Coinbase International has launched a new perpetual contract product — SOPH-PERP, which is expected to open for trading on the Coinbase International site and Advanced platform starting from June 5, 2025, at 17:30 (Beijing time).

When new coins are launched, they often experience significant volatility, even "soaring first and then crashing," but this also presents a good opportunity for us to build short-term models and make high-odds trades. Today, we won't discuss the background of the SOPH project itself; instead, let's change our perspective:

If you encounter a new coin that you are not familiar with, just launched, how do you determine if it is worth trading? How do you use technical indicators to gauge the rhythm? And how should you look at the follow-up?

Early Stage of New Coin Launch: How to Determine if It's Worth Trading?

When a new coin is just launched, a common mistake is to judge "whether it's worth buying" solely based on the theme or investment institutions. However, the initial market price is often more influenced by trading structure, liquidity controllers, and emotional capital.

What should we focus on?

1. Is the trading depth solid?

- Is there a significant "slippage" or "empty order book" situation? Focus mainly on trading volume, bid-ask spread, and other indicators.

- Is the order volume evenly distributed at key price levels? For example, you can pay attention to the chip distribution indicator. If you find the order book dense but suddenly sees a large sell-off, it is likely that institutions are liquidating or inducing buying to offload.

2. Is the funding rate extreme?

- When perpetual contracts are just launched, it is normal for the funding rate to fluctuate greatly.

- If you notice that the funding rate remains consistently above 0.1% within a few hours of launch, be cautious: this is a typical sign of excessive bullishness, which can easily lead to a reversal.

3. K-line rhythm in the first few hours after opening

- Is there a continuous contraction followed by a breakout? This is a common rhythm after market makers accumulate positions.

- Is there a "spike drop" followed by a quick recovery? This could be a potential signal for accumulation and washout.

At this point, your focus should not be on "whether SOPH is a good project," but rather:

"Is anyone pushing the market? Does the order book structure have short-term advantages?"

You can directly pull up key indicators on AiCoin to assist in judging these issues. Remember, short-term trading focuses not on value, but on structure and rhythm.

Technical Indicators Should Be Fast, Short, and Not Apply Traditional Logic

When dealing with new coins, do not use traditional trend strategies. Why?

Because the data is insufficient, and the indicators can be distorted.

The indicators we commonly use, such as MACD, RSI, and KD, rely on stable cycles and clear trends. The early stage of new coins is often characterized by high volatility, limited data, and easily changeable directions, so a "fast, short, and responsive" indicator system should be used. Here are some indicators to pay attention to in the early stages of new coins:

1. EMA Short Cycle Cross (e.g., 5EMA/13EMA)

- Faster than the traditional 60/120EMA, suitable for capturing breakout points.

- Can be combined with volume expansion to judge the authenticity of breakouts.

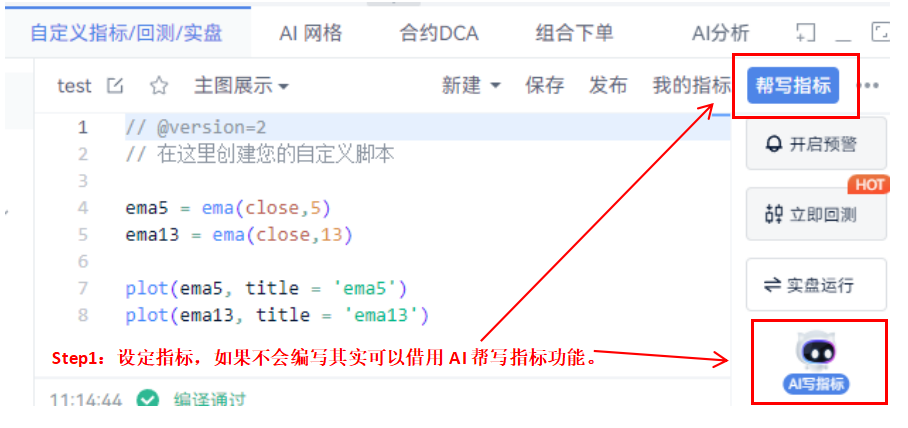

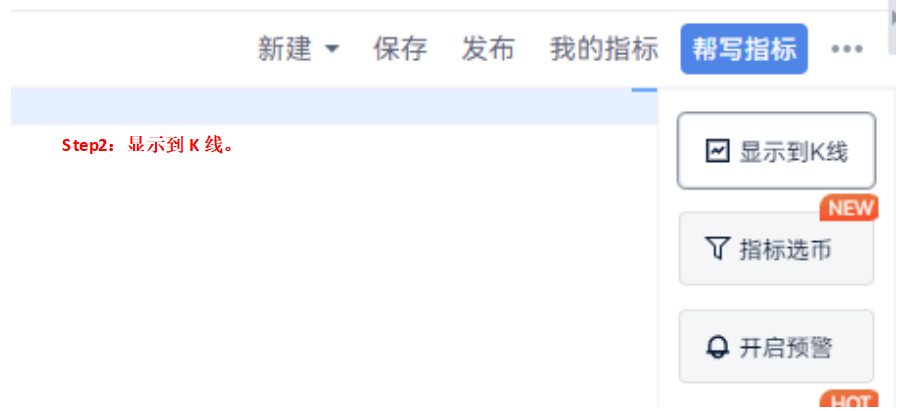

Although AiCoin defaults to providing 24-day and 52-day EMA, you can completely customize the indicator function to set shorter cycle EMAs or other technical indicators based on your trading rhythm, which aligns better with the "fast-paced, short volatility" trading characteristics of new coins.

2. Bollinger Bands + ATR Dynamic Bandwidth to Judge Volatility Explosion

- A rapid widening of the Bollinger Bands + K-line closing at the upper band can serve as a "short-term momentum initiation" signal.

- An increase in ATR indicates enhanced volatility expectations, suitable for tighter take-profit/stop-loss settings.

3. OI (Open Interest) + Funding Rate Linked Indicators

- Rapidly rising OI + positive funding rate indicates that bulls are concentrating on building positions.

- Rapidly rising OI + negative funding rate may indicate bearish selling, presenting potential opportunities for a rebound from oversold conditions.

The indicators used in the second and third points can also be customized in AiCoin, just like the first point. Whether for volatility judgment or contract sentiment, as long as you want, the indicators can be "self-written." Don't forget, AiCoin can also intelligently help you write indicators, so you can manage without coding—make sure to utilize it well!

Market rhythms differ, and indicators must adapt accordingly. Fixed templates may not suit the fast-paced market of new coins; to make more precise judgments, you need to use flexible custom logic.

What Next? Don't Miss Three Key Rhythm Points

You may not plan to enter the market immediately upon launch, but you should know which event rhythms to monitor to determine if it is "worth paying attention to again." Here are three key points we recommend keeping an eye on:

- Is there an official announcement of an airdrop or staking plan? Many new coins will launch staking, incentive programs, or governance airdrops after going live, which are key opportunities for short-term price increases or re-accumulating liquidity.

- Is there a new listing on mainstream exchanges for spot trading? SOPH has already launched spot trading on mainstream exchanges (such as Binance, OKX) and offers contract trading on Coinbase. The combination of spot + contract means it has a complete trading ecosystem, providing possibilities for arbitrage, basis squeeze, and other advanced strategies.

- Are there frequent transfers from whale or project addresses? It is advisable to monitor the top 50 addresses of the SOPH token and track the movements of major orders. A large amount of inflow and outflow on-chain, accompanied by price fluctuations, often indicates that the market will change.

Every coin has its own lifecycle, but the best opportunity to capture high-odds trades is always in the "early stage of launch."

You don't need to follow the hype every time, nor do you have to become an expert in researching this project, but you can have a "standard process for quickly assessing trading value when a new coin launches" and seize the market's chips at the first moment when the market starts. This is the greatest advantage as a trader!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。