作者:bms

当 Circle 在 2025 年 6 月敲响纳斯达克的钟声,稳定币的大规模采用第一次摆脱了 “概念验证” 的标签,拥有了真实的资本市场坐标。正如 Circle CEO Jeremy Allaire 在 TOKEN 2049 所言:“我们正在走向一个让资产流动像发邮件一样无链感、无国界的世界。” 而今天的多链环境仍像拨号上网时代的网关:开发者为了兼容各条链四处打补丁,用户在钱包、网络与 gas 费之间反复跳转。Web3 资产迫切需要一次类似云原生对 Web2 的基础设施升级——把底层复杂性封装进统一抽象层,让应用创新不再被链的边界束缚,多链对资产发行与应用造成的摩擦,需要被彻底抹平。

一. 为什么 Web3 资产需要一条贯通多链的「超导体」

过去两年,Layer 2 与应用链的爆发式增长让链上资产似乎“遍地开花”,但对最终用户而言,在跨链金融拓扑中,Web3 资产面临的并非单纯转账延迟,而是一组彼此交叠的系统性问题:

1. 资本层面的“多重羁绊”

· 机构资金池若要在 Ethereum、Berachain、Sonic 等网络同步部署,需要反复经历“锁仓 → 铸币 → 解锁 → 再铸币”的循环;每一次状态迁移都暴露在桥接合约可重入、信标延迟、最终确认性等灰犀牛风险之下。

· 合规视角则更尖锐:当一笔稳定币或证券化资产在多条链、跨越多个司法辖区时,往往需要同时满足“资金来源地”与“资金流向地”的 KYC / AML 报告,若企业或个人没有同步申报,轻则被冻结资产,重则面临洗钱指控。此外,一些国家规定境外链上资产回流本土时必须重新计入本地资本账户。

2. 用户体验与开发者的“协议视野遮蔽”

对 C 端而言,“交易签名 → 网络切换 → Gas 计算 → 等待确认”这四连跳,本质是把协议内部复杂性裸露给用户;一旦跨链,还需额外认知“映射代币折价、桥上流动性深度、预言机时效”等信息噪声。结果是:资金可组合性被切分,链间摩擦率陡增。

开发者面对“三向耦合阻尼”,调用多链流动性时,开发者需手动处理 Gas 费异步回补、闪电贷回滚边界、Merkle Proof 深度差异;即使借助通用桥,也要时刻关注 Router 重排 和 Sequencer 拥塞。

由于安全模型各异,合约调用路径出现“最短逻辑栈 ≠ 最低信任栈”的悖论:看似简单的 2 条链 兑换,实则拉长为 N + 1 个潜在攻击面。

二. 多链时代的 Web3 资产降摩擦路径

当前业界围绕 “让资产在哪里都能发行、哪里都能用” 形成了三条思路,各自针对链间摩擦的不同环节出招:

·Everclear 把注意力放在“意图净额”——它用 Netting Solver 先在本地把多余路径抵消,帮助机构在多网络部署时降低再平衡与对冲成本;

·Particle Network 则从账户抽象入手,用 Universal Account 把不同链的身份、签名和授权统一到同一界面,省掉了用户来回切换钱包和网络的心智负担;

·One Balance 主打实时 Portfolio + 轻量跨链兑换,把各链代币、LP 头寸与 NFT 汇总成一张总资产视图,并内置原生路由支持小额换链。三者各有所长,却都仍不同程度依赖底层桥接或分散流动性。

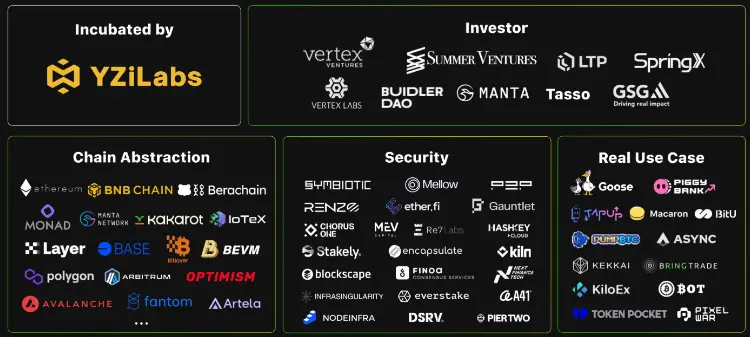

而近段时间进入大众视野,由 Yzi Labs 孵化、淡马锡旗下 Vertex Ventures 领投的 Cycle Network 则选择再向下扎一层:通过 Verifiable State Aggregation 把多链状态汇聚到统一安全共识,让“清算最终性”与“流动性深度”同时归拢,为上层应用提供类似“云原生”般的抽象底座,供上述三类乃至更多创新自由调用。

三. Cycle Network 是什么

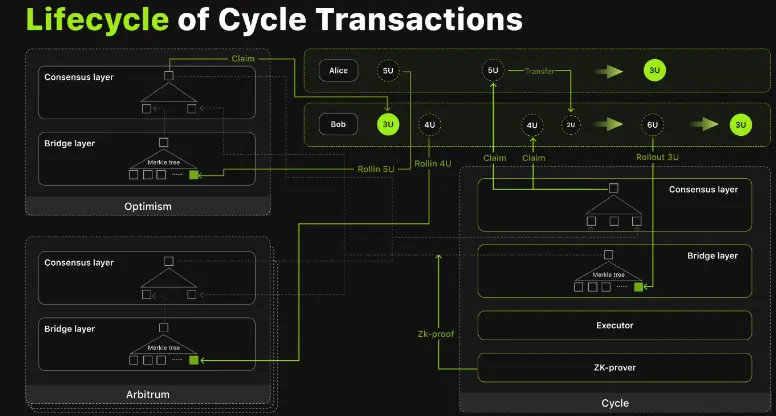

3.1 创新的多链结算层(MultiChain Settlement Layer)

Cycle Network 是一套旨在消除多链摩擦的「多链结算层」,通过自研的 Verifiable State Aggregation 技术+ Symbiotic 安全共识,把以太坊、BNB Chain、Arbitrum、Berachain、Monad 等 20 + 网络的状态汇聚到统一结算面,用户与开发者无需再依赖传统跨链桥即可调用异链资产。

3.2 Cycle Network 的核心优势

Cycle Network 的核心优势在于把复杂的跨链过程“隐藏”进底层协议:借助 Verifiable State Aggregation 与 Rollin / Rollout API,用户只需一次签名即可在任意 dApp 内完成资产转移,完全不必理解桥、网络切换或 gas 代币,从而消除传统跨链的认知与操作障碍。

同时 Cycle 通过统一的结算层与流动性路由,将 EVM 与非 EVM 链上的 ETH、BTC、稳定币乃至 RWA 资产抽象为同一流动池,实现 any asset, any chain 的自由调用,让开发者能够像调用 API 接口一样组合多链资产。

简单地说,Cycle 像在多条河流交汇处建了一座闸门——水流不再纠结源头,只需抬闸,资产就顺势而下。

3.3 产品深析:B 端与 C 端同时发力

B 端开发者福音:链抽象 SDK 快速落地

针对开发者,Cycle Network 推出了 Cycle SDK,本质是一套将 Verifiable State Aggregation 能力封装成易于接入的开发工具集。开发者只需在合约或服务器中引入 Rollin / Rollout 模块,即可在 ≤ 1 天 内把单链应用升级为真正意义上的链抽象DApp,无需再手写桥接逻辑或维护多套前端网络切换。SDK 内置 自动流动性路由、统一 gas 预估 与 Symbiotic 共享安全验证,同时开放 Webhook 与 Subgraph,方便项目在后台对多链交易进行实时监控和风控。

实际应用场景案例:

去中心化交易所 DEX:利用 SDK 的聚合流动性,将 ETH — BNB、BTC — wBERA 这类跨生态交易做进同一撮合池;用户交易路径与单链体验无异,却可自动在后台拆分为多链流动性源。

跨链借贷平台:开发者可调用 Rollout 在一条链抵押资产、在另一条链借出稳定币,所有抵押品价值与清算逻辑由 Cycle 结算层统一校验 → 极大降低清算延迟与价差风险。

链上游戏:游戏工作室只对接一次 SDK,就能让玩家用 SOL 购买 Bera 链 NFT 道具或用 USDC 结算 gas,玩家侧感知为「直接支付」,而复杂多链流程在后台完成。

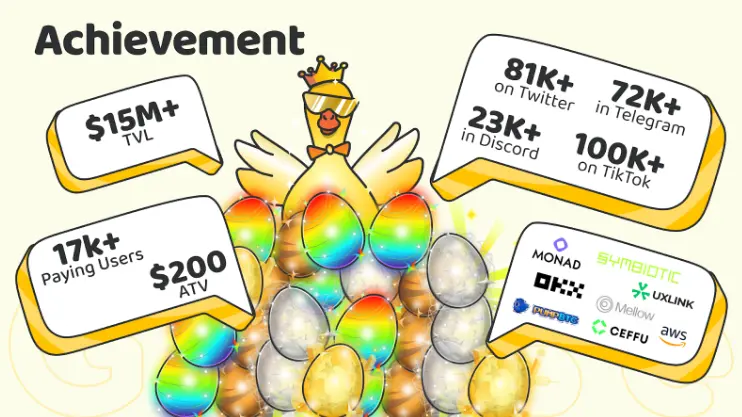

TikTok 上火热的“养鹅”小游戏应用:Golden Goose

Golden Goose 是 Cycle 生态最具代表性的 C 端 DeFAI 应用:它把「链抽象 + 游戏化」写成了可落地的收益入口,让 Web 2 用户也能在一次点击中获得链上收益,而无需切换网络或准备 gas。平台分为 Game Mode 与 Pro Mode:前者将收益策略包装为养鹅游戏,结合 NFT 成长体系与循环复投机制;后者则整合稳定利差、LP 挖矿与借贷套利等结构化策略提供收益。

TikTok 上有人形容:Golden Goose 就像一台自动派息的“链上贩卖机”:你只需投下一枚「开始」按钮,背后错综复杂的跨链齿轮便悄悄运转,把多条链上的流动性与策略打包成收益蛋,从出货口滚到你手里——全程不用懂钱包、不用切换网络,只管收钱。(前提注意风险)

四. 驱动链上资产:Cycle Network 在稳定币与 RWA 中价值定位

4.1 为何稳定币与 RWA 成为全球焦点

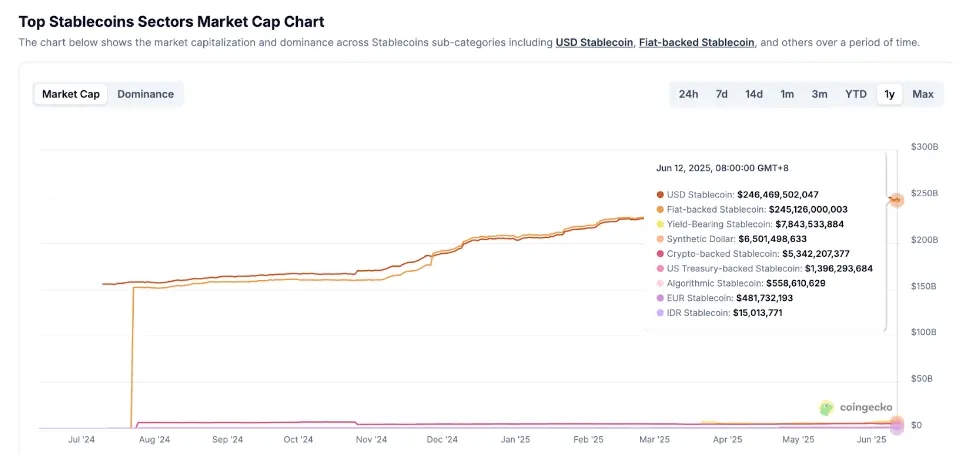

· 避险与流动性需求:全球宏观波动加剧,法币通胀与资本管制使市场对 USD 计价、链上实时清算的资产产生刚需,据 Coingecko 最新数据,稳定币流通市值已突破 250 B 美元。

· 资产数字化加速:监管沙盒与链上结算试点不断落地,房地产、应收账款、国债等 Real-World Assets 被视为区块链落地最具确定性的赛道。

· 成本与透明度优势:链上转移与结算平均手续费低于传统跨境系统一个数量级,可编程性又为审计与合规提供即时可验证的底层数据。

4.2 Cycle 的多链结算机制如何成为稳定币和 RWA 的基础设施?

4.3 从以往的“边缘实验”到具体应用场景

多链稳定币清算网关:发行方可在 Chain A 铸造 USDC, 通过 Cycle 结算层将同额资产无桥映射至 Chain B,零滑点完成商户收款。对用户而言,支付路径与传统卡支付无异。

RWA 二级市场撮合:假设 Tokenized 国债在 OP Stack 链发行,机构做市商可在 Berachain 侧仓位管理、在 Arbitrum 侧报价,底层净额结算由 Cycle 聚合完成,规避了桥接延迟导致的价差风险。

跨境工资 / 供应链结算:企业在 LATAM 以稳定币发薪,供应商在 SEA 即时兑付本地法币,通过 Cycle 自动路径优化与批量净额,相比传统 SWIFT 可节省 50 %+ 手续费与 1-2 个工作日到账时间。

4.4 Cycle 对赛道的长期影响

成本曲线下移:多链发行与结算的边际成本趋近零,RWA 的发行门槛被显著降低。

流动性深度提升:统一的流动性路由减少碎片化,稳定币与 RWA 可在更多链上充当抵押物或支付媒介。

合规桥梁完善:标准化 API 与可验证状态证明,为审计机构和监管方提供实时数据接口,加速合规框架的成型。

五. 增长杠杆与生态飞轮:Cycle 的商业透视

5.1 量化机会:从「小众 DeFi」到「万亿美元真资产」

· DeFi 用户基数:据 DeFiLlama 2025 年数据,全网链上活跃钱包仅不足 20 M;若多链门槛被彻底抹平,参考移动支付从早期试水到普及的渗透曲线,五年指数级扩张到 100 M – 150 M 并不夸张;

· 稳定币市场:最新总市值已超 USD 250 B;若全球跨境支付年规模 USD 150 T(McKinsey,2024),哪怕 1% 迁移上链,对结算网络就是 USD 1.5 T 的可清算流水;

· RWA 潜力:BCG 报告预计 2030 年链上真资产规模可达 USD 16 T;这些资产需要安全、低摩擦的跨链流动层。

5.2 收益结构:多源现金流而非单点博弈

C 端:如 Golden Goose 已在 2025 年前两季度创造超过 20 万美元的内购与策略分成;随着每日活跃和复投率持续提升,这条曲线增长最迅猛;

B 端:Cycle SDK 采用订阅 + 成交抽佣的混合模式;一旦更多 DApp 把结算交给 Cycle,SDK 费与企业定制服务会带来可预测的年费收入;

基础设施:Rollin / Rollout 链间结算费起步虽低,但随着 20 + 链同时接入、日跨链量提高到千万甚至亿美元级,其“基建抽税”将成为最稳健的现金流。

要点:收入端呈 C 端消费(快钱)+ B 端订阅(稳钱)+ 基础设施抽税(长尾) 三层递进,避免依赖单一爆款或空投炒作。

5.3 用户漏斗:让 Web2 自然流向链上

Cycle 并不是“又一个跨链桥”,而是把跨链桥的逻辑做成看不见的公共底座,这使其天然成为了叠加流量入口的杠杆。

当推广侧先通过 TikTok 与 X 视频实现曝光,再用“零钱包安装”的登陆页把观众引导进站。其后,一键绑定与法币直充让客完成账户激活;漏斗每一级都建立了可量化 KPI,使营销预算与产品优化能精确迭代,而非靠空投博眼球。

当新的流动性通过 Rollin / Rollout 汇入 Cycle,不仅直接贡献手续费,也令 C 端产品的策略容量与收益率上升;更高收益又吸引更多 C 端用户与资金,推动流动性继续扩大。与此同时,收益示范会吸引开发者采用 Cycle SDK,在 DEX、借贷、链游、支付网关等场景里复用同一结算层——开发者越多,资金周转率越高,手续费越低,飞轮转得越快。

六. Liquidity Hub —— 把流动性注入底层结算层

Cycle Network 宣布将在本周上线 Cycle Liquidity Hub 公测,向任何持有 USDC 或 USDT 的用户开放底层流动性池。与传统流动性挖矿将资金锁定在单一协议中不同,Liquidity Hub 中的资金将直接注入 Cycle 的多链结算缓冲区,用作 Rollin / Rollout 的实时清算备付金。

截至 6 月中旬,Cycle 主网已通过 Symbiotic 的共享安全机制获得超过 400M 美元TVL的资金保护,稳居 Symbiotic 网络前三,成为其重质押体系下最核心的多链结算网络之一。这意味着,Cycle 所承载的多链流动性与结算操作,正运行在一个由真实资产支持的高安全性基础上。

这意味着 Cycle 的用户,不只是参与者,更是结算网络的共建者:你的稳定币不仅追求收益,还在为多链清算体系提供深层流动性,直接增强所有 DApp 的资金效率与安全冗余。

结语:迈向 Web 3 大众时代的「关键一环」

从拨号时代迈入移动互联,从支票清算跃升到秒级支付,每一次基础设施的重构,都是一次价值传输范式的升级。而在 Web3 的世界中,真正的“普及风暴”从不诞生于单一协议或热点叙事,而源自底层信任与体验的共同演进。

Cycle Network 正是在这样的时代节点上,提出了一种全新的答案:以链抽象重塑交互范式,用统一结算打破流动性壁垒,在“任何资产、任何链、一次点击”的愿景之上,构建一个无需桥梁的多链清算网络——让链上的价值流动,不再是一场技术豪赌,而是一种日常生活。

当稳定币与 RWA 成为链上资产的主力军,当新一代用户通过游戏、内容、支付无感接入 Web3,Cycle 不仅提供路径,更是成为信任在多链之间自由穿梭的高速通道。

未来的Web3应用,不会再问“在哪条链上”,而是像我们今天用电、用网一样,习惯于“它就在那里”。而那条隐形却强大的价值通路,很可能,就叫 Cycle。链上的云原生时代已经拉开了序幕。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。