Author: Fairy, ChainCatcher

Editor: TB, ChainCatcher

SharpLink Gaming, hailed by the market as the "Ethereum version of MicroStrategy," was originally riding the wave of the ETH treasury narrative, but a filing with the SEC caused its stock price to plummet nearly 70% in after-hours trading.

The fervor turned into skepticism, and faith took a dive into panic. This article will dissect this sudden "crisis of trust" and discuss the hidden picture behind it.

Market Misinterpretation Behind the Plunge

At the end of May, SharpLink Gaming completed a $425 million private investment in public equity (PIPE), with investors including established institutions heavily invested in Ethereum such as ConsenSys, Galaxy, and Pantera Capital. The funds were used to acquire ETH as reserve assets. This move caused SharpLink's stock price to soar to a high of $124, increasing over 40 times from before the financing announcement.

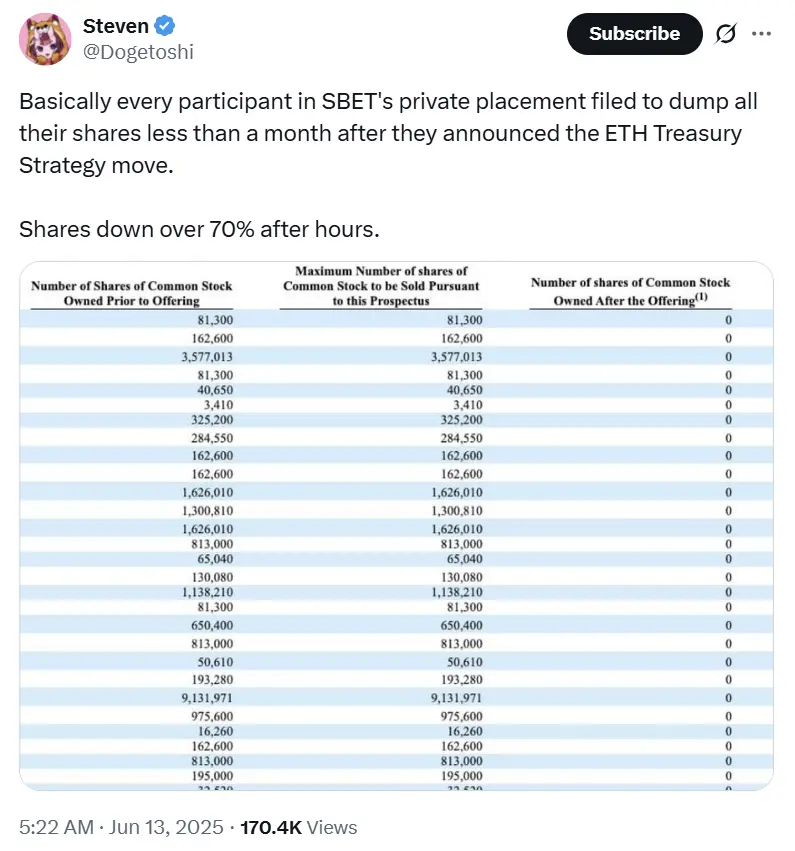

However, yesterday, SharpLink Gaming submitted an S-3ASR registration statement to the SEC, authorizing the resale of up to 58,699,760 shares related to the PIPE financing. This meant that over 100 PIPE investors could choose to sell their holdings at any time.

In an instant, the market misinterpreted this as "PIPE investors have begun to apply to offload their shares," and panic spread rapidly.

Market Misinterpretation

SharpLink's after-hours stock price fell to $8.75, a drop of 73%, before slightly rebounding to the $10 range.

Source: yahoo!finance

Subsequently, SharpLink's board chairman and ConsenSys CEO Joseph Lubin clarified: this document is merely a routine registration process following the PIPE, intended to "pre-register shares for potential resale," and does not represent any actual sales. He emphasized: "The 'post-issuance shareholding' in the document is hypothetical data; neither ConsenSys nor I have sold any shares."

Although the storm has temporarily subsided, the market remains full of speculation about SharpLink's movements. BTCS Inc CEO Charles Allen stated: "In my experience, given the backgrounds of some investors involved in the transaction, they may indeed be quietly selling off. Additionally, 'prefunded warrants' are essentially a way to avoid disclosure of holdings and to avoid becoming a related party."

He further pointed out that after SharpLink obtained WKSI status on May 30, it immediately submitted a $1 billion ATM (at-the-market) plan (issuing stock at market price), suggesting they may have quietly completed financing through ongoing trading without immediate disclosure. If operations go smoothly, an announcement of a $1 billion purchase of ETH could be made tomorrow, reigniting market enthusiasm.

SBET Currently at a 100% Premium?

SharpLink (SBET)'s current stock performance and premium situation also reveal investors' complex expectations for its future trajectory. According to cutting-edge technology investor Zheng Di, SBET currently has a premium of about 100%.

According to the documents submitted to the SEC, the company's fully diluted total share capital is 77,526,682 shares. Based on an after-hours price of about $10, the company's total market capitalization is approximately $800 million. The number of shares registered in this filing is 75,319,345 shares (assuming all warrants from advisors and investment banks have been fully converted), plus the original share capital of 690,000 shares. Zheng Di deduced that the previously valued $1 billion ATM has actually only executed about 1,517,337 shares, indicating that the vast majority of the ATM capacity may still be unused, posing a risk of future dilution.

He noted that the total amount of this PIPE financing is $425 million, and considering ConsenSys as the company's Ethereum strategic advisor, along with reports that ConsenSys-related addresses have purchased about $300 million in ETH, there is reason to believe that most, if not all, of the financing funds have been used to acquire ETH. Given the limited recent price fluctuations of ETH, the current market value of the company's ETH holdings should remain around $400 million.

Therefore, taking all these factors into account, Zheng Di speculated that SBET currently has a market premium of about 100%.

The premium of SBET reflects, to some extent, the market's recognition of its asset value, particularly the potential value of its Ethereum reserves. However, an excessively high premium also brings market risks, and future releases of more ATM capacity and potential share dilution may exacerbate stock price volatility.

The drama surrounding SharpLink is still unfolding. If, as Zheng Di analyzed, there is still room for share dilution in the future, it may bring volatility pressure in the short term; however, if, as Charles Allen mentioned, news of a $1 billion ETH purchase is disclosed soon, it could reignite market sentiment and drive up the stock price.

This combination of "opacity" and "possibility" makes SharpLink both controversial and full of imaginative potential. The real climax may still lie ahead.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。