Organized by: Fairy, ChainCatcher

Edited by: TB, ChainCatcher

"Stablecoins cannot reduce remittance costs between mainstream currencies, and cryptocurrencies have not demonstrated clear practical use cases in the past 15 years."

On June 7, a tweet from Airwallex founder and CEO Jack Zhang sparked intense discussion about the actual value of stablecoins. This "bearish" sentiment drew attention precisely because Jack Zhang is at the core of global fintech.

Airwallex is a leading global enterprise cross-border payment platform, operating in over 50 countries, with core products including international receiving accounts, multi-currency corporate cards, and global transfers. In May of this year, Airwallex completed its Series F funding round, raising its valuation to $6.2 billion, with total funding reaching $1.2 billion, backed by well-known investors including Tencent, Sequoia China, DST, and Hillhouse.

As stablecoins enter the mainstream financial view, Jack Zhang's "tone" seems particularly jarring. However, his viewpoint is not an isolated case but reflects the opinions of some traditional payment practitioners and even the financial elite regarding the rise of stablecoins.

Here is Jack Zhang's tweet (translated by ChainCatcher):

Investors always ask me about stablecoins and how they can reduce foreign exchange costs; but if you are remitting from USD to EUR, and the recipient still requires the funds to be in EUR in their bank account, I really don't see how stablecoins can reduce costs— the cost of converting from stablecoins to the receiving currency is far higher than traditional interbank foreign exchange markets.

Cryptocurrency is a field I have never been able to understand. In the past 15 years, I still haven't seen how cryptocurrencies have truly helped. Even with the lower volatility of stablecoins, I don't see any benefits in B2B transactions unless it's for some very niche currency markets, but those markets have very low liquidity to begin with.

Unlike artificial intelligence, whose applications are tangible and used by each of us every day through various AI tools. What about stablecoins? How many people are really using them?

I still remember in 2021, I felt like a fool watching everyone talk about cryptocurrencies, and the market went crazy, even a16z released a white paper on the future of Web3. But I still can't see that "future."

And this year, I feel like a "complete fool" again because I still don't see any prospects for using stablecoins for cross-border transactions between G10 currencies. The cost of our current cross-border transfers is already below 0.01%, and they are real-time. You can't get cheaper than "free," and you can't get faster than "real-time."

The only real use case I can see might be Stripe providing stablecoin wallet infrastructure to consumers in Latin America or Africa through the acquisition of Bridge… but that's really just regulatory arbitrage.

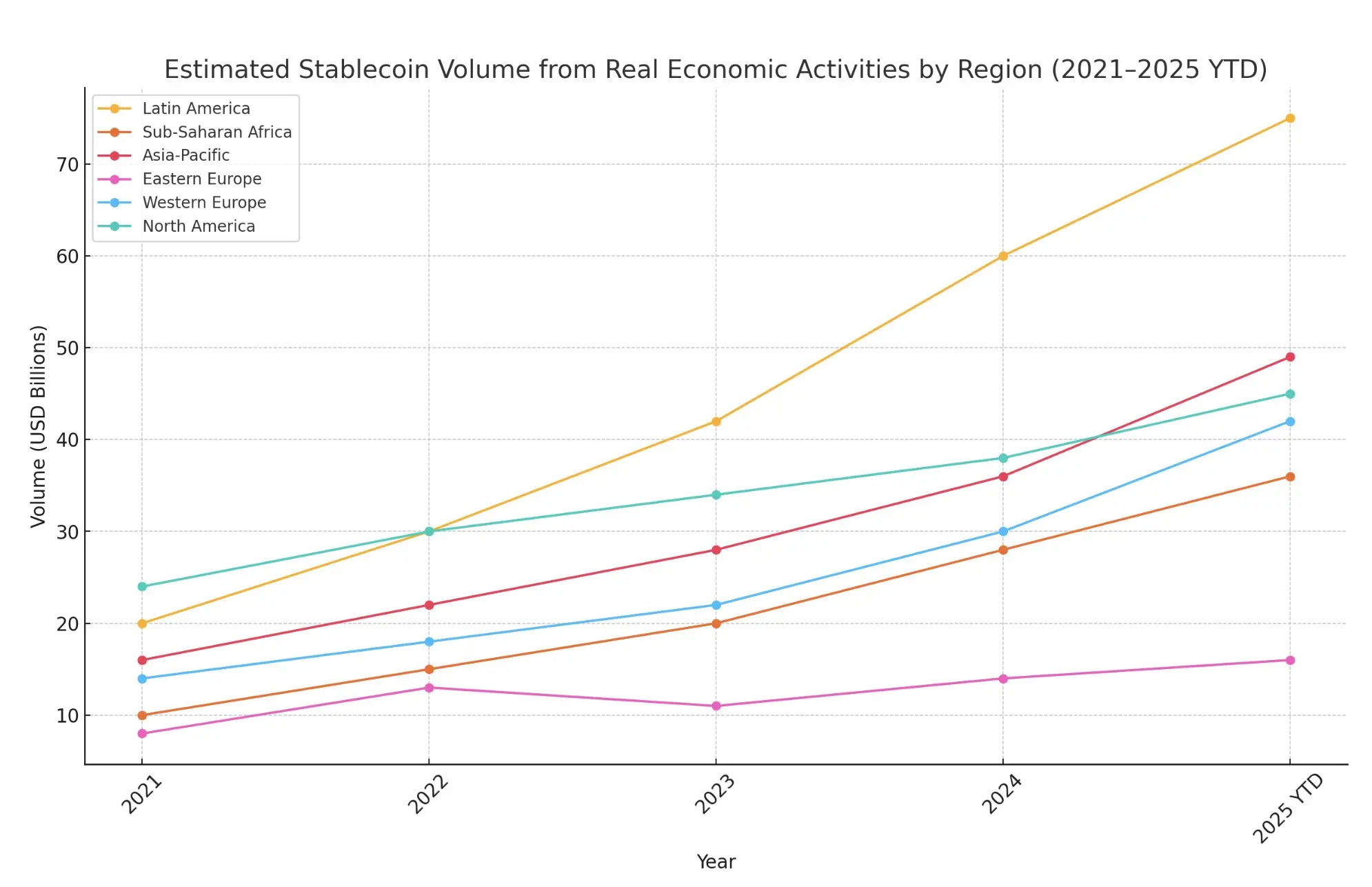

If someone wants to counter me with trading volume, here is a finely processed chart that only shows stablecoin trading volume related to real economic activities (such as payments, remittances, and commercial transactions), by region from 2021 to the beginning of 2025.

Source: Jack Zhang

In the comments section where he engaged with netizens, Jack Zhang further clarified his stance on stablecoins:

- Stablecoins may serve as a supplementary option for payment tools and financial infrastructure in the future, rather than a disruptive transformation.

- Stablecoins are being overhyped, and their development path is still long; excessive promotion and hype can mislead the public's judgment of their real value.

- Currency issuance should be led by central banks; purely financial products do not create any real value for society.

- The combination of multinational regulatory restrictions and developing countries' resistance to dollarization makes the global compliance prospects for stablecoins bleak.

These viewpoints have sparked intense rebuttals from the financial and crypto circles:

Financial analyst Simon Taylor pointed out that stablecoins are currently just "another option" and have not yet formed a mainstream financial track, but he believes a key turning point is imminent. With the upcoming stablecoin regulatory rules in the U.S., stablecoins are expected to usher in a systemic shift. He noted that similar to the path of "Eurodollars," stablecoins could also become an alternative to SWIFT for certain countries. Under the G20's push, multilateral organizations like the OECD are advancing a "functional equivalence" regulatory framework to lay the institutional foundation for their globalization.

Juan Lopez, a partner at VanEck Ventures, stated that true innovation often arises from marginal markets. The potential of stablecoins is enormous and should not be dismissed solely based on "speculation." It is precisely the attractiveness of the potential market (TAM) that fuels ongoing exploration. He emphasized that while Airwallex and Wise provide excellent services, they still cannot meet the many needs of stablecoin users in global transactions, and this market feedback precisely proves that stablecoins are addressing real pain points and represent a necessary path of innovation.

Interests Determine Positions, Defense of Old Forces?

As the U.S. stablecoin legislation achieves a critical breakthrough, with several states taking the first steps to issue stablecoins, this asset, once seen as a "chain-based tool," is evolving into a frontline force in global financial games. Stablecoins are no longer just a part of the tech stack; they carry the struggle for capital power, the reshaping of regulatory frameworks, and profound collisions in geopolitical landscapes.

Therefore, many believe that Jack Zhang's statements on stablecoins are not merely a technical viewpoint or market judgment but a true reflection of the discourse position of old financial interest groups.

Crypto KOL BroLeon pointed out that Airwallex's business model is not complex; its core competitiveness comes from the financial licenses held in multiple countries and the funding pool advantage brought by deposited funds. Through multiple rounds of large-scale financing, Airwallex has effectively become deeply bound to the global traditional financial vested interest groups, becoming part of the old system.

BroLeon further stated that the current rise of stablecoins relies not only on blockchain's technical transformation of outdated financial infrastructure but also on deeper driving forces from the internal political ecology of the U.S. The emerging political forces represented by the Trump camp are challenging the traditional financial groups represented by the Federal Reserve, and stablecoins have become a product and tool in this "new finance vs. old finance" conflict of interests.

Tastingo.eth/.sol, co-founder of OHDAT Labs, expressed a similar viewpoint. He believes that Jack himself is a representative figure within the vested interest system, and his stance on stablecoins naturally reflects this reality. The development of stablecoins is largely not a simple technological innovation but a redistribution of power between new and old financial forces against the backdrop of global competition. In the U.S., stablecoins have, to some extent, become a tool for the MAGA camp to challenge the Federal Reserve's dominance.

Stablecoins lie between financial innovation and regulatory reality, and Jack Zhang's skepticism stands in stark contrast to the probing of emerging forces. Can this quietly gathering new political driving force truly shake the foundations of the global payment system?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。