In 2025, the debate over whether stablecoins can disrupt traditional cross-border payments has not only intensified but has also entered a more heated "deep water zone" with the preliminary establishment of regulatory frameworks and explorations of real-world applications.

Recently, Airwallex, a fintech unicorn, and Uber's CEO engaged in a rare public exchange on this issue, bringing two starkly different viewpoints to the forefront: one side, a pragmatic player with years of experience in payments, pointed out the cost black hole of stablecoins in the real world; the other, an optimistic advocate of cutting-edge technology, sees its potential as a global transaction lubricant.

The core of this debate is no longer the grand narrative of "Is crypto technology the future?" but rather a pointed soul-searching question: After stripping away all technological glamour, what problem does stablecoin actually solve for whom? Is the efficiency revolution it claims sufficient to bridge the "last mile" of payment delivery?

The Pragmatist's Cold Water: Jack Zhang and the "Last Mile" Payment Challenge

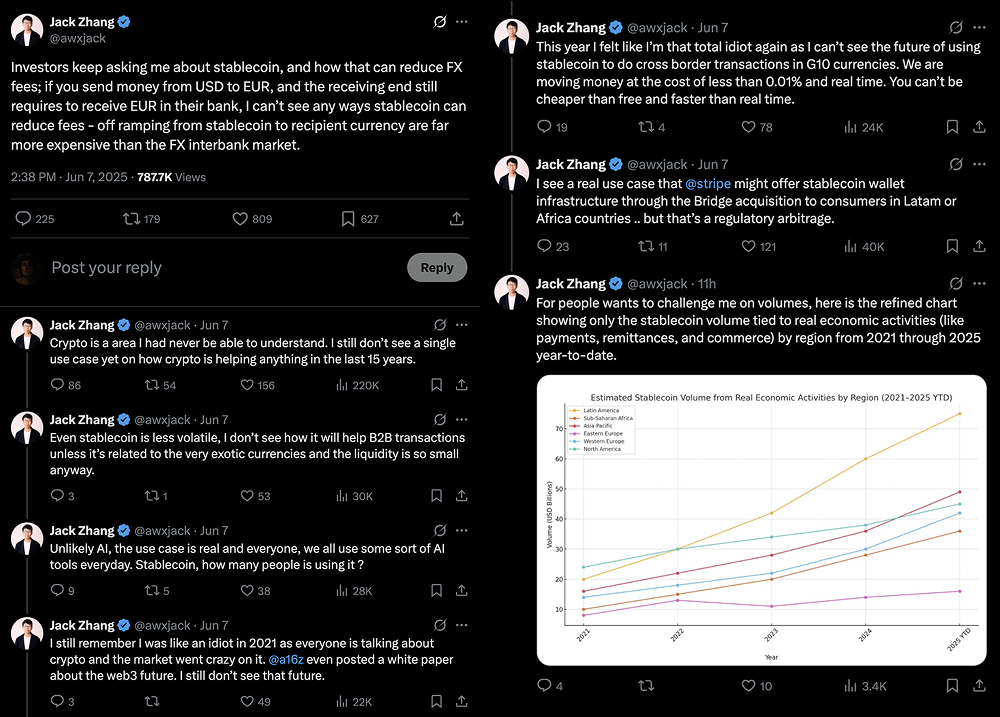

"Investors keep asking me how stablecoins can reduce foreign exchange costs, and my answer is that, in the vast majority of mainstream scenarios, they cannot." Jack Zhang, co-founder and CEO of Airwallex, recently stated on platform X, pouring cold water on the overly romantic fantasies surrounding stablecoin payments.

His logic is simple yet fatal: Suppose a user needs to send $10,000 from the United States to Germany, and the recipient ultimately needs to receive an equivalent amount in euros in their Deutsche Bank account. The traditional path is completed through the SWIFT network and correspondent banking system, with costs primarily reflected in exchange rate spreads and wire transfer fees.

The theoretical stablecoin path is as follows:

On-Ramp: The user exchanges $10,000 for 10,000 USDC or USDT in the U.S. This step may incur transaction fees or slight spreads.

On-Chain Transfer: The 10,000 stablecoins are sent to the recipient's wallet via a blockchain network (such as Ethereum L2 or Solana). This step incurs very low fees, is extremely fast, and is available 24/7.

Off-Ramp: The recipient sells 10,000 USDC/USDT for euros at a compliant exchange or OTC platform in Europe and withdraws it to their bank account.

Jack Zhang's critique directly targets the third step, the most critical "last mile." He sharply points out: "The conversion cost from stablecoins to the receiving currency is far higher than that of the interbank foreign exchange market."

Here, "conversion cost" is a composite concept that includes at least:

Exchange/OTC Spread: The trading pair of stablecoins to euros (e.g., USDC/EUR) typically has lower liquidity, depth, and buy-sell spreads than the interbank foreign exchange market's USD/EUR. For large transactions, slippage costs can rise sharply.

Platform Fees: Whether transaction fees or withdrawal fees, these are significant expenses that cannot be ignored.

Compliance and Operational Costs: The recipient needs to have and operate a crypto wallet and exchange account while meeting relevant KYC/AML (Know Your Customer/Anti-Money Laundering) requirements, which can impose hidden time and learning costs for ordinary users or corporate finance departments unfamiliar with the crypto world.

"Crypto technology has not seen any (large-scale) application cases in the past 15 years," Jack Zhang's concluding remark may seem absolute, but it accurately reflects the dilemma from the practitioner's perspective: the enormous superiority of on-chain efficiency is offset by the significant friction at the connection point with the off-chain and real world. As long as the final recipient requires sovereign fiat currency in their bank account, stablecoins must cross this chasm, and each crossing incurs a cost.

The Optimist's Vision: Dara Khosrowshahi and the New Paradigm of Global Transactions

In stark contrast to Jack Zhang's caution, Uber CEO Dara Khosrowshahi stated that Bitcoin has become "a verified commodity" and believes that "stablecoins can effectively facilitate international transactions."

Uber's business spans the globe, and the payment challenges it faces are highly representative: high-frequency, small-value, multi-currency driver commissions and passenger payment settlements. The traditional banking system appears cumbersome, expensive, and slow when handling such payments. A $15 payment to a driver in Kenya could be eroded by fees through traditional wire transfers, with a long settlement period.

From this perspective, the advantages of stablecoins seem almost tailor-made for such scenarios:

Cost Revolution: Gas fees of just a few cents or even lower make cross-border micro-payments shift from "uneconomical" to "feasible," which is disruptive for gig economies, content creator economies, and small purchases in cross-border e-commerce.

Efficiency Revolution: 24/7 availability and near-instant settlement eliminate delays caused by bank operating hours, holidays, and intermediary processing, significantly enhancing the flow efficiency of global funds. For companies that need to manage global cash flow frequently, this means lower capital occupation costs and greater financial flexibility.

Programmability: Based on smart contracts, complex payment logic can be automated and triggered by conditions, such as "automatically paying the supplier once the goods are delivered and confirmed by IoT devices," which is complex and costly to implement in traditional financial systems.

Khosrowshahi's perspective represents a large group and scenarios that are "underserved" by the existing financial system. They are willing to learn and adapt to new operational processes to gain extreme efficiency and cost advantages. For them, while the friction of the "last mile" exists, the full-chain friction of traditional payments may be even greater.

The Reality Divide in 2025: Coexistence, Penetration Rather Than Total Replacement

After nearly a year of market evolution, especially with the full implementation of the EU's Markets in Crypto-Assets Regulation (MiCA) and the increasingly clear regulatory path for payment stablecoins in the U.S., the contours of stablecoin payments are no longer vague. They have not launched a full-scale attack on SWIFT as early prophets predicted but have instead shown a trend of "precise penetration, with scenarios as king."

B2B settlements and corporate treasury management have become the main battleground: The most successful application of stablecoins today is not in C2C personal remittances but in the B2B sector. Multinational companies use stablecoins for internal fund transfers between subsidiaries or to pay global suppliers that also accept stablecoin settlements. In this "closed-loop" or "semi-closed-loop" system, funds remain on-chain for as long as possible, avoiding frequent On/Off-Ramp operations, thereby maximizing on-chain efficiency and circumventing the cost challenges of the "last mile."

Emerging markets and special channels as "sweet spots": In regions where local currencies are unstable, foreign exchange controls are strict, or banking services are insufficient (such as parts of Latin America, Africa, and Southeast Asia), stablecoins (mainly dollar-pegged stablecoins) have become de facto hard currencies and mainstream payment options. Here, people and businesses have long been accustomed to P2P (peer-to-peer) exchanges or using local OTC merchants for fiat currency exchanges, with inherent friction costs even lower than those of imperfect official financial systems. Stablecoins have opened a door for them to the global digital economy.

The "dual-track" integration of fintech companies: Payment companies like Airwallex, although their CEO publicly expresses skepticism, cannot ignore this trend due to their underlying business logic. The common practice in the industry is to adopt a "dual-track" strategy: while continuing to optimize traditional FX channels, they integrate stablecoins as a new, optional payment/settlement "track" into their platforms. Customers can choose the optimal path based on their needs, cost sensitivity, and the acceptance of their trading partners. Future competition will be about who can better shield the complexity of underlying technologies and provide users with seamless, intelligent routing options.

Returning to the Initial Question: Can Stablecoins Replace Traditional Cross-Border Payments?

The answer in 2025 is becoming increasingly clear: not in the short term, but in the long term, it is about integration and coexistence.

Jack Zhang's skepticism is valid; he points out the fundamental barriers stablecoins face when integrating into the existing fiat world. The costs and experiences of the "last mile" are the "life and death line" determining whether they can be accepted by the mainstream public and enterprises.

However, Dara Khosrowshahi's optimism is not unfounded; he sees an incremental market driven by efficiency and cost, a blue ocean that traditional financial services have not fully satisfied.

Stablecoin payments and traditional cross-border payments are not a zero-sum game of life and death. It is more like a brand new high-speed railway that has emerged on the ancient financial continent, adopting different technological standards. It will not make all old roads disappear, but it will permanently change people's expectations regarding speed, cost, and possibilities.

In the future, the real winners will be those who can build the most convenient "transfer stations" for customers, allowing them to switch freely between traditional roads and new railways, reaching their destinations with the lowest cost and highest efficiency, creating "super integrated transportation hubs." This profound transformation of global value flow has just begun to depart from the platform.

This article only represents the author's personal views and does not reflect the position or views of this platform. This article is for informational sharing only and does not constitute any investment advice to anyone.

Join our community to discuss this event

Official Telegram community: t.me/aicoincn

Chat room: Wealth Group

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。