Author: Nancy, PANews

Coinbase is undoubtedly one of the important supporting forces in the advancement of cryptocurrency compliance in the United States. Through an active political donation strategy, it promotes industry-friendly policies. Recently, it has also sponsored the 250th anniversary parade of the United States, attempting to strengthen its influence in mainstream society and the political arena.

At the same time, Coinbase has been accelerating product innovation and ecosystem expansion over the past few months, significantly optimizing user experience and enhancing market confidence, while trying to create a more diversified growth engine.

Inclusion in the S&P 500 Boosts Stock Price, but Profit Model Raises Concerns

Since the beginning of this year, Coinbase has shown positive signals in several key indicators, with both stock price and user activity rebounding.

In terms of stock performance, as of June 16, 2025, Coinbase (COIN) stock price has risen to $242.71, an increase of over 60% since hitting a low of $151.47 in April 2025. This rebound is partly attributed to the positive momentum from Coinbase's official inclusion in the S&P 500 index in mid-May 2025. As the first cryptocurrency company to join the S&P 500, it marks an increase in its recognition in mainstream financial markets, undoubtedly providing solid support for its stock price. However, compared to the listing peak of $342.98 in April 2021, its stock price has still declined by about 29%.

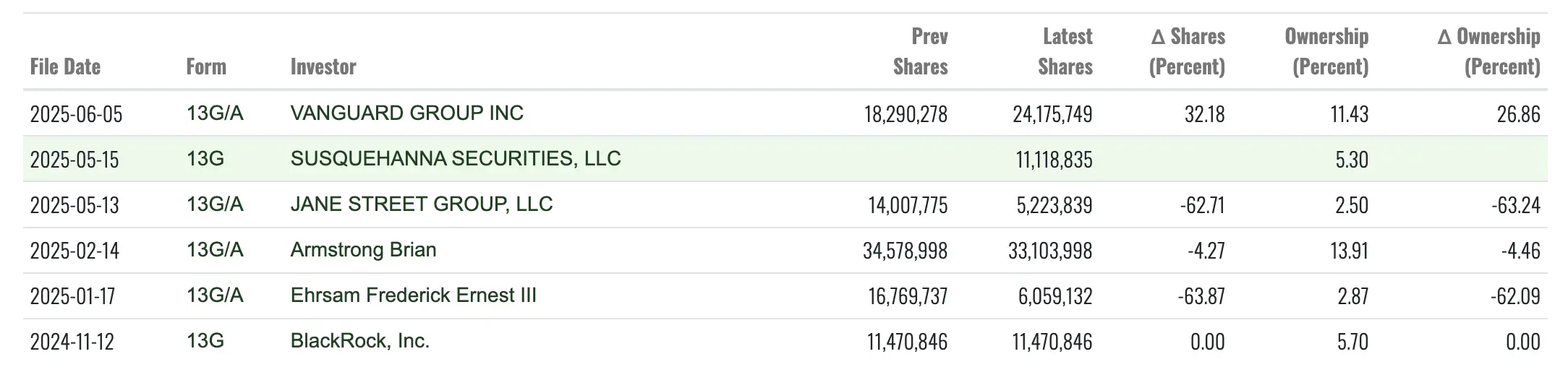

According to Fintel data, 1,560 listed institutions have reported holding Coinbase stock, with a total holding of over 120 million shares. This includes heavyweight investors such as Vanguard Group, BlackRock, HNA International Group, State Street Bank, Jane Street, and Paradigm.

Some listed companies holding COIN

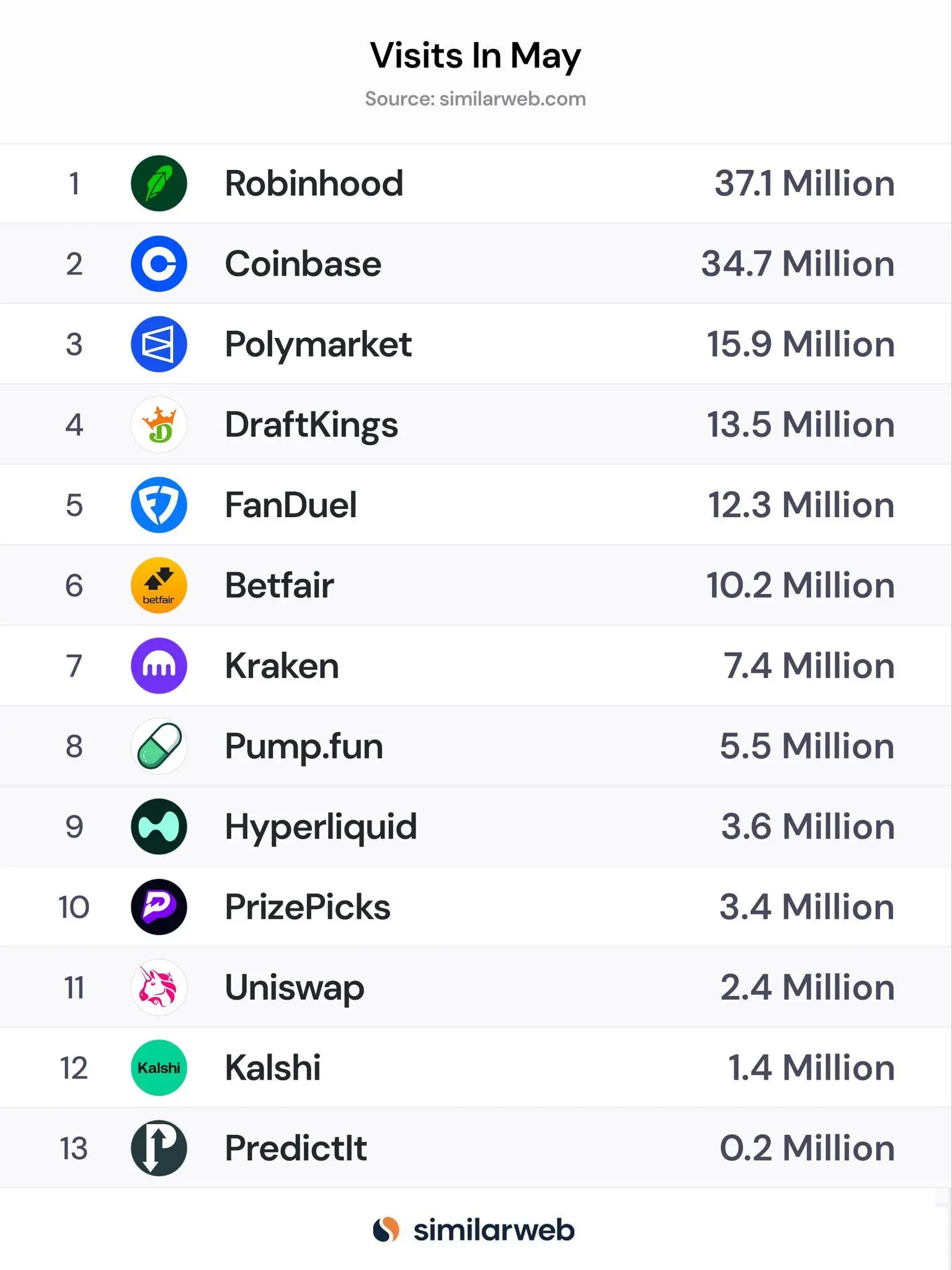

Meanwhile, Coinbase still maintains a certain scale of user activity. According to website traffic monitoring agency Similarweb, the number of active users on Coinbase reached 34.7 million in May, ranking second in the industry, only behind traditional brokerage and trading platform Robinhood.

However, behind the impressive market performance, Coinbase's profit structure has significant concerns. The 2024 financial report shows that about $4 billion of the company's revenue comes from transaction fees, accounting for approximately 63% of the total annual revenue (about $6.3 billion). This high dependence on transaction fees makes its revenue extremely sensitive to fluctuations and activity levels in the cryptocurrency market. In the first quarter of 2025 alone, Coinbase's transaction revenue fell by 19% quarter-on-quarter to $1.3 billion, indicating that market trading volume is under significant pressure. Additionally, with the rapid development of on-chain ecosystems, trading volume and user attention are gradually being diverted, intensifying competition pressure on centralized exchanges.

Moreover, Coinbase has recently faced serious trust challenges. In May of this year, Coinbase publicly disclosed a serious data breach incident affecting over 69,000 users, with potential losses reaching hundreds of millions of dollars, severely impacting user trust and brand image. Furthermore, due to poor stock performance and information disclosure issues, Coinbase is facing a class-action lawsuit. The U.S. SEC is investigating whether Coinbase exaggerated user data during its direct listing process in 2021, focusing on the authenticity of its so-called "100 million verified users" metric, which was quietly discontinued two years later. The data breach and lawsuit turmoil have also triggered market panic, becoming one of the negative factors suppressing the stock price.

Multi-Dimensional Competition, Accelerating Product Onboarding and Global Strategic Expansion

In the face of multiple challenges in the market environment, Coinbase is actively seeking diversified growth paths through product innovation and global strategic layout, aiming to reshape its competitive advantage in the market.

On one hand, Coinbase is promoting deep expansion of its product and service lines. For example, in the area of perpetual contracts, Coinbase announced this month that it will launch compliant perpetual contract products in the U.S., marking its official entry into the U.S. cryptocurrency derivatives market and filling a long-standing strategic gap in domestic derivatives offerings. Due to regulatory ambiguity and compliance costs, domestic investors in the U.S. have long been unable to directly use high liquidity and high leverage perpetual contracts, having to trade through overseas platforms. However, as the regulatory environment gradually becomes clearer, the U.S. cryptocurrency derivatives market is approaching a policy turning point. Summer Mersinger, a commissioner of the U.S. Commodity Futures Trading Commission (CFTC), recently publicly stated that cryptocurrency perpetual futures contracts may be traded compliantly within the U.S. in the future, releasing positive signals for the market.

More strategically, shortly before announcing the launch of perpetual contracts, Coinbase announced that it had reached an agreement to acquire Deribit for $2.9 billion, which is one of the largest cryptocurrency options and perpetual contract platforms globally, with a very solid institutional client base and strong product depth. This acquisition not only sets a record for the largest acquisition in the history of the cryptocurrency market but also significantly enhances Coinbase's voice in the cryptocurrency derivatives market.

In payment scenarios, Coinbase has recently partnered with Shopify and Stripe to promote the use of USDC for payments on e-commerce platforms. Moreover, Coinbase has continued to deepen its cryptocurrency credit card business. Following the initial trial of a cashback credit card, Coinbase recently announced the launch of the Coinbase One Card in collaboration with American Express, which is set to be issued to the U.S. market in the fall of 2025. Cardholders will enjoy up to 4% Bitcoin cashback based on their asset scale on the platform, making it one of the highest cashback cryptocurrency credit cards currently on the market. In addition to Bitcoin cashback, cardholders will also receive additional benefits provided by American Express, including travel insurance, shopping protection, return protection, and Amex Offers limited-time discounts. The mature payment network and brand reputation of Amex will also enhance the acceptance and reliability of the Coinbase One Card.

This credit card is only available to Coinbase One subscription users, which can strengthen the closed-loop effect of Coinbase's platform membership system. After paying a monthly subscription fee, Coinbase One members can enjoy a series of benefits, including zero transaction fees, exclusive customer service channels, higher staking rewards, and Base chain gas fee subsidies, significantly enhancing user stickiness. Since its launch in 2023, this subscription service has accumulated nearly 1 million users, becoming one of the most robustly growing business segments within the Coinbase ecosystem. In the first quarter of 2025, subscription and service revenue reached $698.1 million, a 9% increase from the previous quarter, with its proportion in total revenue continuing to rise.

In response to the trend of increasing integration between CEX and DEX, Coinbase is also making efforts at the on-chain trading entry level. Coinbase recently announced that it will integrate the Base network DEX into its main application, allowing access to millions of on-chain assets. This move is similar to the on-chain competitive strategies of CEXs like Binance Alpha. As a core promoter of Base, this action will not only greatly enhance the activity and liquidity of assets on Base, injecting stronger network effects into the chain, but also strengthen Coinbase's position in the on-chain trading entry dimension. Additionally, Coinbase has recently launched cbDOGE and cbXRP tokens on Base, which will enhance Base's competitiveness and liquidity in the Layer 2 network.

For developers, Coinbase launched the CDP wallet at the end of May this year, which is a new type of wallet infrastructure that combines account abstraction and custodial entry. Users can fully control their on-chain assets without managing private keys or relying on centralized custodians.

Furthermore, as institutional investors' demand for Bitcoin continues to rise, Coinbase's asset management company launched a new fund, the Coinbase Bitcoin Yield Fund (CBYF), in May this year. This fund is designed specifically for non-U.S. institutional investors, aiming to help institutional clients earn stable on-chain yields while holding Bitcoin, with a target annual net return of 4%–8%, with returns denominated and distributed in Bitcoin. Abu Dhabi's digital asset management platform Aspen Digital is one of the seed investors in CBYF and has been designated as the exclusive distribution partner for the fund in the UAE and Asian markets.

With the product matrix gradually improving, Coinbase is also accelerating its global layout through global compliance expansion and political-economic resource integration. For instance, in terms of global compliance expansion, Coinbase is actively seeking to become one of the first platforms to obtain a full European cryptocurrency business license under the MiCA regulations. It has also obtained a virtual currency license issued by the New York State Department of Financial Services (NYDFS) in the U.S.; in terms of political-economic resources, Coinbase has been making frequent moves. For example, former Obama campaign manager and senior Democratic strategist David Plouffe recently joined Coinbase's global advisory council; at the same time, Coinbase recently sponsored the Trump military parade celebration, which has also raised public relations risks and controversy.

In summary, with its first-mover advantage in compliance, support from political-economic resources, and market recognition brought by its inclusion in the S&P 500, Coinbase has secured a place in the mainstream financial system. However, in the face of an increasingly complex and changing regulatory environment and intensifying market competition, whether Coinbase can effectively respond to policy risks, enhance the diversity of its profit structure, and continue to win user trust will remain key challenges for its future development.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。