BlackRock's Short-term and Long-term Planning

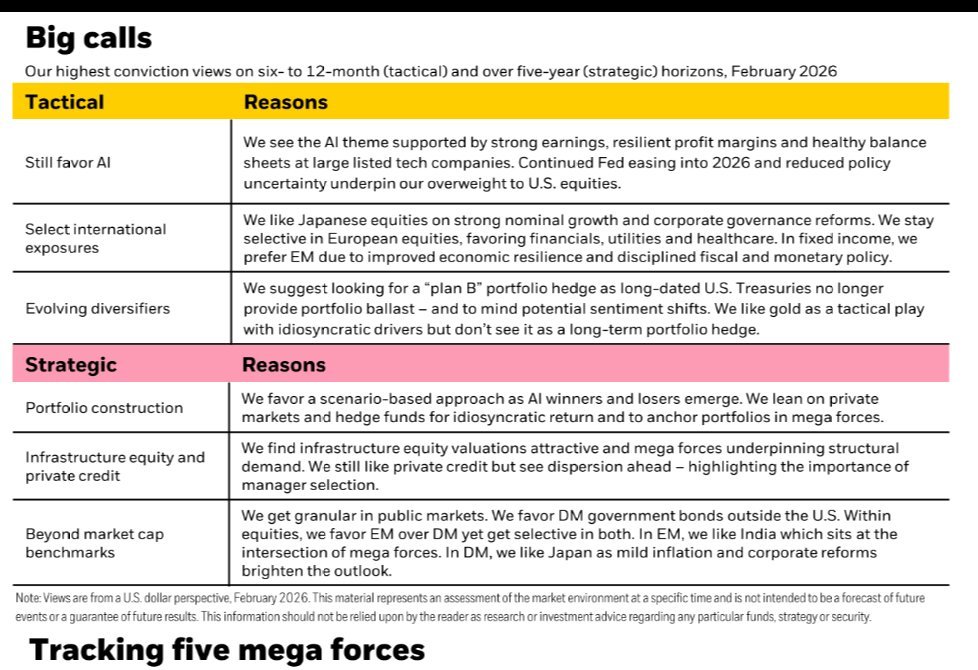

According to the latest data released by BlackRock, the future asset allocation is divided into two lines: one being the tactical (short-term) for 6-12 months, and the other the strategic (long-term) for over 5 years.

Tactical Level:

BlackRock is still betting on the main line of AI, believing that the profits and profit margins of big tech companies are still present, their balance sheets are strong enough to support, and combined with their expectation of continued easing in 2026 and a decrease in policy uncertainty, the conclusion is to continue overweighting U.S. equities, focusing on AI and technology.

PS: Although cryptocurrencies or $BTC are not explicitly mentioned, from all the data, tech stocks and Bitcoin still have a certain positive correlation. If tech stocks strengthen, the Fed moves towards easing, and policy uncertainty decreases, it will also be beneficial for BTC.

Overseas, BlackRock believes that the Japanese stock market has a higher priority (nominal growth + corporate governance reform), while in Europe only structural selections are made (focusing on finance, utilities, and healthcare), and in fixed income, it is more inclined towards emerging market bonds, believing that the economic resilience and fiscal and monetary discipline in EM are improving.

The focus on hedging is not to rely on long-term U.S. Treasuries but to prepare new allocation plans, where gold can serve as a tactical position to capitalize on the volatility of emotions, events, or inflation expectations, but BlackRock does not view gold as the sole long-term hedging core.

Strategic Level:

BlackRock's point is that AI will create clear winners and losers in industries, so future portfolios should not rely solely on market capitalization-weighted indexes but should construct portfolios using scenarization and leverage private markets and hedge funds to obtain "non-β returns," making the portfolio more stable in large trends.

In terms of specific asset allocation, BlackRock believes that the valuation and demand structure for infrastructure equities are better, private debt still warrants allocation, but future differentiation will be greater, making the choice of manager more important than the choice of sector.

In the public market, BlackRock emphasizes the need to surpass market capitalization benchmarks, with bonds favoring government bonds from developed markets outside the U.S., and stocks overall preferring EM over DM, specifically naming India within EM and still optimistic about Japan within DM (mild inflation + reform dividends).

PS2: A few days ago, I happened to discuss the reasons for being bullish on India, and those interested can take a look.

Address: https://x.com/PhyrexNi/status/2008223614257283551?s=20

@bitget VIP, lower rates, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。