The article rationally analyzes and refutes these arguments, emphasizing the complexity of the market, improvements in transparency, and the multi-factor drivers of Bitcoin's value.

Written by: Luke, Mars Finance

In the financial world, especially in the emerging and uncertain field of cryptocurrency, various interpretations and speculations abound, among which "conspiracy theories" often attract a large audience due to their dramatic and provocative nature. When the market experiences severe fluctuations, and when certain narratives diverge from intuitive feelings, stories about "puppet masters" and "carefully orchestrated scams" find fertile ground for dissemination. Recently, a narrative depicting the Bitcoin market as a "house of cards" manipulated by insiders, relying on false demand and unlimited money printing, has sparked widespread discussion, targeting industry participants such as Tether and Bitfinex.

These arguments often amplify and connect certain doubts or controversies that do exist in the market, constructing a seemingly coherent narrative that is, in fact, filled with logical leaps and evidence flaws. As rational observers and responsible media, it is necessary for us to peel away these sensational appearances, deeply analyze the core arguments of these so-called "conspiracy theories," clarify their specific accusations, and examine them one by one based on facts and logic, rather than easily falling into preconceived judgments.

Argument 1: Tether is an "infinite money printer" that creates USDT out of thin air to manipulate Bitcoin prices

Core accusation of the "conspiracy theory": This argument claims that Tether (USDT), issued by Tether Ltd., can "create money out of nothing" and "print" large amounts of USDT, which are then used to purchase Bitcoin on a large scale without real fiat currency backing. This action artificially inflates Bitcoin's price, creating a false sense of prosperity; on the other hand, once Bitcoin's price is driven up, the manipulators sell some Bitcoin for real dollars or other fiat currencies, thus completing a "picking up the white wolf with empty hands" profit scheme, using these real fiat currencies as their so-called "reserves" to pass inspections, forming a self-reinforcing fraudulent loop. In short, Tether is the biggest "insider trader" in the Bitcoin market, dominating Bitcoin's rise and fall through unlimited money printing.

Rational rebuttal and factual analysis: Simplistically depicting Tether's operations as "infinite money printing and manipulating Bitcoin" is an overly simplified narrative that overlooks the inherent complexity of the market and the actual operational mechanisms and market demand of stablecoins.

First, the core issuance mechanism of USDT is based on market demand. Theoretically, when authorized market makers, large trading platforms, or institutional investors need USDT for trading, providing liquidity, or arbitrage, they will deposit an equivalent amount of fiat currency (mainly dollars) to Tether at the official exchange rate (usually 1:1). Only after receiving the fiat currency does Tether issue an equivalent amount of USDT to these institutions. Conversely, when institutions need to exchange USDT back to fiat currency, Tether will destroy the corresponding USDT and return the fiat currency. Therefore, the growth in the total amount of USDT largely reflects the actual demand for stablecoin liquidity in the overall crypto market, especially during active market conditions or significant price movements, where the demand for stablecoins as a medium of exchange and a hedging tool significantly increases.

Second, the issue of Tether's reserves has indeed been a historical point of controversy, but the situation is gradually improving. Historically, Tether has faced scrutiny from regulatory agencies (such as the New York Attorney General's Office NYAG investigation) and widespread market skepticism regarding the transparency and sufficiency of its reserve composition. These concerns mainly focus on whether it has always held high-quality reserve assets equivalent to the total amount of USDT issued. Although such cases often end in settlements (for example, Tether and Bitfinex paid fines to NYAG without admitting wrongdoing), they have not completely dispelled all doubts. However, in recent years, Tether has begun to regularly publish reserve detail reports verified by third-party accounting firms (though not the top "Big Four"). While these reports are not equivalent to a comprehensive financial audit, they do provide a snapshot of its reserve asset composition (such as cash, cash equivalents, commercial paper, corporate bonds, precious metals, digital assets, etc.). Critics may still question the liquidity and risk levels of its reserve assets, but this differs from the nature of the "printing money out of thin air" accusation.

Furthermore, attributing the long-term trend of Bitcoin prices entirely to Tether's "manipulation" is untenable. Bitcoin's price is driven by a variety of complex factors, including the global macroeconomic environment (such as inflation expectations, interest rate policies), technological developments and innovations (such as the Lightning Network, Taproot upgrade), changes in the structure of market participants (such as the entry of institutional investors), regulatory policy directions, market sentiment, and geopolitical factors. While large-scale capital injections (whether from USDT or other sources) may theoretically impact short-term prices in the early market, which lacks effective regulation, proving that the entire decade-long bull and bear cycle of Bitcoin is entirely a "scam" orchestrated by Tether requires a much more direct and comprehensive chain of evidence than merely observing the correlation between USDT issuance and Bitcoin price fluctuations during certain periods. Many academic studies and market analyses have also failed to reach a definitive conclusion regarding Tether's systematic, long-term manipulation of Bitcoin prices.

Finally, if Tether were truly a pure "money printer" without real demand to support it, its stablecoin USDT should have collapsed long ago due to its inability to maintain its peg to the dollar. Although USDT has experienced brief periods of de-pegging in the past, it has generally maintained relative stability, which indirectly indicates that there is widespread actual demand for its existence in the market.

Argument 2: "National adoption" is a carefully orchestrated illusion, with key figures deeply involved in "insider trading"

Core accusation of the "conspiracy theory": This argument claims that certain countries (such as El Salvador) announcing Bitcoin as legal tender, or certain well-known entrepreneurs (such as Jack Mallers and Michael Saylor) heavily investing in Bitcoin, are not genuine national strategies or business decisions, but rather "performances" carefully planned and funded by "insiders" from Tether, Bitfinex, etc. The goal is to create the illusion that "even countries/large institutions are buying Bitcoin," enticing retail investors (FOMO sentiment) to take over, thereby creating conditions for these insiders to offload or further drive up prices. Specific accusations include:

- The Bitcoin held by El Salvador was not purchased with real money but was directly transferred from Bitfinex and Tether;

- Tether was deeply involved in drafting El Salvador's Bitcoin legislation;

- Jack Mallers' company funds come directly from Tether's reserves;

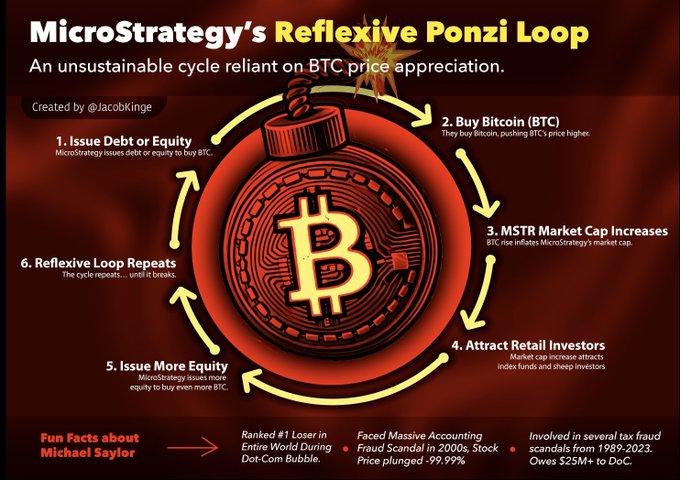

- Michael Saylor's MicroStrategy is playing a "reflexive Ponzi scheme" by continuously leveraging to buy Bitcoin.

Rational rebuttal and factual analysis: Simplistically categorizing national actions or corporate strategies as part of a "conspiracy theory" often overlooks the complex background of events and the conventional ways the market operates.

Regarding El Salvador's Bitcoin experiment:

- Standard operations for large Bitcoin transactions: The claim that El Salvador's treasury Bitcoin comes directly from transfers from Bitfinex and Tether is viewed by "conspiracy theorists" as evidence of "non-genuine purchases" or "insider transfers." However, in the cryptocurrency market, especially for large purchases involving sovereign nations or major institutions, it is standard operating procedure to conduct over-the-counter (OTC) transactions rather than directly buying on the open market. This is done to avoid severe price impacts on the exchange due to large buy orders, allowing for the acquisition of the desired amount of Bitcoin at a more stable price. After the transaction is completed, Bitcoin is directly transferred from the seller's wallet (which may be the OTC department of a large exchange, a mining pool, or other entities holding large amounts of Bitcoin, such as Bitfinex or Tether's trading department/affiliates) to the buyer's wallet (such as the treasury wallet designated by the El Salvador government), which is a completely normal settlement process. Therefore, asserting the nature of the transaction solely based on on-chain transfer paths may overlook the conventional market practices for large institutions acquiring digital assets.

- Considerations of transparency and actual benefits: Of course, this does not mean that El Salvador's Bitcoin experiment is flawless. The transparency of its decision-making process, the specific costs of acquiring Bitcoin, the significant decline in the usage rate of the Chivo wallet after its initial promotion, and the actual impact of Bitcoin's legalization on the national economy are all topics worthy of continued attention and in-depth discussion. These issues need to be objectively assessed based on facts, rather than simply labeled as a "scam."

- The possibility of Tether's involvement in legislation: As for whether Tether was deeply involved in drafting El Salvador's Bitcoin legislation, this is indeed a matter that needs to be taken seriously. If true, it would require an assessment of the extent and manner of its involvement and whether it gained any improper benefits or negatively impacted the fairness of the legislation. However, this alone does not directly constitute sufficient evidence that the entire "national adoption" is a false scam, and it should be examined from the perspectives of regulation, lobbying, and potential conflicts of interest.

Regarding Jack Mallers and Michael Saylor:

- Business cooperation and sources of funding: The accusation that Jack Mallers' Strike company or its affiliates' Bitcoin investments largely stem from Tether's reserves requires specific evidence to confirm the direct flow and nature of the funds. Investments, collaborations, or fund borrowings between companies in the crypto industry are not uncommon. The key is whether these transactions are compliant, transparent, and whether there are undisclosed relationships that may harm the interests of other investors.

- MicroStrategy's high-leverage strategy: Michael Saylor's MicroStrategy has adopted a publicly known, high-risk, high-leverage financial strategy of acquiring and holding Bitcoin for the long term. Saylor himself does not shy away from expressing his extreme optimism about Bitcoin and the company's aggressive approach. This strategy resembles a public declaration of betting on Bitcoin's future, the risks of which are already known to the market, allowing investors to judge for themselves whether to participate in its stock trading. Referring to it as a "reflexive Ponzi cycle" may be a misunderstanding. The core characteristic of a "Ponzi scheme" is that later investors' funds are used to pay returns to earlier investors, while MicroStrategy's model is to use financing to purchase real existing assets (Bitcoin), with its success or failure directly dependent on Bitcoin's future price performance and the company's debt management capabilities, which fundamentally differs from the definition of a Ponzi scheme. Of course, the extreme riskiness of this strategy should not be overlooked.

Argument 3: "Institutional Demand" is a Temporary Fad, ETF Fund Outflows are Warning Signals

Core accusation of the "conspiracy theory": This argument posits that the narrative of "institutional investors entering Bitcoin on a large scale" is merely a product of temporary hype and FOMO sentiment, and that real, sustained institutional demand does not exist or has significantly weakened. The net outflow of funds from Bitcoin spot ETFs after initial inflows, or the lack of expected interest from certain institutions in Bitcoin, is interpreted as evidence that "institutions are collectively fleeing" and "smart money has quietly exited," indicating a lack of long-term support for Bitcoin prices.

Rational rebuttal and factual analysis: Interpreting short-term fluctuations in institutional behavior as a fundamental reversal of long-term trends often lacks a comprehensive understanding of the dynamics of financial markets.

- Normal fluctuations in ETF fund flows: The inflow and outflow of funds in exchange-traded funds (ETFs) inherently exhibit volatility. Short-term net outflows do not necessarily represent a complete reversal of long-term trends or a fundamental decline in institutional interest. Various factors influence ETF fund flows, including cyclical changes in investor sentiment, shifts in macroeconomic conditions (such as interest rate adjustments and inflation data), short-term profit-taking behavior, periodic adjustments in asset allocation strategies, tax considerations, and changes in the attractiveness of alternative investments. To assess institutions' true attitudes toward Bitcoin and long-term allocation trends, it is necessary to observe data over a longer time frame and consider the institutions' own public reports, changes in holdings, market depth research, and the fundamental development of the industry, rather than relying solely on short-term fund flow data to draw hasty conclusions.

- Gradual and diverse adoption by institutions: The adoption of emerging assets like Bitcoin by institutional investors is typically a gradual and cautious process, rather than an instantaneous one. Different types of institutions (such as pension funds, endowment funds, family offices, hedge funds, publicly traded companies, etc.) have varying risk preferences, investment cycles, regulatory constraints, and decision-making processes. The approval of Bitcoin spot ETFs indeed provides some institutions with a more convenient and compliant investment channel, but this is just one of the ways institutions participate in the Bitcoin market. Other methods include directly purchasing and custodying Bitcoin, investing in Bitcoin mining company stocks, and participating in Bitcoin-related financial derivatives trading. Therefore, judging the overall institutional demand's "retreat" solely based on the short-term performance of ETFs may be overly simplistic.

- Regulatory caution does not equate to industry denial: Regulatory agencies (such as the U.S. SEC) maintaining a cautious stance toward cryptocurrency-related products (such as more types of ETF applications) and emphasizing investor protection and prevention of market manipulation is a normal expression of their regulatory responsibilities. This also reflects that the cryptocurrency market, while maturing and becoming more standardized, still needs to continue efforts in transparency, compliance, risk control, and market infrastructure development. Equating regulatory caution directly with a denial of the entire industry or Bitcoin's long-term value, or interpreting it as part of some "conspiracy," is clearly an over-interpretation and misjudgment.

Argument 4: Tether and Bitcoin have formed a "death spiral," and any imbalance will lead to a total collapse

Core accusation of the "conspiracy theory": This is a dramatic doomsday narrative that suggests an unstable, interdependent "vicious cycle" or "death spiral" has formed between Tether and Bitcoin. Specifically, Tether supports its own "value" (or creates the illusion of sufficient reserves) by continuously purchasing Bitcoin, while the price of Bitcoin, in turn, relies on the ongoing liquidity provided by Tether (i.e., "money printing" buying pressure). If any link in this fragile cycle breaks—such as Tether facing a massive run that prevents it from meeting redemptions, or a catastrophic drop in Bitcoin prices leading to a severe reduction in Tether's Bitcoin reserves—the entire system could collapse like a house of cards, triggering an epic financial disaster. Saifedean Ammous's remarks about Tether's Bitcoin reserves potentially exceeding its dollar reserves in the future are often cited to support the instability and potential risks of this structure.

Rational rebuttal and factual analysis: While there is indeed a possibility of risk transmission between highly correlated financial assets or entities, directly depicting the relationship between Tether and Bitcoin as a precarious "death spiral" may exaggerate its inherent fragility and misinterpret the core logic of value support between the two.

- Core value support of Tether: Tether (USDT), as a stablecoin, primarily claims to maintain a stable peg to fiat currencies like the dollar (typically 1 USDT ≈ 1 USD). Its value support mainly comes from the reserves it claims to hold, which correspond to the total amount of USDT issued. According to Tether's regularly published reserve reports, these assets currently include cash and cash equivalents (such as short-term treasury bills, money market funds, etc.), corporate bonds, secured loans, and other investments, including Bitcoin. While Bitcoin does occupy a place in Tether's reserves, it is not the entirety or the absolute majority of its reserves. The stability of USDT primarily depends on the liquidity, safety, and adequacy of its overall reserve assets, as well as the market's confidence in its ability to fulfill redemption commitments.

- Diverse value drivers of Bitcoin: The value of Bitcoin does not solely depend on the liquidity provided by Tether. As previously mentioned, Bitcoin's price and value are influenced by a variety of factors, including its technical characteristics (such as decentralization, scarcity, and security), network effects, market supply and demand dynamics, macroeconomic factors, regulatory environments, and investor sentiment and adoption levels. While Tether, as a major supplier of stablecoins in the market, plays an important role in the activity and depth of Bitcoin trading markets, this does not mean that Bitcoin's intrinsic value is entirely tied to Tether.

- Complexity of risk transmission: If Tether experiences a severe crisis of trust or reserve issues, it could indeed impact the entire cryptocurrency market (including Bitcoin), leading to liquidity strains and risk-averse sentiment. Conversely, if Bitcoin prices experience extreme and sustained declines, it could also pressure Tether's balance sheet, which holds Bitcoin as part of its reserves. However, whether this risk transmission will inevitably evolve into an uncontrollable "death spiral" depends on various factors, including the scale of the shock, the reactions of other market participants, the intervention capabilities of regulatory agencies, and the resilience of both systems. Interpreting certain speculative or forward-looking statements (such as future projections about Tether's Bitcoin reserve ratios) as established facts or imminent signs of systemic collapse may lack an accurate grasp of the current situation and dynamic balance.

- Focus should be on transparency and risk management: A more rational perspective is to continuously monitor the transparency of Tether's reserve composition, the quality and liquidity of its reserve assets, the independence and credibility of audit reports, and the effectiveness of its own risk management framework and contingency plans. These are the key factors in assessing its stability and potential systemic risks.

Why do "conspiracy theories" easily arise and spread?

The world of Bitcoin and the underlying cryptocurrency ecosystem, due to its disruptive technology, idealistic concepts, and the relatively slow regulatory response in its early development stages, along with the mixed quality of market participants, naturally provides fertile ground for various extreme narratives and speculations. The following points may explain why such "conspiracy theories" are particularly prevalent:

- Information asymmetry and insufficient transparency in certain areas: Although blockchain technology is characterized by the public transparency of its on-chain data, many key centralized operating entities (such as certain exchanges, stablecoin issuers, project foundations, etc.) often lack transparency regarding their internal operations, complete financial conditions, decision-making mechanisms, and actual controllers, making it difficult for the general public to access this information. This information gap provides ample space for various speculations, doubts, and even malicious conjectures.

- The warning effect of historically real fraud and failure cases: From the early Mt. Gox theft to the recent bankruptcies of Celsius and Voyager, and the dramatic collapse of the FTX exchange, the cryptocurrency industry has indeed experienced multiple significant loss events due to fraud, mismanagement, insider control, or hacking. These real negative cases have severely undermined some investors' trust in the industry, making people more likely to accept explanations pointing to "conspiracies" or "scams" when faced with uncertainty or market fluctuations.

- The severe price volatility and the psychological tendency to seek simple explanations: Cryptocurrencies like Bitcoin are known for their dramatic price fluctuations. When the market experiences sharp rises and falls, many people, especially those who have suffered losses, often rush to find a simple, direct reason to explain it all. "The market is manipulated by a few whales/insiders" is often easier to understand, accept, and spread than acknowledging "this is a natural market fluctuation influenced by a complex interplay of multiple factors, compounded by high-risk speculative sentiment." This reflects a common cognitive bias and psychological defense mechanism.

- Interest-driven and deliberate construction and dissemination of specific narratives: In any financial market, some participants may actively create, amplify, and spread specific narratives for their own interests (such as profiting from shorting the market, undermining competitors, promoting their own projects or viewpoints, attracting traffic and attention, etc.), including sensational, exaggerated risks, and even distorted facts in the form of "conspiracy theories." The anonymity and rapid dissemination characteristics of social media further exacerbate the spread of such information.

- The cognitive threshold of new technologies and the universality of emotional interpretations: For the general public who are not fully familiar with blockchain technology, cryptographic principles, and the complex models of crypto-economics, there exists a high cognitive threshold to deeply understand Bitcoin's intrinsic value logic, mining mechanisms, consensus algorithms, and the operation of the entire ecosystem. In this context, simplified, labeled, emotional, or even demonized interpretations are often more easily spread and accepted than rational, objective, and complex analyses.

Conclusion: Upholding Rationality, Evidence, and Critical Thinking Amidst the Fog

The world of Bitcoin is an arena where cutting-edge technological innovation, disruptive financial experimentation, and complex human interactions intertwine. It showcases both the immense potential and appeal of decentralization and peer-to-peer value transfer, while also exposing the various irregularities, opacities, and high risks that emerging markets inevitably encounter in their early stages. The so-called "conspiracy theories" are often products of selective extraction, one-sided interpretation, and subjective speculation about these bizarre and complex realities. They may keenly point out certain real issues or potential risk points within the industry, but the explanatory frameworks and final conclusions they provide often lack solid evidence support, rigorous logical reasoning, and comprehensive factual consideration.

We need not view all doubts and criticisms as threats or malicious attacks, as constructive criticism, reasonable skepticism, and the ongoing pursuit of transparency and accountability are necessary external pressures and internal motivations for any industry (especially emerging industries) to mature, standardize, and develop healthily. Continuous attention to the composition of Tether's reserves and calls for independent audits, vigilant analyses of significant on-chain movements and their underlying reasons, and strict scrutiny and full disclosure of related transactions and potential conflicts of interest are all manifestations of the market's maturation and responsibility.

However, when faced with grand narratives that claim to reveal "global manipulation," "massive scams," or "doomsday prophecies," it is particularly important to maintain a clear mind, independent thinking, and steadfast critical thinking. We need to carefully discern the sources and reliability of information, distinguish between objective factual statements and subjective expressions of opinion, understand that correlation does not equate to causation, and be wary of arguments that appeal to emotions rather than reason.

The future of Bitcoin cannot be easily dominated or completely controlled by one or two so-called "conspiracies" or a few accused "insiders." It is more like a large-scale, ongoing, multi-party global socio-economic experiment. Its ultimate direction and historical positioning will be shaped by the continuous breakthroughs and iterations of the technology itself, the gradual clarity and coordination of the global regulatory framework, the cognitive maturity and rational behavior of market participants, and the degree of acceptance and interaction patterns within the broader socio-economic environment.

In this digital new frontier filled with unknowns, opportunities, and challenges, only by adhering to a lifelong learning attitude, cultivating the ability to think independently, and developing the habit of making judgments based on evidence can we avoid being blinded by temporary fogs and misled by sensational narratives, thus gaining a clearer insight into its essential characteristics and development trends. For the entire cryptocurrency industry, actively embracing transparency, continuously strengthening self-discipline, courageously accepting supervision, and honestly responding to reasonable market concerns and doubts are fundamental ways to effectively reduce the breeding and spread of "conspiracy theories" and to win long-term trust and broad recognition from society.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。