As a "vassal" of traditional finance, the crypto industry has always struggled to take the initiative in the payment sector.

Written by: Deep Tide TechFlow

The once-booming crypto payment card (U Card) business is now facing a decline.

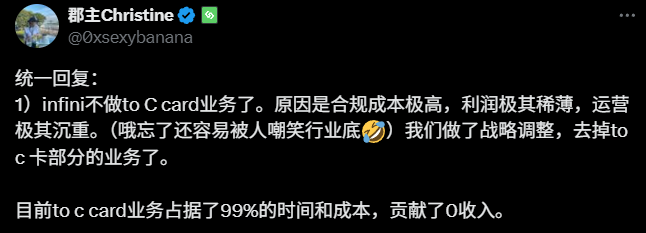

On June 17, Christine, co-founder of Infini, posted on X, announcing the cessation of its consumer-facing crypto U Card business, while also detailing the reasons behind this decision:

High compliance costs, thin profits, and heavy operational burdens.

She admitted that the to-C card business consumed 99% of the company's time and costs, yet contributed almost no revenue. This announcement marks Infini's strategic withdrawal from the to-C card business, shifting its focus to wealth management and B-end services.

However, 1-2 years ago, U Cards were seen as a groundbreaking innovation combining cryptocurrency and traditional finance.

By supporting stablecoins like USDT and USDC for direct consumption, U Cards quickly attracted users from the crypto community; at that time, ChatGPT was just emerging, and many wanted to experience subscription services but were hindered by the lack of overseas bank cards for payment, making U Cards a new payment channel in this AI craze.

Withdrawal and ChatGPT represent the crypto community's desire for secure channels and activate new payment scenarios.

Currently, it seems that with the industry's development, neither of these demands has a strong need for U Cards. As more U Card projects continue to collapse, the difficulties of this business become increasingly apparent.

Not an Isolated Case

Infini's exit is not an isolated incident.

We can find numerous examples of U Card businesses partially or completely shutting down from publicly available information, with some typical cases being:

In September 2024, OneKey announced it would stop new registrations and recharge functions, officially discontinuing its U Card service on January 31, 2025. Although the official explanation did not detail the reasons, industry speculation suggests it is related to disruptions from upstream payment service providers or compliance pressures;

In December 2023, Binance terminated its card services in the European Economic Area and ended cooperation in parts of Latin America and the Middle East in August 2023. This adjustment is seen as a response to tightening regional regulations;

Going back to 2018, one of the world's largest payment networks, Visa, terminated its partnership with WaveCrest due to compliance issues. The latter was an intermediary that provided card issuance and payment processing for crypto payment cards, responsible for integrating U Cards into the Visa network. Visa's sudden exit directly led to WaveCrest's inability to continue serving its clients, including U Card providers like Bitwala and Cryptopay.

These cases point to a fact: the U Card business faces systemic challenges globally.

Upstream Loss of Control and High Costs

From the perspective of ordinary users, U Cards are a very simple product—what you see is what you get; they are ready to use. The only considerations are rates and wear.

However, from the perspective of U Card providers, the root of the problem lies in the complex upstream and downstream logic and high cost pressures.

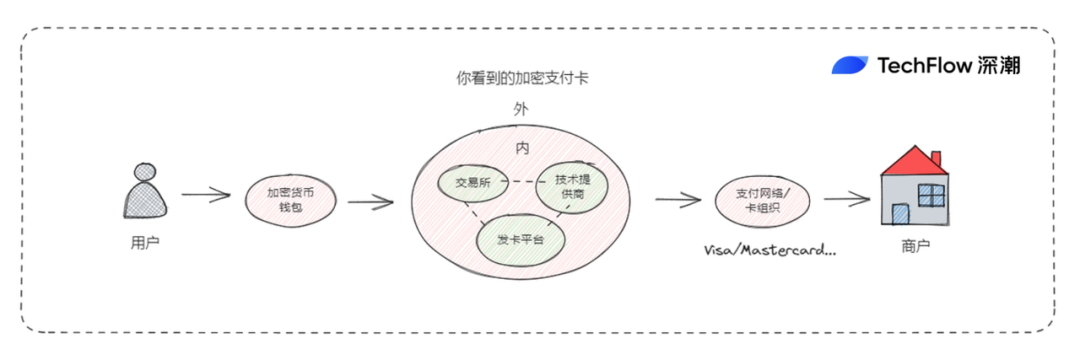

First, the operation of U Cards relies on multi-party collaboration: users recharge stablecoins like USDT, card providers (like Infini) convert them into fiat currency through off-ramp withdrawals, and payment networks (like Visa, Mastercard) settle with issuing institutions and banks.

However, the upstream segments—especially payment networks and banks—are not under the control of the crypto community. This makes U Cards a "vassal" of the traditional financial system, with weak bargaining power.

But why do you see so many different brands of U Cards?

Exchanges issue cards, wallets issue cards, and payment startups also issue cards… Can anyone issue a crypto payment card?

When users see a card branded with a certain cryptocurrency exchange and bearing the VISA logo, what is often unknown is the collaboration model between the issuer and the technology provider.

For example, the VISA card from Coinbase was previously supported by the technology provider Marqeta, enabling it to issue crypto debit cards and provide users with real-time transaction authorization and fund conversion services;

Furthermore, due to the existence of the "technology provider" role, the issuance process of crypto payment cards becomes relatively simple.

Technology providers offer a capability similar to "card issuance as a service": by providing necessary security technology, payment processing systems, and user interfaces to organizations that need to issue cards, they support the issuance of crypto cards, currency conversion, and payments.

The demand side for card issuance only needs to call the technology provider's API or SaaS solution to issue and manage crypto credit/debit cards.

At the same time, the technology provider's "card issuance as a service" also includes various functions such as transaction authorization, fund conversion, transaction monitoring, and risk management, helping issuers simplify operations and improve efficiency.

(In clearer terms, please refer to previous articles: Rushing to Issue Cards: The Business Behind Crypto Payment Cards)

In other words, the U Card in your hand is actually the result of collaboration among issuers, technology providers, banks, and payment networks.

This also means that every party in the card issuance chain has a profit motive. Everyone wants a piece of the pie, but the issuers and brand parties, standing relatively downstream in the entire chain, can obviously gain very little profit.

The revenue from U Cards mainly comes from transaction fees, but the 1-3% fees charged by payment networks, additional costs for stablecoin conversion, and bank account maintenance fees quickly eat into the profits of this business.

Revenue struggles to cover costs, but the more troublesome issue is that fixed costs cannot be cut.

Supporting the operation of U Cards is no easy task. Technical maintenance requires real-time transaction processing and security assurance, while customer support must handle refund and inquiry demands—such as Infini's promised 10 working days for refunds, which also requires human support and response.

On the user side, individuals may encounter issues due to various payment scenarios, but the project parties of U Card businesses must address these personalized problems; and due to the long upstream chain, when technology providers or card organizations encounter issues leading to service interruptions or anomalies, they often find themselves in a position of being unfairly blamed.

Compliance Risks

Additionally, the survival of U Cards faces stringent compliance requirements. KYC and AML (anti-money laundering) are basic thresholds, and if doing business in North America and Europe, registration with the U.S. FinCEN and compliance with the EU MiCA regulations further complicate matters.

USDT itself is also a favored asset in gray markets (such as money laundering), which naturally means that U Cards need to invest more effort in handling risk control issues.

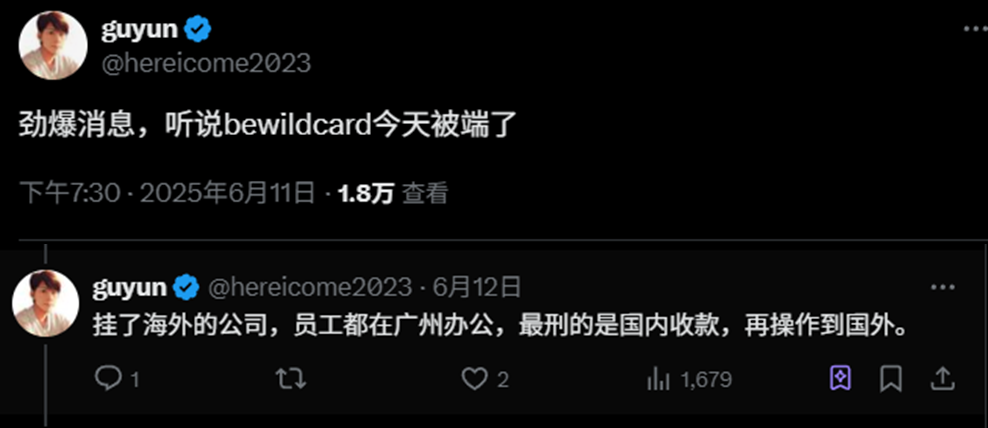

Moreover, when companies operating U Card businesses adopt the model of "overseas registration with employees working domestically," the unique nature of the crypto industry in the domestic context makes this business more susceptible to certain legal risks.

Recently, there have been reports on social media about certain U Card businesses being shut down. We cannot ascertain the authenticity and specific details of these events, but one thing is certain:

The effort required for U Card businesses to comply with local regulations, as well as the risks posed by other factors, far exceed those of many on-chain businesses. Sometimes, it is not necessarily the card itself that is the problem; the funds involved, the users, and the relatively tightening public opinion environment can all cast a shadow over the brand and perception of U Card businesses.

Laborious and thankless, worrying without profit—this may be the common dilemma faced by most U Card projects focusing on the payment sector.

Currently, U Card businesses may be more suitable for CEXs. CEXs do not rely on U Cards for profit and revenue; when trading operations can generate sufficient profits, using U Cards for customer loyalty management and treating them as a differentiated brand service is a better choice.

For example, Bybit and Bitget still have corresponding U Cards, while Coinbase recently announced at the State of Crypto summit that it will launch the Coinbase One Card in the fall of 2025, offering users up to 4% Bitcoin cashback on each purchase, with the card supported by the American Express network.

Everyone wants to issue cards, but who can ultimately succeed will depend more on compliance resources and risk control capabilities. From the current situation, the U Card business is gradually moving towards oligopoly.

From Vassal to Independence

On one side, the crypto industry faces obstacles in traditional business, while on the other, traditional finance is increasingly engaging in crypto-related businesses.

Whether it’s stablecoins, RWA, or the recent hot trend of crypto asset reserves by U.S. publicly listed companies, traditional finance is leveraging its existing resources and compliance accumulation to "learn from" and profit in the crypto space;

Conversely, crypto businesses, apart from those that are crypto-native and revolve around trading and asset creation, seem to feel increasingly constrained when trying to expand outward.

The challenges faced by the U Card business actually reflect the awkward position of the entire crypto industry in its interaction with the traditional financial system. As a "vassal" of traditional finance, the crypto industry has always struggled to take the initiative in the payment sector.

Perhaps reducing dependence on fiat currency conversion, initiating transactions directly from wallets, and conducting transactions through on-chain settlements to bypass traditional payment networks is the original form of crypto technology. However, under the premise of compliance and embracing reality, this path appears overly idealistic.

Moreover, if one attempts to take control of the industry chain—such as acquiring banks, payment channels, and technology providers—due to constraints in traditional business, it may further increase the costs of the business, especially when it is uncertain how many users will actually use the cards.

Furthermore, looking at the contradictions reflected in the U Card business, they are not limited to the payment sector but permeate the entire external development of the crypto industry.

When innovation and enthusiasm can only continue in the crypto-native soil, the grassroots, independent opportunities for crypto to break out have still not arrived.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。