users from front-running, most high-throughput public chains set their mempools to private. While this effectively defends against front-running, it also prevents searchers from seeing user order flows. Without the ability to react before transactions are on-chain, searchers can only blindly probe for opportunities by initiating highly expressive transactions.

3. Low Fees

The low cost of block space further amplifies on-chain search behavior. Searchers know that the profit from a single successful arbitrage can cover the costs of many failed trades, so they dare to send massive speculative transactions to each block. The lower the Gas fees, the more complex logic searchers can write, pursuing more intricate strategies.

4. Lack of Efficient Auction Mechanisms

The competition among searchers lacks a formal mechanism for expressing transaction ordering preferences. Without a direct way to bid for the ordering of specific transactions in a block, competition devolves into a wasteful alternative: consuming more Gas. The primary way for searchers to increase their win rate is to consume Gas in more positions within the block, increasing the probability that their transactions land in the "correct position."

These four factors together give rise to "garbage trading auctions," an extremely wasteful mechanism that exacerbates network congestion while failing to effectively capture MEV value. To quantify the inefficiency caused by garbage trading, we conducted data validation.

Research Findings

Analysis confirms that MEV-driven garbage trading constitutes an economic constraint on scalability.

We define garbage trading by identifying transactions that "query DEXs repeatedly without transferring tokens." This heuristic approach aims to pinpoint systematic wasteful "backrunning" arbitrage behavior that could have been completed off-chain but is forced on-chain. We implemented this method in both Python tools and Dune dashboards, with detailed methodology provided in the appendix.

Since the garbage trading detection tool relies on specific RPC methods, the current data analysis is limited to OP-Stack Rollups. However, data from the Ghost Logs team indicates that similar phenomena exist on Solana, and other Ethereum Rollups (like ZKsync and Arbitrum) have also shown signs of garbage trading.

1. Garbage Trading is Systematic and Widespread

First, this issue is systematic and widespread. Analysis of OP-Stack Rollups shows that garbage trading is not an isolated phenomenon but a dominant force within the entire ecosystem. On chains like Unichain, Base, and OP mainnet, garbage trading typically consumes over 50% of total Gas. This indicates that it is a structural consequence of the current market design, rather than a localized anomaly.

2. Gas Consumed by Garbage Trading Far Exceeds Fees Paid

The second finding shows that, from the chain's perspective, the efficiency of garbage trading is extremely low.

In all the Rollups we analyzed, there is a significant gap between the resources consumed by garbage trading and the revenue it generates. Compared to other users, garbage trading bots consume several times the Gas they pay in fees. For example, garbage bots on the OP mainnet consumed about 57% of the Gas but paid only about 9% of the fees, a difference of up to 6 times.

The disparity between fee payments and Gas consumption indicates that garbage trading imposes significant external costs on the network while providing almost no corresponding value, which is a hallmark of a systematically inefficient market. This includes tangible waste of computational resources, as every full node is forced to execute these transactions, thereby increasing the hardware requirements for all network participants.

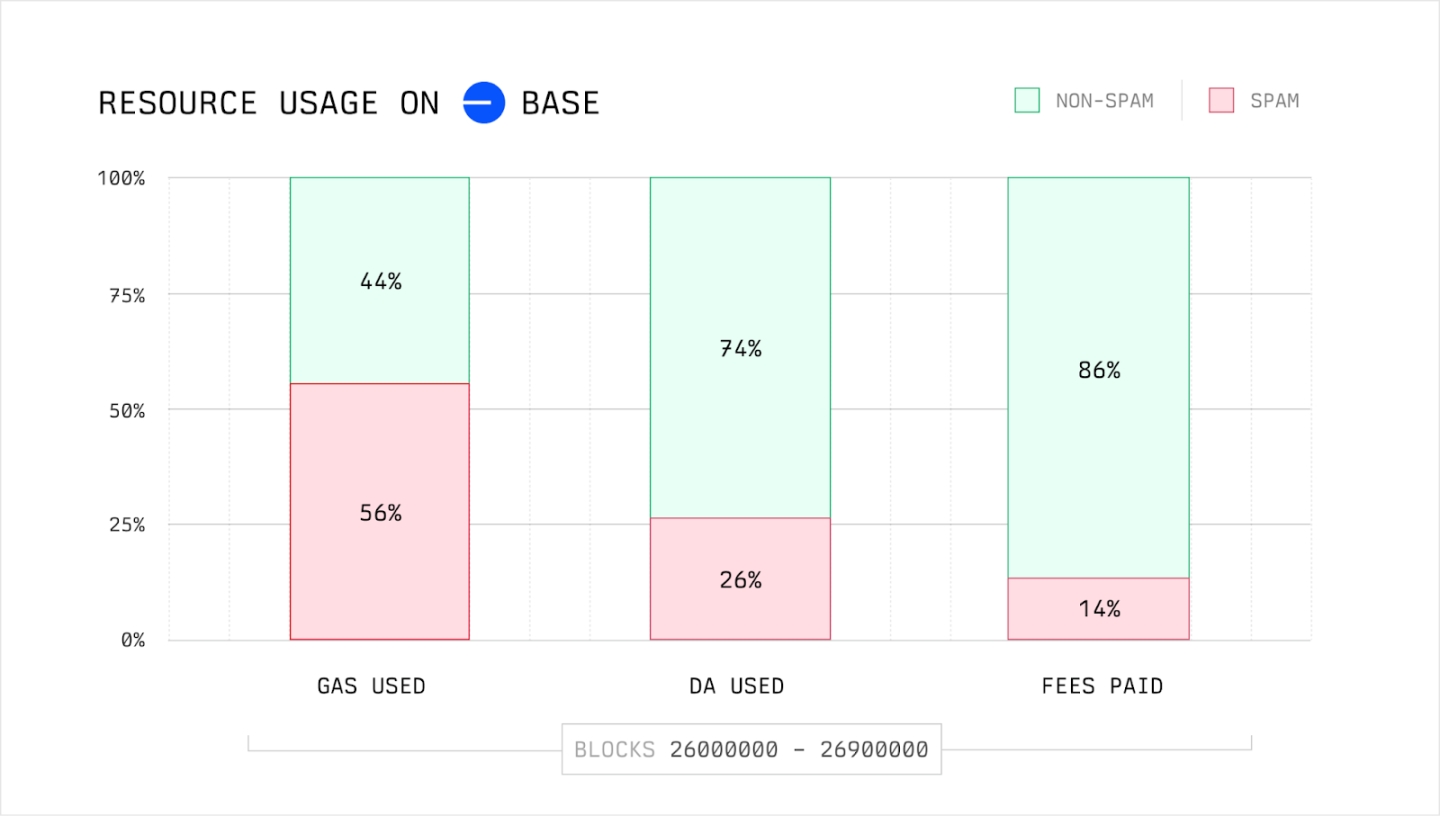

Additionally, we analyzed how garbage trading in L2 affects Rollups' use of L1 Data Availability.

Data shows that in one million blocks in February 2025, garbage bots on Base contributed approximately 56% of Gas consumption, 26% of L1 DA (Data Availability) usage, and 14% of on-chain fees. The proportion of DA usage by garbage bots initially surprised us, but we later found that it was related to their transaction volume share (rather than Gas consumption). This is reasonable, as DA usage depends on data compression efficiency, not Gas consumption.

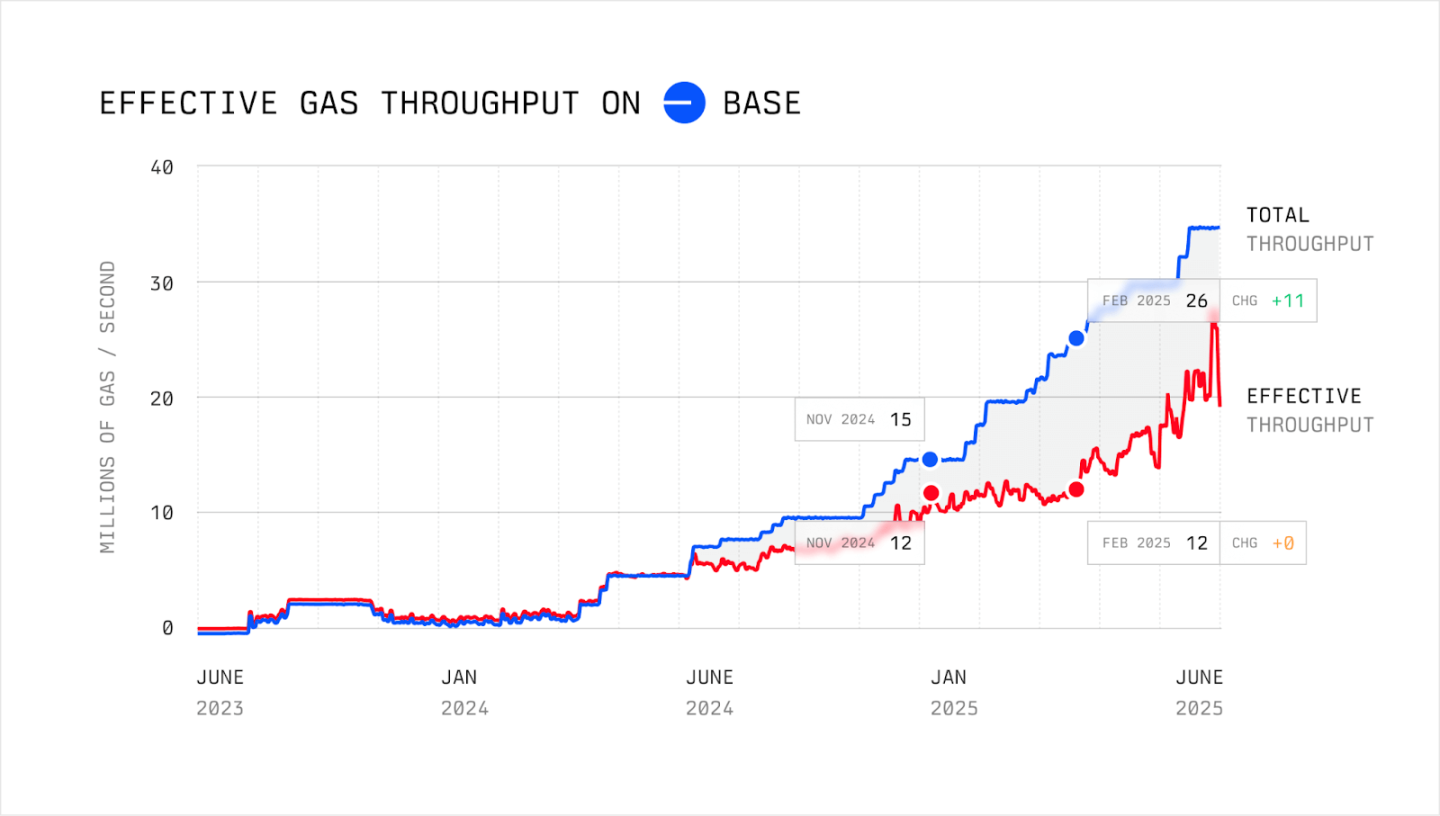

3. Garbage Trading Limits and Offsets the Benefits of Scalability

Thirdly, this inefficiency directly offsets the benefits of scalability. To measure the negative impact of garbage trading, we introduced a new metric: effective Gas throughput, which is the amount of user-available Gas processed per second after Rollup deducts the consumption by garbage bots.

The trend on Base is particularly evident: in November 2024, the total Gas throughput was 15 million Gas/second, while the effective Gas throughput for users was only 12 million Gas/second. In the following four months, although total throughput increased by 11 million Gas/second, effective throughput remained almost unchanged. In other words, nearly all of the newly added processing capacity was occupied by garbage trading.

Interestingly, after the end of February, effective throughput began to align more closely with the growth trend of total throughput. This seems to correlate with market trading volume (and the resulting MEV): after the "Libra Scandal" broke on February 14, effective throughput began to grow again as the trading volume of Memecoins via Telegram bots declined.

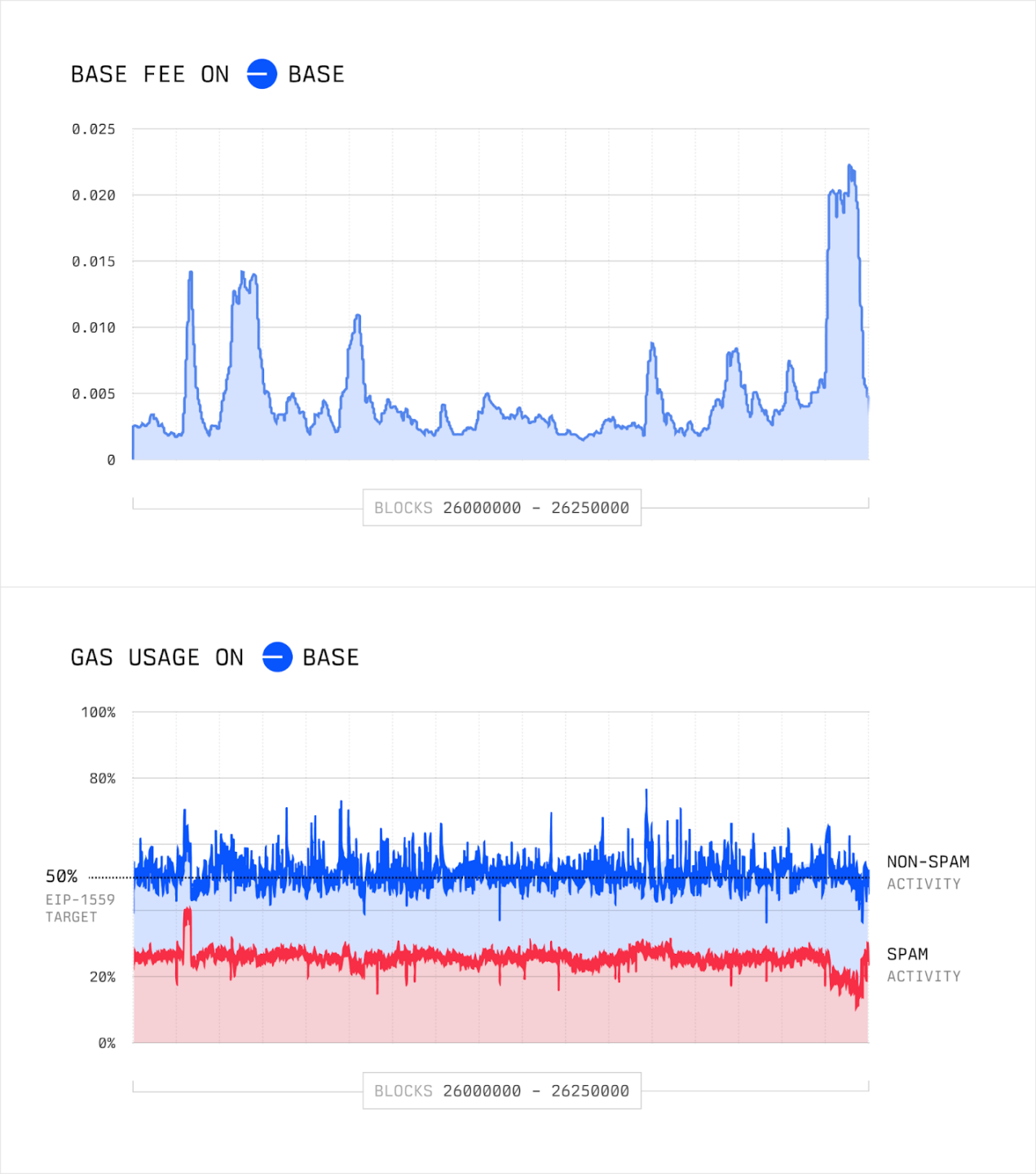

4. The Continued Demand for Garbage Trading Drives Up User Fees

Perhaps the most direct impact on users is that the persistent presence of garbage trading artificially raises the baseline for transaction fees, keeping them high over the long term.

Although the scalability measures of Rollups have reduced nominal fees to extremely low levels (e.g., around $0.01), making many natural users insensitive to price, theoretically, if block space is abundant, users are insensitive to price, and with the effect of the EIP-1559 fee market mechanism, fees should approach an absolute minimum. The vision for scalability is to create enough capacity to make this near-zero fee state the norm.

However, the reality is different. Searchers attempting to capture MEV through garbage trading are filling blocks with massive transactions, consuming large amounts of Gas. This behavior raises block utilization rates, leading to a continuous increase in base fees, which reflects the systemic inefficiency of the MEV market rather than the genuine demand from natural users.

Although the fees borne by end users remain low, the overall level is far higher than what is actually needed. The key point of this issue is that innovative application scenarios relying on large amounts of cheap block space (such as on-chain social networks or automated micropayments) are being excluded from the market as a result.

5. The Garbage Trading Market is Highly Concentrated

Finally, the analysis shows that the market for MEV garbage trading is characterized by extreme centralization.

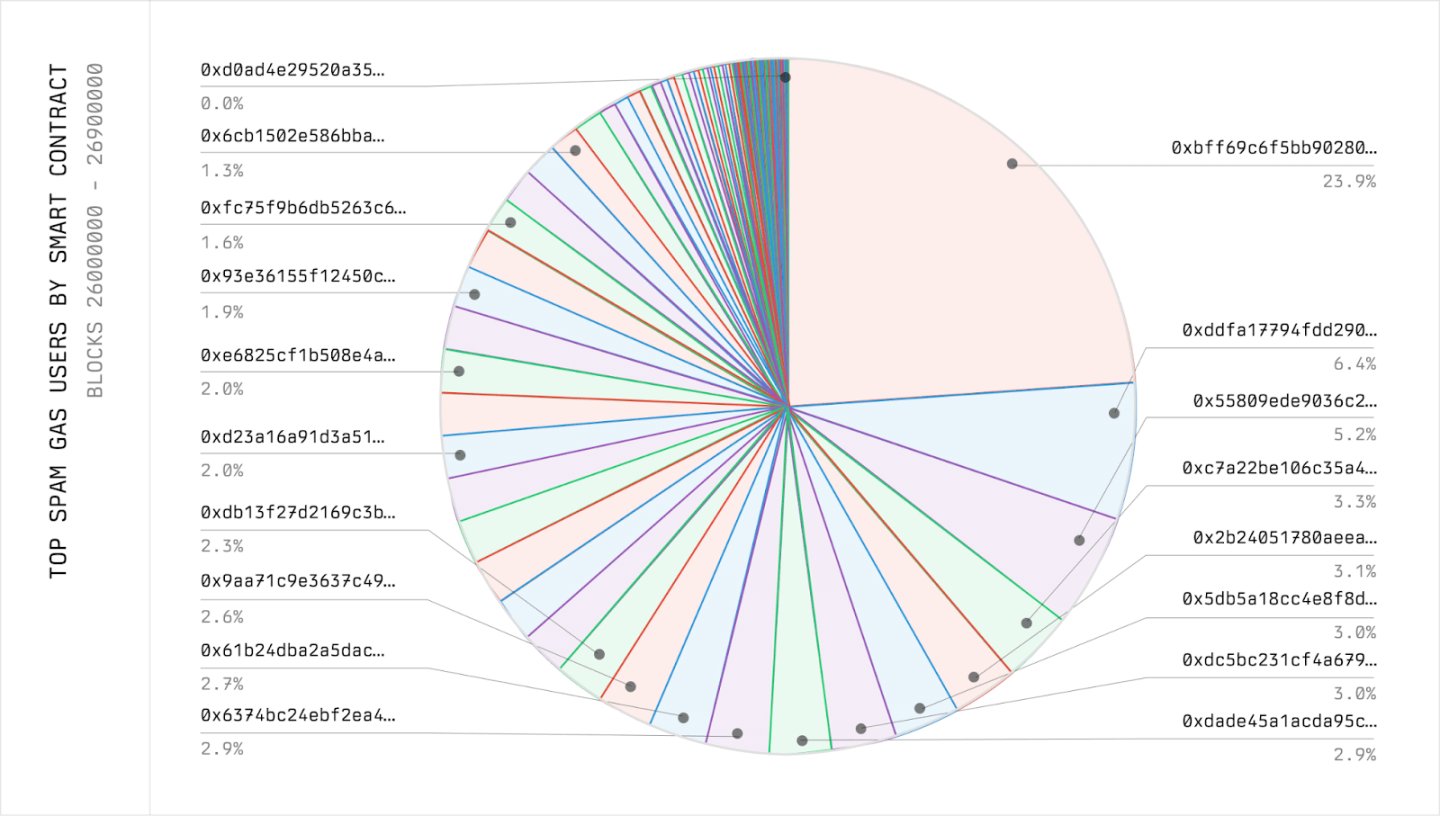

To verify this, we counted which smart contracts consumed the most Gas classified as "garbage trading" between block heights 26,000,000 and 26,900,000. At first glance, the market seems to have a high concentration of top players but a dispersed structure.

However, this appearance is deceptive. On-chain analysis shows that searchers commonly use strategies to rotate the smart contracts used to send garbage trades, but funnel profits into a fixed "profit address." By tracking the ETH transfer paths of successful arbitrage trades, we attempted to identify smart contracts controlled by the same operator. Although not all bots adopt this model, it is common among leading bots.

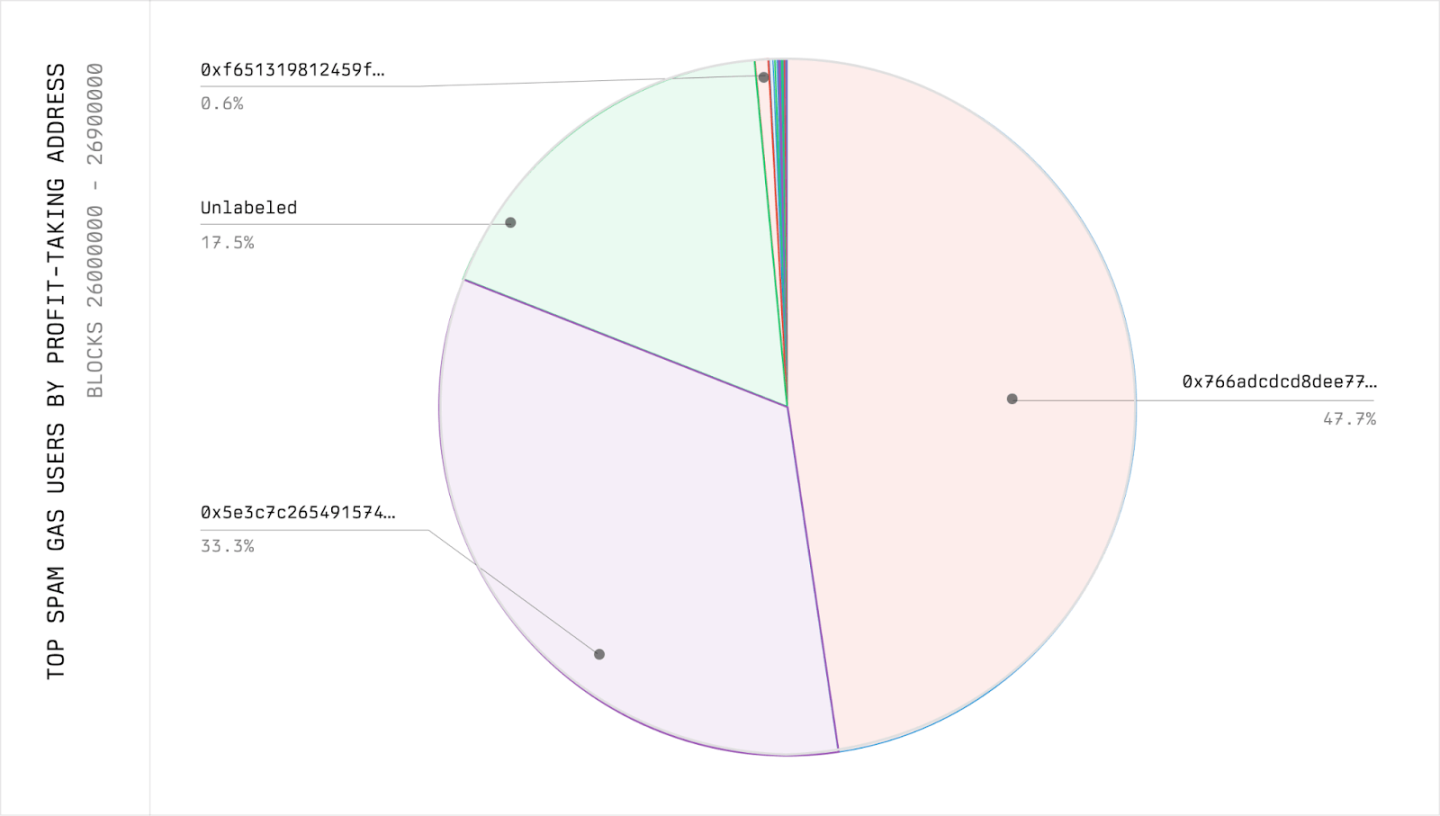

When the data is grouped by profit address, market concentration becomes extremely significant:

The results are clear: just two entities dominate over 80% of garbage trading on Base. This extreme centralization indicates that there are significant entry barriers in the market, and the current "garbage trading auction" is not a truly competitive market. The lack of competition further weakens the price discovery mechanism, leading public chains to be unable to capture the real value of extracted MEV while having to endure the negative externalities brought by garbage trading.

The Path Forward

We believe that blockchains should maximize the accommodation of valuable economic activities within limited block space.

From this standard, the current "garbage trading auction" mechanism is extremely inefficient: completing two swaps on Uniswap v3 requires only about 200,000 Gas, while achieving the same economic result on Base consumes about 130 million Gas. The efficiency gap is as high as 650 times, and narrowing this gap is key to unlocking the true potential of scalability.

To address this issue, we must return to the four main reasons why on-chain searching has become the mainstream model: transaction expressiveness, mempool privacy, low fees, and lack of efficient auction mechanisms. Among these, low Gas fees and high expressiveness are explicit goals for general-purpose smart contract chains, and we need to continue to strengthen these features. Therefore, solutions must focus on the other two points: enabling searchers to read the state about to be on-chain and expressing their preferences in a way that protects user rights while minimizing on-chain garbage trading.

Solution Directions

1. Achieving State Transparency through Programmable Privacy

An efficient market needs to provide searchers with real-time access to transaction flows while programmatically restricting how they can use that information. The system must verifiably ensure that searchers can only engage in "backrun" trades and cannot implement front-running, sandwich attacks, or leak private data. This visibility allows searchers to execute conditional logic off-chain rather than blindly probing on-chain. Once searchers generate potentially profitable trades off-chain, there still needs to be a way to accurately embed them into blocks to capture MEV.

2. Building an Explicit Bidding MEV Auction Mechanism

Abandoning the "garbage trading auction" model that competes based on Gas consumption, we should design a bidding mechanism for transaction ordering rights based on economic incentives. Searchers can directly submit monetary bids for the block positions of target transactions, determining transaction order through a market-based pricing mechanism. This model transforms the chaotic competition of Gas consumption into an efficient price discovery process:

- Searchers do not need to send hundreds of invalid transactions; they only need to pay for the ordering rights of truly valuable transactions;

- The blockchain can capture the real value of MEV through auctions rather than wasting resources on meaningless on-chain computations.

Flashbots has been attempting to leverage Trusted Execution Environments (TEEs) to provide visibility for searchers while preventing sandwich attacks. TEEs can ensure that specific code remains confidential even to machine operators during execution.

This allows searchers to run in a TEE, verifiably backrunning private trades while being unable to implement sandwich attacks or export any private data. We have validated this model on Ethereum L1, where searchers have been conducting backrun trades through a similar system for several months and are actively adapting it to L2.

Conclusion

For a long time, discussions about scalability have been limited to foundational technical throughput. However, our research indicates that the key breakthrough point is no longer expanding block capacity but rather utilizing block space more efficiently. This is because every unit of block space released incentivizes garbage trading to consume the newly added capacity. In other words, most of the benefits brought by "scalability" are captured by economically rational MEV bots, leaving real users unable to benefit. This issue is driving up fees for ordinary users, constraining the effectiveness of scalability, and causing massive waste of network resources.

The limitation of scalability lies here: while increasing block space can enhance throughput, it has limited effects on fee improvement because increasingly complex on-chain MEV will consume most of the gains. To break through these limitations and unlock the true potential of scalability, we must eliminate the wasteful garbage trading market. Through programmable privacy and explicit bidding, we can eliminate the incentives for garbage trading and replace it with a more expressive, fair, and efficient MEV market.

Adopting MEV auctions is not a luxury choice but a strategic necessity. The core lies in leveraging TEEs to provide searchers with access to transaction flows while programmatically restricting their usage. This design can achieve the ideal outcome: supporting backrun arbitrage without garbage trading while preventing sandwich attacks. For the blockchain, this means capturing more revenue in an efficient, garbage-free market; for users and developers, lower and more stable fees along with genuinely available capacity will ultimately unlock the full value of scalability.

What will happen when we break through the limitations of garbage trading? When transaction costs are low enough to be almost negligible, what new possibilities will be unlocked? What new applications will emerge? The answers can only be proven through practice.

Thanks to DataAlways, Hasu, Fahim, Danning, dmarz, Nathan, Georgios, Dan, buffalu, Quintus, Tesa, Anika, Brian, Xin, Sam, Eli, Christine, Christoph, Alex, Fred, and many others for their valuable feedback. Special thanks to Phil, and also to Achal for his help with the design.

Appendix

Heuristic Methods for Identifying Garbage Trading

To identify garbage trading, we employed two heuristic rules:

- No Token Transfer: Does the transaction involve any token transfer? If so, it is not classified as garbage trading.

- Repeated DEX Price Queries: If a transaction initiates at least 4 queries for common DEX price data without executing a token transfer, it is classified as garbage trading.

We believe that at the time of writing this article, these heuristic methods are reliable: any operation involving token transfers typically has real value for users, while garbage trading only transfers tokens when capturing MEV opportunities. Additionally, the DEX price query rule effectively identifies bots that systematically probe for arbitrage opportunities, which is the main form of garbage trading we have observed. This definition focuses on wasteful behavior that only queries DEX prices on-chain while excluding productive backrunning behavior.

However, this definition needs further optimization in the future: garbage trading bots can bypass this rule by simply transferring tokens, so the classification criteria for "garbage trading" remain a direction worth further research. Additionally, this definition mainly covers the blind backrunning arbitrage bots that dominate MEV, while not including other MEV strategies such as liquidation.

Methodology for Identifying Garbage Trading

We identify garbage trading by analyzing transaction traces: for each transaction, we check all its traces to determine whether it calls token transfer functions or DEX price functions (such as slot0(), getReserves(), etc.). If the transaction involves a token transfer, it is excluded; if no tokens are transferred and it initiates 4 or more DEX price queries, it is classified as garbage trading.

The choice of 4 as the threshold is conservative; experiments show that setting the threshold to 3 has minimal impact on the overall results. Similarly, we filtered transactions on Dune by transfer events and found that the results were not significantly different from those based on tracing methods.

spam-inspect Tool

To study garbage trading, we developed spam-inspect, a Python tool specifically designed for analyzing Ethereum Rollup activity, aimed at efficiently identifying garbage bot behavior. This tool analyzes each transaction within a block by tracing it and applying the aforementioned heuristic rules.

This tool relies on the trace_block method and is currently only available on OP-Stack chains that support OP-Reth or OP-Erigon.

Dune Queries

We built materialized views on Dune, filtering transactions that contain Transfer events and identifying repeated DEX price calls to locate hashes that meet the garbage trading criteria. The difference from spam-inspect is that this method relies on transfer events rather than transaction tracing. These garbage trading materialized views are used for subsequent query analysis.

Estimation of Data Availability (DA)

Although this article mainly discusses the impact of garbage trading on Gas, it also consumes other resources, such as Rollup's usage of L1 data availability. To estimate the L1 DA resources wasted by L2 garbage trading, we constructed a custom data pipeline (reusing some modules from op-batcher) and derived results through two sets of calculations:

- The total size of blocks containing all transactions after compression;

- The total size of blocks after compression, excluding garbage trading.

The difference between the two is the estimated L1 DA consumed by garbage trading in a single block.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。