作者:Fairy,ChainCatcher

编辑:TB,ChainCatcher

Coinbase 最近动作有点多。

一边向美国 SEC 申请推出股票代币化交易;一边联手 Shopify,让 34 个国家的消费者可用 Base 链上的 USDC 购物;同时还通过 DEX 支持所有 Base 生态资产。

币、股、支付、合约,一应俱全,并在自家公链 Base 上完成闭环。Coinbase 的野心正在彻底显形。

“链上券商”:Coinbase 的超级入口梦

据路透社报道,Coinbase 正在寻求美国 SEC 批准,为用户提供股票代币化交易服务。一旦获批,用户将可通过区块链技术交易代表美股的代币化资产。Coinbase将直接与 Robinhood、嘉信理财等传统零售券商展开竞争,同时也有望开启其全新的链上证券业务版图。

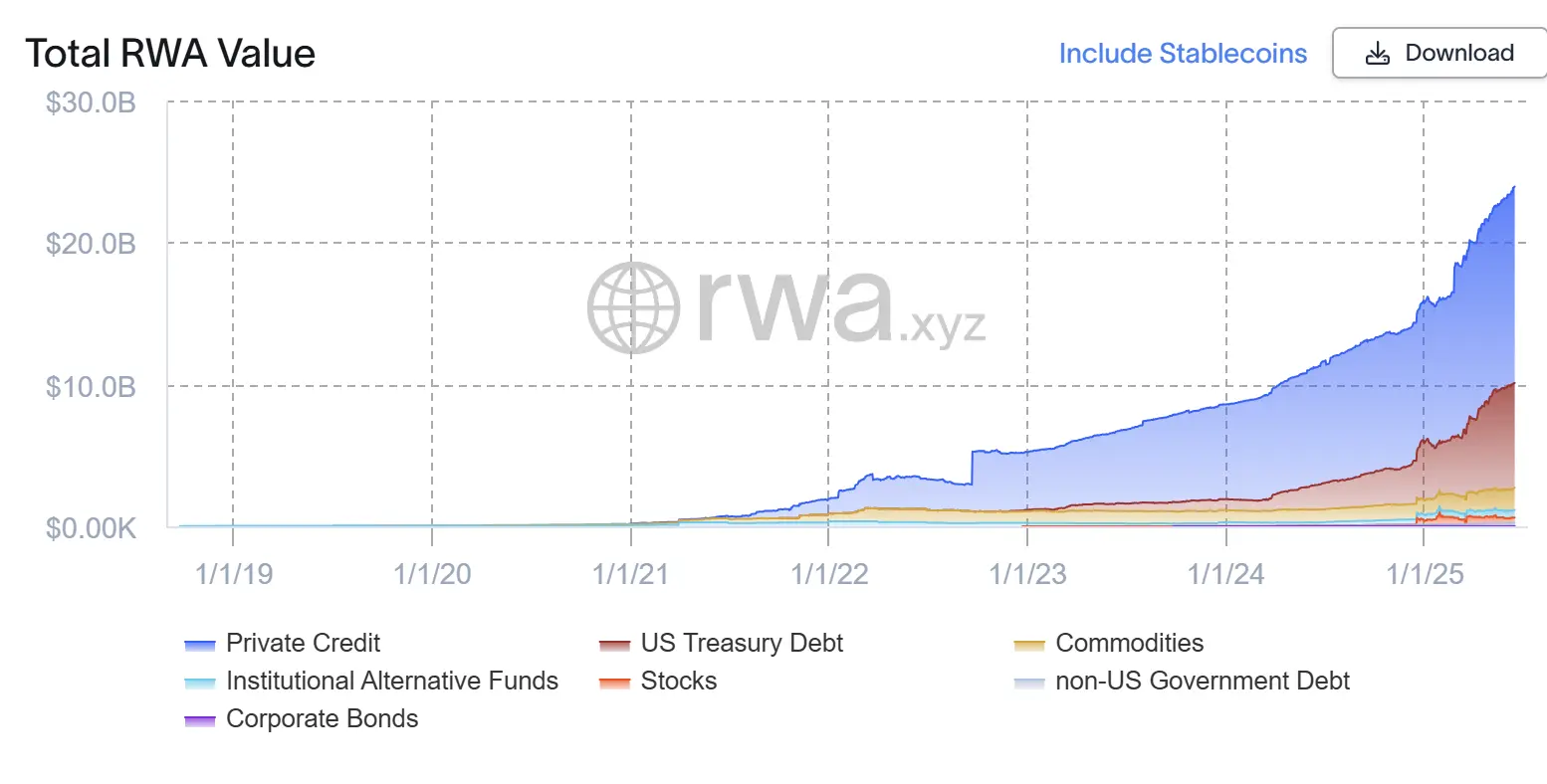

这一步棋背后,是一个快速崛起的市场:今年以来,RWA领域整体市值从 1 月的 157 亿美元增长至目前的 239 亿美元,短短数月涨幅超过 50%。

图:rwa.xyz

Coinbase 并非唯一看准这一趋势的玩家。上月,其主要竞争对手 Kraken 宣布将在美国以外的地区推出美股代币产品 “xStocks”,首批覆盖苹果、特斯拉、英伟达等超过 50 种股票与 ETF。该产品部署于 Solana 区块链上,并支持 7×24 小时的全天候交易。

不过,Coinbase 想在美国本土实现这一模式,仍需迈过监管高门槛:其必须获得美 SEC 的“无异议函”或豁免许可。根据现行法规,所有提供证券交易服务的机构都必须持有券商执照。好在 Coinbase 早在 2018 年便已收购拥有该牌照的 Keystone Capital,尽管该子公司尚未实际启用,但理论上Coinbase具备提供类似服务的资格。

此外,Coinbase 首席法务官 Paul Grewal 也明确表示,股票代币化业务是公司当前“高度优先”的战略方向。如果这一模式落地成功,Coinbase 有望打破传统券商格局,在链上掀起一场对华尔街的正面冲击。

Coinbase 的战略支点:Base

Coinbase 正在全力助推 Base 链,试图将其打造为链上金融闭环的底层基建与战略中枢。

近期,Base 负责人 Jesse 表示,Coinbase 通过 DEX 机制上线所有 Base 生态资产,用户可直接用 CEX账户资金无缝交易。这意味着,Base 上的项目一经发行,便能第一时间触达 Coinbase 全平台用户。而这无论是流动性还是市场关注度,都给 Base 带来了巨大增益。

在现实支付场景上,Coinbase 同样在推动Base 加速破圈。6 月 13 日,电商平台 Shopify 宣布与 Coinbase 和 Stripe 达成合作,允许商家接受USDC 作为支付方式。消费者如今可在 34 个国家使用 Base 链上的 USDC 进行结账购物。

传统金融巨头也已将 Base 纳入其链上实验。今日,摩根大通宣布将在Base上试点发行JPMD代币,代表美元存款。JPMD具可扩展性,未来或支持计息和存款保险,被视为稳定币的合规替代。这表明,大型机构正在积极探索链上资产的合规发行、流转与结算路径,而 Base 则可能成为银行、券商、支付平台等“上链”的重要落脚点。

从战略维度看,Base 是 Coinbase 通往链上一级市场、链上券商、链上支付乃至“链上银行”的关键桥梁。Base 承载生态活跃度,Coinbase 则以 CEX 回收入口与资产。

从股票代币化,到链上支付与稳定币,再到大型机构资产的发行试验,Coinbase 试图用币、股、链三大利器构建可合规运作的“链上金融帝国”。但监管政策的风云变幻、竞争者的激烈角逐,以及技术与合规的深度融合,都是这场“帝国”扩张不可回避的考验。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。