作者:Peggy,BlockBeats

6 月 12 日,去中心化资产管理平台 Trident 宣布启动一项最高达 5 亿美元的 XRP 财库融资计划,并聘请 Chaince Securities LLC 担任战略顾问。

在散户热情退潮、社区讨论降温的背景下,这一消息引发市场侧目:为何仍有机构选择大额配置 XRP 作为链上储备资产?这是否意味着曾被称为「XRP 军队」的散户阵营,正逐步被机构资金所取代?

XRP 是最早进入公众视野的区块链项目之一,却也长期承受「中心化」「官司缠身」「缺乏创新」等标签。与 SEC 的拉锯诉讼持续五年,技术迭代放缓,社区参与感薄弱,让它一度成为「旧时代项目」的代表。然而,自 2024 年以来,XRP 的生态悄然转向:价格重新逼近历史高位,XRPL 围绕侧链、稳定币与 DeFi 模块构建基础设施,企业买盘与开发投入也逐步回暖。这些变化虽然不喧哗,但正在多个指标上积累实质进展。

这不是一次「翻红」式的叙事逆袭,而是一场在低关注度中完成的结构重构。本文将从资金动向、生态演进与链上数据出发,观察 XRP 如何在争议与沉寂之间,走出「既不爆火,也不消亡」的第二路径。

XRP 正在「翻身」?

战略买盘:谁在买 XRP?

虽然主流叙事尚未更新,但现实世界的资金选择正在提供另一种答案。尽管 XRP 在加密社区中的「老币」形象仍未退场,现实中的资金流向却已悄然转向。

过去一年间,这个长期被视作「中心化遗产」的项目,并未陷入消亡,相反,其价格稳定运行于 2 美元上下,在多轮市场回调中保持抗压态势。2024 年底,XRP 市值一度超过 USDT,重返全球前三大加密资产行列;链上 TVL 同期也由不足千万美元增长至逾 4000 万美元。

与此同时,一批机构开始重新评估 XRP 的资产属性,并将其纳入中长期配置范围。5 月 30 日,香港科技企业 Webus International 启动 3 亿美元融资计划,将 XRP 用于全球支付系统。次日,纳斯达克上市能源企业 VivoPower 宣布完成 1.21 亿美元私募融资,用以构建以 XRP 为核心的资产储备机制,由沙特皇室成员领投、Ripple 生态高管顾问。6 月 12 日,Trident DAO 启动上限 5 亿美元的 XRP 财库计划,将其纳入链上治理与资产挂钩工具。

这些来自能源、交通与 Web3 金融领域的实际案例共同表明,企业对 XRP 的认知已不再停留于争议标签或市场叙事,而是逐渐将其视作「弱波动型数字资产」的一种现实选项。尤其在 SEC 监管案件接近尾声、Ripple 完善合规路径的背景下,XRP 的法律不确定性有所缓解,其低手续费、高结算效率等特性也更契合跨境支付与财务配置需求。

尽管技术端的更新尚在推进中,但这些资金行为已经构成了一种非情绪化、面向中期规划的资产选择逻辑。换句话说,即便社区仍存疑虑,市场的另一端已经在用行动重新定义它的价值。

生态重构:不再只是支付链?

在长期被定义为「跨境支付通道」之后,XRP 的生态结构正经历一次系统性转向。过去一年内,Ripple 陆续推出 EVM 兼容侧链、美元稳定币 RLUSD,并在多个国家启动开发者活动与支付基础设施合作。

从最初的汇款网络,Ripple 正演化为一个涵盖支付、托管、稳定币与项目孵化的多层平台,目标是为机构客户提供完整的链上金融服务栈。随着产品结构不断延展,一批围绕 XRPL 构建的新协议相继出现,将这条传统公链引入链上金融、收益管理与资产治理等更广阔的场景中。

2024 年底,Ripple 推出兼容以太坊的 EVM 侧链,配合 RLUSD 稳定币上线与主网功能更新,逐步扩展 XRPL 的基础设施能力。这些举措使 XRP 不再局限于支付用途,而具备承载链上金融应用的潜力。

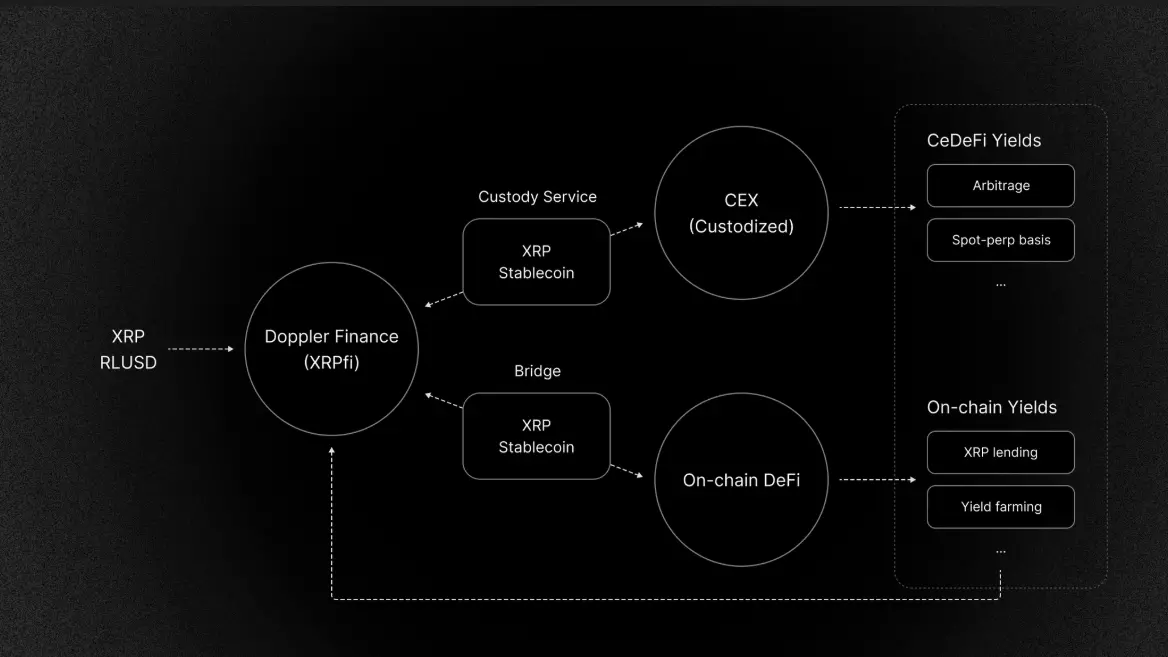

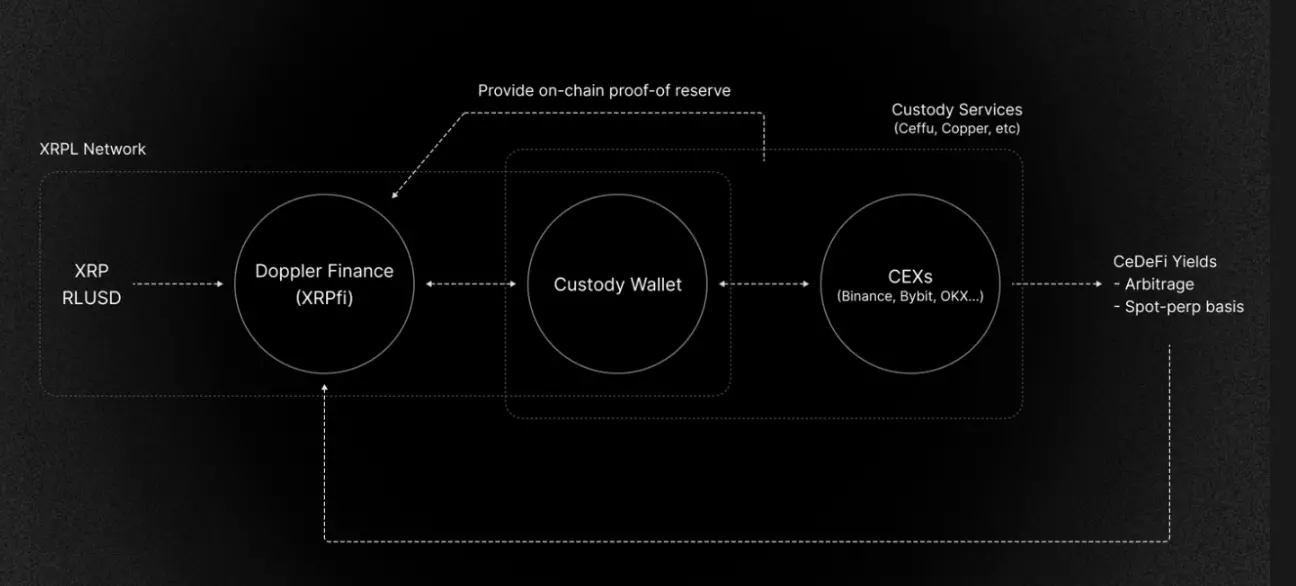

基于这些底层更新,一种被称作「XRPFi」的新型链上金融结构开始成型,其核心目标是在 XRPL 原生链缺乏质押与收益机制的背景下,为 XRP 注入新的链上效用。其中,Doppler Finance 是目前最具代表性的项目之一,采用托管与链上并行的双路径架构,向持币者提供收益产品与资产管理接口。根据官方数据,平台当前 TVL 超过 3000 万美元,资金通过合规托管渠道运行,支持用户查看资产流向与收益来源。

Doppler Finance 的双路径收益结构,图源官网

从产品结构上看,Doppler 的收益策略主要来自两类模型:

一是结构化套利策略(如现货-永续套利、跨平台价格中性套利),主打「净增 XRP 数量」而非纯美元收益;

Doppler Finance 的 CeDeFi 收益结构

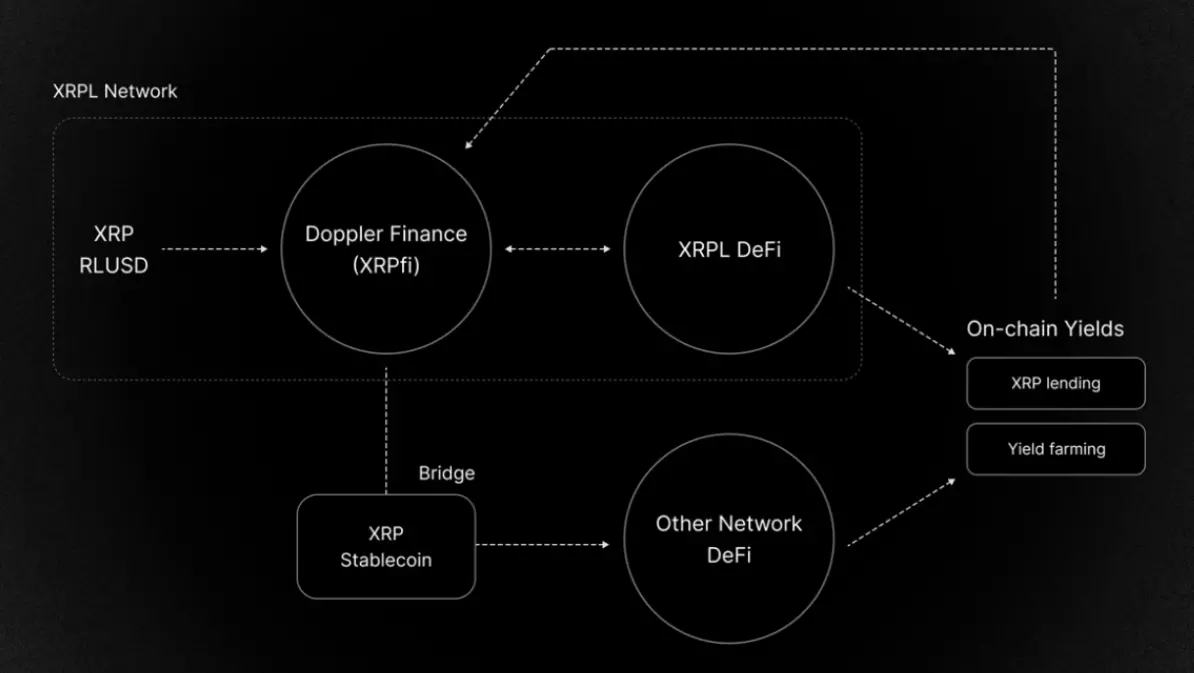

二是利用 XRP 抵押获取稳定币,再部署至高流动性 DeFi 协议中,实现低杠杆的风险可控型收益。同时,其平台还支持 Root Network 上的质押收益、即将上线的 XRPL 借贷协议,以及一键式质押加杠工具,用于降低用户参与门槛。

XRPfi 在链上生态中的收益路径结构

除 Doppler 外,XRPL 上还出现了 OnXRP、Magnetic、Anodos 等围绕 AMM 与借贷构建的项目。这些协议有的部署在 XRPL 的 EVM 侧链,有的则借助 Root Network 等侧链进行资产映射。整个 XRPFi 生态并未走「高 TVL 冲刺」路径,而是通过侧链扩展、合规接口与激励机制,逐步搭建适配 XRP 用户结构的 DeFi 系统。

根据 DefiLlama 数据,截至 2025 年 6 月,XRPL 链上 TVL 首次突破 4000 万美元,资金主要来自韩国、菲律宾、新加坡与欧洲部分市场。

从路径上看,XRP 当前正在尝试一种与波场或 Solana 相似的「转向式叙事」——即从支付工具转型为机构金融协议底座。但与后两者相比,XRPL 未放弃其「低费用、高确定性」的合规导向,而是在维持主链精简结构的同时,借助可组合化侧链实现扩展。

这种「技术分层+应用分工」的模式虽进展缓慢,但正在为 XRP 构建新的应用边界,并构成 XRPFi 生态搭建的重要基础。

不是主角,但活着

尽管生态逐步扩展,但 XRP 在主流社区中的认知仍滞留在旧印象中。对于许多加密原生用户而言,XRP 仍是一个「缺乏共识」的项目。

这一情绪落差,在社交平台上表现得尤为明显。面对接连不断的利好,有用户无奈留言,「别再有好消息了,币价又跌了」。这句戏谑式评论,在一定程度上捕捉了 XRP 社区当下的真实处境:建设不断,情绪不涨;结构演进,市场未感。

总之,XRP 可能不会再次成为叙事中心,也未必适合追求爆发性增长的短线投资者。但它仍在构建,仍被机构纳入财务体系,也仍有开发者在此搭建金融基础设施。在一个项目生命周期普遍不超过五年的行业里,「还活着」本身,或许已足够稀缺,足够值得再看一眼。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。