A comprehensive answer to all the mysteries surrounding Pop Mart.

Author: Tastingo.eth/.sol Tallinn

On June 13, 2025, Pop Mart's market value reached $46 billion, and the combined wealth of Wang Ning and his wife surpassed $20 billion, successfully entering the global billionaire list TOP 100. All of this was achieved in just two years, with investment returns far exceeding mainstream assets like gold and Bitcoin.

As someone who has personally experienced the development of the trendy toy industry since 2017, I have seen many popular science articles and analyses about Pop Mart on the market, but most of them are superficial and lack a true understanding of the real situation.

This article will present another side of Pop Mart from the perspective of capital and frontline operations. Thanks to all the friends who liked and supported my creation; your encouragement has sparked my desire to write. The views in this article are based on my observations within the industry and logical judgments from public information, and there may be deviations. Copyright belongs to me, and it is published only on the X.com platform; unauthorized reproduction is strictly prohibited.

First, let me briefly talk about my experience in the trendy toy industry:

In 2016, shortly after graduating, I was working in venture capital. At that time, I noticed that Pop Mart had opened stores in several business districts in Beijing, but when I found out that it was merely an agent for the Japanese IP Sonny Angel, I did not leave a deep impression. Because in the common knowledge of investors, only owning independent IP gives real imagination to the business space.

At that time, the boss was keen on OFO, and I was also focusing on exploring shared economy projects, so I missed out on Pop Mart.

I paid attention to Pop Mart again at the end of 2017. The great success of Molly pulled my attention back, but it was too late.

By then, Pop Mart had already been invested in by multiple institutions, and its valuation had rapidly increased. I turned to look for "Long Er," which was 52TOYS, about to be listed on the Hong Kong stock market. At the end of 2017, I strongly advocated for our fund to invest in its Series A round, with a valuation of about 200 million RMB.

In 2019, I personally joined 52TOYS, responsible for signing and incubating designer IPs, serving over 500 designers, and leading or collaborating on exhibitions, e-commerce platforms, media matrices, industry competitions, etc. I was also recommended by Qiming Venture Partners and successfully selected for Forbes China 30 Under 30.

In 2021, with the emergence of NFTs, I left to start my own business, focusing on NFT IP issuance. More experiences are recorded on my personal website, and I will not elaborate further here.

As a practitioner, I have competed directly with Pop Mart on the designer side, vying for the same market attention and creator resources, thus accumulating a lot of insider perspectives and practical experience. At the same time, as a serial entrepreneur, I am more accustomed to understanding a business phenomenon from the perspective of entrepreneurs and capital operators.

TL;DR of the viewpoints

1) Pop Mart is a rare asset that cannot be replicated; its success requires a loose and patient environment, whether in capital supply or optimistic consumer expectations, conditions that are difficult to reproduce today.

2) Pop Mart established stores using a "luxury + Disney" model, binding designers and user mindsets through an incubation mechanism, creating a high-margin moat; the ironclad Pop Mart, with flowing revenue.

3) The ceiling moment for Pop Mart is when the demographic of people who understand and purchase it continues to expand, until the moment when even those from the aristocratic class cannot accept that people they like also buy it. It’s no longer cool!

(1)

Pop Mart is irreplicable; it was born in that bygone golden era of entrepreneurship in China, where liquidity was rampant.

In the winter of 2010, Wang Ning arrived at Zhongguancun, Beijing, with 200,000 RMB in startup capital earned from running a grocery store in Zhengzhou, and opened the first Pop Mart store.

Initially, Pop Mart operated under a grocery retail logic similar to Miniso—selling a bit of everything—but this "everything" led to "no focus," causing users to position Pop Mart as a grocery store with little brand premium, not very profitable. After expanding, it contracted again, reflecting on strategic adjustments, and thus it took four years to navigate.

If it were 2025 and starting a business, Wang Ning would likely have gone bankrupt. But fortunately, from 2011 to 2014, several local angel investors and VC institutions, still considered second-tier at the time, became early supporters of Pop Mart, continuously supplying Wang Ning with resources, allowing him to successfully open more than a dozen quality stores. Wang Ning also gained valuable negotiation resources for representing Japanese trendy toys from 2014 to 2015.

Pop Mart was a surprise for early second-tier local VCs who banded together for warmth.

In 2015, the Japanese Sonny Angel, represented by Pop Mart, became a sensation in China, with revenue from this doll consistently accounting for more than one-third.

Wang Ning and others finally confirmed the power of combining the trendy toy category with their stores and decided to go all in on trendy toys.

However, the good times did not last long, as the Japanese side subsequently canceled the exclusive agency authorization. This move sounded the alarm for Wang Ning: relying on others' IPs was ultimately unsustainable; they must own their own IP.

Wang Ning then initiated a survey post on Weibo: "Besides Sonny Angel, what other trendy toys are you collecting?" Nearly half of the comments mentioned "Molly."

Wang Ning immediately flew to Hong Kong to personally visit Molly's creator, Kenny Wong, demonstrating an unprecedented determination to "dig for IP." At that time, almost no company in the industry was willing to fly out to negotiate for a designer's image; this sensitivity to "creator value" became the model for all of Pop Mart's successful IP operations later on.

The early collaboration with Japanese IPs gave Pop Mart the confidence to go all in on trendy toys.

A few months later, the "Molly Zodiac" blind box series was launched, selling out immediately, with hidden versions reaching a market premium of up to 10 times. With Molly's explosive popularity, Wang Ning realized that owning IP meant having a voice. He began to frequently sign contracts, securing various trendy toy artists with different styles, such as Pucky, Dimoo, Skullpanda, The Monsters, Bunny, and Yuki.

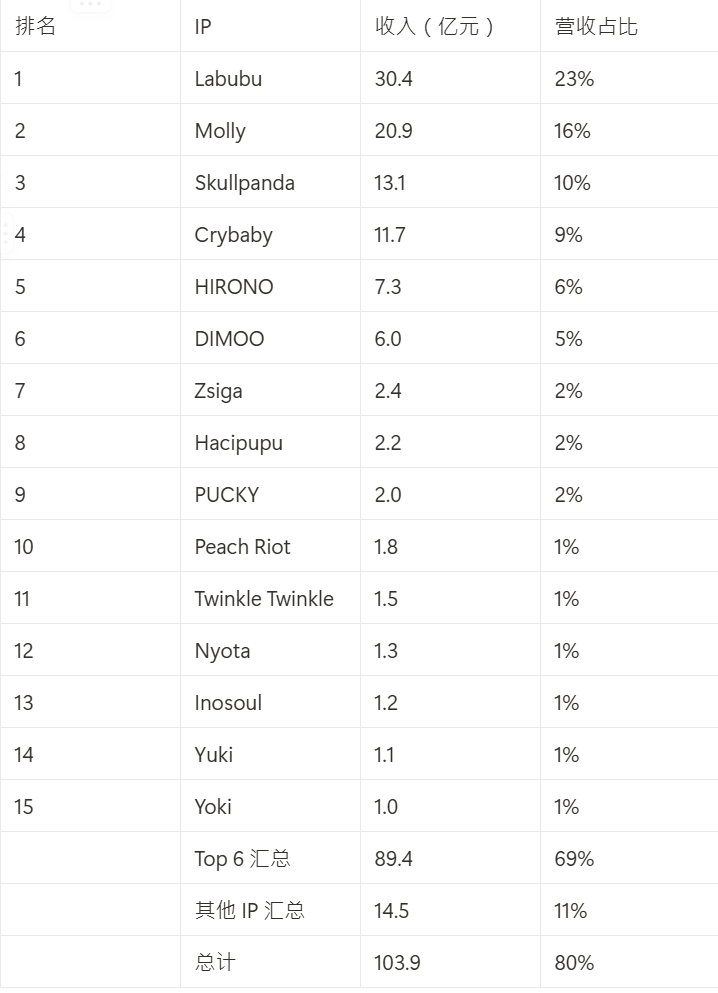

As of now, Pop Mart has signed over 100 in-house designers, with the top ten IPs generating flowing revenue, the ironclad Pop Mart continues to grow at lightning speed.

The ironclad Pop Mart, with flowing signed IPs.

Why was Wang Ning able to boldly take 100% responsibility for all upfront costs of the Molly IP blind boxes (starting at about 1-2 million RMB) and continue to increase efforts to develop signed designers?

Because he was confident he could make more money → because he felt market research had discovered a new IP to replace Sonny Angel → because he had previously made 30 million from Sonny Angel → because he had many stores to ensure sales and secured Japanese authorization → he kept fighting back despite failures because he had continuous support from patient capital, and the market had more and more users willing to buy → because he was born in an era of rampant liquidity and long-term optimistic expectations.

Of course, if Wang Ning sees this article, he might think I am criticizing him. But I don’t see it as criticism; rather, continuously having common sense and adapting strategies from a business perspective is precisely what most entrepreneurs do, and this is Wang Ning's strength. I have seen many entrepreneurs ruin a good hand of cards.

The pandemic in 2022 brought a significant setback to Pop Mart, and its stock price hit a low point. In the entire market, patient capital and optimistic consumer expectations disappeared. However, what everyone (including me) did not see was that this environment also completely destroyed all competitors who had not yet gone public but had once ambitiously aimed to replace Pop Mart.

Pop Mart became the absolute leader in the trendy toy industry, monopolizing the high ground. Why the capital race? Why go public early? Pop Mart's success is evident.

After withstanding the pressure of the pandemic, Pop Mart, with a massive amount of cash from its IPO, went all in on the overseas market and achieved success in 2024, with Labubu and Crybaby becoming the heroes of this success.

Crybaby (left), Labubu (right).

(2)

In the gradually clarifying development context of trendy toys going overseas, a new luxury model has emerged.

China is a society where the middle and affluent classes have a high per capita luxury goods consumption, supporting the market value of several major European luxury brands before the pandemic. Even today, post-pandemic, we see the most common scenes of social media showcasing "Labubu" are in conjunction with luxury goods or limited trendy clothing and accessories.

The Wang Ning family certainly noticed this phenomenon long ago. The strategic resources they invested the most in were often site selection, brand packaging, and store design and decoration, creating a unique aesthetic that positioned their stores between luxury goods and Disney toy stores, cleverly finding their niche.

Pop Mart in France is approaching the level of luxury stores.

While others had not yet reacted before the pandemic, Wang Ning, who came from a retail background, had already figured out the growth flywheel.

Good brand packaging, good site selection, good products → high-end brand exposure → wealthy people start to pay attention to Pop Mart → the value of limited and hidden editions appreciates → the financial consumption attributes of blind boxes emerge → ordinary users and scalpers begin to enter the market → designers discover the wealth code → learn the skills, goods go to the royal family → Pop Mart monopolizes the best trendy toy designers → wealthy people consume Pop Mart again.

When others finally understood, the era had already passed.

There were once many competing companies that wanted to challenge Pop Mart's position, but none grasped the key points.

TOPTOY, under Miniso, opened stores well, but the products were average, lacking exclusive and high-quality designer resources.

Finding unicorns was also a project backed by many well-known VCs, which had signed excellent Korean IPs like FarmerBob, but lacked the strength to open stores and could not create the trendy toy experience, failing to close the loop.

Other companies like Cool Trendy Toys, AC TOYS, IP Station offline, and Meichai online each had their own issues.

TOPTOY spent a lot of money but did not have its own good IP.

On the contrary, Alibaba's Koitake, under the brand name Jinli Naku, has achieved significant success with self-operated IP blind boxes from TV dramas like "Zhen Huan" and others; 52TOYS focuses on collaborating with top anime IPs like Crayon Shin-chan and Tom & Jerry, and actively explores male collectible IPs like Beast Box, all of which have found their own niche. Although they lag far behind Pop Mart in the trendy toy IP field and cannot catch up, their continuous growth in areas they excel in is commendable.

Alibaba Pictures' Jinli Naku's rural love blind box was once a huge hit.

Monopoly creates FOMO. Thus, all capital, the wealthiest consumer groups, trendy toy design resources, and prime store locations began to concentrate on Pop Mart. Labubu's popularity overseas is just a matter of time. With massive capital, store strength, and IP reserves, Pop Mart is simply waiting for an opportunity.

Lisa's strong collaboration has officially brought Pop Mart into the global trendy star circle. I don't know how much Pop Mart paid Lisa's team, but I believe that if Lisa didn't genuinely like it, such a perfect honeymoon collaboration wouldn't be possible. Without Pop Mart's stores in prime locations in Paris, Bangkok, and elsewhere, it wouldn't have garnered the attention of these top stars.

Lisa wholeheartedly promotes Labubu, sparking a buying frenzy overseas.

At this point, even if Pop Mart doesn't release new IPs for three years, a single Labubu would be enough to remain popular for a long time, allowing the Pop Mart team to slowly research and discover where the next Labubu might be.

History has proven that Pop Mart has the ability to continuously discover new IPs.

In 2016, Molly took the lead, but before that, Molly had already been sold for ten years.

In 2021, Skullpanda rose to prominence, but few knew that Skullpanda had quietly developed for three years prior.

Before 2024, Labubu was officially crowned the new queen (yes, Labubu is female), but Labubu was signed by Pop Mart in 2018, after Long Jiasheng had already cultivated this IP for three years.

The next Long Jiasheng (the designer of Labubu) will likely also sign with Pop Mart because they have already built a trendy toy luxury empire. Without signing, they will never be able to showcase their work to the wealthiest individuals.

So how can you say Pop Mart will lose?

(3) Prejudice and misunderstanding are Pop Mart's wealth secrets

Many people ask me, when can we short Pop Mart!

I say it's simple: when the news reports about Pop Mart are all positive, with no negative comments, that's when it has peaked.

Why can a trendy toy IP only be popular for 3-5 years? Because after this period, the items in the hands of the wealthy become the same as what ordinary people can buy second-hand at a high price. However, subjectively, the wealthy do not accept that someone from their class can own their toys, so they stop showcasing them or even abandon them.

Without the support of the wealthy class, social media will no longer have new content to continuously stimulate ordinary people, and in such a forgetful world, the next hot topic will be pursued, and the cycle will repeat.

The same logic applies: when Pop Mart is widely accepted by people from all walks of life, it is the moment the wealthy demystify it. At gatherings, it becomes a casual mention, and it’s no longer cool. This would effectively pronounce a death sentence for Pop Mart.

In fact, it’s not that it’s no longer cool; it’s that it can no longer provide the superiority of class oppression to the wealthy. There are no longer those comments from the lower classes saying, "I don’t understand; I wouldn’t want it even if it were given to me!" Everyone likes Pop Mart! So why should I still like it?

Finally, let me answer a few online questions from followers:

1) Is it true that Pop Mart has a secondary market-making team? What strategies are used in the trendy toy industry for market-making?

Yes! Especially in the early stages, whether an IP can be seen by more people through reasonable means, leading to discussions and collections among the wealthy circles, is the core point.

Trendy toy venues frequented by the wealthy include: 1) core location stores; 2) annual large-scale exhibitions; 3) social circles with fashion influence, etc. Thus, you see the so-called long lines for limited edition signings, high-end accounts in second-hand markets like Xianyu making bold purchases, and collectors casually mentioning at gatherings, "Do you even know about this toy?" blablabla.

Honestly, sometimes when I see that Aaron Kwok can marry someone from a training camp for gold diggers, it shows the grassroots nature of the world. Everyone is human; no one is inherently more noble than others. If you have more money, it’s still about brainwashing you or being brainwashed.

2) I'm actually curious about the sales channels for those large items. I've only recently started paying attention to Pop Mart, but the wealthy second-generation friends around me (mostly night club types) have been buying these things for a long time. When they bought them, their understanding was just blind boxes, yet they started purchasing large items worth tens of thousands. Now their homes are filled with Labubu (and other companies' IPs as well). What’s their mindset?

This should refer to large trendy toys. Typically, there are large limited editions that are 1000% the size of blind boxes, which is actually an early step for each designer's debut. When a blind box can sell, it indicates that the designer is already quite famous. This is because the development cost of blind boxes is very high, while small-batch large vinyl or resin materials are relatively low-cost and easier to produce.

If you mix in the trendy toy circles of different IPs, it’s not difficult to get information about the release of limited large toys. It’s similar to cryptocurrency trading, where some people can get into the inner circle, wait for the launch, and then sell large toys for dozens of times the price to the wealthy. The next one will be even better.

Their mindset is simply to play; if you like trendy toys and delve into them, that’s enough.

3) Compared to NFT or meme coin market-making, does trendy toy market-making have any volume actions?

Yes, this is an auxiliary method. It’s much simpler to operate than NFTs. Everyone batches accounts and trades controllable rare chips at high prices to guide the secondary prices of ordinary items. If the deviation is too outrageous, they directly intervene to sweep the floor. Since trendy toys are not tokens, their authenticity is not apparent in transactions, and there aren’t many records to check. From the perspective of recommendation algorithms, it can create a high trading price at a very low cost.

But ultimately, this is an auxiliary method. If your product is not good and doesn’t catch the eye of the wealthy, you will never start market-making, nor will you begin large-scale releases. If market-making is done, but the market doesn’t believe it, a real transaction will expose the flaws. This IP may need to be reworked and continuously managed and iterated until your product is ready to deploy more resources.

Otherwise, if market-making alone could push an IP, who knows how many Labubus would be popular in the world?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。