Compiled by: Jerry, ChainCatcher

Performance of Crypto Spot ETFs Last Week

U.S. Bitcoin Spot ETF Net Inflow of $1.37 Billion

Last week, the U.S. Bitcoin spot ETF saw a net inflow for five consecutive days, totaling $1.37 billion, with total assets under management reaching $130.26 billion.

Nine ETFs experienced net inflows last week, primarily from IBIT, ARKB, and FBTC, which saw inflows of $1.115 billion, $82.8 million, and $80 million, respectively.

Data Source: Farside Investors

U.S. Ethereum Spot ETF Net Inflow of $533 Million

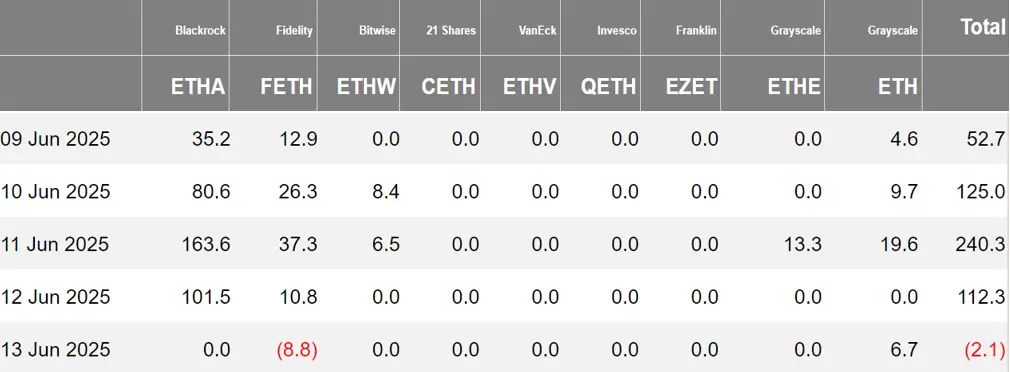

Last week, the U.S. Ethereum spot ETF had a net inflow over four days, totaling $533 million, with total assets under management reaching $10.03 billion.

The inflow was mainly from BlackRock's ETHA, which had a net inflow of $380 million. A total of four Ethereum spot ETFs had no fund movement.

Data Source: Farside Investors

Hong Kong Bitcoin Spot ETF Net Outflow of 347.31 Bitcoins

Last week, the Hong Kong Bitcoin spot ETF experienced a net outflow of 347.31 Bitcoins, with total assets under management reaching $46 million. The holdings of the issuer, Harvest Bitcoin, decreased to 301.64 Bitcoins, while Huaxia's holdings fell to 2,470 Bitcoins.

The Hong Kong Ethereum spot ETF had no fund movement, with total assets under management at $5.716 million.

Data Source: SoSoValue

Performance of Crypto Spot ETF Options

As of June 13, the nominal total trading volume of U.S. Bitcoin spot ETF options was $1.71 billion, with a nominal total long-short ratio of 1.67.

As of June 12, the nominal total open interest of U.S. Bitcoin spot ETF options reached $19.4 billion, with a nominal total long-short ratio of 1.84.

The market is currently active in trading Bitcoin spot ETF options, with overall sentiment leaning bullish.

Additionally, the implied volatility stands at 46.52%.

Data Source: SoSoValue

Overview of Crypto ETF Developments Last Week

Multiple SOL ETF Potential Issuers Submitted Updated S-1 Filings

According to The Block, several companies submitted updated S-1 filings on Friday for listing spot Solana exchange-traded funds. Some experts suggest that this indicates the U.S. Securities and Exchange Commission (SEC) is closer to approving these products.

According to a series of regulatory documents, investment firms Franklin Templeton, Galaxy Digital, and VanEck submitted updated S-1 filings, which are required registration statements for ETFs to gain approval for public trading from the SEC. Fidelity also submitted its Solana fund S-1 filing on Friday, with an insider stating, "This is Fidelity's first submission of an S-1 filing for a Solana ETP."

Invesco Galaxy Solana ETF Registered in Delaware

According to information from the Delaware Division of Corporations, the Invesco Galaxy Solana ETF was officially registered in Delaware on June 12, 2025, as a Statutory Trust, with its registered address at 251 Little Falls Drive, Wilmington, and CSC Delaware Trust Company serving as the registered agent.

Nasdaq Submitted Application to SEC for Listing 21Shares SUI ETF

Nasdaq has submitted an application to the U.S. Securities and Exchange Commission (SEC) for listing the 21Shares SUI ETF, a spot trading fund based on the SUI token. The 19b-4 filing has been officially released to the SEC's public registration system, marking the formal start of the review process.

This application follows 21Shares' submission of the S-1 registration document in April, reflecting the growing institutional embrace of the Sui ecosystem. The two documents together advance the process for the SUI ETF to enter the U.S. market. If listed in the U.S., it will further broaden investor adoption of this innovative Layer 1 ecosystem known for its outstanding performance and utility. 21Shares has already launched the Sui ETP on Euronext exchanges in Paris and Amsterdam, with significant inflows this year.

In addition to 21Shares, Sui's technology has attracted institutions including Canary Capital, Ant Group, Franklin Templeton, VanEck, and Grayscale, which have gradually launched investment products or related plans on Sui since the fourth quarter of last year.

According to Blockworks, citing insiders, the SEC has requested issuers of the proposed spot Solana ETF to update their S-1 prospectus, suggesting that related approvals may be forthcoming. While the specific approval timeline is unclear, Bloomberg's senior ETF analyst Eric Balchunas expects approval within two to four months.

In an interview with The Block, he stated that spot funds for Solana, XRP, and others are likely to be approved in the future, with an approval deadline potentially in October, and a spot ETF combination including Solana, XRP, Ethereum, and Bitcoin may emerge in July. Issuers are racing to launch spot ETFs to gain a first-mover advantage. Balchunas also mentioned that a large number of spot products will emerge in the next four months, but on a smaller scale, with Solana and XRP reaching a scale of $1 billion being a good outcome.

SEC Initiates Review of Bitwise Bitcoin and Ethereum Mixed ETF Listing Application

According to official documents, the U.S. Securities and Exchange Commission (SEC) announced today that it has initiated the process to review the listing application for the Bitwise Bitcoin and Ethereum mixed ETF submitted by NYSE Arca.

This ETF plans to hold both Bitcoin and Ethereum, with asset allocation based on the relative market values of the two cryptocurrencies (currently approximately 83% Bitcoin and 17% Ethereum). The ETF will determine its daily net asset value by referencing the CME CF Bitcoin and Ethereum pricing benchmarks and will allow authorized participants to create and redeem shares in cash in units of 10,000 shares.

Canary Capital Establishes Delaware Trust Fund to Bet on Injective ETF

According to Cointelegraph, fund manager Canary Capital has established a trust fund in Delaware named "Canary Staked INJ ETF," aimed at launching a fund based on staking the Injective token. This move is the first step toward launching the ETF, typically done before submitting further documents to the U.S. Securities and Exchange Commission (SEC). The native token of Injective, INJ, rose 3.7% in the past 24 hours, indicating a positive market reaction to the news.

According to The Block, Bloomberg ETF analyst Eric Balchunas stated that BlackRock's Bitcoin ETF—IBIT fund (the largest in its category)—surpassed $70 billion in assets in just 341 trading days, making it the fastest ETF to reach this milestone, achieving this at a speed five times faster than the previous record holder, GLD (1,691 days). GLD is the SPDR Gold Trust, which was listed on the NYSE in November 2004 and is the largest physically-backed gold ETF in the world, managing approximately $100 billion in assets.

BlackRock launched its spot Bitcoin ETF in January 2024. According to Arkham Intelligence data, in April this year, BlackRock's fund held 2.8% of the total Bitcoin supply. The asset management company holds Bitcoin on behalf of its clients but does not own the cryptocurrency itself.

ProShares and Bitwise Submit ETF Applications Tracking Circle Stock

Bloomberg senior ETF analyst Eric Balchunas retweeted on the X platform, revealing that ProShares and Bitwise have submitted ETF applications tracking Circle stock to the U.S. SEC, namely: ProShares Ultra CRCL ETF and Bitwise CRCL Option Income Strategy ETF.

The trading codes are currently pending, with an expected effective date of August 20.

U.S. SEC Delays Decision on Canary Hedera ETF Application

Market News: U.S. SEC Delays Decision on VanEck Spot Avalanche ETF

Market News: U.S. SEC Delays Decision on Grayscale HEDERA Spot ETF

COINSHARES SOLANA ETF Registered in Delaware

CANARY STAKED INJ ETF and CANARY MARINADE SOLANA ETF Registered in Delaware

Views and Analysis on Crypto ETFs

Bloomberg Analyst: This Summer May Bring Altcoin ETF Summer, with Solana Expected to Lead

According to Bloomberg senior ETF analyst Eric Balchunas, this summer may see the emergence of an Altcoin ETF Summer, with Solana expected to take the lead, along with some combination products.

Bloomberg Analyst: Litecoin and Solana Spot ETF Approval Chances as High as 90%

Bloomberg ETF analysts have updated the latest approval chances for cryptocurrency spot ETFs, with basket/index funds, Litecoin, and Solana leading the way, boasting approval chances as high as 90%.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。